Written by: David Waddell | Waddell and Associates

THE BOTTOM LINE:

The weakness in labor markets fully revealed on Friday drove the 10-year Treasury yield down to a 14-month low of 3.79%. Unfortunately, this benchmark rate decline signals rising recession risks. Fortunately, lower interest rates decrease recession risks. Clearly, the Fed has fallen behind, but they can quickly catch back up with the next FOMC meeting only six weeks away. They need to cut rates by .50% and commit to a more aggressive path toward their 3% “neutral” target. While the risk of a policy mistake should concern investors, corporate earnings releases should not. “Weak” earnings announcements from the Magnificent 7 stem from overheated expectations, not tepid reality. Furthermore, earnings strength has broadened and accelerated well beyond the Magnificent 7. Should the Fed correct this most recent policy mistake and preserve the expansion, this market downturn will prove opportune for the investors holding $6.4 trillion in money market funds… which will soon be earning far less.

The Full Story:

This week produced a deluge of earnings reports, Fed policy decisions, and economic reports. Each held stand-alone information that told investors one thing, while their combined information told investors another. This dissonance created anxiety in the marketplace, culminating in a sharp sell-off to begin August. Let’s pick through the headlines and low lines to ascertain if this is cataclysmic or simply a storm before the calm.

Second quarter earnings reports have proven supportive for the markets overall, with 80% of those reporting beating expectations. However, notable exceptions weighed heavily on sentiment. Among the Magnificent 7, six have now reported earnings. Here is how they have fared since reporting:

Tesla bombed with numbers far short of expectations. Alphabet whiffed with disappointing ad growth from YouTube. Amazon revenue growth and guidance disappointed. Microsoft fell short of growth expectations for its cloud services. Each fell notably. Apple fanned hopes that AI integration will soon boost lagging iPhone sales. Meta reported solid earnings and raised forward guidance as AI has boosted ad sales. Each rose marginally. So, of the Mag 6 that have reported, only Meta proved its magnificence.

But is this true?

Even including Tesla’s troubles, the Mag 6 reported average earnings growth of 30% over the past year despite colossal capital expenditures. In reality, these earnings are magnificent. Unfortunately, expectations were higher. Pricing these stocks for perfection set the stage for a sell-off, just as pricing small-cap stocks for death set the stage for a surge. Sentiment extremes invite rotations. Don’t confuse investor rotation with fundamental failure. The added lift from the reporting Mag 7 has pushed S&P 500 expected earnings growth well over 10% for this quarter… a level that may persist for many quarters to come.

What the Fed Shoulda Said

The Federal Reserve concluded its July meeting by releasing an official statement shifting focus slightly away from inflation concerns and slightly toward unemployment concerns, bringing the two concerns roughly into balance. The Fed noted that a rate cut in September “seems appropriate.” An off-cycle cut in July might have appeared panicky, but by passing in June and waiting until September, the Fed may have fallen behind the curve. If they view the balance between inflation and employment risks as neutral, then why leave the Fed funds rate in such restrictive territory? The Fed has held rates at 5.5% for 12 months now while broadcasting that the neutral rate sits near 3%. Maintaining a 2.5% restrictive rate spread between today’s “normal” economics and the “neutral” policy rate seems like a mistake to us. Jerome Powell will surely outline his “soft landing” plan for insurance interest rate cuts at Jackson Hole at the end of this month. However, should “hard landing” risks percolate, appropriate policy will need to quickly shift from insurance cuts (slow and shallow) to emergency cuts (fast and deep). No denial accommodations afforded to backward-looking FOMC members who prefer inertia, please. Powell needs the courage to speak and act decisively.

Insurance or Emergency?

The COVID economy followed a clear progression. First, fear and quarantines forced a fast recession. Next, stimulus and stay-at-home requirements ignited a surge in goods demand and goods inflation. Then, as quarantines lifted and cabin fever roared, the splurge on services led to labor shortages and wage inflation. To combat roaring inflation, the Fed hiked rates aggressively and inverted the yield curve. This led to major bank failures in early 2023, contained only by major response measures from the Treasury and the Fed. In the latter part of 2023, the strength of the “Swifty” economy offset the undertow from goods and housing weakness. 2024 provides “soft landing” potential as COVID aftershocks pass, restoring normalized growth, inflation, and Fed policy. Close curtain!

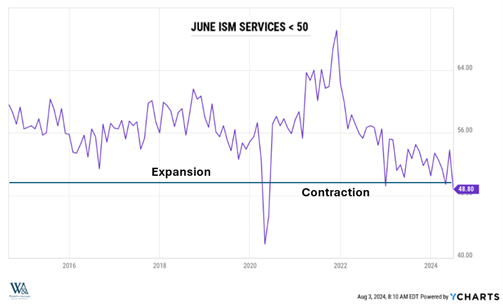

Unfortunately, economics isn’t so neatly predictable. Acute data hawks took nervous note of the June ISM services report, depicting a service economy (78% of GDP) in surprise contraction.

Without an uplift from the services side of the economy, the undertow of housing and manufacturing threatens overall economic buoyancy. For our readers, you will remember our call for rate cuts intensified around this time. With the goods and services sides of the economy indicating weakness, a weak labor report should logically follow… and we received that report on Friday.

The US economy added 114,000 jobs in July, far less than the 185,000 jobs expected. The unemployment rate rose to 4.3%, its highest level since October of 2021 and nearly a full percentage higher than the 3.4% low reached in 2023. Historically, upticks of this magnitude in the unemployment rate have presaged recession, as seen below:

Source: https://fred.stlouisfed.org/graph/?g=1r8Aa

Following the report, futures markets priced in a greater than 70% chance that the Fed will cut interest rates by .50% in September. While this may appear like an emergency cut (faster and deeper), we see it more as a catch-up insurance cut (slower and shallower), but the message in the markets is clear: the “long and variable lags” have arrived and without rate normalization, a recession will follow.

In sum, by not cutting rates starting in June, the Fed has fallen behind the curve. Friday’s labor report confirms the mistake but provides the opportunity for correction, first with decisive language from Powell’s Jackson Hole speech and then with decisive action at the September FOMC meeting. Investors should use this summer swoon to relocate money market funds with falling yields into longer-term bonds with rising prices and corporate equities with rising earnings.

Sources: FRED, YCharts, Yahoo Finance