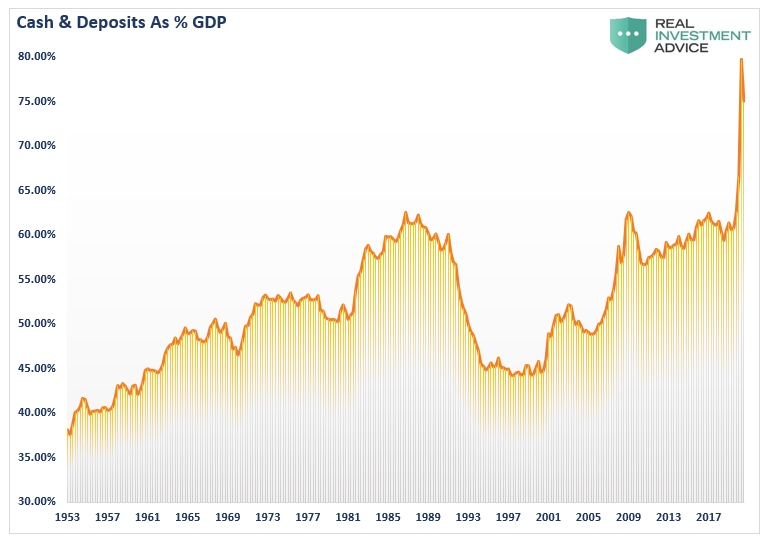

The following chart, making the rounds lately, suggests an unprecedented level of savings among Americans. The problem is that it is an illusion amid the reality of rising economic uncertainty.

