Written by: Brian Resnick

Investors naturally gravitate toward higher-income segments when traditional core bond yields are low. But many US fixed-income investors have been limiting their choices to just a few aisles in the income supermarket, primarily focusing on US high-yield exposure. We think a better approach is to stock the cart with a greater variety—not all of them found in the domestic aisles.

A global multi-sector approach can deliver much more than just international diversification. If investors are willing to expand their horizons, in our view, they stand a much better chance of meeting their investment goals. Here are three compelling reasons to go global and multi-sector.

1. More Credit Segments—A Broader Net for Income Opportunities

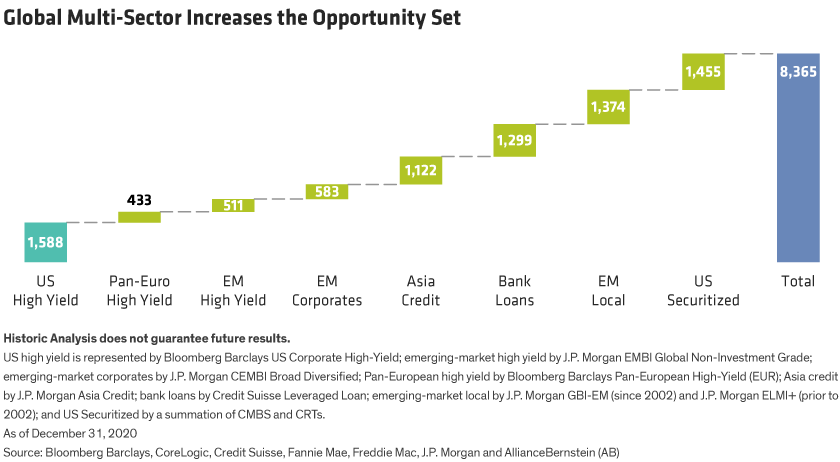

A global multi-sector credit approach can tap a broad spectrum of segments, including international and US high-yield bonds, local-currency and dollar-denominated emerging-market (EM) debt, mortgage-backed securities, and leveraged loans. The US high-yield index is almost $1.6 trillion, but it pales in comparison to a broader global multi-sector universe that tops $8 trillion (Display).

That’s quite a broad net for income opportunities: bank loans, securitized debt, EM sovereign and corporate credit, and developed-market high-yield corporates. With such an extensive universe, bond managers can target areas that provide the best income and value at any given time. It also means more opportunities to be flexible in exposures, sourcing alpha opportunities even when one area might be out of favor.

2. You Never Know Which Sector Will Come Out on Top

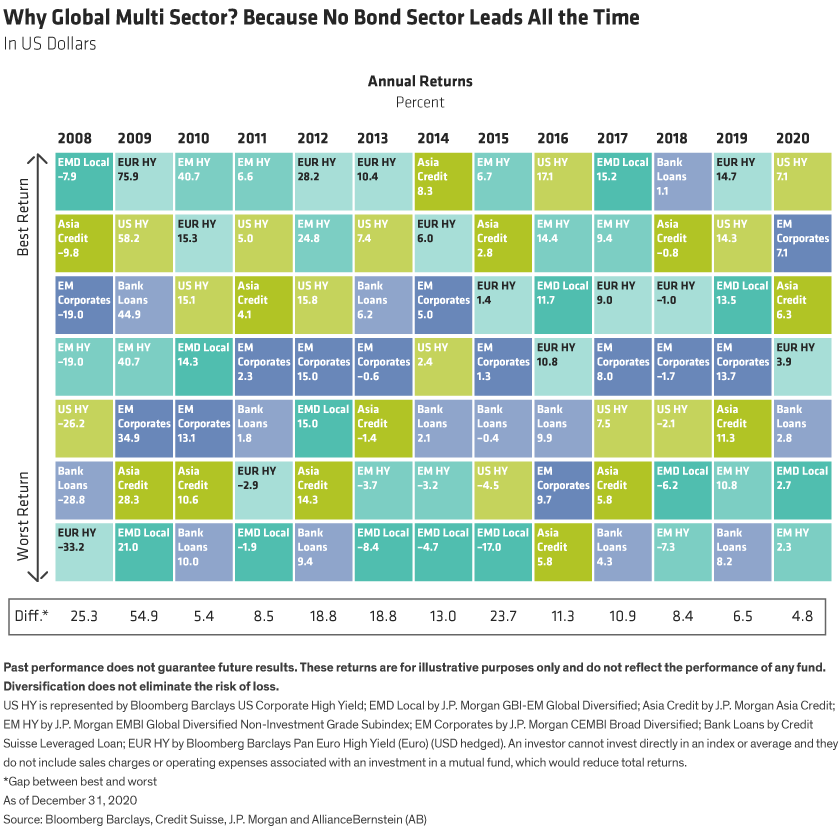

No single fixed-income sector can dominate year after year. Ever-changing global economic and market conditions mean every category has the chance of being the best or worst performing in any given year.

For example, in 2020, US high-yield and EM corporate bonds each returned a credit-market-leading 7.1%. But in 2019, European high yield bested US high yield, returning 14.7% to the US’s 14.3%. And even though EM high-yield bonds were among the top two sectors from 2015 through 2017, they’ve trailed the pack the past three years (Display).

Because no one can know which sector will be the best performer in any given year, we think it makes sense for investors to spread their money across a diversified basket—because each sector has its own merit. EM debt, for example, especially bonds denominated in major developed-market currencies or “hard” currencies, offer exceptional value today. In fact, hard currency EM debt is trading at historically high spread premiums versus US high yield.

Securitized debt also offers compelling opportunities. Credit risk–transfer securities, in particular, are being bolstered by a strong housing market, sturdy consumer balance sheets and tighter lending standards. Finally, BB-rated traditional high-yield corporate bonds feature strong valuations and a large pool of potential rising stars. When credits are upgraded to investment grade, the yield spread declines, on average, by more than 80 basis points. That’s a great source of alpha if an investor can identify improving credits early.

3. Portfolio Alchemy Creates a More Efficient Package

A diversified global multi-sector credit allocation can provide hearty yields, robust total returns and a higher degree of income efficiency. These characteristics have helped the global multi-sector index outperform US high-yield corporate bonds over the long run and in more than 80% of three-year periods—with similar risk levels (Display).

For US investors seeking income in what looks to be an extended low-yield environment, we think it makes sense to invest across market boundaries and borders, tapping into a global opportunity set. Efficiently designed, a diversified global multi-sector credit strategy can improve return potential and boost portfolio efficiency while expanding the field for alpha opportunities.

Actively adjusting a portfolio’s exposures to emphasize the most attractive opportunities throughout the cycle can be a highly effective way to navigate changing markets. What’s more, a global multi-sector credit strategy can combine with other building blocks to form any number of Efficient IncomeSM portfolios anywhere on the income-to-risk continuum.

Related: Look Inside Hot Products for Transformational Growth Stocks