Written by: David Waddell | Waddell and Associates

THE BOTTOM LINE:

High sentiment levels entering 2025 lowered our expectations for returns in 2025, as we recently shared in our annual Outlook presentation. Markets lacking clarity and conviction seldom move high and to the right. However, sideways markets with high volatility levels provide investors with terrific entry opportunities. Use sentiment as your guide. When investor sentiment reaches negative extremes (as they have this week), buy something. Adhering to this strategy during Trump 1.0’s tariff deliberations led to outstanding investment returns once his policies hardened. Clarity builds conviction. Furthermore, Trump considers the stock market his economic scoreboard. Should the score move against him, expect him to call different plays. This year will require patience and courage. Use the fear to endear your future returns.

I hope you have had a chance to watch our 2025 Outlook presentation. If not, click here! In it, we conclude with the notion that high expectations for 2025 will likely lead to lower returns for investors.

Remember that investment returns largely rely on reality exceeding expectations. High economic and investment return expectations at the end of 2024 reduce the odds of positive surprises in 2025 and increase the odds of negative surprises.

Many of Trump’s campaign promises fueled these expectations. Trump promised to “reaccelerate” economic growth. That’s hard to do with economic growth already running well above potential—especially when imposing tariffs, slashing government spending, and reducing labor force growth reduce GDP.

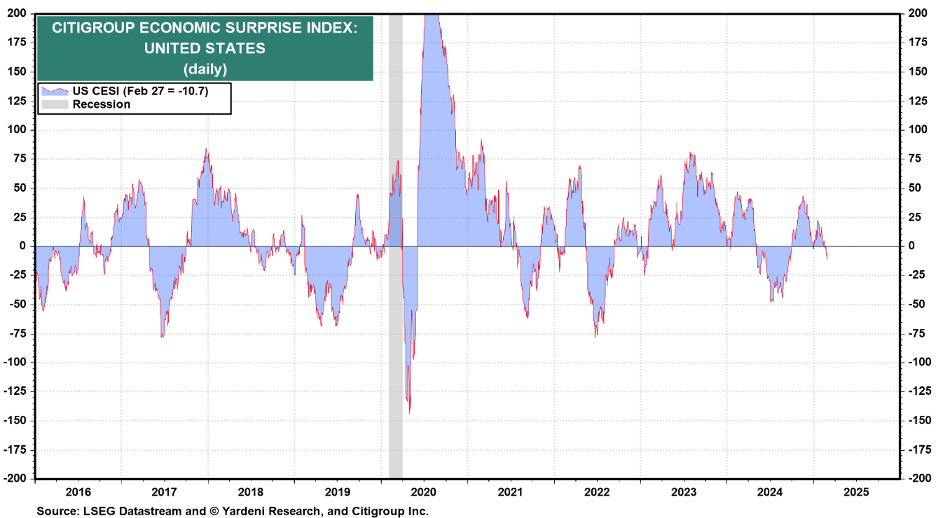

These policies may be good for America as Trump restructures our economy, but in the short term, they act to reduce growth, not accelerate it as seen in the current Citigroup economic surprise index. Positive readings mean economic realities are exceeding expectations, while negative readings mean economic realities are falling below expectations:

Fortunately, as you can see, mismatches between expectations and reality become resolved as expectations adjust. During the middle of 2024, we had a solid growth scare when GDP fell to a 1.6% growth rate in Q1, the unemployment rate rose from 3.7% to 4.5% in July, and the S&P 500 fell 8.5% in August.

Moved by fears of being “behind the curve”, the Fed cut rates in September by 0.5%, clearly unnerved by the deceleration in activity. Fortunately, the growth scare of 2024 didn’t metastasize into a growth collapse as GDP reaccelerated and reality began outperforming lowered expectations as seen in the chart above. By year end, the S&P 500 rallied 13.5% off the August lows.

