Stocks continue to look shaky. Despite rebounding a bit over the past couple days, the S&P 500 is down 7% over the past month.

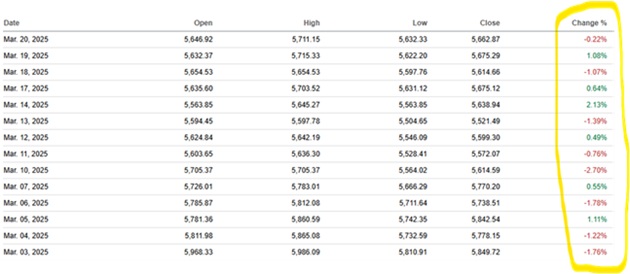

And just look at how the market’s closed each day since March. This is the definition of a roller coaster. Up big one day, down big the next.

I (Chris Reilly) have been in the investing research business for over 10 years now, and I can tell you:

These are exactly the times when having a steady guide makes all the difference.

I feel bad for investors who listened to Wall Street coming into the year.

But members of our flagship advisory Disruption Investor knew better.

In the January issue of Disruption Investor, RiskHedge’s Chief Analyst Stephen McBride flagged four “caution” lights flashing over the market:

#1: Too many record highs in 2024. The S&P 500 made 57 new all-time highs last year—the most since 2021.

After studying nearly 100 years of market history, Stephen and his team found that when stocks notch 50+ record highs in a year, they typically stumble the next. Since 1928, this has happened seven times, with stocks falling an average of 3% the following year.

#2: Wall Street’s universal bullishness. Every major Wall Street firm predicted stocks would rise in 2025. Problem is, Wall Street’s public forecasts are consistently awful.

In 2022, it predicted stocks would rise 5%; stocks tanked 18%.

2023? It predicted stocks would fall for the first time ever. The S&P soared 26%.

History tells us you usually make money by doing the opposite of what Wall Street expects.

#3: The market was starting to feel frothy. Back in late 2022, when pessimism peaked, Stephen pounded the table to buy stocks—and the S&P 500 rocketed 60%+ afterward.

Fast forward to the start of 2025... investors were showing record-high confidence, financial journalists were cheering for bubbles, and even career pessimists had turned bullish.

These were classic warning signs which Stephen identified. “When financial journalists turn cheerleaders, it’s usually time to turn cautious.”

#4: The presidential cycle reset. Year one of a presidential term historically delivers the second-weakest returns of the four-year cycle. While stocks tend to inch higher with an average gain of 4.8%, there’s a 45% chance they’ll fall instead—basically a coin flip. Another reason to be cautious.

Here’s Stephen’s three-part strategy for this market...

First, sell stocks you only “kinda, sorta” like.

As Stephen recently said, it’s time to be extra selective.

Second, continue accumulating shares of great disruptors. Specifically companies that can continue to grow revenues and profits and are not just relying on stories or hype.

Finally, #3:

Protect against downside with strategic hedges.

This balanced approach is why our readers have been so well-positioned during recent volatility.

Let’s quickly touch on that last part: the hedge.

There are countless “one-hit wonder” investors who strike it big during a stock market rally... only to give it all back when markets turn south.

The whole point of investing is to build lasting wealth.

That’s why opportunistic hedging is a cornerstone of our investment research.

Unlike simple diversification (which spreads risk across various investments), hedging actively protects your capital from specific risks during specific time periods.

While many investors confuse diversifiers (like bonds, gold, real estate…) with true hedges, there’s one crucial difference: timing.

With hedging, timing is essential. If a hedge doesn’t “work” when you need it to, it’s not a good hedge.

The best hedges rise a lot in value exactly when you need them to—when most other prices are falling.

Navigating markets like we’re seeing today isn’t easy.

That’s why having a proven guide like Stephen is so important.

Stephen has been helping investors sidestep risk and capitalize on opportunities for years. And every week, he shares his best insights—for free—in The Jolt, his must-read investing letter.

If you want a way to stay informed on what’s happening in the market and make smarter investing decisions, I encourage you to sign up for The Jolt today. You’ll get Stephen’s latest research and market insights delivered straight to your inbox twice a week.

Click here to join thousands of investors who are already reading The Jolt.