Last week, President Joe Biden hosted Narendra Modi in a lavish state visit, the Indian prime minister’s first, with both nations seeking to realign their strategic interests at a time when China’s global influence continues to grow.

During the event, both leaders committed to strengthening defense and commercial ties, highlighting the importance of international law and maritime freedom amid rising tensions in the East and South China Sea.

The state visit also underlined the burgeoning technological partnership between the two nations, with many notable tech leaders in attendance, including Google’s Sundar Pichai and Microsoft’s Satya Nadella, both born in India.

The prime minister’s goal? To establish India as a global manufacturing and diplomatic powerhouse, an ambition fueled by strained relations with China.

The visit led to several significant agreements, spanning sectors from semiconductors and critical minerals to technology, space and defense. Of these, a landmark deal will allow General Electric to produce jet engines in India, underscoring the country’s manufacturing prowess. Boise, Idaho-based chipmaker Micron Technology’s $800 million investment for a semiconductor facility in India was also announced. Further, India agreed to join the U.S.-led Artemis Accords, marking a new era in collaborative space exploration.

The World’s Second-Largest Economy By 2075?

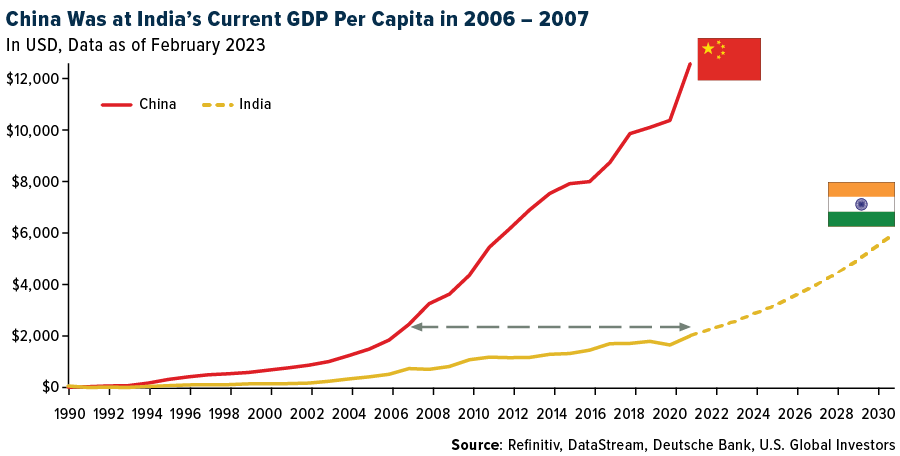

These ties aren’t just about politics. They’re rooted in a flourishing economy that’s turning heads globally. India’s GDP currently stands at around $3.7 trillion, but Deutsche Bank believes it could double to $7 trillion by 2030. Put another way, India’s GDP per capita is right around where China’s was in the 2006-2007 period.

Deutsche attributes this growth to an expanding middle class, policy reforms, infrastructural development and a shift toward clean energy, among other factors. The nation has very favorable demographics, with the median age of its citizens below 30.

At the end of April, the United Nations reported that India had overtaken China as the most populous country on earth, and it’s now on track to add 97 million individuals to its working population over the next 10 years. This is believed to represent the largest workforce growth of any nation on earth for that period.

Yet challenges persist, such as inadequate employment opportunities and “jobless growth.”

Despite these issues, India continues to be a powerhouse of wealth creation. New millionaires are being minted at a staggering pace, and according to the Henley Private Wealth Migration Report 2023, the country’s net outflow of high-net-worth individuals (HNWIs) appears to be slowing year-over-year.

