Written by: Invesco

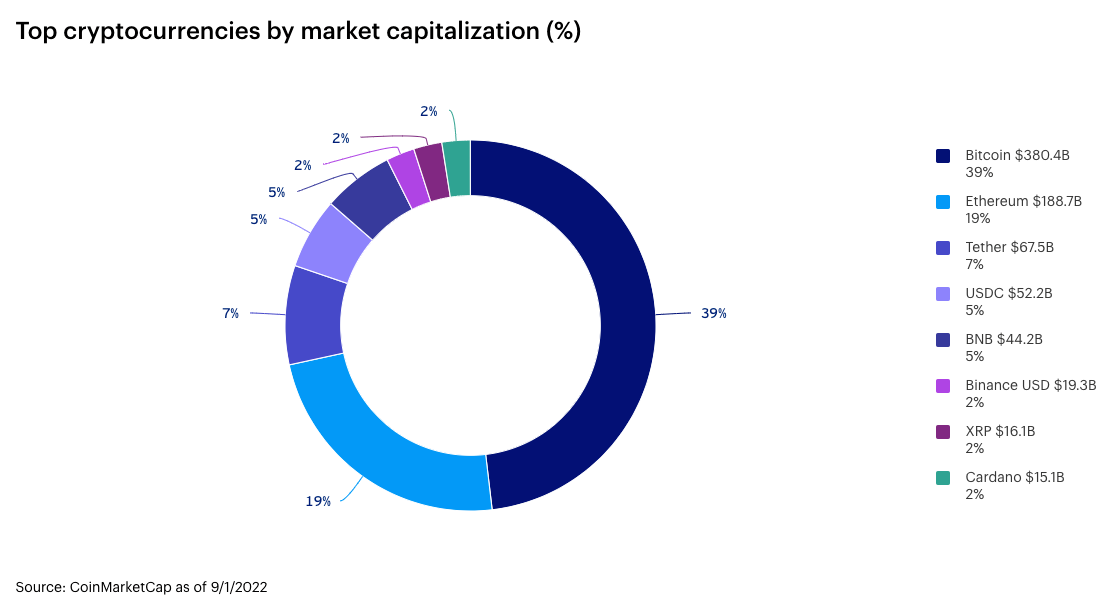

Blockchain and cryptocurrency (e.g. Bitcoin) aren’t just disruptive forces that are transforming the way people, businesses and governments transact and share information. These digital assets have become a major asset class for investors looking for potential returns and diversification. The cryptocurrency market alone comprises more than 20,000 cryptocurrencies representing nearly $1T in market capitalization.1

