Written by: David Waddell | Waddell and Associates

I first visited Jekyll Island, Georgia in the mid-90’s, just after the internet went public. For those not familiar with Jekyll Island, it became the south’s Newport, RI for the robber barons of the Gilded Age. Imagine the evening cocktail banter between the Morgans, Rockefellers, Pritzkers, Vanderbilts, et al. in the clubhouse dining hall. One such discussion in 1910 led to the founding of the U.S. Federal Reserve. Another in 1915 led to the first transcontinental telephone call between Theodore Vail, Alexander Graham Bell, and President Woodrow Wilson.

Of all the amazing Jekyll Island stories I heard over the years though, nothing struck me more than the heated debate over electrifying the island in 1903. Apparently, some of the most wealthy and industrious people on the planet argued that electricity might just be a fad! I was floored at how short-sighted even titans can be. On my flight back to San Francisco after that first visit, I found myself reflecting on these stories and thinking, “There may be something to this ‘internet.’”

What Grows an Economy

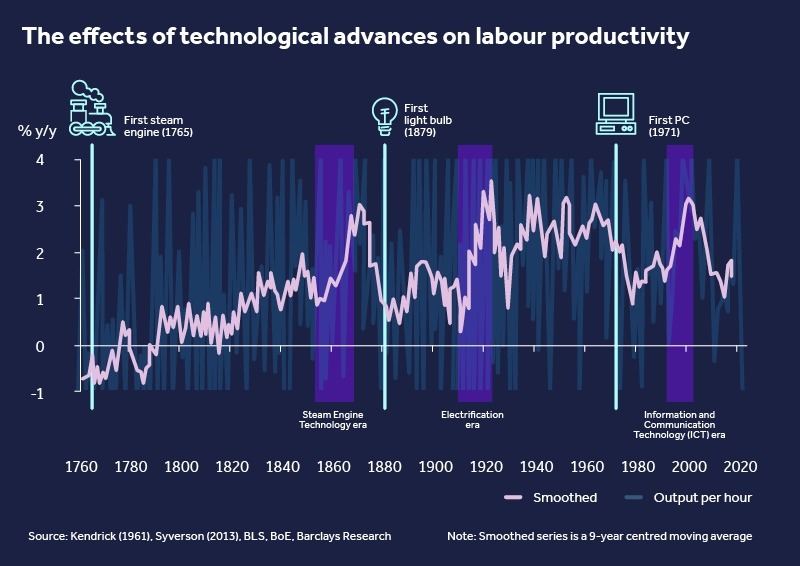

Economic growth sprouts from two primary inputs, growth in the number of laborers (workforce) and the growth in output per laborer (productivity). Every so often, major political, societal, or technological breakthroughs propel one or both variables higher, stimulating economic growth rates and quality-of-life measures.

Electricity provided the ability for workers to work longer hours (productivity). Inclusion of women into the labor force provided more laborers (workforce). The construction of highways and railroads improved the division of labor (productivity). The discovery of penicillin increased life expectancy by eight years (workforce).

On that same flight from Jekyll Island, I pondered how to measure the benefits of internet adoption through this lens. Clearly, the internet itself wouldn’t create workers, but enhanced information access should increase productivity and profitability. Here’s what happened:

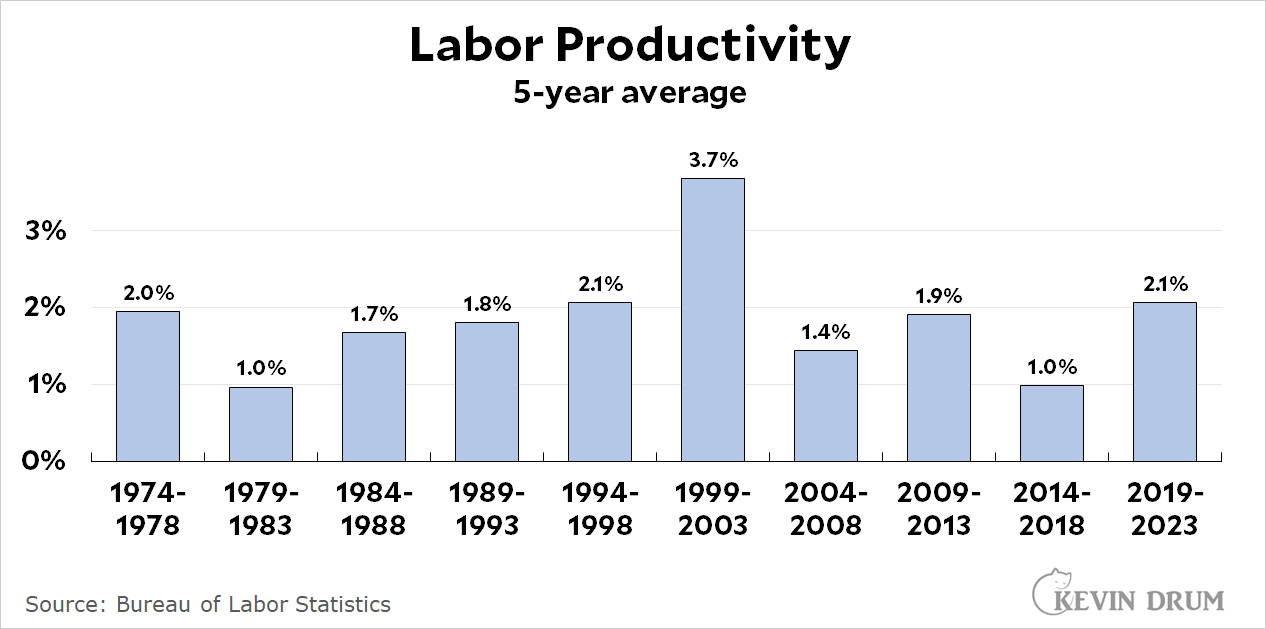

Note that on average, labor productivity typically runs between 1-2%. However, during the internet age, productivity grew at twice that rate, validating the productivity theory. As for the profitability theory?

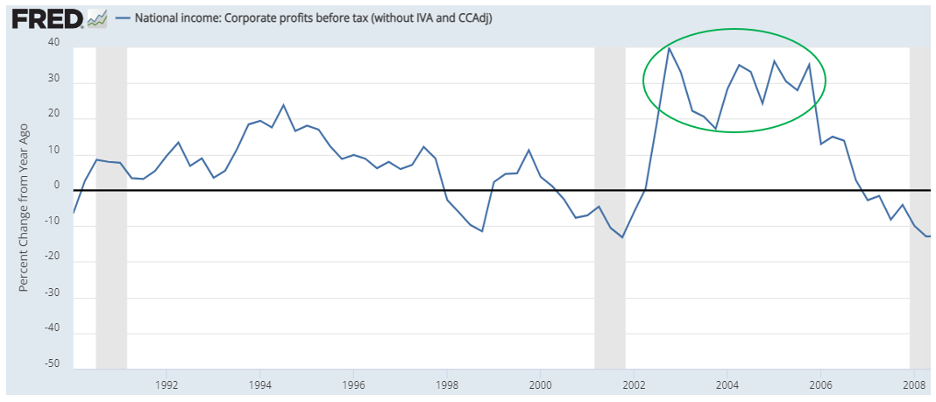

This chart chronicles pre-tax corporate profits between 1990 and 2008. Like productivity, profit growth rates doubled during the period of widespread internet adoption: Theory proven.