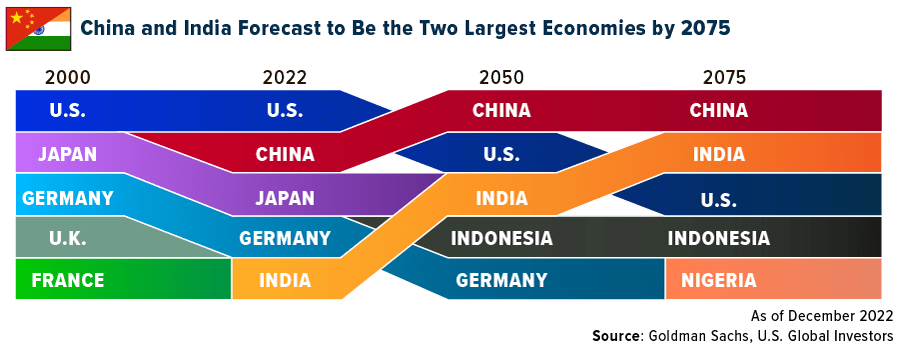

And the future? Goldman Sachs predicts that by 2075, India will be the world’s second-largest economy after China, overtaking the U.S. by a slim margin. The possibilities seem endless if the right policies can be aligned with the anticipated rapid population growth.

Global Giants Are Betting On India’s Growth Story

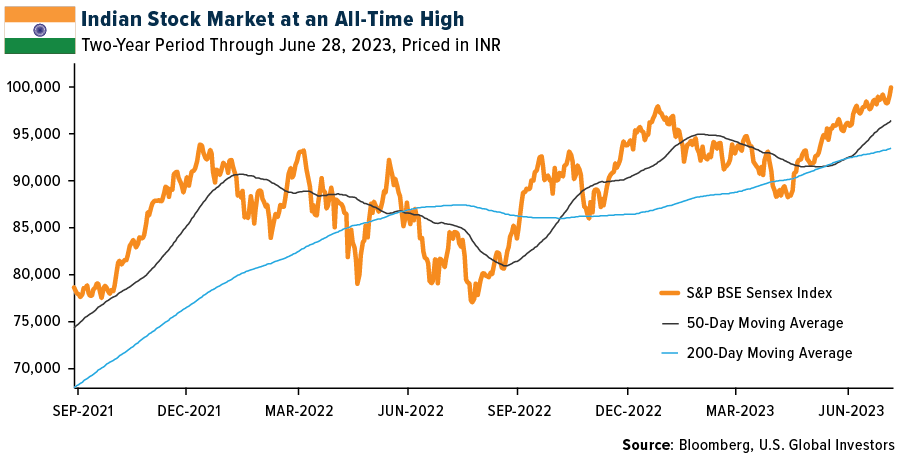

While uncertainties remain, signs of optimism abound. India’s Sensex, the benchmark index of the Bombay Stock Exchange, recently hit a record high, buoyed by rapid economic growth and increased foreign investment.

Investors, too, are recognizing India’s potential. Despite recent dips in foreign direct investment (FDI) due to geopolitical tensions, India has managed to attract nearly $920 billion in total from April 2000 to March 2023, according to Dezan Shira & Associates.

Major global corporations like Amazon and Google are betting big on India. Amazon plans to invest an additional $15 billion by 2030, with Amazon Web Services (AWS) contributing $12.7 billion to cater to surging customer demand. Google aims to establish a fintech center in India’s Gujarat International Finance Tec-City (GIFT City) and extend its AI chatbot Bard to more Indian languages, making the internet more accessible to India’s diverse population.

During his U.S. visit, Modi met with Elon Musk, signaling potential investments in India’s renewable energy and electric vehicle sectors. With its recent policy reforms opening its space sector to private players, India offers a promising arena for SpaceX’s Starlink satellite internet service.

India has “more promise than any large country in the world,” Musk said following the meeting, adding that he was confident that Tesla will be in India “as soon as humanely possible.”

A Rising Beacon Of Opportunity

India is rapidly transforming into a formidable global superpower and an increasingly attractive destination for investor capital. Amid rising geopolitical tensions and the impact of disruptive technologies, India’s story is a beacon of opportunity in a challenging landscape. Its steadily growing middle class, policy reforms and digital prowess are reshaping its economic trajectory, inviting an influx of foreign capital.

For investors, I believe the time to recognize India’s potential could be now.

To my Canadian friends and family, Happy Canada Day! And to my American friends and family, Happy Fourth of July!

Index Summary

- The major market indices finished up this week. The Dow Jones Industrial Average gained 2.02%. The S&P 500 Stock Index rose 2.35%, while the Nasdaq Composite climbed 2.19%. The Russell 2000 small capitalization index gained 3.68% this week.

