Written by: Kent Hargis, Teresa Keane, and Brian Holland

Investors seeking to reduce climate risk in targeted equity strategies might not be aware of hidden hazards to portfolio construction. Climate-focused benchmarks have big positions in US heavyweight stocks, which adds concentration risk and mutes portfolio diversification benefits.

There are different ways for equity portfolios to address climate-related issues. Some might focus on companies that help solve climate challenges, while others target firms with lower carbon emissions than their peers. Another approach is to focus on companies that are integral to the energy transition across diverse sectors and industries.

Whatever approach an investor chooses, we believe it’s important to manage a climate-related portfolio with the same research rigor and risk management as any other active equity strategy. That means ensuring that the portfolio has adequate diversification.

Heavy Weights in US Mega-Caps

Passive approaches to climate-focused investing may lack that diversification. That’s because key climate benchmarks are prone to heavy concentration in a small group of giant US stocks—just like broad cap-weighted benchmarks.

It sounds surprising. After all, you would expect a climate-focused benchmark to have much different positions than the broad equity market. But in fact, the MSCI World Climate Paris Aligned Index is heavily concentrated in the same stocks that dominate the MSCI World broad market index. This is largely by design, as climate indices typically seek to limit tracking error to the broader market index.

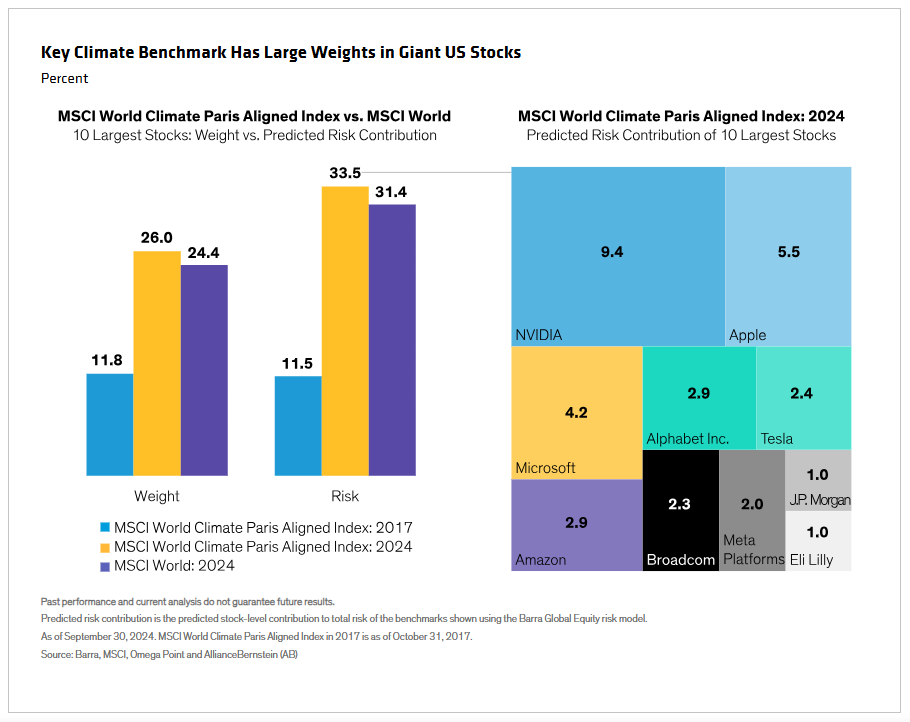

As a result, the weight of the 10 largest stocks in the MSCI World Climate Paris Aligned Index has more than doubled since 2017, to 26% (Display), higher than their weight in the MSCI World. Most of the 10 biggest stocks in the MSCI World Climate benchmark are the same as those in the MSCI World and S&P 500, such as NVIDIA, Apple and Microsoft. And the top 10 account for 33.5% of the MSCI World Climate Paris Aligned Index risk, versus 31.4% of the MSCI World risk.

To be sure, the US megacaps, also known as the Magnificent Seven, include some excellent businesses. However, we think it’s risky to own the entire group at benchmark weights, and the recent divergence in returns of the Mag Seven reinforces the case for selective stock picking. In any equity strategy, portfolio managers should own each stock based on the strategy’s philosophy while also paying attention to its overall risk characteristics. These principles apply to climate portfolios, too.

Diversifying Return Streams in Climate Portfolios

Effective low-carbon equity strategies involve more than just vetting companies for carbon emissions. Many other variables must be weighed too, since so much can determine a stock’s risk/reward profile beyond the long arm of climate change.

In climate portfolios, we believe investors should search across sectors and industries for high-quality companies that are transitioning to a lower-carbon economy. These include enablers, implementers and beneficiaries of the transition that play instrumental roles in the global energy transformation but whose carbon emission scores may not reflect that.

That’s why company fundamentals such as profitability and capital discipline are equally vital inputs in active climate-focused strategies. Strong fundamentals help quality businesses surmount macro hurdles beyond climate risks, such as inflation and higher interest rates. Attractive share valuations support return potential and help investors avoid risks in expensive parts of the market. We believe that integrating these three targets in stock selection—quality, climate and price—can better align a portfolio’s climate goals with investors’ long-term financial objectives and risk appetite (Display). Today, heightened political and geopolitical risk makes it especially important to apply thorough fundamental research to stock selection in a climate-focused portfolio.

Investors seeking a climate-focused portfolio should also think about how it fits into a broader equity allocation. The heavy concentration of the MSCI World Climate Paris Aligned Index in giant US stocks could lead investors to inadvertently double down on absolute risk if they hold similar large weights in the same companies in a US or global equity allocation.

Diversification is the cornerstone of prudent, risk-aware equity investing. Climate-focused investing is no different—long-term investing success depends on the real diversification of businesses and return streams, both within a portfolio and versus a broader equity allocation.

Related: Capital Markets in 4Q 2024: Navigating the Normalization Endgame