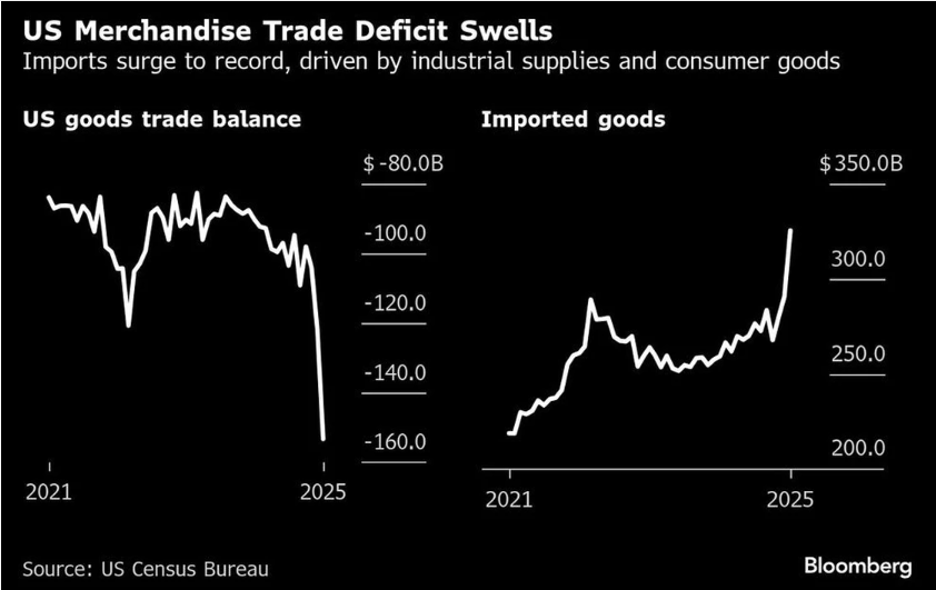

In a market wrestling with so many policy unknowns, moves in activity and sentiment can become exaggerated. For instance, business operators fearful of upcoming tariffs have accelerated offshore purchase orders to stockpile supplies. On Friday, we received a much higher than expected trade deficit report:

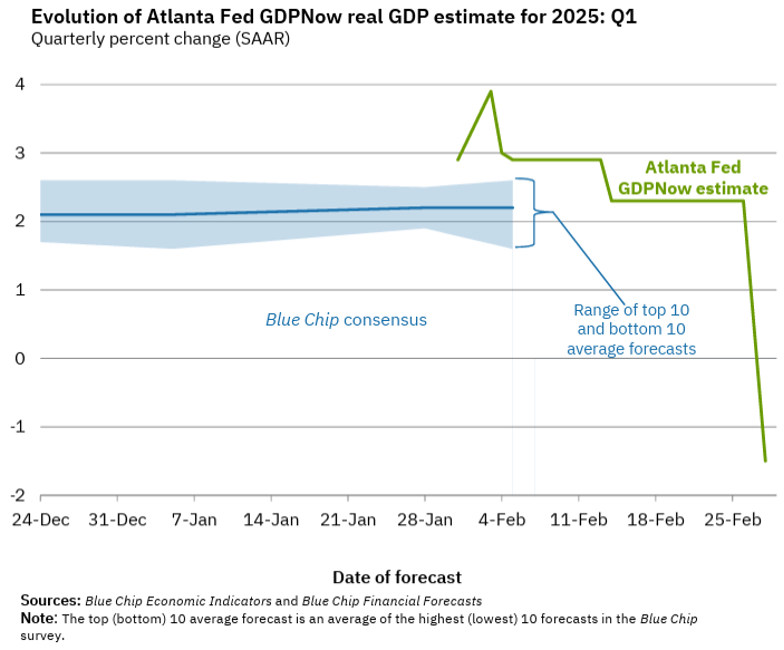

This massive distortion will weigh heavily on first quarter GDP. Import levels rose 12% (negative for GDP) while export levels rose 2% (positive for GDP). Consider the impact on the real-time Federal Reserve’s GDPNow estimate for first quarter GDP:

In the words of the Atlanta Fed:

“The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2025 is -1.5 percent on February 28, down from 2.3 percent on February 19. After recent releases from the US Bureau of Economic Analysis and the US Census Bureau, the nowcast of the contribution of net exports to first-quarter real GDP growth fell from -0.41 percentage points to -3.70 percentage points.”

