Can one person make a difference to the value of a business? Of course, and with small businesses, especially those built around personal services (a doctor or plumber’s practice), it is part of the valuation process, where the key person is valued or at least priced and incorporated into valuation. While that effect tends to fade as businesses get larger, the tumult at Open AI, where the board dismissed Sam Altman as CEO, and then faced with an enterprise-wide meltdown, as capital providers and employees threatened to quit, illustrates that even at larger entities, a person or a few people can make a value difference. In fact, at Tesla, a company that I have valued at regular intervals over the last decade, the question of what Elon Musk adds or detracts from value has become more significant over time, rather than fading. Finally, Charlie Munger's passing at the age of ninety-nine brought to a close one of the most storied key person teams of all time at Berkshire Hathaway, and generations of investors who had attached a premium to the company because of that team's presence mourned.

Key Person: Who, what and why?

While it is often assumed that key people, at least from a value perspective, are at the top of the organization, usually founders and top management, we will begin this section by expanding the key person definition to include anyone in an organization, and sometimes even outside it. We will then follow up with a framework for thinking about how key people can affect the value of a business, with practical suggestions on valuing and pricing key people. We will end with a discussion of how enterprises try, with mixed effects, to build protections against the loss of key personnel.

Who is a key person?

In the Open AI, Tesla and Berkshire Hathaway cases, it is persons at the top of the organization that have been identified as key value drivers, but the key people in an organization can be at every level, with differing value effects.

- It starts of course with founders who create organizations and lead them through their early years, partly because they represent their companies to the rest of the world, but more because they mold these companies, at least in their formative years. It is worth noting that while some reach legendary status, sharing their names with the organization (like Ford and HP), others are unceremoniously pushed aside, because they were viewed, rightly or wrongly, as unfit to lead their own creations.

- Staying at the top, CEOs for companies often become entwined with their companies, especially as their tenure lengthens. From Alfred Sloan at General Motors to Jack Welch at General Electric to Steve Jobs at Apple, there is a history of CEOs being tagged as superstars (and indispensable to the organizations that they head), in successful companies. By the same token, as with founders, the failures of businesses often rub off on the people heading them, fairly or unfairly.

- As you move down the organization, there can be key players in almost every aspect of business, with scientists at pharmaceutical companies who come up with pathbreaking discoveries that become the basis for blockbuster drugs or design specialists like Jon Ive at Apple, whose styling for Apple’s devices was viewed as a critical component of the company's success. The skills they bring can be unique, or at least very difficult to replace, making them indispensable to the organization's success.

- In businesses driven by selling, a master-salesperson or dealmaker can become a central driver of its value, bringing in a clientele that is more attached to the sales personnel than they are to the organization providing the product or service. In businesses like banking, consulting or the law, rainmakers can represent a significant portion of value, and their departure can be not just damaging but catastrophic.

- In people-oriented businesses, especially in service, a manager or employee that cultivates strong relationships with customers, suppliers and other employees, can be a key person, with the loss of that person leading to not just lost sales, as clients flee, but create ripple effects across the organization.

- In some businesses, the key person may not work for the organization but contribute a significant amount to its value as a spokesperson or product brander. In sports and entertainment, for instance, business can gain value from having a celebrity representing them in a paid or unpaid capacity. In my valuation of Birkenstock for their IPO, just a few weeks ago, I noted the value added to the company by Kate Moss or Steve Jobs wearing their sandals. Over the decades, a significant part of Nike’s value has been gained and sometimes lost from the celebrities who have attached their names to its shoes.

In short, the key person or people in an organization can range the spectrum, with the only thing in common being a “significant effect” on value or price.

Key Person(s): Value effects

Given my obsession with value, it should come as no surprise that my discussion of key people begins by looking at the many ways that they can affect value. As I identify the multiple key person value drives, note that not all key people affect all value drivers, and the value effects can also vary not only widely across key people, but for the same key person, across time. At the risk of being labeled as a one-trick pony, I will use my intrinsic value framework, and by extension, the It Proposition, where if it does not affect cash flow or risk, it cannot affect value, to lay out the different effects a key person can have on value:

For personnel at the top, and I include founders and CEOs, the effect on value comes from setting the business narrative, i.e., the story that animates the numbers (revenue growth, profit margins, capital intensity and risk) that drives value., and that effect, as I have noted in my earlier discussions of narrative and numbers, can be all encompassing. The effects of people lower down in the organization tend to be more focused on one or two inputs, rather than across the board, but that does not preclude the effect from being substantial. A salesperson who accounts for half the sales of a business and most of its new customers will influence value, through revenues and revenue growth, whereas an operations manager who is a supply chain wizard can have a large impact on profit margins. As someone who teaches corporate finance, I have always tried to pass on the message, especially to those who are headed to finance jobs at companies or investment banks, that of all of the players in an organization, finance people are among the most replaceable, and thus least likely to be key people. It is perhaps the reason that you are less likely to see a company’s value implode even when a well-regarded CFO leaves, though there are exceptions, especially with distressed or declining companies, where financial legerdemain can make the difference between survival and failure.