- The Hang Seng Composite gained 0.58% this week; while Taiwan was flat and the KOSPI fell 0.23%.

- The 10-year Treasury bond yield rose 9 basis points to 3.832%.

Airlines And Shipping

Strengths

- The best performing airline stock for the week was Sun Country, up 13.7%. Bank of America is raising its 2023E EPS for airline coverage due to lower fuel costs versus earlier in the quarter (jet fuel is down 13% since early April). The bank’s second quarter revenue estimates remain largely unchanged and its third quarter revenue estimates are below consensus given softness in bookings data. They expect earnings season to continue to highlight international over domestic with limited visibility into post-Labor Day travel.

- YZJ Shipbuilding announced fresh orders: 1) Maersk – maiden 6 X 9,000 TEUs dual-fuel (DF) methanol containership orders; 2) Klaveness Combination Carriers (KCC) – fleet upgrades for existing three combination carriers; and 3) an additional 37 vessels spanning containerships, oil tankers and dry bulk carriers.

- Southwest Airlines reached a tentative agreement with mechanics and related employees. Last week, the company’s management announced that they reached a tentative agreement with the Aircraft Mechanics Fraternal Association (AMFA), which represents Southwest’s aircraft maintenance technicians and related employees (ground equipment technicians, maintenance controllers, etc.). Since October 2022, Southwest has ratified numerous contracts with union work groups and remains committed to continuing negotiations.

Weaknesses

- The worst performing airline stock for the week was Cathay Pacific, down 3.6%. U.S. airline cancellations ticked up noticeably over the past week, primarily due to bad weather. The AlphaWise Flight Tracker indicated that 2,360 flights of over 119,520 captured flights from nine of the major U.S. focused airlines were canceled last week. This represents 2% of their scheduled flights. Spirit Airlines and United Airlines had the highest percentage of cancellations occurring over the past week at 4% of captured flights.

- Container rates have declined by $100 over the last month on the West Coast, and are down $30 on the East Coast, now sitting at $2,300 out East, and $1,200 out West. This compares to pandemic highs of $22,100 and $20,600, respectively. Labor disruptions seen in June on the West Coast Ports appear to have had no impact on spot pricing, suggesting excess capacity in the network.

- Embraer disclosed 13 new commercial orders during the Paris airshow, seven 175-E1 to American Airlines and six 195-E2 to Binter, below investors’ expectations, and derailing the stock by 13%. UBS sees Embraer with too much downside priced in, as the company is trading at 6.5x EV/EBITDA for FY2023E.

Opportunities

- Copa Airlines recently hosted its Investors Day. Highlights included: 1) CASM ex-fuel target of $5.8 cents by 2025; 2) the company expects to reduce CASM ex-fuel through aircraft densification, it has a new ticket distribution strategy, and lower frictions in aircraft engine maintenance are affecting Copa in the last years; 3) ancillary revenues and revenues coming from the upsell from basic to classic fares are becoming more representative of the company’s total revenues; 4) the company already repurchased $110 million from the $200 million repurchase program.

- Dry bulk demand has trended at 3-4% year-over-year, higher so far in 2023 led by strong major bulk demand particularly for coal. Freight rates have been unseasonably low through June 2023 on easing Chinese coal imports and softer macro, combined with lower vessel congestion – although larger to mid-sized vessels appear to have found a bottom. Forward curves suggest that the second half of 2023’s handysize/supramax rates can average $3,000 per day higher than current spot levels helped by seasonality. However, the extent of the uptick will depend on China macro and any stimulus measures.

- Airbus expects 40,850 deliveries in the next 20 years (up from 39,490 in its previous forecast). This includes 32,630 narrowbodies and 8,220 widebodies. Boeing expects 42,595 deliveries in the next 20 years (up from 41,170 deliveries in its previous forecast). This includes 32,420 narrowbodies, 440 widebodies, 925 freighters, and 1,810 regional jets.

Threats

- Workers represented by IAM at Spirit AeroSystems, a Tier 1 OEM supplier, announced a strike starting June 24. While the duration of the strike is unknown and likely limited, the timing comes when OEMs are already stressed to ramp up production targets.