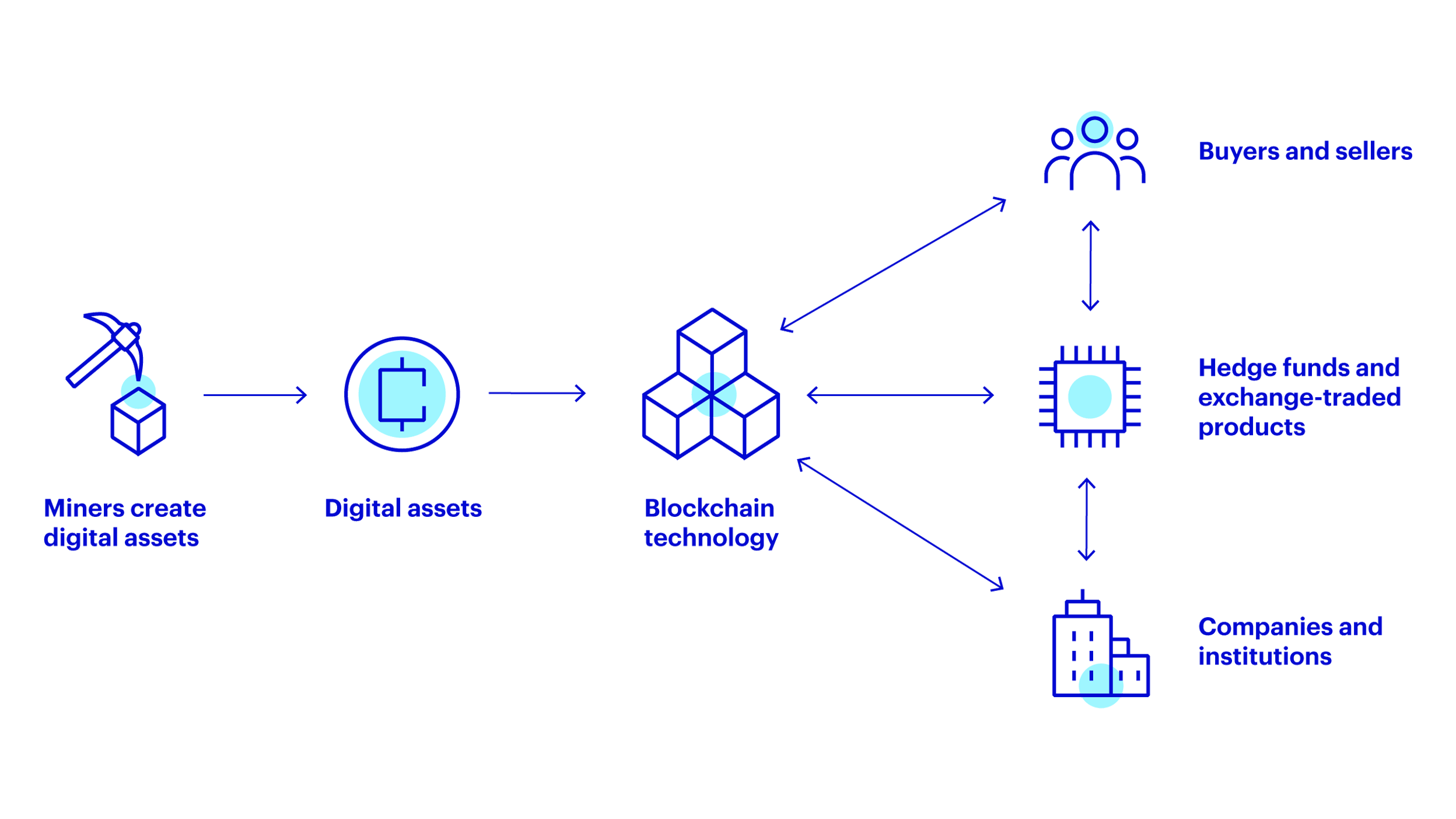

Digital assets encompass more than just cryptocurrency and blockchain; the ecosystem also includes companies that mine cryptocurrencies and provide technology, as well as companies that stand to benefit from blockchain’s myriad uses.

Each of these aspects of the digital asset ecosystem presents an opportunity for investors. Even if you don’t plan on investing in digital assets, it’s valuable to understand how all the parts fit together.

Knowing the basics: Blockchain and cryptocurrencies

A blockchain is an immutable database that allows data to be recorded and distributed across countless computers globally. It provides benefits in terms of decentralization, security and transparency compared to traditional methods of transacting and sharing information.

Not just for cryptocurrency: Blockchain has a wide—and rapidly expanding—array of uses that could change the way consumers, companies and governments transact and share information. Example uses of blockchain technology include secure medical record storage, insurance claim fraud prevention, and food safety traceability. Some of today’s most well-known companies are leveraging blockchain technology. Take Mastercard as an example. Mastercard provides financial transaction processing services and allows people to to use their debit and credit products to buy crypto. When people want to cash it, they help them gain access to be able to use their crypto balances everywhere Mastercard is accepted.2

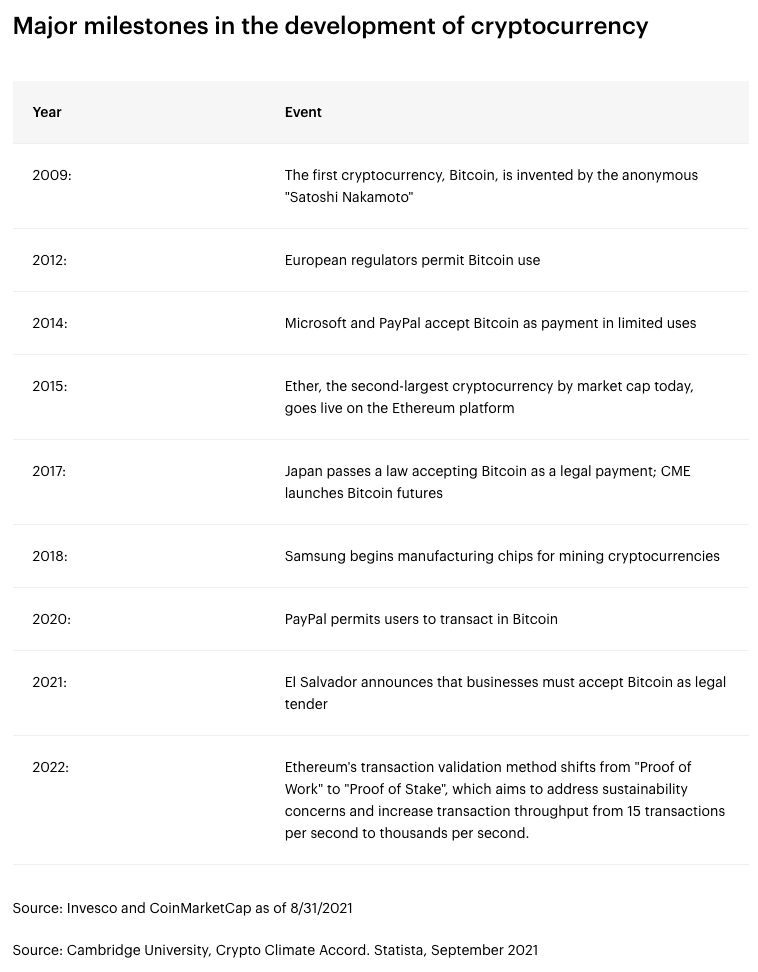

First invented in 2009, cryptocurrency is decentralized digital money based on a blockchain. More precisely, a cryptocurrency is a non-traditional, digital form of currency that is a medium of exchange that uses cryptography to validate and secure transactions. Bitcoin is the first and most widely used cryptocurrency, and other cryptocurrencies collectively are referred to as altcoins. The space continues to grow and evolve as new players come to market.