With this framework, valuing a key person or persons becomes a simple exercise, albeit one that may require complex assumption. To estimate key person value, there are three general approaches:

1. Key person valuation: You value the company twice, once with the key persons included, with all that they bring to it’s cash flows and value, and then again, without those key persons, reflecting the changes that will occur to value inputs:

Value of key person(s) = Value of business with key person - Value of business without key person

A key person whose effect on a business is identifiable and isolated to one of the dimensions of value will be easier to value than one whose effects are disparate and difficult to isolate. Thus, valuing a key salesperson is easier than valuing a key CEO, since the former's effects are only on sales and can be traced to that person's efforts, whereas the effect of a CEO can be on every dimension of value and difficult to separate from the efforts of others in the organization.

2. Replacement Cost: In some cases, the value of a key person can be computed by estimating the cost of replacing that person. Thus, key people with specific and replicable skills, such as skilled scientists or engineers, may be easier to value than key people, with fuzzier skill sets, such as strong connections and people skills. However, finding replacements for people with unique or blended skills can be more difficult, since they may not exist.

3. Insurance cost: Finally, there are some key people in an organization who can be insured, where insurance companies, in return for premium payments, will pay out an amount to compensate for the losses of these key people. For companies that buy insurance, the key person value then become monetized as a cost, reducing the value of these companies when the key person is present, while increasing its value, when it loses that person.

The key person valuation approach, while general, can not only yield different values for key people, but also generate a value effect that is negative for a key person whose influence has become malignant. The framework can also help explain how the value of a key person can evolve over time, from a significant positive at one stage of an organization to neutral later or even a large negative, explaining why some key people get pushed out of organizations, including those that they may have founded.

Key Person(s): Pricing effects

It is true that markets are pricing mechanisms, not instruments for reflecting value, at least in the short term, and it should come as no surprise then that the effects of a key person are captured in pricing premiums or discounts, sometime arbitrary, and sometimes based upon data. In this section, I will start with the practices used by appraisers to try to adjust the pricing of businesses for the presence or potential loss of a key person and then move on to how markets react to the loss of key personnel at publicly traded companies.

In appraisal practice, the effect of the potential loss of an owner, founder or other key person in a business that you are acquiring is usually captured with a key person discount, where you price the business first, based upon its existing financials, and then reduce that pricing by 15%, 20% or more to reflect the absence of the key person. Shannon Pratt, in his widely used work on valuing private companies, suggested a key person discount of between 10%-25%, though he left the number almost entirely to appraiser discretion. In addition, the nature of private company appraisal, where valuations are done for tax or legal purposes, has also meant that the acceptable levels of discount for key people have been determined more by courts, in their rulings on these valuations, than by first principles.

In public companies, the market reaction to the loss of key personnel can be an indication of how much investors priced the presence of those personnel. Empirically, the research in this area is deepest on CEO departures, with the market reaction to those departures broken down by cause into Acts of God (death), firing or retirement.

- CEO Deaths: In the HBO hit series, Succession, the death of Logan Roy, the imperious CEO of the company causes the stock price of Waystar Royco, his family-controlled company, to drop precipitously. While that was fiction, and perhaps exaggerated for dramatic effect, there is research that looks at the market reaction to the deaths of CEOs of publicly traded companies, albeit with mixed results. A study of CEO deaths at 240 publicly traded companies between 1950 and 2009 finds that in almost half of all of these cases, the stock price increases on the death of a CEO, and unsurprisingly, the reactions tended to be positive with under-performing CEOs and negative with highly regarded ones. Interestingly, this study also finds that the impact of CEOs, both positive and negative, was greater in the later time periods, than in earlier periods. A different study documented that the stock price reaction to CEO deaths was greater for longer-tenured CEOs in badly performing firms, strengthening the negative value effect argument.

- CEO (forced) replacements: CEOs are most likely to be replaced in companies, where their policies are at odds with those that their shareholders desire, but given the powers of incumbency, change may require the presence of a large and vocal shareholder (activist), pushing for change. To the extent that shareholders have good reasons to be disgruntled, the companies can be viewed as case studies for key-person negative value, where the top manager is reducing value with his or her actions. Research on what happens to stock prices and company performance after forced replacements largely confirm this hypothesis, with stock prices rising on the firing, and improved performance following, under a new CEO.