The Savings Mirage

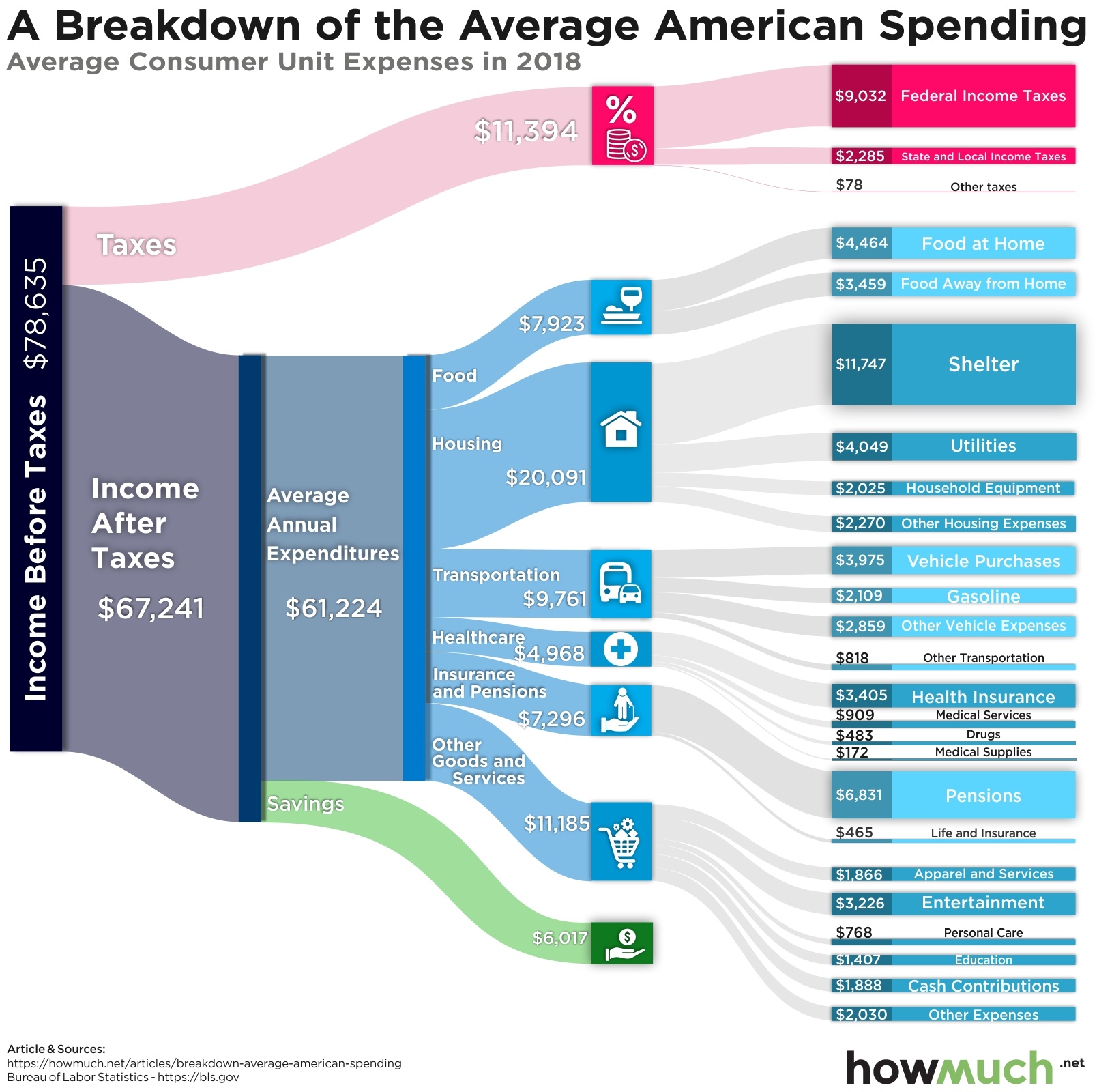

To understand why the “savings rate” is not what it appears to be, you must understand its underlying construction. The website HowMuch.com recently provided that calculation of us.

While the table is dated, the point is that for most, there is often little left for “savings.”

Lies, Damn Lies, and Statistics

There are also multiple problems with the calculation.

- It assumes that everyone in the U.S. lives on the budget outlined above.

- It also assumes the cost of housing, healthcare, food, utilities, etc., are standardized across the country.

- That everyone spends the same percentages and buys the same items as everyone else.

The cost of living between California and Texas is quite substantial. While the inflation-adjusted median household income of $68,703 may raise a family of four in Houston, it will be problematic in San Francisco.

