When you strip out the fluff, there’s not as much there, there. Adjustments to consider.

I have railed against so-called 60/40 portfolios in the past. And, I am about to do it again.

This “classic” portfolio mix of 60% stocks and 40% bonds is the product of years of Wall Street marketing effort. The initial 60/40 concept was OK in theory. And, it has worked pretty well for a while. That’s not my issue with them.

The problem with the 60/40 approach is that the messaging surrounding it has not kept up with the times. It is now divorced from market reality. As the stock market has bubbled up, primarily due to the dominance of a small number of huge tech companies, 60/40 has become more dangerous, along with the broad stock market itself.

And, as interest rates have fallen, then cratered toward zero over the past 2 decades, the bond side of the 60/40 mix (the 40% piece) has rendered buy-and-hold bond investing fairly useless.

When good is gone

As a result, 60/40 has gone from one of many good portfolio construction concepts to something else. Frankly, it has become a sort of Wall Street financial advisor cult. I say this because in my decades of managing money and providing advice, once investors get very familiar with a concept like 60/40 (and they have), it probably means that concept is past its prime.

This is the plight of today’s investor, trying to distinguish between solid advice and a convenient sales pitch. Today, the typical 60/40 portfolio is over-hyped, over-simplified, and over-invested, especially by Baby Boomer investors.

It is no longer driven by meeting investor objectives, but rather by firms wanting to buzz-word their way into scaling their businesses. “Just throw them in a 60/40 portfolio mix, and move on to the next sale.” That’s the attitude I have seen anecdotally, too many times.

Not ready to retire

So, do we take 60/40 and throw it away? Surprisingly, my answer is no. But we definitely need to give it a makeover. And, we need to recognize its limitations.

First, here is a reality check. 60/40 portfolios often reference the S&P 500 as the 60% equity segment. And, the 40% bond segment is often portrayed through the Barclays Aggregate Bond Index, which is a blend of U.S. Treasury securities, and higher-quality U.S. Corporate Bonds.

Change the 60 or the 40? How about both!

Both of these pieces need to be re-cast, just to make benchmarking 60/40 portfolios more reflective of today’s investment market realities. The S&P 500 is highly unlikely to be as dominant in the future as in the past, versus the rest of the U.S. and global stock market.

And, returns for the Barclays Aggregate Bond Index have been goosed by abnormally high returns, driven by falling interest rates. With rates starting where they are now, bond investors would be challenged to even earn the current yield on short-term Treasuries going forward. What’s that yield? Under 1%.

60/40 – the past

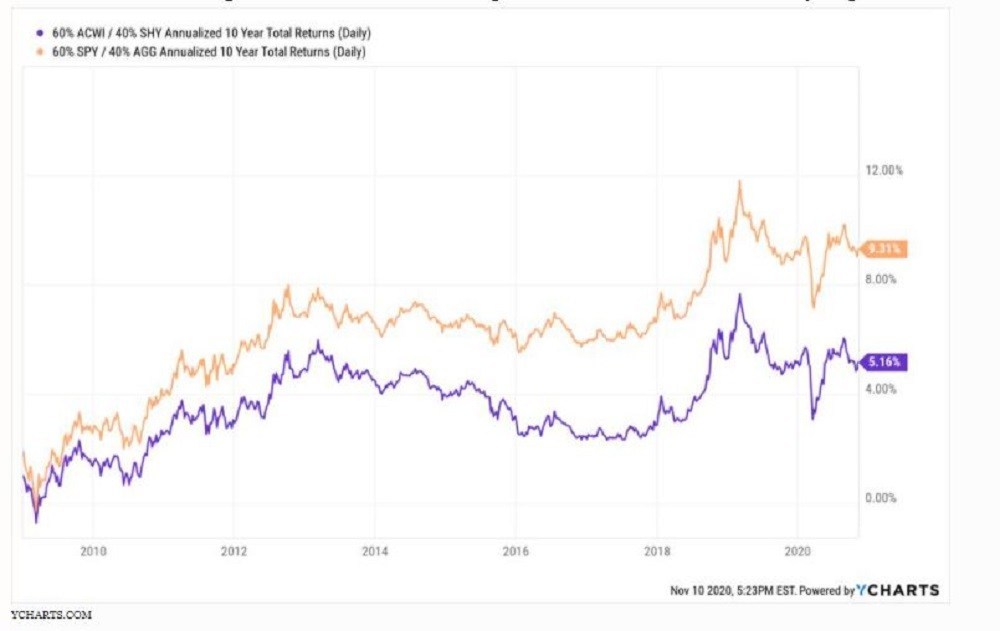

Below you see 2 versions of a 60/40 portfolio. I charted their 10-year “rolling” returns. In other words, this is a graph of every 10-year time frame since about 2009. So, the far left part of the graph shows 10-year periods coming out of the Global Financial Crisis.

And, the far right side of the chart (the orange line) shows that the latest 10-year annualized return of a 60% S&P 500 ETF / 40% Barclays Aggregate Bond Index ETF mix is about 9.3% a year . That’s the version of 60/40 that I just do not believe is sustainable. As a result, it fools investors into thinking the future will be like the past. It won’t. It’s mathematically impossible.

Why 60/40’s past is not its future

Stay focused on the right side of the chart, and you will see that the purple line, a more realistic forward-looking mix of 60% MSCI World Stock ETF and 40% U.S. 1-3 Year Treasury ETF, produced an annualized return of about 5.2% over the past 10 years. If you look further back (toward the left of the chart), you can see that as of a decade ago, it was a closer contest.

But as time went on, the S&P 500 started to dominate the stock market. And, U.S. bond rates plunged. As a result of that combination of market events, the returns of the popular 60/40 mix dwarfed those of my more forward-looking 60/40 benchmark.

A realistic 60/40

Going forward, I think investors and financial advisors need to be more realistic in their approach to this type of portfolio mix. They need to get with the times, and put away the sales manual.

They need to take a more contemporary approach. That starts with using a more realistic version of 60/40 portfolio. After all, past performance is no indicator of future returns. That’s especially the case this decade.

I am no fan of 60/40 portfolios. The bonds add nothing, unless you “reach for yield” with junk bonds and the like. And that’s fraught with credit risk.

A “core” equity portfolio, created through stocks and/or ETFs, is a solid starting place for many investors. But that portfolio is taking on a ton of cyclical market risk if it crowds into the same, herd-driven group of stocks that have made the past decade a strong one for the S&P 500.

Stocks, and then what?

Where it really gets interesting for the next decade is in designing your portfolio around that core stock segment. Others will simply stick to some version of 60/40, out of habit. They are taking risks they don’t realize, and that’s never a good thing in investing.

I prefer to use hedging techniques, and tactical management around that core equity portfolio. The goals are simple: to protect against the kind of drop in the value of the stock portfolio that can alter your retirement lifestyle, even if you are not already in retirement. And, to be proactive in combating what often follows long bull markets like the one we just had. Namely, a bear market in stocks, and likely in bonds as well.

During that part of the cycle, stock prices are not going down all the time. It is more a story of higher volatility, lots of ups and downs…that lead to little or no gain over a period of years. THAT is when it helps to have a more active, tactical part of the portfolio, where a good chunk of your bear market returns may come from.

60/40: the sequel

So, 60/40 needs more than a tune up. It needs a total re-thinking. As I noted earlier, we can’t count on Wall Street firms to make that pivot for us. We need to get a bit more creative, and realistic. Your future investor self will thank you for making that effort.

Related: How To Be A Conservative Investor At All-Time Stock Market Highs