Written by: Meera Pandit

With monetary policy still at the forefront of the macro landscape in 2024, investors are left wondering how the election might influence Fed policymakers. Historically, the Fed doesn’t sit on the sidelines during election years, but rather continues to pursue its dual mandate of price stability and maximum employment, while maintaining its independence from politics.

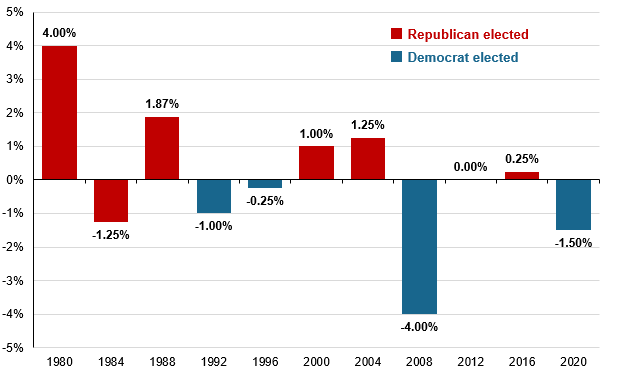

Since 1980, the Fed has either hiked or cut rates in every single election except 2012, when rates were at zero and the economy was still healing from the financial crisis. Otherwise, the Fed cut rates in five election years and hiked in five election years.

Some years were more active than others: in 1980, the Fed hiked 1%, then cut rates by 5.5% between February and July when the economy fell into recession but resumed rate hikes to continue battling double-digit inflation between August and November. In 1984, the Fed hiked 2.25% in Q2 as inflation ticked up and unemployment declined, only to cut 3.5% in Q4 as inflation steadied. In 1988, the Fed kicked off the year with modest rate cuts, then hiked through August and resumed hiking after the election.

Other years were merely extensions of cutting or hiking cycles already underway. In 1992, the Fed concluded the steady cuts it had initiated at the onset of the 1990-1991 recession. Similarly, the Fed implemented its final cut in January 1996 after the soft-landing that followed the ’94-’95 hiking cycle. On the other hand, the Fed concluded its rate hiking cycle in May 2000 that had begun in 1999 as asset prices surged and the stock market peaked in March 2000. In 2016, the Fed waited until after the election to hike once in December and continued rate hikes into 2017 and 2018.

There were instances in which the Fed initiated new monetary policy cycles though. The Fed began a two-year rate hiking cycle in June 2004, but off the very low base of 1%, where rates had sat for the past year. Severe recessions in 2008 and 2020 prompted swift and substantial cuts.

One theme emerges clearly: whether the Fed was adjusting based on dynamic economic conditions, responding to severe recessions, or following a path already forged, it continued to pursue its dual mandate irrespective of elections.

If the Fed doesn’t sit on the sidelines during election years, neither should investors. Economic data is likely to support rate cuts as growth moderates and inflation meanders towards 2%. This backdrop should be supportive for maintaining equity exposure and adding some duration given attractive entry points if yields fall.

Monetary policy changes in an election year

Net change in federal funds rate, %

Source: Bloomberg, Federal Reserve, J.P. Morgan Asset Management. Data are as of March 1, 2024.

Related: Exploring Opportunities Beyond the 'Magnificent 7' and Beyond U.S. Borders