Any way you look at it, 2021 was an eventful year—from a new president to new virus variants to new all-time highs for Bitcoin and the S&P 500 (70 record closes!). We even saw the rise of a whole new asset class: non-fungible tokens, or NFTs, with annual trading volume between $22 billion and $24 billion this year, up from only $100 million last year.

Based on our own data analytics, readers of the Investor Alert and Frank Talk were most interested in stories on gold mining, precious metals, natural resources and emerging markets (no surprise, as our firm is well-known for our expertise in those sectors). But there was also interest in macroeconomic topics (inflation, mostly) as well as Bitcoin and cryptocurrencies.

That said, below are what I believe were the biggest investment stories of 2021.

Game “Stonks”

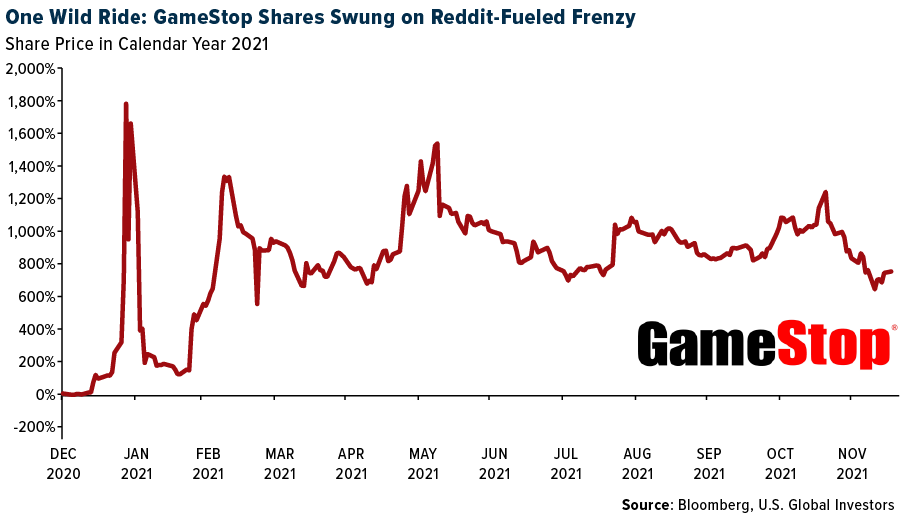

What do you get when you combine Reddit, Robinhood and hundreds of thousands of retail investors? One of the wildest episodes in public markets, of course, which pitted amateur millennial and Gen Z traders’ David against Wall Street’s Goliath. Hedge funds that bet against struggling video game retailer GameStop lost billions after do-it-yourself investors, getting their cues from organizers on Reddit, bid up the distressed stock, forcing the hedgies into a short squeeze.

Personally, I’ve never seen anything like it. Nearly 1.3 billion shares of GameStop were traded in January alone. That’s the kind of volume you’d expect from the massive SPDR S&P 500 ETF, not a barely mid-cap company that hasn’t posted a profitable year since 2018.

Although the trading frenzy has cooled somewhat, GameStop still ended the year up around 690%. Other so-called “meme stocks,” most notably AMC Entertainment, also saw eye-popping returns in 2021.