I don’t recall an economic report that upended growth estimates this much. And yet, markets rallied Friday morning, comforted by a benign reading from the Fed’s preferred inflation gauge and a stronger-than-expected report on real personal income.

So, if the books closed on Q1 today, precautionary import activity and restrained Government spending could offset positive investment and consumption activity, perhaps producing a negative GDP number. Were the tariffs imposed tomorrow, imports would collapse and entirely reverse the polarity.

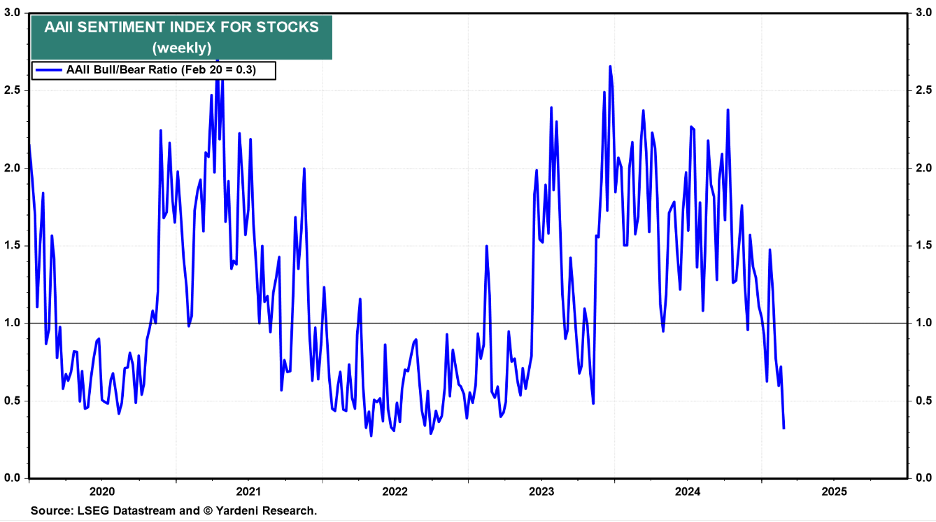

In the following quarter, consumption might collapse under the weight of higher import prices, and investment might accelerate as domestic suppliers ramp up production. Seasick yet? No wonder options volatility levels have spiked and investor sentiment levels have collapsed:

This chart divides the number of retail investors declaring themselves “bullish” by the level of retail investors declaring themselves “bearish”.

Currently. 19.4% of survey respondents count themselves “bullish”, while 60.6% count themselves as “bearish”. These are the most pessimistic numbers we have seen since 2022 and one of the most rapid collapses in sentiment on record.

As a result, market leadership has shifted significantly, with the MAG-7 having declined 8% on the year while healthcare, consumer staples, and utilities have gained 6%, 4%, and 3%, respectively. This “risk off” sentiment calibrates with growth concerns, and with our 2025 outlook predictions.

Trump levied his first tariffs on imported goods in January of 2018. Trump concluded his tariff campaign late in 2019. Markets struggled to advance during this period, unsure of the policies and their economic implications:

However, during this volatile period, the late 2018 growth scare led to a fantastic entry point for investors as the Federal Reserve cut rates and confidence reaccelerated. GDP reached the highest growth rate of Trump’s first administration at nearly 5% during the third quarter of 2019, and the S&P advanced nearly 32% on the year.

We expect similar results from the current environment. Expect markets to lack conviction, and trade within a range that has occasional collapses in sentiment. Use these moments to increase risk within portfolios since low expectation extremes create copious opportunities for positive surprises. The current retail investor survey may mark such an entry point worth exploiting, but be patient—we suspect this will not be the only one.

Related: The One Sure Thing in Markets Today? Uncertainty

Sources: LSEG Datastream, Yardeni Research, Citigroup, Census Bureau, Blue Chip, Atlanta Fed, S&P Global, Macrobond