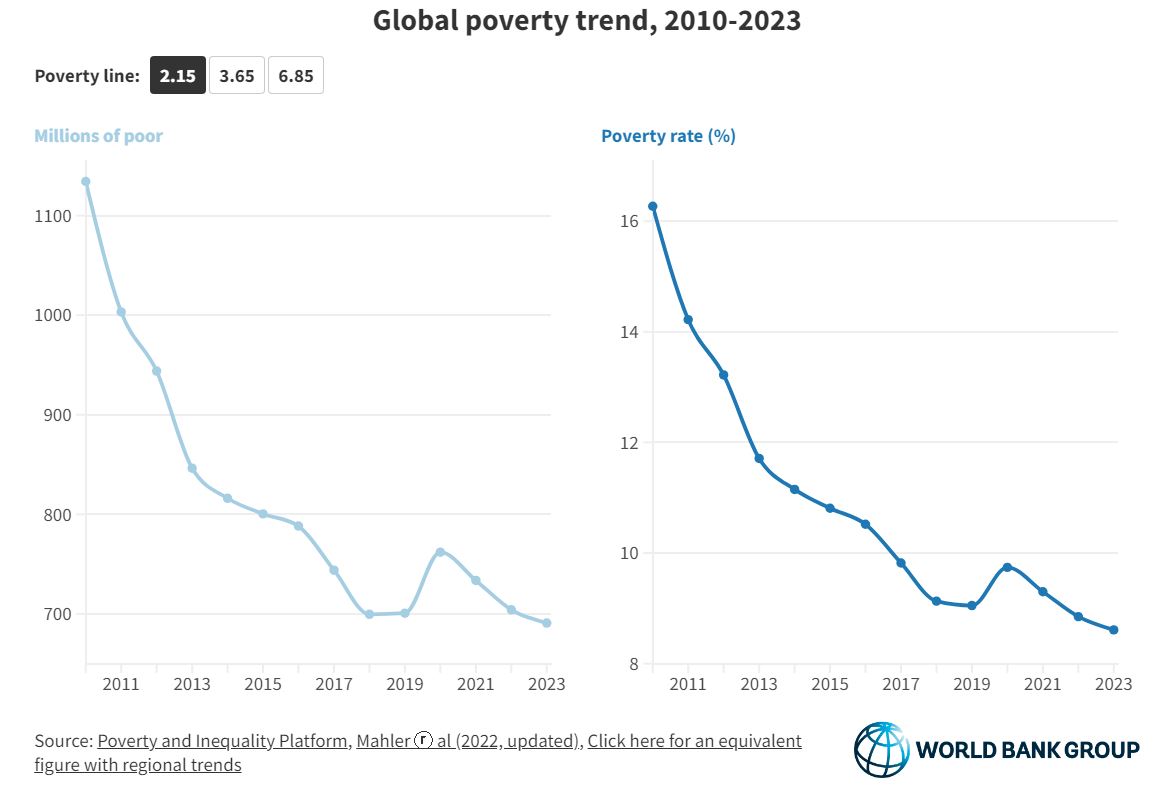

The next economic “big bang” that captured my attention was globalization and the integration of the BRICs economies (Brazil, Russia, India, and China). The BRICs house nearly half of the world’s population, and therefore, half of the planet’s potential labor force. Integrating the underutilized BRICs’ labor force into the modern global economy should have theoretically reduced global poverty rates and reduced global inflationary levels.

According to World Bank, the global poverty rate has fallen by 50% over the past dozen years. Over that same time-period, consumer inflation levels worldwide also fell by half:

Theory proven.

Since the Great Financial Crisis ended, there really haven’t been any breakthroughs to enhance productivity or labor force. The advances we have made, including higher levels of social spending, more realistic video games, and evermore addictive social media platforms, have had no effect on either. In fact, by 2016, economists began discussing “secular stagnation”, the idea that high government indebtedness, low workforce growth, and low productivity growth would plague the U.S. economy with low GDP growth for decades. That sounds dire and unacceptable… cue the AI revolution!