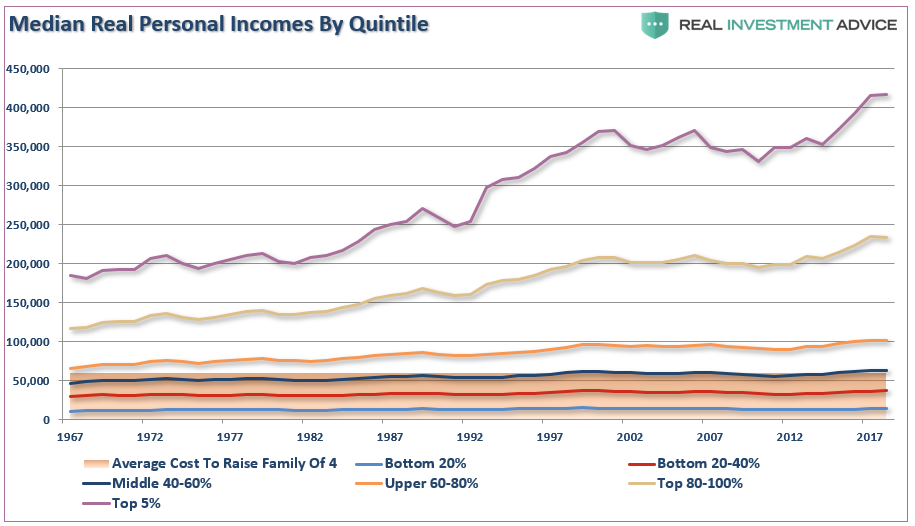

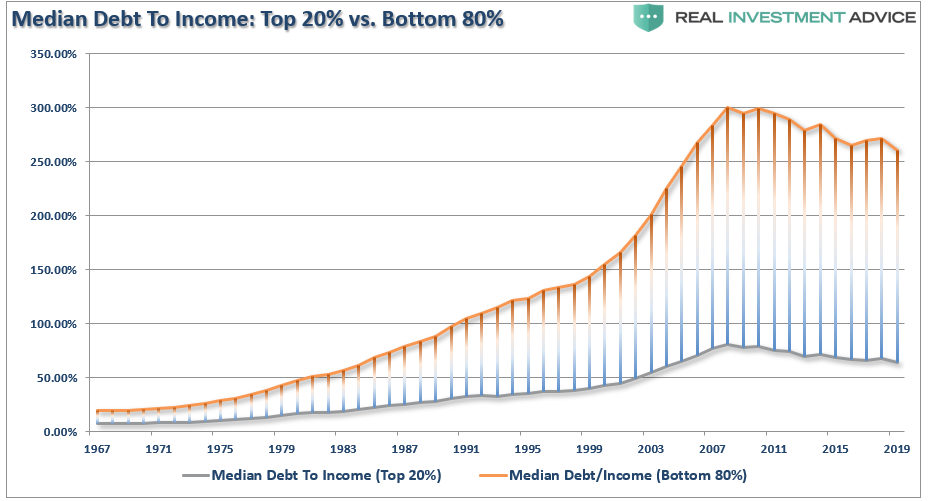

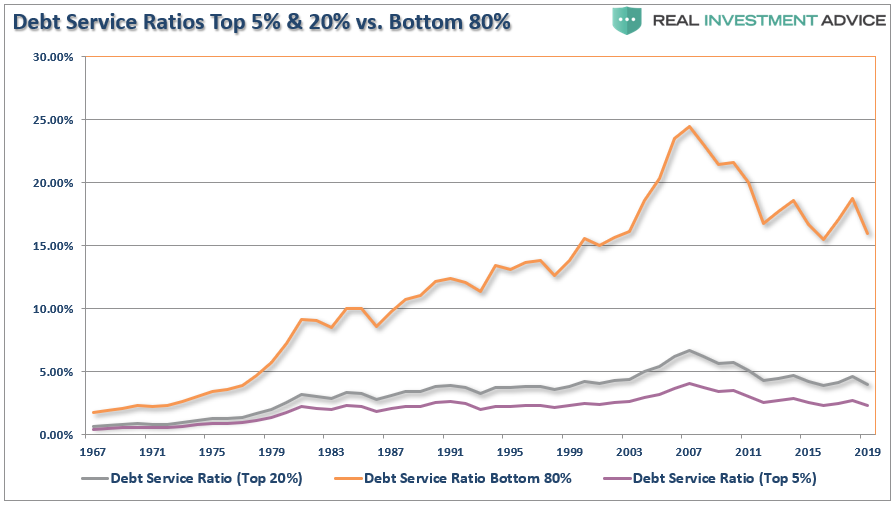

While those flaws are apparent, the top 10% of income earners skew the rate sharply upwards. The same problem also plagues disposable personal income and debt ratios, as previously discussed in “America’s Debt Burden Will Fuel The Next Crisis.” To wit:

“More importantly, the top 20%, and specifically the top 5%, of income earners skew the measure. Those in the top 20% have seen substantially larger median wage growth versus the bottom 80%. (Note: all data used below is from the Census Bureau and the IRS.)”

Since the top income earners have more than enough income to maintain their living standards, the balance falls into savings. This disparity in incomes also generates a “skew” to the savings rate.

Yes, there is a significant amount of cash and deposits relative to the economy, which is also skewed higher by falling GDP, but the wealthy have it.