- CEO retirements: If CEO deaths represent unexpected losses of key people, and CEO dismissals represent the subset of firms where CEOs are more likely to be value-reducing key people, it stands to reason that CEO retirements should be more of a mixed bag. Research backs up this hypothesis, with the average stock price reaction to voluntary CEO departures being close to zero, with a mildly negative reaction to age-related departures. It is worth noting that market reactions tend to be much more positive, when CEOs are replaced by outsiders than by someone from within the firm, suggesting that shareholders see value in changing the way these businesses are run.

The positive reaction, at least on average, to CEO firing is understandable since CEOs usually get replaced by boards only after extended periods of poor performance at companies or personal scandal, and investors are pricing in the expectation that change is likely to be positive. The positive reaction to some CEO deaths is macabre, but it does reflect the reality that they are more likely to occur in organizations that are badly in need of fresh insights.

There are a few case studies that look at how the market reacts to a company signing or losing a key celebrity spokesperson or product endorser, especially when that loss is unexpected. Thus, when Tiger Woods, who operated as a spokesperson or product endorser for five companies (Accenture, Nike, Gillette, Electronic Arts and Gatorade), had personal troubles that were made public, these five companies collectively lost 2-3% of their market value (about $5-12 billion). That should come as little surprise, since Tiger Wood's product endorsements, prior to this incident, had added significant value to these companies, with one study noting that Nike generated a 10% increase in profits in its golf ball division, after the endorsement. In an earlier episode, Nike also lost billions in market capitalizations, when Michael Jordan, an NBA superstar whose name-branded footwear (Air Jordan) had become a game changer for Nike, unexpectedly announced in 1993, that he would be retiring from basketball, to play baseball. Finally, and this is perhaps a reach at this point, the biggest story coming out of the National Football League (NFL) this year has been the Taylor Swift-Travis Kielce romance, which in addition to creating tabloid headlines, has also increased NFL ratings, especially among women. Is it possible that the person who adds the most value to the NFL this year is not Patrick Mahomes (its highest profile quarterback) or Roger Goodell (its commissioner), but a pop star? Time will tell, but it is not an implausible claim.

Managing Key Person Value

A business that has significant positive value exposure to a key person can try to mitigate that risk, albeit with limits. The actions taken can vary depending on the key person involved, with more effective protections against losses that are easily identifiable.

- Insurance: Smaller businesses that are dependent on a person or persons for a significant portion of their revenues and profits can buy insurance against losing them, with the insurance premia reflecting the expected value loss. To the extent that the insurance actuaries who assess the premiums are good at their jobs, companies buying key person insurance even out their earnings, trading lower earnings (because of the premiums paid) in periods when the key person is still present for higher earnings, when they are absent. It is also true that key person insurance is easier to price and buy, when the effects of a key person are separable and identifiable, as is the case of a master salesperson with a track record, than when the effects are diffuse, as is the case for a star CEO who sets narrative.

- No-compete clauses: One of the concerns that businesses have with key people is not just the loss of value from their departure, but that these key people can take client lists, trade secrets or product ideas to a competitor. It is for this reason that companies put in no-compete clauses into employment contracts, but the degree of protection will depend on what the key person takes with them, when they leave. No-compete clauses can prevent a key person from taking a client list or soliciting clients at a direct competitor, but will offer little protection when the skills that the person possesses are more diffuse.

- Overlapping tenure: As we noted earlier, it is routine, when pricing smaller, personal service businesses to attach a significant discount to the pricing of those businesses, on the expectation that a portion of the client base is loyal to the old owner, not the business. Since this reduces the sales proceeds to the old owner, there is an incentive to reduce the key person discount, and one practice that may help is for the old owner to stay on in an official or unofficial capacity, even after the business has been sold, to smooth the transition.

- Team building: To the extent that key people can build teams that reflect and magnify their skills, they are reducing their key person value to the business. That team building includes hiring the “right’ people and not just offering them on-the-job training and guidance, but also the autonomy to make decisions on their own. In short, key people who refuse to delegate authority and insist on micro-management will not build teams that can do what they do.

- Succession planning: For key people at the top of organizations, the importance of succession planning is preached widely, but practiced infrequently. A good succession plan starts of course by finding the person with the qualities that you believe are necessary to replicate what the key person does, but being willing to share knowledge and power, ahead of the transfer of power.