- The gradual implementation of the EU Emission Trading System (ETS) between 2024 and 2026 will lead to incremental carbon costs for ocean carriers. For Maersk, 15% of its global CO2 emissions will be subject to the ETS Scheme. Using the current price of €90/ton of carbon, the total annual compliance cost could be around €440m in fiscal year 2027.

- Qantas has suffered from negative publicity associated with its Covid credit scheme and the challenges faced by consumers in redeeming the $400 million in credits remaining. Qantas has $5.4 billion of revenues received in advance on its balance sheet as of December 2022, a meaningful increase from the $3.3 billion pre-Covid. The $2 billion improvement in cash on the balance sheet has been a material driver of the group’s reduced net debt balance.

Luxury Goods And International Markets

Strengths

- Economic data in the United States is beating expectations, reducing the likelihood of a recession. New home purchases jumped 12.2%, durable goods orders unexpectedly climbed 1.7%, and consumer confidence reached the highest since the start of 2022.

- Goldman Sachs reiterated a buy on luxury goods producer, Richemont. The broker expects the company’s growth to moderate, but still believes the outlook for next year remains positive. This is supported by an acceleration in Chinese consumption, offsetting the deceleration in the U.S.

- RealReal Inc. (an online retailer platform) was the best performing S&P Global Luxury stock in the past five days, gaining 59.63%. Bank of America analyst Michael McGovern upgraded RealReal to Neutral from Underperform with a price target of $1.85, up from $1. The shares closed at $2.20 on Friday.

Weaknesses

- HSBC cut Kering’s ratings to a hold, citing the uncertain timing of Gucci’s recovery and lack of a near-term catalyst. The company’s performance has been disappointing quarter-over-quarter, lagging its peers. Kering shares were little changed this week.

- Bernstein’s analyst Willian Woods said that German luxury retailer Zalando has an outdated platform, predicting that the company is unlikely to achieve its long-term targets. Later in the week, JPMorgan cut the company’s price target to EUR32 from EUR39. On Friday, shares closed at 26.2 EUR.

- Luk Fook Holdings International (Hong Kong’s jewelry retailer), was the worst performing S&P Global Luxury stock in the past five days, losing 15.6%. Shares dropped after the company announced a full-year earnings miss.

Opportunities

- The partnership between Lucid Group Inc. and Aston Martin, supported by Saudi Arabia’s sovereign wealth fund, presents a significant growth opportunity. Aston Martin’s acquisition of battery-electric powertrain components from Lucid, valued at $232 million, strengthens its position in the electric vehicle market and boosts Lucid’s financial position. This collaboration enables both companies to capitalize on the demand for sustainable mobility solutions and drive future success in the evolving electric vehicle industry.

- Bernard Arnault, chairman and CEO of luxury giant LVMH, arrived in China for his first visit to the country since the end of Covid restrictions, meeting local LVMH teams in several cities. The company reported strong quarterly sales this year driven by a rapid rebound in Chinese spending on luxury goods.

- China Premier Li Qiang said China is still on track to hit its annual growth target of around 5% and he expects the growth to be faster in the second half of the year. Li also said Beijing will roll out “more practical effective measures.” The PBOC will likely cut the medium-term facility rate and reduce the reserve ratio requirement for banks in the coming months. Economists also forecast consumer tax breaks and funding for additional infrastructure projects.

Threats

- The conviction of former Audi boss Rupert Stadler in the diesel emissions scandal poses future threats to Audi and Volkswagen, including potential damage to brand reputation, ongoing regulatory challenges, increased competition, and difficulties in adapting to changing market dynamics. These factors can impact their long-term growth, market position, and overall sustainability.

- A report from Placer.ai, which uses cell phone data to track shopper traffic, said that foot traffic to off-price, luxury, and secondhand retailers surged in May from January 2019 at the expense of apparel retailers. This situation may last longer if inflation remains elevated.

- As expected, China’s Manufacturing PMI improved slightly but remains in contractionary territory, below 50. Last week, the preliminary EU Manufacturing PMI for June dropped to 43.6 from 44.8. Next week, the United States will release its Manufacturing PMI and we are expecting to see a low reading as well, indicating a global slowdown in manufacturing activities.