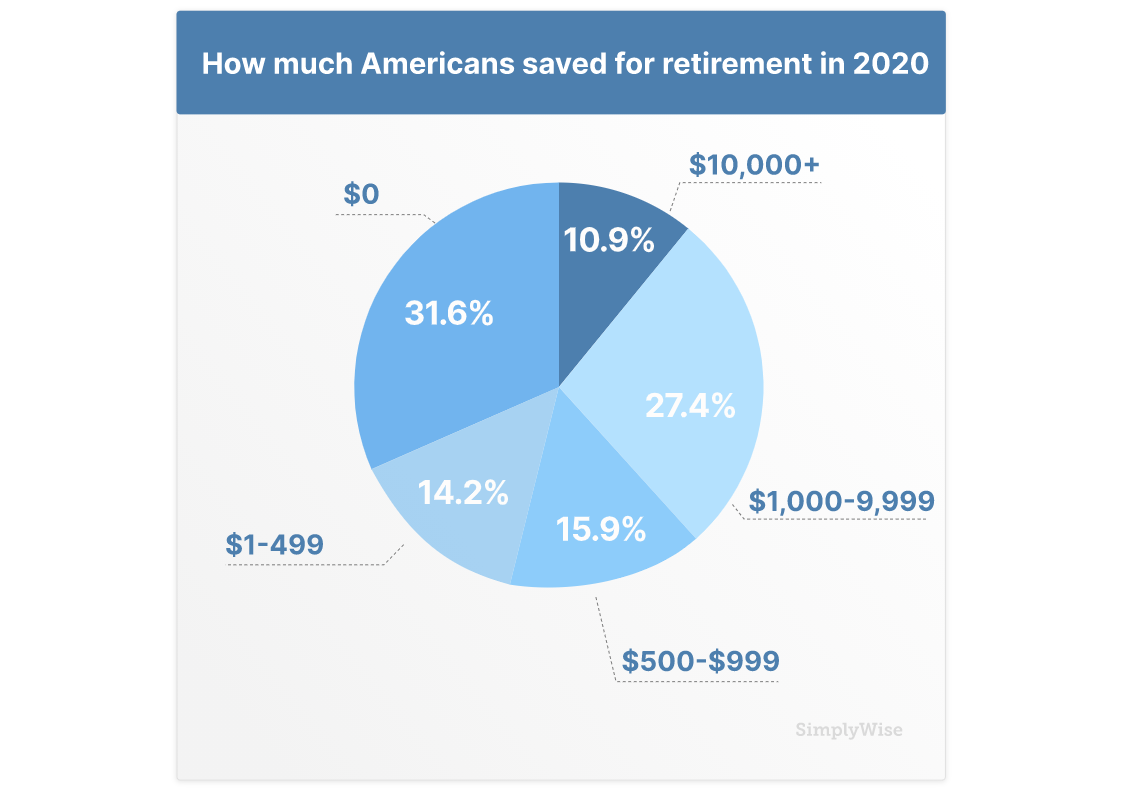

If savings were indeed soaring, then the average American wouldn’t be so concerned about their financial security. Such got documented in a recent survey by SimplyWise.

Financial Insecurity

“Despite buoyant markets, millions of Americans faced unprecedented financial hardship caused by COVID-19. It has upended what work, income, and employment opportunities look like, as well as retirement. It has eaten into savings, forced people into debt, and created unprecedented levels of housing instability. And while the rollout of vaccinations gives some hope, continued lockdowns coupled with the change of power in Washington and current political unrest are causing many to continue feeling uncertain about the future. Yet certain populations, including seniors, people of color, and lower income Americans, have been disproportionately impacted both by the virus itself and the instability in its wake.” – SimplyWise

Here are some of the key findings:

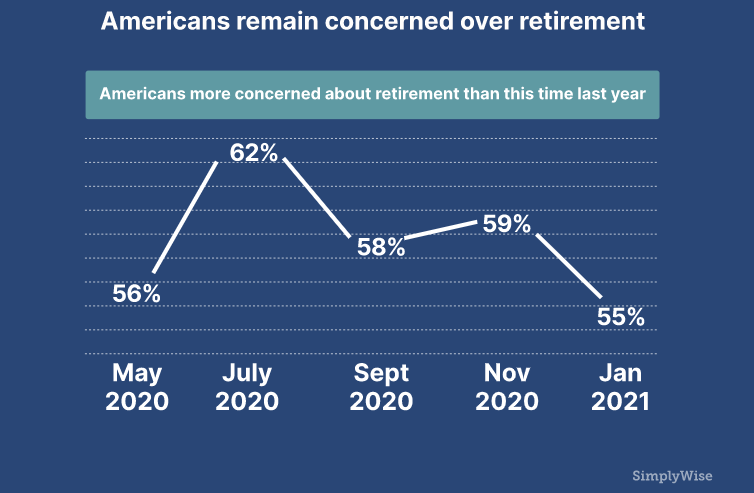

- 55% of people are more concerned about retirement today than this time last year.

