Written by: Laurent Saltiel and Sergey Davalchenko

Emerging market (EM) countries have long relied on commodity cycles and low-cost manufacturing for export-driven growth. But a wave of corporate innovation is changing that, helping to drive growth from within and providing equity investors with higher quality, sustainable opportunities across many countries.

Investors in EM stocks are facing challenges with countries like India and Brazil still struggling to contain COVID-19. The MSCI Emerging Markets Index rose by 6.5% this year through June 30 in US-dollar terms, trailing the MSCI World Index’s 12.2%. Growth stock returns were weaker. But as the earnings outlook improves, we believe that three powerful long-term trends, driven by innovation, are creating growth opportunities that will persist through the pandemic and beyond.

Trend 1: New Technology for Emerging Economies

Technology is leading the charge. Today, technology and internet-centric companies make up 40% of the EM benchmark, up from only 11% in December 2007. In comparison, tech stocks comprise 39% of the MSCI USA Index and only 9% of the MSCI Europe Index. We think the extraordinary growth story of emerging market tech is only beginning.

This new wave of EM technology isn’t only about exports. Indeed, many EM companies are developing new technologies for use at home. In many cases, these companies have advantages in capturing local market share versus US peers, and it’s not just happening in China. Local internet companies are growing fast and establishing strong market positions in countries as diverse as India, South Korea or Russia. Poland’s Allegro, for example, is an internet shopping destination with a 33% market share of Polish e-commerce, well ahead of US competitors such as Amazon.

The breakthroughs go well beyond shopping. What is one of the fastest-growing markets for financial technology? India. In 2020, India processed US$25.5 billion in real-time payments, according to ACI Worldwide. Banks in India are leveraging technology and big data to grow their business. For example, HDFC Bank has developed technology to approve personal loans for customers in as little as 10 seconds; its personal loan business grew over 12% year over year in April 2021.

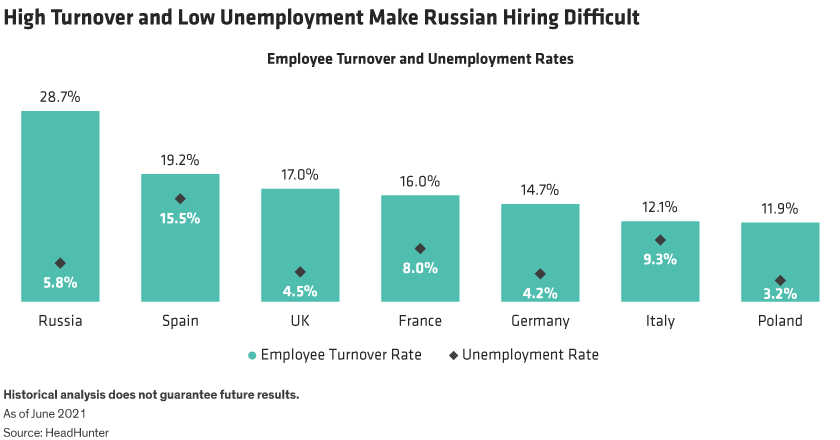

In Russia’s job market, companies face a human capital problem. Russian companies suffer from higher than average employee turnover, and the unemployment rate is only 5.8%, making it difficult to find replacement workers (Display).

Online job search is still relatively underutilized in Russia—less than 30% of available jobs appear on an online service. And the global leader in online recruiting, LinkedIn, isn’t in the Russian market due to data storage requirements.

Russian-based HeadHunter has helped employers solve this demographic dilemma. Job seekers get a free service that matches their resumes with open positions across five countries. Employers get access to all those resumes as well as additional value-added services. With over twice as many job listings as the nearest competitor, HeadHunter is the job search leader in a market that offers plenty of room for future growth.

Trend 2: The Pandemic Changed Healthcare in Unexpected Ways

Some recent emerging market advances were products of the pandemic. The lockdowns caused both EM companies and consumers to move everything from shopping to business meetings online, much like in developed economies.

Chinese healthcare also underwent a pandemic-accelerated transformation in 2020. Innovations were swiftly adopted and created a path for future growth.

China had banned online pharmacies before 2019, so they were still in their infancy when the pandemic began. In a swift about-face, China started actively promoting online drug sales in 2020 to alleviate bottlenecks. It’s now a US$53 billion industry and Credit Suisse expects it to exceed US$300 billion by 2030.

Online health consultations were also quickly normalized. In the first quarter of 2020, online doctor appointments in China increased 17 times over the same period in 2019. The pandemic highlighted the benefits and efficiencies of online healthcare. Remote diagnosis, for example, helps solve healthcare issues for rural populations, allowing centrally located doctors to treat patients thousands of miles away.

Online systems lower costs and can better monitor chronic conditions, leading to better health. And artificial intelligence now supports clinical decision-making, also improving efficiency. Beyond China, countries with aging demographics and surging healthcare needs provide a ready market for these technological advancements. Companies in China—such as Alibaba Health Information and JD Health—that have facilitated these trends are well positioned to foster broader proliferation of post-pandemic healthcare innovation.

Trend 3: Green Technology for Home and Abroad

Over 200 countries now support the Paris Agreement, and governments worldwide are adopting policies to curb global warming. We expect over US$2 trillion in low-carbon initiative spending just in emerging-market countries over the next 20 years. Companies creating cutting-edge environmental solutions can sell into governments who have pledged to do better environmentally.

State-of-the-art battery technology destined for electric vehicles, for example, is coming from South Korea and China. Today, around 30% of the cost of an electric car is the battery. But rapid technological advances are improving economics and demand, and battery costs are dropping almost 10% per year. Electric cars could cost the same as those with internal combustion engines within two to three years. As many countries seek to ban internal combustion engines in as little as five to ten years, that’s welcome news.

Another growth market stemming from the environmental movement is the treatment of industrial and medical waste. Demand for these services is naturally increasing, and stricter regulations are an added tailwind. New waste disposal facilities are coming online, but capacity constraints remain, and there are high barriers to entry. And as emerging economies grow, there are opportunities for remediating previous environmental damage, as regulations have generally lagged industrialization. Sunny Friend Environmental Technology, an established Taiwanese company, leads this business category in Taiwan and has expanded operations to mainland China.

EM Valuations Are Compelling

While developed market companies are strong players in some of these markets, EM competitors provide compelling benefits for investors. Many EM stocks offer higher quality, more sustainable growth and are often available at less expensive valuations than developed market peers. Even though analysts expect higher earnings growth in 2021, EM stocks currently trade at an almost 30% discount to developed market peers (Display).

Subdued sentiment in key emerging markets is clouding exciting growth trends. While the short-term outlook is challenging, it’s actually a great time to shop for stocks that should benefit from longer-term developments. When the forces of the pandemic give way to a sustainable recovery, we believe EM companies with an innovative edge will enjoy disproportionate benefits from pent-up return potential.

Related: What Are Bond Investors Thinking? Their Three Top Concerns