Written by: Dustin Casebolt | Tarkenton Financial

Sometimes I think about the scary movies that creep me out the most. The movies that freak me out are the ones with monsters/creatures/etc., that are sneaky or stealthy. The ones you don’t see coming. Think about it. In the movie “Aliens,” there is a scene when the monsters are in the ceiling and they drop on our heroes after it is too late to defend themselves. By far the scariest part of the movie.

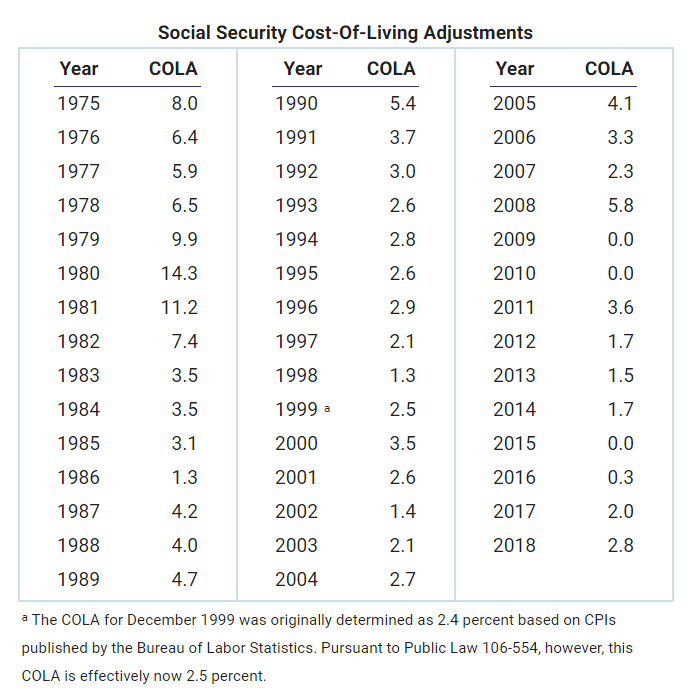

Inflation is the retirement monster a lot of people don’t see coming. So, what do we do to defend ourselves against this monster? Well, the Social Security Administration offers a COLA (cost of living adjustment) on Social Security benefits. And this helps, right? Well, let’s dive deeper. The COLA announcement is typically made in mid-October, and is based on the 3rd quarter change in the CPI-W (Consumer Price Index for Urban Wage Earners and Clerical Workers) from the previous year to current year. So what is the big announcement for this year? 2.8%. Retirees receiving Social Security will receive a 2.8% raise, the largest raise since 2012. Seems like a pretty decent increase, right? Well, let’s look at some of the factors that go into determining this “generous” raise.

As I stated earlier, the Social Security COLA is based on the change, if any, in the CPI-W from the 3rd quarter year over year. So, one inherent flaw with the way the COLA is determined is that only 3 of 12 months of the year are looked at. Another flaw lies in the categories that the CPI-W looks at. The following categories are included in the CPI-W:

- Food and beverages

- Housing (e.g., fuel to heat the home, rent, home prices, etc.)

- Apparel

- Transportation (e.g., gasoline, etc.)

- Medical care

- Recreation

- Education

- Communication

- Other goods and services (e.g., haircuts, tobacco, etc.)

Looking at all those categories, 2.8% seems good right? The short answer is yes. However, we need to understand what “wage earners and clerical workers” means, precisely. The CPI-W is used for Social Security purposes because it is a better representation for low and low-middle income earners. As Social Security was a means to cover the “essentials” for retirees, that is essentially what the CPI-W measures.

This means it does not include more luxurious items or services that most of us would aim or strive for in retirement. A lot of pre-retirees dream of travel to bucket list destinations, buying their dream car, finally getting that boat, or even just going out to dinner and socializing more. None of these are included in the CPI-W.

The other major flaw with regards to the CPI-W is that wage earners have different spending habits than retirees. In fact, retirees spend twice as much on medical expense than urban and clerical workers do. Retirees housing expenditures are also significantly higher than urban and clerical earners.

In fact, a recent study found that Social Security’s buying power has actually decreased by 34% since the year 2000. While the total COLA, in that same time has been 41.4%. Below is a historical chart of Social Security COLA’s from the ssa.gov website. So, think about that, if a client was receiving $30,000 in Social Security in the year 2000, their buying power is now equivalent to $19,800. Even though that same $30,000 would have grown to $45,094 in 2018. Let that sink in.

So, the moral of the story is that the 2.8% increase helps, but more is needed to be able do the things retirees want to do, and need to do, in retirement. That’s where, in many cases, a fixed indexed annuity (FIA) can be a great companion to Social Security benefits to help cover essential expenses for retirees. And some FIAs that you have access to through Tarkenton Financial even offer the potential for increasing income for additional protection against that sneaky old retirement monster – inflation.

Related: Positioning Annuities in the Midst of a Volatile Stock Market