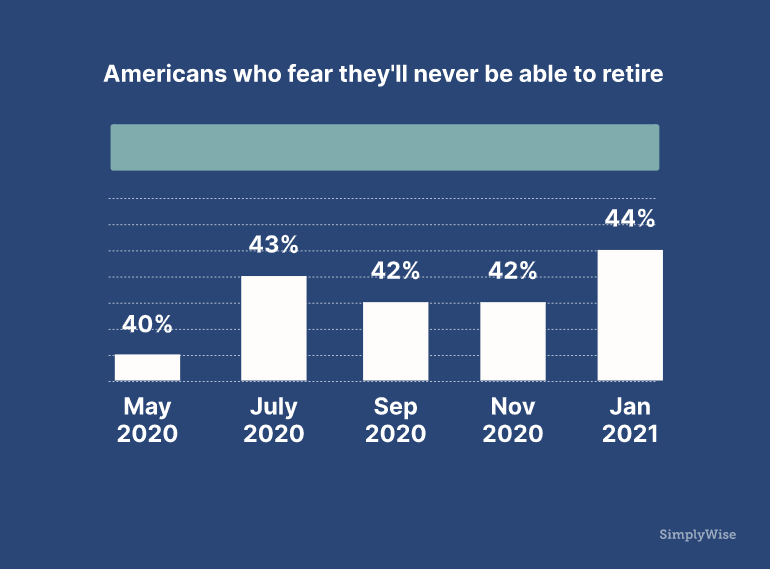

- 44% of Americans worry they’ll never be able to retire—an all-time high.

- 23% of Americans don’t have any retirement plan.

- 51% of Americans will need a 3rd stimulus check within the next 3-months.

- 48% of White Americans could not last more than 3-months off of their savings.

- 25% of Americans in their 60s could not last more than 3-months off their savings—an all-time high.

- 75% of people laid off due to COVID-19 couldn’t come up with $500 cash.

- 45% of Black Americans now fear falling behind on their rent or mortgage compared to 44% of Hispanic Americans and 28% of White Americans.

These critical issues encapsulate the ongoing financial distress that not only existed before the pandemic but have since worsened. Despite a surging stock market that has increased the wealth disparity in the economy, most Americans remain financially insecure.

Rising Concerns Across The Spectrum

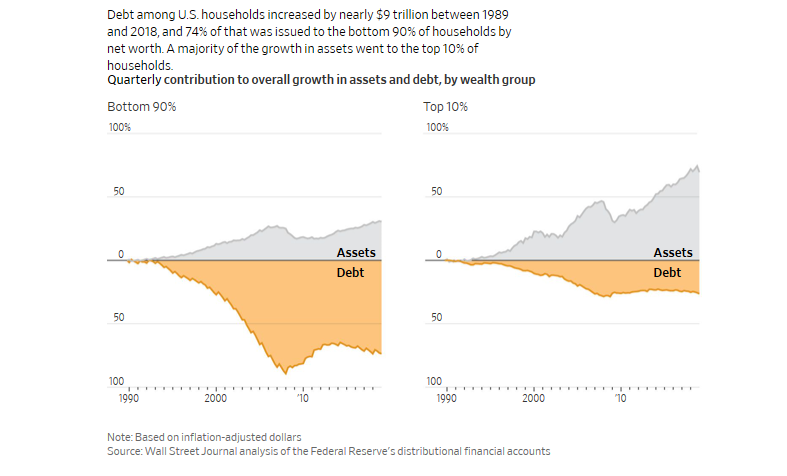

While economic statistics such as debt-to-income, savings, and net worth seem to have improved in aggregate, such has not been the case. In every case, the top-10% of income earners who carry little debt, have substantial free cash flow and invest heavily skew the data upward. A previous Wall Street Journal analysis revealed the same.