Energy And Natural Resources

Strengths

- The best performing commodity for the week was crude palm oil, rising 4.67%, as exports from Malaysia were down 6.9% for June and its rival, soybean oil, has also seen strengthening prices. Copper will surge in coming years as relatively low prices now stymie investment in new mines, even as the energy transition drives more demand, Eurasian Resources Group said. Miners will need to boost supplies by moving into more challenging and expensive jurisdictions, which will require higher prices to offset increased costs, Benedikt Sobotka, ERG’s chief executive officer, said in a Bloomberg TV interview at the World Economic Forum’s Annual Meeting of New Champions.

- The global lithium market is facing a supply crunch toward the end of this decade amid wider adoption of electric vehicles, with more than $51 billion in investments

needed to meet future demand of rechargeable batteries, according to Benchmark Mineral Intelligence. “We need to move urgently here or we’re going to have massive problems meeting the demands of the auto industry,” Chief Operating Officer Andrew Miller told a seminar in New York on Tuesday. - Copper is poised to follow other commodities upended by recent price surges as the mining industry struggles to expand ahead of accelerating demand, warns the man behind some of the world’s biggest mines. Demand for critical raw materials is set to jump as nations mandate clean energy and transport while clambering to develop their own supply chains. But a combination of factors suggests supply will not keep pace, according to billionaire Robert Friedland. They include the fact that deposits are getting pricier and tricker to find and dig up, funding is scarce, and societies have yet to grasp mining’s role in the shift from fossil fuels.

Weaknesses

- The worst performing commodity for the week was corn, dropping 13.82%, on rain forecast to relieve the drought-battered U.S. crop after corn prices surged since late May. Gasoline, long the mainstay of oil demand, is the only product which demand could decline over the current decade. Additionally, consumption of petroleum-based road diesel will likely plateau, with a larger share of demand substituted by biofuels. In contrast, demand for all other products will continue to grow as decarbonization technologies do not yet exist at the scale required to move the needle by 2030.

- Uranium spot prices continued to retrace recent gains, declining for a second consecutive week, with demand being pushed out to the 6–12-month timeframe as immediate concerns around Russian import bans have tempered.

- The Baker Hughes U.S. land rig count continues to decline. It has now fallen for eight consecutive weeks and ended last week at 663 rigs. The count has now declined by 101 rigs since the end of last year. The market’s focus is already more concentrated on expectations for the second half and into 2024.

Opportunities

- Shell’s new CEO used last week’s investor day in New York to make his mark on the company’s strategy – not by changing it, but by centering it around tighter cost and capital control. The $5 billion cut to Shell’s Group capex and opex budget acts as a powerful ‘redemption’ signal as Shell no longer talks of absolute growth ambitions in any metric – and instead focuses on per share FCF creation.

- According to JPMorgan, global aluminum inventory continues to decline, and is now at a five-year low, while the price sits below 90th percentile cash. Chinese aluminum demand has been surprisingly strong, and is up about 6% year-to-date, while Chinese production in the past few months is flat year-over-year.

- A research team led by the U.S. Department of Energy’s Argonne National Laboratory has developed a cost-effective catalyst for the electrolysis process, which generates clean hydrogen from water. The new catalyst, primarily composed of cobalt, a much cheaper element than iridium traditionally used, outperformed competitors’ catalysts in terms of performance and durability under industrial operating conditions. The development aids the DOE’s Hydrogen Energy Earthshot initiative, aiming to lower the cost of green hydrogen production to $1 per kilogram in a decade.

Threats

- According to Goldman, as oil demand has realized in line with fundamentals such as GDP, the energy crisis has not led to any significant already visible damage to demand. That said, investment in clean energy (up 15% year-on-year) and EVs (up 60%) jumped in 2022, and any sustained sharp rises in capex in substitutes would weigh on long-run oil demand. These findings support Goldman’s view that oil prices will likely not rebound to their 2022 highs over the next year.

- Gas well drilling is decreasing. Development gas wells declined to 60 as increases in the Piceance and in small plays were offset by losses in the Barnett, the Marcellus, and the Woodbine. Development oil wells fell to 190, driven by large losses in the Permian, the Powder River Basin, and other small plays.