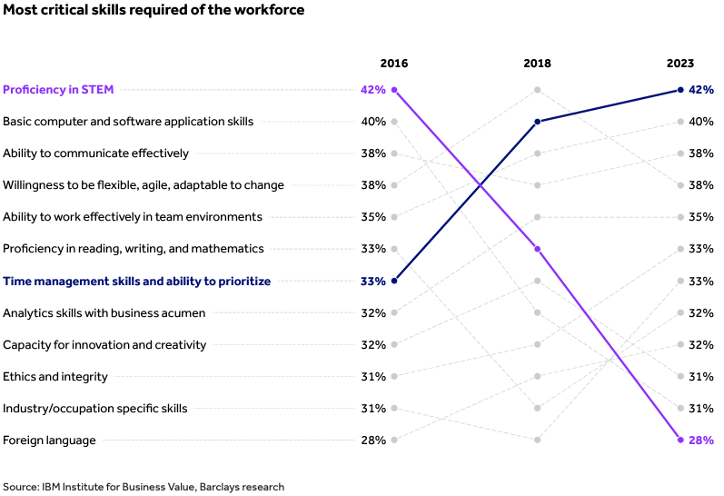

Imagine an optimized economy. An economy that works smarter, faster, and more accurately all the time. Think about the mundane tasks you do daily that, if automated, would free you to do higher-level tasks. For instance, if I let Chat GPT write our blogs, I would regain my Fridays and thus 20% of my workweek! That won’t happen, as writing these missives sharpens our minds as investment managers and your returns as our investors. However, AI does give me the CHOICE. That’s what will become so liberating. Consider this analysis of skill requirements within the AI age:

Notice that the machines will do machine things like software coding, while the humans will do human things like strategizing, communicating, and collaborating.

Imagine the time it will save Perry Green, our CFO, if he could tell the machine to build our 2025 budget using a simple set of assumptions rather than contemplate and key every cell. It would add countless hours back each December which Perry can reinvest in client consultations and financial plan construction.

This time top-grading would happen firm-wide as we task less, and strategize and communicate more. Client outcomes will improve. Job satisfaction will improve. Profitability will improve. Win, win, win!

