Written by: David Waddell | Waddell and Associates

THE BOTTOM LINE:

The market has priced in near certain odds of a Trump victory and a Jerome Powell September rate cut. Anxieties will now congregate around S&P 500 earnings releases. Analysts expect earnings growth will be “higher for longer”, justifying the market’s lofty valuations. This makes each earnings quarter a test that requires passage. Over the next two weeks, 321 companies will report second quarter earnings results. Should they meet or beat, the rally remains. Should they miss, high sentiment will require recalibration. Welcome to the rally test.

The Full Story:

The most important thing when forecasting markets is to know what the most important thing is. Over the past few years, the most important thing has migrated from COVID cases to stimulus programs to inflation reports to geopolitical skirmishes to rate expectations. Strategists today must decide whether to focus on election risks, rate risks, or earnings risks after such a robust run. Let’s take a look at each to decide what’s most important now.

Election Inspection

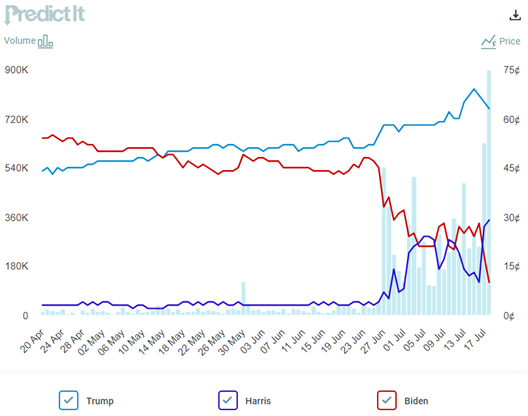

With bullets bouncing off Trump and Democrats in disarray, the Trump odds look bankable. According to futures markets, Trump has a 65% chance of winning the White House compared with 27% for Kamala and 13% for Biden:

Source: https://www.predictit.org/markets/detail/7456/Who-will-win-the-2024-US-presidential-election

Regardless of your political preference, not having a clear candidate going into the homestretch doesn’t bode well for Democrats. Anything can happen, but at this point, markets have inaugurated Donald Trump. While this level of certainty creates vulnerabilities, markets have accepted this election fate, shifting anxieties elsewhere.

Interest Rate Fate

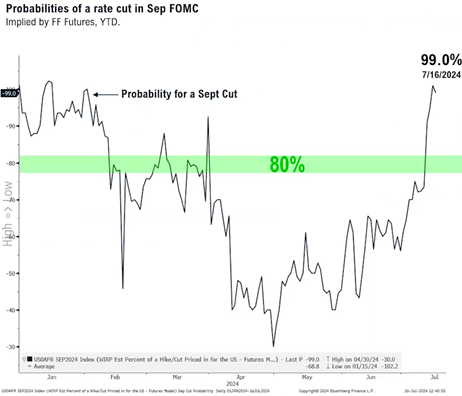

June’s soft Consumer Price Index report, paired with softening employment data, has markets pricing in near certain odds for a September rate cut:

We concur and believe Powell would happily cut them at the July meeting, but markets price in only a 5% chance of that. The Fed prefers to time policy moves with FOMC calendared press conferences and doesn’t want to appear concerned. After they cut in September, markets expect cuts to continue, currently pricing in 5 over the next twelve months. Whether they cut rates more or less isn’t material, what’s material is that cuts will soon occur. While this level of certainty creates vulnerabilities, markets have accepted this rate fate for now, shifting anxieties elsewhere.

Concerning Earnings

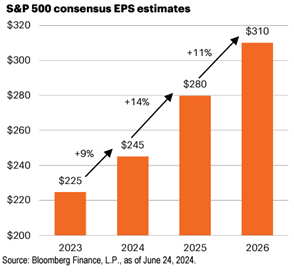

Rarely have analysts ever been as optimistic about forward earnings as they are today. Analysts see S&P 500 earnings rising 9% this year, 14% next year, and 11% the following year:

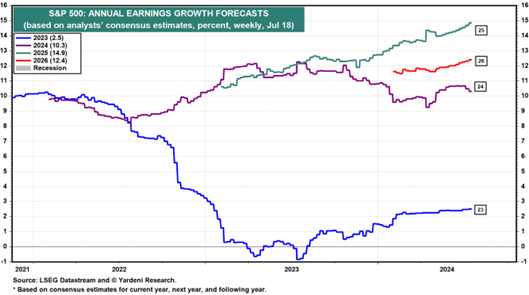

The S&P 500 currently trades at a forward P/E of 21.2x. Should that valuation persist, mathematically, the S&P 500 should close 2024 at 5936 and 2025 at 6572, 8% and 11% higher, respectively (based upon Friday’s 5505 close). Unfortunately, analyst’s earnings enthusiasm at this level hasn’t historically held. Focus on the LTEG blue line in the following chart, which represents the 5 year forward annualized earnings growth rate expected for the S&P 500:

The last few times analysts have projected 5-year growth rates anywhere near 20%, markets have fallen and pulled estimates lower. Should these earnings growth rates materialize, this market will climb much, much higher. Should they dematerialize, this market will lack further rally fuel, and valuations will lack justification. Earnings have become the market’s greatest vulnerability, making earnings season the most important thing.

Let the Season Begin

About 15% of the S&P 500 companies have reported so far, with 83% of reporting companies beating expectations. This exceeds the long-term average of earnings beats, providing healthy foreshadowing. However, most earnings releases arrive over the next two weeks, and expectations have recently receded. Note that the conviction in 2024’s earnings growth rate has waned of late, somewhat offset by rising expectations for growth rates in 2025 and 2026.

This tension requires attention and will receive plenty over the next two weeks as 300 S&P 500 companies report. While Jerome Powell may no longer be “data dependent” to justify rate cuts, this rally has become heavily “earnings dependent” to justify further gains. While we remain optimistic, the risks seem asymmetric. Should earnings meet or beat expectations, markets can hold these levels. Should earnings miss, markets could correct. On average, the S&P 500 contracts 14% during election years. To date, we have only seen a 5.5% correction. Perhaps we are due. If so, however, fear not! On average, markets have also rallied 24% within the year following those election year lows, making that truly… the most important thing!

Related: Finding Value in Bonds: A New Challenge

Sources: Predictit.org, Bloomberg Finance, L.P., LSEG Datastream and Yardeni Research