Written by: David Waddell | Waddell and Associates

THE BOTTOM LINE:

Consumer, business, and investor sentiment indices have roughly doubled from where this bull market began two years ago. Historically, higher levels of optimism have correlated with lower levels of returns. Fortunately, because sentiment levels came off such historically low levels in 2022, current levels still correlate historically with positive forward returns. Those who know me know that I get nervous when no one else seems to be. However, low recession risks, falling overnight rates, and rising earnings estimates should overcome any sentiment limitations entering 2025. With bullish levels twice as high, return expectations for next year should be half as much, but after two consecutive 20%+ years, half… feels just fine.

At the end of 2022, economic, investor, and consumer sentiment reached some of the lowest levels in history. Economists and business leaders expected a recession while investors expected a bear market. We mused at the time that nothing pleased us more than pessimism because peak pessimism typically signals performance troughs.

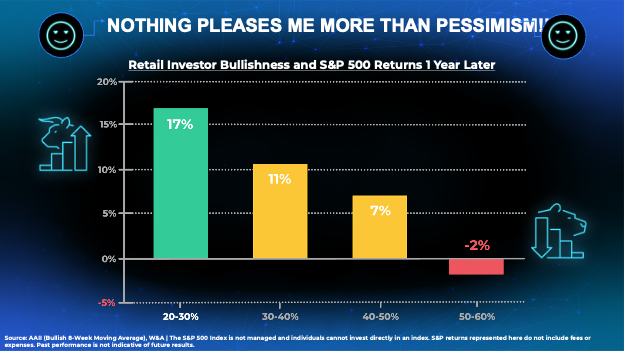

We captured this concept in the following slide from our 2023 Outlook presentation which basically concluded that, since we couldn’t find much fundamentally to be optimistic about, the lugubrious consensus likely meant the market would rally smartly:

Indeed, it did. Only 20% of investors entered 2023 expecting the stock market to advance. Historically, after equivalent levels of pessimism, stocks rose 17% over the following year, on average. On cue, in 2023 the S&P 500 rose roughly 26%, thereby proving our point that pessimism pays!

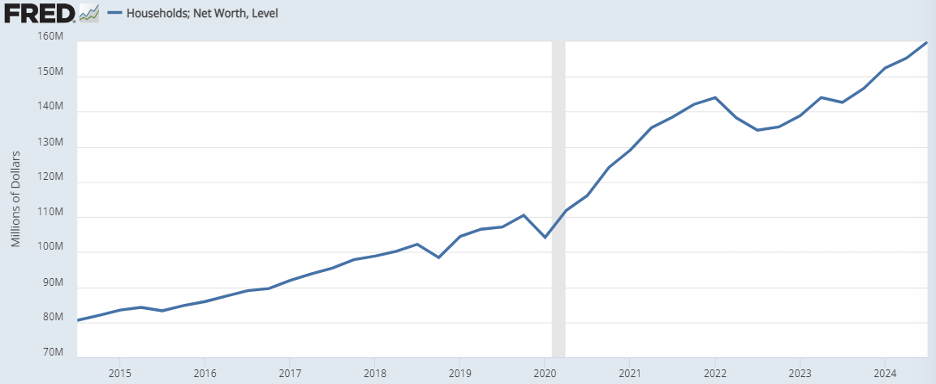

As we enter 2025, it’s clear that nearly every asset class has hit record highs. Rather than take inventory, we can see the combined results in total household net worth:

Household net worth in the US has grown from roughly $100 trillion pre-COVID to $160 trillion today. That’s a 60% increase in only four years. It took ten years to accumulate a 60% increase before that. US households have never gotten so rich, so fast.