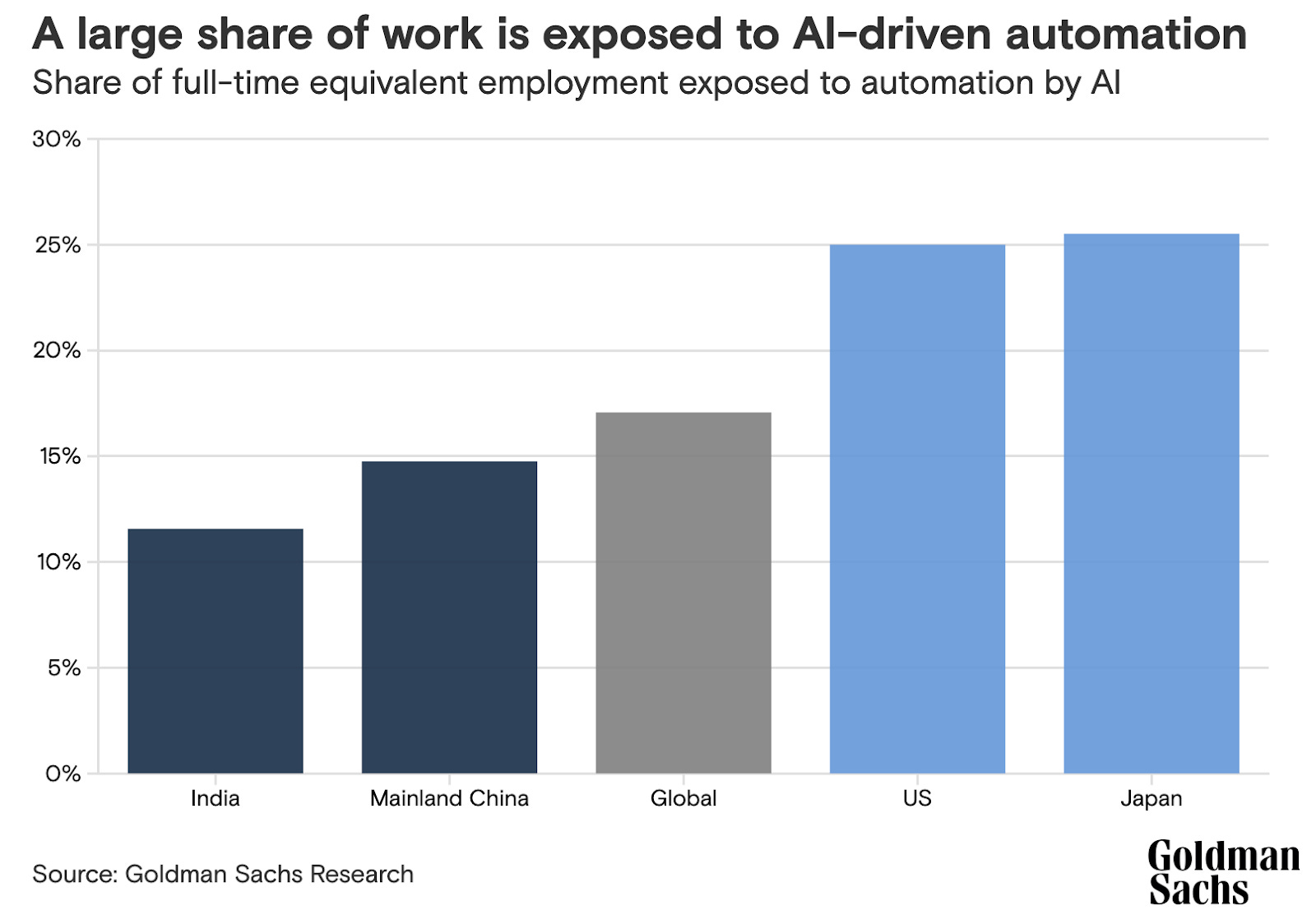

At its fullest expression, AI adoption not only increases productivity, but it also increases the size of our available labor force. Goldman Sachs predicted, in a controversial study, that 25% of observable jobs would soon be automated:

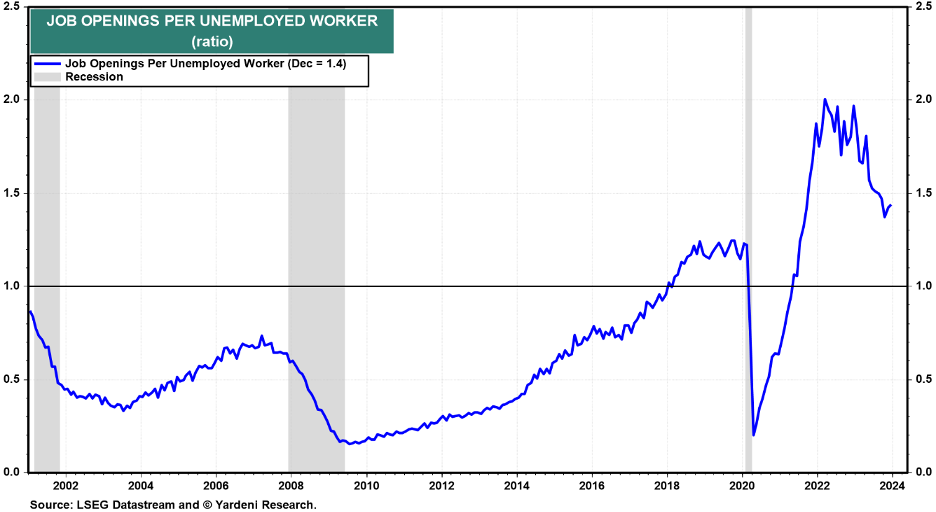

While that sounds frightening, recall that our economy suffers from a labor shortage, not an employment shortage. In fact, we currently have 1.4 job openings for every unemployed American:

If AI “workers” could slot in and take those jobs, we would capture even more economics and even more profits.

This will happen. The impact of AI will show up as productivity gains in the data, but the concept of minting “virtual” workers adds further economic lift. Integrating AI with dexterous robotics will unleash perhaps the greatest technological upgrade cycle in the history of the world.

Welcome to the next gilded age.

Sources: Bureau of Labor Statistics, FRED, Poverty and Inequality Platform, Mahler, IBM, Barclays, Goldman Sachs, LSEG Datastream, Yardeni, Kendrick, Syverson

Related: Stay Focused: Don't Let the Fed's Rate Drama Distract You