I don’t usually bet against the market.

If a stock is moving in one direction, there’s usually a good reason for it.

But every now and then, sentiment around a stock gets so extreme, it pays to take the other side.

And when you’re right, such contrarian trades return some of the highest profits.

Take Tesla (TSLA), for example. After peaking in 2021, the stock started tumbling. The lower it fell, the more I realized investors had become way too negative on Tesla stock.

By June 2024, Tesla was down more than 50%. That’s when I told my Jolt readers it looked like it had bottomed. TSLA is up 133% since and hitting all-time highs.

Meta Platforms (META) was another profitable contrarian trade. In July 2022, the stock was in a deep bear market, having crashed 58% in less than a year. Investors began treating the company like it was already dead.

I told my readers it was “a chance to buy a dominant disruptor at fire-sale prices.” The stock is up 286% since.

And remember what happened after the crypto exchange FTX collapsed in late 2022? The whole crypto market crashed, fear was rampant, and everyone was writing about how this was the end of crypto.

No one wanted to touch anything crypto-related.

It was a perfect moment to bet against the market. I told my readers the crypto exchange Coinbase (COIN) was a screaming buy. The stock has surged 474% since.

The next great contrarian trade is…

Solar stocks.

The Invesco Solar ETF (TAN) has plunged 70% since peaking in 2021.

And investors keep selling solar stocks now that Trump has won the presidency. Trump promised to repeal many climate policies passed by Joe Biden. Investors think this will be bad news for the solar industry.

We’ve been here before. Leading up to Trump’s election in 2016, solar stocks sunk 45%. But TAN bottomed three weeks before Trump’s first inauguration.

Then… it surged 660%.

Biden then got elected and promised to invest heavily into green energy. After he won the 2020 election, investors piled into solar stocks. They drove prices to extreme heights.

But just three days after Biden’s inauguration, the speculative bubble in solar stocks popped. They’ve been sliding lower ever since.

Notice the pattern? Solar stocks tend to do the exact opposite of what you’d expect.

TAN is down 70% today. Trump’s inauguration is just 35 days away.

And here’s something else investors are missing...

Trump needs solar power to make good on his “US energy dominance” promise.

Last month, Trump announced the creation of the National Energy Council, which will oversee a path to “US energy dominance.”

Most folks believe the sole purpose of the new council is to promote the oil and gas industry.

But what Trump actually said was that the National Energy Council will cover all forms of American energy.

Trump said his goal is to slash electricity costs to avoid power outages and “WIN the battle for AI superiority."

The artificial intelligence revolution requires massive amounts of power. Together, data centers already gobble more electricity than entire countries like Australia, Taiwan, or Italy.

There’s also electric vehicle (EV) demand to consider. Some estimates suggest the US will need to produce up to 50% more electricity if all cars are replaced by EVs.

The bottom line is we need as much energy as we can get.

US oil production is already at all-time highs. Great.

Nuclear would be a better solution to solve the growing energy demand, and Trump supports it. But nuclear plants take around a decade to build. Solar plants in comparison can be up and running in as little as five months.

Solar is the No. 1 fastest-growing energy source in human history. Last year, more solar power was installed worldwide than between 1956–2017.

In 2004, it took a whole year to install 1 gigawatt of solar power. Now, we’re deploying that much every 12 hours!

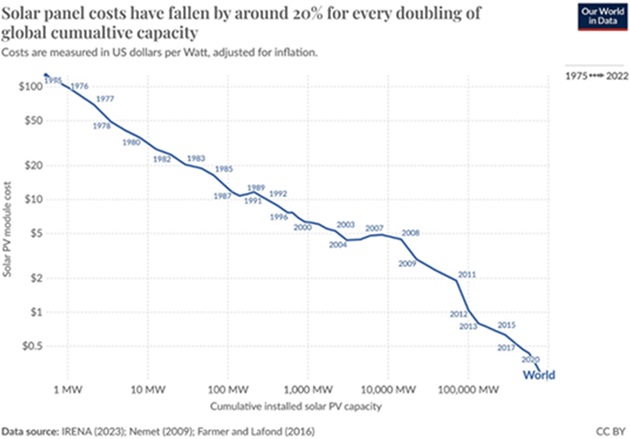

Meanwhile, solar costs continue to plunge. In the last 50 years, the price of solar modules declined from $106 to $0.38 per watt—a 99.6% decline!

Source: Our World in Data

Note this isn’t the “all in” cost of running solar. Solar is still more expensive than fossil fuel, for now.

But the plunge in solar costs continues to accelerate. In 2023 alone, prices nearly halved. If this trend continues, solar could be one of the cheapest forms of energy very soon.

Bottom line: The solar industry will do just fine under Trump.

Here’s what to do...

An easy, one-click way to play this contrarian solar trade is with the TAN ETF—the bellwether for the entire industry.

Its largest holdings include First Solar (FSLR), Enphase Energy (ENPH), and Nextracker (NXT), which we took profits on in my Disruption Investor advisory earlier this year.

Related: Can Quantum Computing Break Bitcoin’s Security?

PS: Tired of the same old investing guidance? The Jolt brings fresh, actionable insights on today’s most disruptive technologies. Here’s how to sign up.