“The median net worth of households in the middle 20% of income rose 4% in inflation-adjusted terms to $81,900 between 1989 and 2016, the latest available data. For households in the top 20%, median net worth more than doubled to $811,860. And for the top 1%, the increase was 178% to $11,206,000.

Put differently, the value of assets for all U.S. households increased from 1989 through 2016 by an inflation-adjusted $58 trillion. A full 33% of that gain—$19 trillion—went to the wealthiest 1%, according to a Journal analysis of Fed data.”

Given this disparity in incomes and net worth, it is not surprising the SimplyWise survey found that more than half of Americans (55%) are concerned about their retirement.

Again, this is a vastly different response to what current “savings rates” would suggest.

The D.A.D. Plan

The problem isn’t getting better despite repeated stimulus checks, monetary interventions, and fiscal policy hopes. Currently, 44% of Americans fear they will never be able to retire.

The lack of financial security, and concerns over the solvency and stability of social welfare, has led to an increasing number of Americans adopting the D.A.D. retirement plan. (Die. At. Desk.)

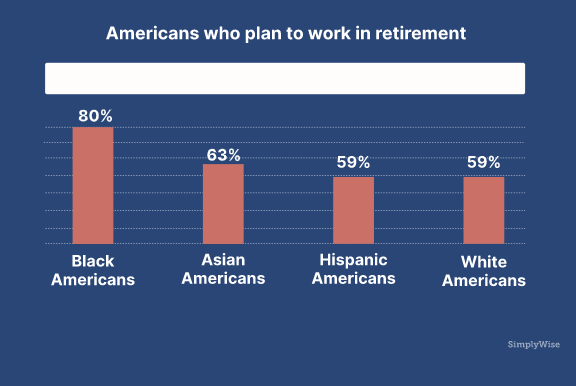

The survey also found a record number of Americans planning to work into retirement.

“Yet for a majority of Americans today, ‘retiring’ no longer means the end of. The January Index found that 71% of workers plan to continue working in retirement.” – SimplyWise

Most importantly, individuals in their 50’s and 60’s are planning to postpone retirement due to financial insecurity.

“An Index-high of 32% of people in their 50s are now planning to postpone retirement from work. And a record 21% of people in their 60s are now planning to postpone retirement from work.” – SimplyWise

These statistics are not new. However, there are far-reaching consequences on the fiscal solvency and social welfare of a large portion of the population.

The Savings Dilemma

Yes, these are pretty depressing statistics and certainly don’t support the mainstream bullish narrative. However, for the bottom-80% of income earners whose income growth has been stagnant over the last two decades, the roadblocks to being “financially secure” for retirement shouldn’t be surprising. A recent study from Brookings shows the problem.

“Adjusted for inflation, hourly wages of workers in the very middle (the 50th percentile, or the worker who makes more than half of all workers but less than the other half) grew 12% between 1979 and 2018. In contrast, wages toward the top (the 90th percentile, the worker who makes more than 90% of all workers) rose 34 percent. Toward the bottom (the 10th percentile), wages have grown only 4%.”

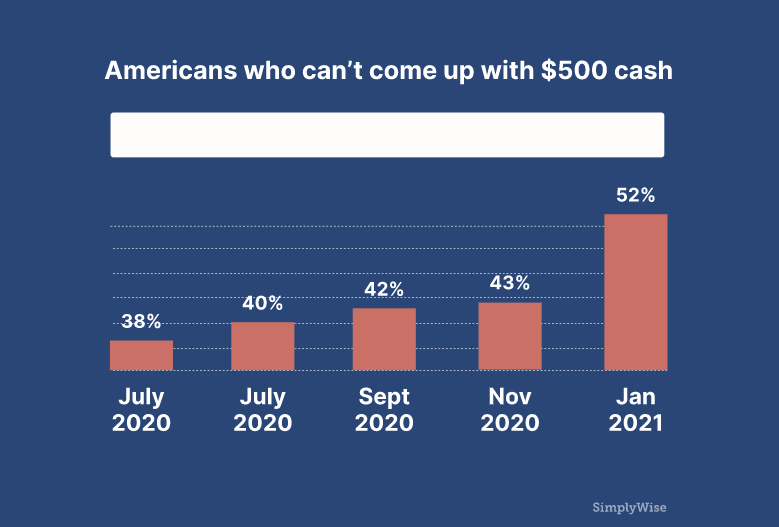

Again, back to our surging savings chart, if savings were equally distributed, then we wouldn’t see more than 50% of those surveyed unable to come with $500 in cash to meet an emergency.