Top cryptocurrencies by market capitalization (%)

Looking beyond blockchain and cryptocurrencies: The broader digital asset ecosystem

There are a host of players, technologies and financial instruments involved in bringing digital assets to life—and each aspect presents an investible opportunity.

What companies and technologies are involved in the production and usage of digital assets?

Blockchain users: Companies that are involved in the research and development of blockchain technologies for cryptocurrency and non-cryptocurrency-related purposes.

Cryptocurrency buyers: Companies that report crypto assets on their balance sheets.

Cryptocurrency miners: Companies that mine cryptocurrency assets, bringing them into existence. Miners are critical to the blockchain since their computational power keeps the network secure. By solving complex computational problems, they are rewarded in coin and permitted to update the ledger. The Proof of Stake model (Ethereum's methodology) validates block transactions based on the number of coins a miner has, whereas Proof of Work (Bitcoin's methodology) validates based on network computing power. The Proof of Stake model require far less electricity to operate than the Proof of Work model.

Enabling technologies: Companies that facilitate the buying, selling or transfer of crypto assets; provide custody for crypto assets; or create semiconductors or cryptocurrency mining machines.

What investment vehicles have emerged for investing in digital assets?

In addition to owning cryptocurrencies directly, a host of investment vehicles and products have emerged that allow investors and companies to get exposure to digital assets.

Cryptocurrency derivatives: Financial instruments whose value is based directly on the price of an underlying cryptocurrency.

Trusts and exchange-traded products (ETPs): Investment products that are linked to cryptocurrencies or funds that provide broader exposure to digital assets. Investment managers, such as Invesco, have launched exchange-traded funds (ETFs) that invest in digital assets.

Proprietary investment products: Hedge funds and other non-exchange-traded investment vehicles that invest in cryptocurrency.

What other terms are important for digital asset investors to know?

Digital assets, and cryptocurrencies in particular, involve many terms that may be new to most investors. Here are some of terms investors should know.

Decentralized finance (DeFi): A system enabled by blockchain in which financial transactions are made directly between buyers and sellers without needing to be facilitated by banks or other centralized financial institutions.

Exchanges: Platforms where cryptocurrencies can be transacted with other people or currencies for a fee. There are decentralized exchanges (users are matched with buyers/sellers using their own wallets) and centralized exchanges (users create an account with an exchange that holds their cryptocurrency assets).

Initial coin offering (ICO): A mechanism that entrepreneurs use to raise funds to launch a new cryptocurrency coin. ICOs are the object of increasing regulatory scrutiny because they require no formal filings.

Token: A crypto asset whose underlying value is based on another asset (e.g., gold or a title). This is different from a cryptocurrency coin in that a coin’s value is not directly related to the value of an underlying asset.

Wallet: A device or service in which Bitcoin and other cryptocurrencies are, in essence, held for use. It is important to note that wallets facilitate holding cryptocurrencies, whereas an address is specific to each blockchain and is used in transactions.

Visualizing the digital assets ecosystem

Seeing how the various aspects of the digital asset ecosystem work together can help investors identify opportunities to get exposure to the asset class (see the simplified, hypothetical visual below). Miners create cryptocurrency and other digital assets, which come in various forms and types. The creation, transaction and recording of these digital assets take place using blockchain technology. Buyers and sellers of digital assets can exchange them via blockchain technology or get exposure to them via investment funds, like hedge funds and exchange-traded products (ETPs). These types of investment funds either invest directly in digital assets and/or invest in companies and institutions that leverage blockchain technology.

Source: Invesco as of 9/30/21. For illustrative purposes only.

Invesco Digital Asset ETFs: Efficient exposure to an emerging asset class

Digital assets are a dynamic, growing asset class that is constantly evolving as consumers, companies and institutions find more uses to use blockchain and cryptocurrencies. Their rapid expansion highlights the value of considering broad, diversified exposure to digital assets.

In 2021, Invesco launched two new Digital Asset ETFs to provide investors efficient access to opportunities across the asset class.

Whether you’re looking for investment opportunities related to cryptocurrencies or exposure to the broader blockchain ecosystem, Invesco offers tools for diversifying your portfolio.

Want to learn more about Digital Asset ETFs? Read our next feature to learn how to access blockchain and cryptocurrency exposure with ETF simplicity.

Related: New Low-Cost Dividend ETF Arrives

Footnotes:

1 CoinMarketCap as of 9/1/2022

2 Source: Mastercard Inc., Bloomberg L.P.; August 2, 2022