- UK pension funds are dangerously misaligned with the goal of reducing greenhouse gas emissions fast enough to limit global warming to the critical threshold of 1.5C, a new study has found. The industry holds more than £88 billion ($110 billion) in bonds and equities issued by fossil fuel companies, according to a report published Wednesday by Make My Money Matter, a climate

finance campaign co-founded by Love Actually director Richard Curtis. That is roughly 10 times as much as UK pension funds hold in listed FTSE 350 clean energy stocks, it said. A recent study in the U.S. showed that disinvestment tends to force energy companies to pollute more. A better approach might be to offer incentives to mitigate pollution. A 1% reduction of pollution from the heaviest polluters would be very meaningful.

Bitcoin And Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Bitcoin Cash, rising 101.75%.

- MicroStrategy says it has acquired about 12,333 Bitcoin for around $347 million in cash at an average price of about $28,136 each, inclusive of fees and expenses, between April 29 and June 27. The company held an aggregate of about 152,333 Bitcoin as of June 27, writes Bloomberg.

- Bitcoin is hovering around its one-year high as asset manager Fidelity reportedly readies its filing for a spot exchange-traded fund (ETF) for the digital asset. The rally comes on the back of Fidelity’s news, writes Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Conflux, down 27.16%.

- Crypto exchange Huobi Global said it will remove 10 “trading pairs,” primarily ones involving tokens used in transactions with the USDD stablecoin issued by the TRON DAO Reserve that is supported by digital asset entrepreneur Justin Sun, writes Bloomberg.

- Binance Holdings will lose access to euro-denominated bank transfers to and from its cryptocurrency exchange via banking partner Paysafe, the latest in a recent string of blows to its business in Europe. Paysafe will no longer support bank transfers from Sept. 25, writes Bloomberg.

Opportunities

- HSBC Holdings is offering trading of crypto-linked exchange traded funds (ETFs) to customers in Hong Kong amid a push by the city to establish itself as a hub for the alternative asset class, writes Bloomberg.

- Hut 8 Mining, one of the largest public Bitcoin mining companies, said it has entered into a $50 million credit facility with a unit of Coinbase Global. The agreement comes as Bitcoin miners prepare for a preprogrammed event on the digital asset’s blockchain dubbed the halving, writes Bloomberg.

- The opening of a new crypto exchange backed by Citadel Securities has unleashed a speculative mania in Bitcoin Cash, an offshoot of the original digital token. Bitcoin Cash soared 25% to $304 on Friday, writes Bloomberg.

Threats

- Robinhood is cutting about 7% of its full-time staff in the online brokerage’s third round of layoffs in just over a year as the company adjusts to a slowdown in customer trading activity. About 150 employees are being laid off, writes Bloomberg.

- Bankrupt FTX Trading is suing the former top compliance officer to the crypto empire, accusing the lawyer of helping company founder and alleged fraudster Sam Bankman-Fried raid customer funds. Daniels Friedberg allegedly enabled FTX group managers to misuse billions of dollars of customer funds, writes Bloomberg.

- Bitcoin fell on Friday after a report that the U.S. SEC said the recent applications filed by asset managers to launch a spot Bitcoin exchange-traded fund (ETF) are inadequate, writes Bloomberg.

Gold Market

This week gold futures closed at $1,927.80, down $1.80 per ounce, or 0.09%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 0.69%. The S&P/TSX Venture Index came in up 3.77%. The U.S. Trade-Weighted Dollar was essentially unchanged by the end of the week.

Strengths

- The best performing precious metal for the week was silver, up 1.84%, as hedge fund managers raise their new long position in the futures market. Bloomberg reported on Friday that the Securities and Exchange Commission said the recent wave of applications filed by asset managers to launch spot bitcoin exchange-traded funds (ETFs) are “inadequate.” This includes those of Blackrock and Fidelity Investment, stating they were not sufficiently clear and comprehensive. Bitcoin has been a headwind to gold this year, so perhaps this news will cool down the recent enthusiasm.

- B2 provided an update that serves as an important de-risking step for the recently acquired Goose Project, providing increased confidence in the timeline, which remains on-track for the first quarter of 2025. B2 gave an updated capex estimate, with the remaining cost to completion now set at C$550M. In addition, B2 has committed to accelerating the underground mining schedule and is currently progressing geotechnical and engineering studies, which could increase average gold production to over 300,000 ounces per year.