We also wouldn’t be talking about a vast majority of Americans unable to save for their retirement substantially.

As noted in a previous survey from Kiplinger and Personal Capital, Americans’ inability to save for retirement comes from their living and debt costs.

- The high cost of health insurance. “From 1999 to 2017, the cost of family health insurance coverage has more than doubled the amount of take-home pay it consumes.”

- Disappointing investment performance. “Just under 30% of all respondents (29.4%) said that disappointing investment performance had stopped them from saving as much as they would have liked to for retirement.”

- The amount of consumer debt they carried. “21.3% of Americans said that debt, not including student loans, kept them from saving for retirement combined with the increased costs of living.”

Real Debt-To-Income Ratios

There is a vast difference between the level of indebtedness (per household) for those in the bottom 80%.

Of course, the only saving grace for many American households is that artificially low interest rates have reduced the average debt service levels. Unfortunately, those in the bottom 80% are still having a large chunk of their median disposable income eaten up by debt payments. Such reduces discretionary spending capacity even further.

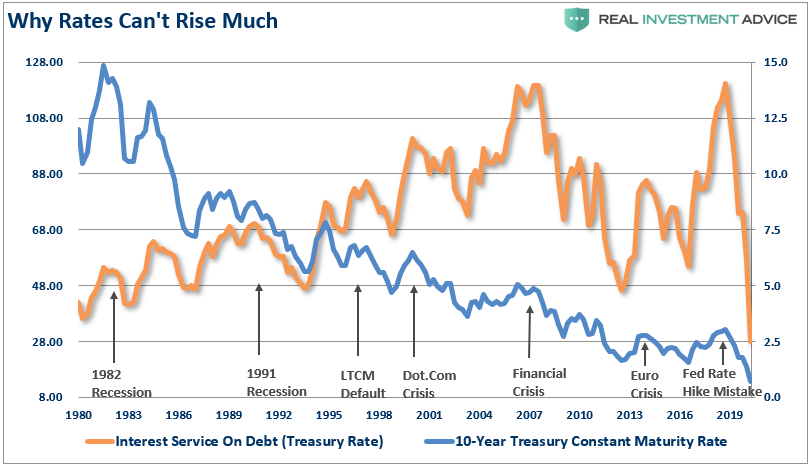

The problem is quite clear. With interest rates already at historic lows, the consumer already heavily leveraged, and wage growth stagnant, the capability to increase consumption to foster higher economic growth rates is limited.

Such is also why interest rates CAN NOT rise by very much without triggering a debt-related crisis. The chart below is the interest service ratio on total consumer debt. (The graph is exceptionally optimistic as it assumes all consumer debt benchmarks to the 10-year treasury rate.) It only takes small increases in rates to trigger a “recession” or “crisis” event.

An Illusion Of Prosperity

The illusion of surging savings rates or the decline in the debt-to-income ratios obfuscates the real economic problems and fosters the belief that monetary policies are working.

They aren’t.

The majority of Americans cannot increase consumption, the driver of economic growth, without further increasing debt burdens. For those in the top-10% of the wealth holders, higher asset prices, tax cuts, etc., do not lead to increases in consumption as they are already at capacity.

While the Federal Reserve’s ongoing interventions, stimulus programs, etc., have certainly boosted asset prices higher, the only real accomplishment has been a widening of the wealth gap. What monetary interventions have failed to accomplish is an increase in production to foster higher economic activity levels.

With the average American still living well beyond their means, the reality is that economic growth will remain mired at lower levels. Such will remain the case as exceedingly large debt and deficits used for non-productive purposes further inhibit economic prosperity.

Those hoping that “savings” will rescue the economy will likely be disappointed when the mirage fades into dust.