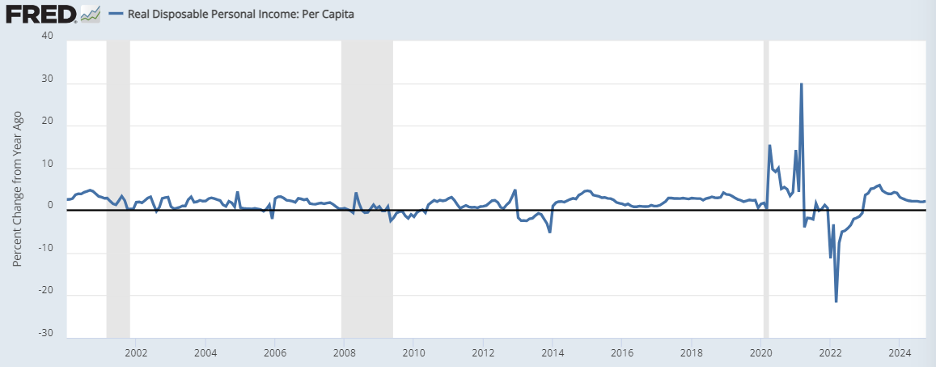

COVID-inspired fiscal stimulus led to dramatic swings in household income, particularly adjusted for inflation:

This chart chronicles annual growth in real disposable personal income per capita. In other words, discretionary spending power for consumers. Note the spike higher from stimulus followed by the spike lower from inflation. Today, disposable income levels sit about 9% higher than they were pre-COVID; a healthy complement to the 60% rise in household net worth.

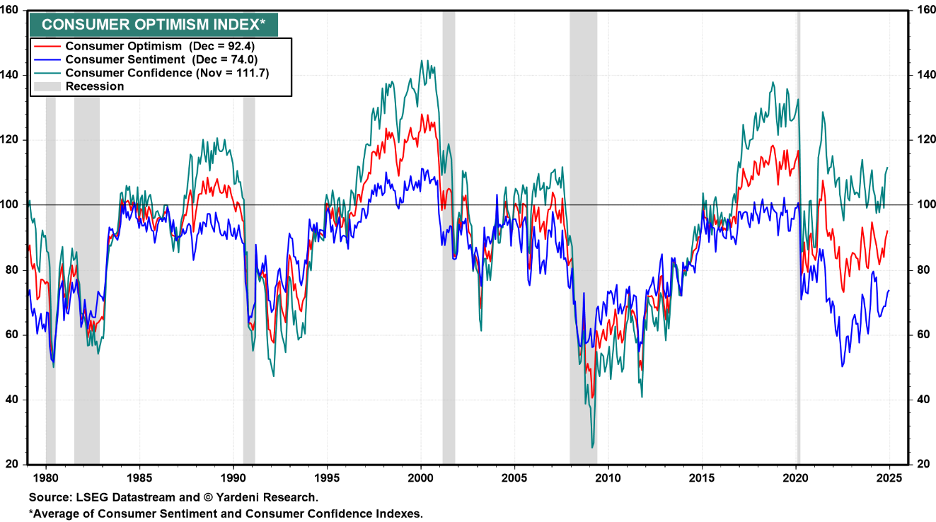

With record net worth and record income, consumer sentiment should be record-breaking as well. Not quite:

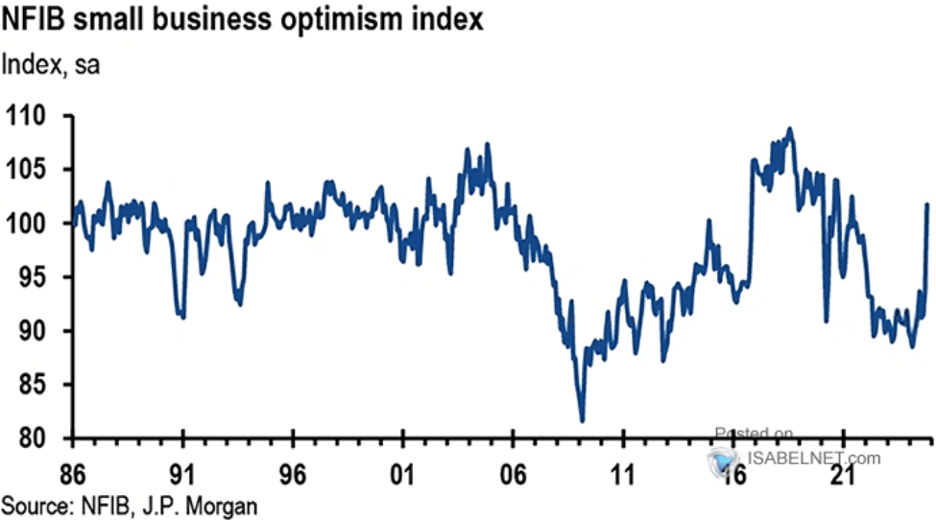

Consumer sentiment levels have continued to sag, despite rosy household economics. Economists have proposed many theories, but our social media obsessions with politics and conspiracy theories likely explain much of it. Nonetheless, we have seen meaningful advances recently in most measures of consumer confidence, specifically around household finances. Note the post-election small business sentiment surge:

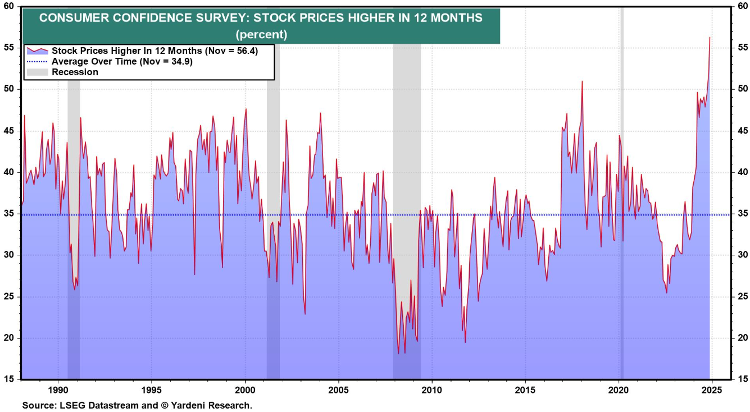

And the surge in household expectations for stock market performance over the next 12 months:

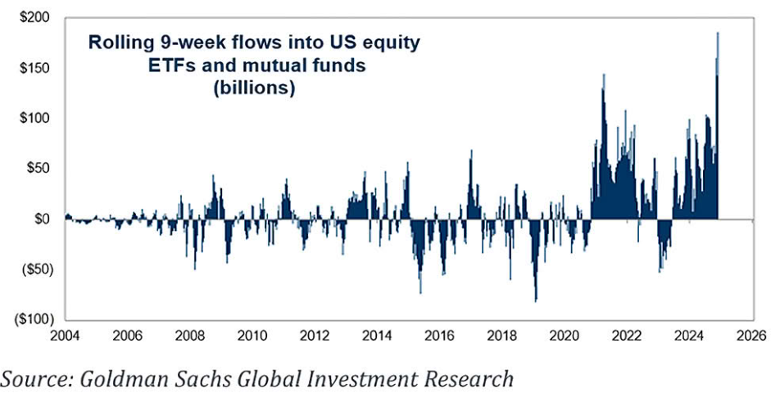

Leading to record inflows for US stock funds:

And record highs for US stocks, as the NASDAQ closed above 20,000 for the first time this week.

In sum, retail investors today are about twice as bullish on the future as they were at the end of 2022. While this removes much of the uplift from positive surprise, this does not necessarily portend a negative outcome for 2025.

Per our initial chart, 40% bullish sentiment historically correlates with 7% to 11% returns over the coming year, on average. After back-to-back 20%+ years, that wouldn’t feel so bad. So, as 2024 comes to a close, don’t feel too bad about feeling good!

Sources: AAII, FRED, LSEG Database, Yardeni, NFIB, JP Morgan, Goldman Sachs