- Endeavour Mining Plc is reported to have made a takeover approach to Kinross Gold in recent months that was rebuffed on differences over valuation, according to Bloomberg. Kinross was thought to be entertaining or drawing some bidders for its assets. Ideally, a third party may need to step in to split the deal cost and take what assets provide the most synergies with existing operations. However, there is no certainty the discussions will be reopened. This is another sign of a strengthening market for acquisitions.

Weaknesses

- The worst performing precious metal for the week was palladium, down 4.26%. Palladium fell to the lowest in more than four years on expectations that South African producers will ramp up supplies going into the earnings season. The metal, primarily used in catalytic converters, declined by as much as 6.6%. Sentiment toward it has worsened in recent weeks because the woes of South African national utility Eskom Holdings SOC Ltd. have not severely impacted output by the No. 2 producer. In the longer term, the metal faces structurally lower

demand as automakers switch to cheaper platinum for gasoline cars and consumers increasingly opt for electric vehicles. - Thirty years ago, in 1992, South Africa was by far the world’s largest gold producing nation, accounting for 27% of total global production. It now accounts for 3% of the global total. South Africa’s gold production is down 85% from 601 tons in 1992 to 93 tons in 2022. Meanwhile, growth in production from Russia, China and several newer producer nations has offset South Africa’s decline.

- South Africa Platinum Group Metal (“PGM”) equities are down 32% year-to-date, on average, partly reflecting negative sentiment related to Eskom operational impact, which perversely should restrict supply and investment and therefore support higher metal prices. SA PGMs are discounting metals prices to perpetuity below current spot prices.

Opportunities

- The chart below shows the past 30 years of gold prices averaged by week and reindexed to 100. There is a distinct seasonal pattern that is depicted by the reoccurrence of gold prices tending to rise in the June – July time window. This seasonal lift in prices is largely attributed to the jewelry industry restocking for the upcoming fall and spring holidays. Now may be an opportune time to consider adding gold and/or gold stocks to your portfolio.

- Hot Chili Limited announced a $15 million binding investment agreement with Osisko Gold Royalties. The royalty includes a 1.0% Net Smelter Return (NSR) royalty on copper and a 3% NSR royalty on gold across Hot Chili’s Costa Fuego Copper-Gold Project in Chile. Hot Chili’s Costa Fuego project has received positive results from the recently released Preliminary Economic Assessment (PEA) and is set to commence a 30,000-m drilling program following the closing of this agreement with Osisko to further upgrade resources as well as fund the advancement of the Costa Fuego PFS and general project development.

- Newcrest Mining Ltd. may have enough gold and copper deposits at its Red Chris project in Canada to open an entirely new section and extend mining in the area for decades, Chief Executive Officer Sherry Duhe said. Australia’s biggest gold producer, which is set to be acquired by U.S. giant Newmont Corp., plans to decide later this year on whether to add underground block cave mining to its open pit operations at Red Chris.

Threats

- Gold prices have typically also broadly tracked with gold ETF holdings – a rising gold price usually comes alongside gold ETF inflows and vice versa. Yet since the start of November, gold rallied as much as 25% while gold ETF holdings stayed stubbornly flat.

- Even if it is trading around a record high of $2,000 these days, gold is likely to remain so for the foreseeable future. According to a new study from the National Bureau of Economic Research, gold prices have followed some standard principles since at least 1990. To put it simply, gold prices decline when real interest rates rise. That is because gold itself has zero direct yield, so at higher interest rates the opportunity cost of holding gold goes up.

- According to Morgan Stanley’s historical analysis on gold, which has focused on real yields versus real gold price, has been shifting. Running this analysis had an R2 of 92% in 2018-2021, which fell to 63% in 2022 and is now just 30% year-to-date. The group expects gold somewhere below $1,300 per ounce and not the $1,930 per ounce it’s at today. Its price forecasts have upside to gold into year-end but have pushed out the timing of peak prices and brought targets down modestly, now calling for gold to reach $2,100 per ounce by the first quarter of 2024.

Related: Investing In Web3 Companies: Riding The Wave Of The Next Digital Revolution