SPAC Attack

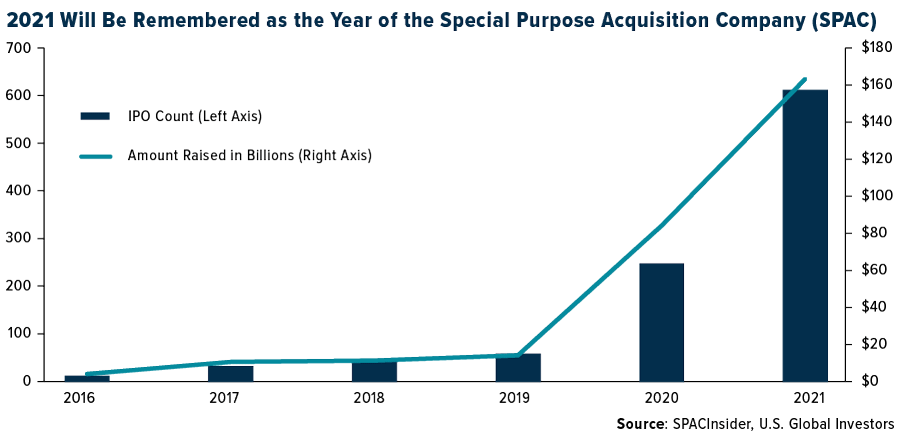

2021 will undoubtedly be remembered as the year of the SPAC, or special purpose acquisition company. Also known as blank check companies, SPACs have no business objective other than to buy or merge with another company and bring it to market. In 2020, SPAC listings outnumbered traditional IPOs for the first time ever, a trend that continued in 2021.

It’s likely we’ll continue to see a healthy stream of SPACs. Compared to traditional IPOs, they’re easier and less costly to close, with fewer disclosures. This is good news for investors, who have seen a steady decline in the number of initial public offerings over the past few decades due to stricter regulations.

These types of deals have tended to attract unexpected names, and 2021 was no different. Former President Donald Trump’s Trump Media & Technology Group, which plans to launch a social media platform to compete with Twitter and Facebook, announced in October that it would merge with Digital World Acquisition Corp., which currently trades on the Nasdaq under the ticker DWAC. The transaction could be at risk, however, as it’s come under investigation by federal regulators.

Planet Bitcoin

This list wouldn’t be complete without mentioning Bitcoin, the world’s first and largest cryptocurrency by market cap. Where do I even begin?

2021 began with Elon Musk announcing that Tesla had as much as $1.5 billion in BTC on its balance sheet, representing the latest example of a large company using the asset as a store of value. Musk’s love affair with the crypto later became complicated, however, when he halted BTC payments over concerns that it used too much dirty energy to mine, a presumption that was proven false by the Michael Saylor-headed Bitcoin Mining Council. (HIVE Blockchain Technologies is a founding member.)

Companies investing in Bitcoin is nothing new, but countries adopting it as legal tender? That was unheard of—until El Salvador did just that in June. The Central American country made history by becoming the first to recognize the digital asset as currency, alongside the U.S. dollar. A Bitcoin City, to be built at the base of a volcano, has also been proposed.

Oh, and don’t forget that 2021 also saw the launch of the very first Bitcoin ETFs.

After all this, what could 2022 possibly have in store for the crypto? I hope you’re as curious as I am to find out!

Shipping Rates And Inflation

I’m conflating shipping rates and inflation into one story because the former is a major contributor to the latter. In 2021, global shipping rates reached all-time highs as consumers shifted much of their spending from services (dining out, going to the theater) to goods. Although rates have rolled over from their September and October peaks, they still remain highly elevated. According to data provided by Freightos, the average global rate to ship a 40-foot container was up a head-spinning 200% in December 2021 compared to the same month in 2020.

At the same time that this has fattened container shipping companies’ coffers, it’s also had a huge impact on consumers’ pocketbooks as prices have soared at a pace unseen since the first Reagan administration. In November, the consumer price index (CPI) advanced 6.8% over last year, with gasoline, natural gas and clothes recording some of the biggest increases.

Honorable Mention: Texas Freezes

Back in February, U.S. Global Investors’ home state of Texas experienced a once-in-a-century winter storm that exposed the vulnerabilities of its standalone power grid, overseen by the Electric Reliability Council of Texas (ERCOT). Millions of Texans, myself included, went without water and electricity for days at a time as “Snovid,” an apt play on Covid, froze un-winterized natural gas pipelines and wind turbines.

So, is the Lone Star State ready for the next monster storm? Like everything else, it depends on who you ask. Legislation signed by Governor Greg Abbott in June requires providers to update their infrastructure and operations, and about 80% of power plants within the state managed to meet the December 1 deadline to report on preparedness. “The lights will stay on,” one official reassured Texans in early December.