As you can see, some of the actions that reduce key people value must come from those key people, and that may seem odd. After all, why would anyone want to make themselves less valuable to an organization? The truth is that from the organization's perspective, the most valuable key people find ways to make themselves more dispensable and less valuable over time by finding successors and building teams who can replicate what they can do. That may be at odds with the key person's interests, leading to a trade off a lower value added from being key people for a much higher value for the organization, and if they own a large enough stake in the latter, can end with being better off financially at the end. I have been open about my loyalty to Apple over the decades, but even as an Apple loyalists, I admire Bill Gates for building a management team that he trusted enough, at Microsoft, to step down as CEO in 2000, and while I cringe at Jeff Bezos becoming tabloid fodder, he too has built a company, in Amazon, that will outlast him.

Determinants of Key Person Value

If key person value varies across businesses and across time, it is worth examining the forces that determine that value effect, looking for both management and investment lessons. In particular, key people will tend to matter more at smaller enterprises than at larger ones, more at younger firms than at mature businesses, more at businesses that are driven by micro factors than one driven by macro forces and more at firms with shifting and transitory moats than firms with long-standing competitive advantages.

Company size

In general, the value of a key person or persons should decrease as an organization increases in size. The value added by a superstar trader will be greater if he or she works at a ten-person trading group than if they work at a large investment bank. There are clearly exceptions to this rule, with Tesla being the most visible example, but at the largest companies, with hundreds or even thousands of employees, and multiple products and clients, it becomes more and more difficult for a single person or even a group of people to make a significant difference.

Stage in Corporate Life Cycle

I have written about how companies, like human beings, are born, mature, age and die, and have used the corporate life cycle as a framework to talk about corporate financial and investment choices. I also believe it provides insight into the key person value discussion:

As you can see, early in the life cycle, where the corporate narrative drives value, a single person, usually a founder, can make or break the business, with his or her capacity to set narrative and inspire loyalty (from employees and investors). As a business ages, CEOs matter less, as the business takes form, and scales up, and less of its value comes from future growth. At mature companies, CEOs often are custodians of value in assets in place, playing defense against competitors, and while they have value, their potential for value-added becomes smaller. At a company facing decline, the value of a key person at the top ticks up again, partly in the hope that this person can resurrect the company and partly because a CEO for a declining company who doubles down on bad growth choices can destroy value over short periods. The research provides support, with evidence that CEO deaths at young companies more likely to evoke large negative stock price reactions.

This life-cycle driven view of the value of to management may provide some perspective into the key person effects at both Open AI and Tesla.

- At OpenAI, for better or worse, it is Sam Altman who has been the face of the company, laying out the narrative for the future of AI, and Open AI remains a young company, notwithstanding its large estimated value. While the board of directors felt that Altman was on a dangerous path, the capital providers, which included not only venture capitalists, but Microsoft as a joint-venture investor, were clearly swayed not in agreement, and Open AI’s employees were loyal to him. In short, once Open AI decided to open the door to eventually being not just a money-making business, but one worth $80 billion or more, Altman became the key person at the company, as Open AI’s board discovered very quickly, and to its dismay.

- With Tesla, the story is more complicated, but this company has always revolved around Elon Musk. As a young company, where investors and legacy auto companies viewed it as foolhardy in its pursuit of electric cars, Musk's vision and drive was indispensable to its growth and success. As Tesla has brought the rest of the auto business around to its narrative, and become not just a successful company, but one worth a trillion dollars or more at its peak, Musk has remained the center of the story, in good and bad ways. His vision continues to animate the company’s thinking on everything from the Cybertruck to robo-taxis, but his capacity for distraction has also sometimes hijacked that narrative. Thus, the debate of whether Musk, as a key person, is adding or detracting from Tesla’s value has been joined, and while I remain convinced that he remains a net positive, since I cannot imagine Tesla without him, there are many who disagree with me. At the same time, Musk is mortal and it remains an open question whether he is willing to make himself dispensable, by not only building a management teams that can run the company without him, but also a successor that he is willing to share power and the limelight.

In general, the life cycle framework explains why good venture capitalists often spend so much time assessing founder qualities and why public market investors, especially those who focus on mature companies, can base their investments on just financial track records.

Micro versus Macro

There are some companies where value comes more from company-specific decisions on products/services to offer, markets to enter and pricing decisions, and others, where the value comes more from macro variables. A media company, like Disney, where movie or television offerings constantly have to adjust to reflect changing demand and in response to competition, would be an example of the former, whereas an oil company, where it is the oil price that is the key determinant of revenues and earnings, would be an example of the latter.

In general, you are far more likely to find key people, who can add or take away from value at the former (micro companies) than at the latter (macro companies). Consider the heated arguments that you are hearing about Bob Iger and his return to the CEO position at Disney, with Nelson Peltz in the mix, arguing for change. While some of the forces affecting Disney are across entertainment companies, as I noted in this post, I also argued that whether Disney ends up as one of the winners in this space will depend on management decisions on which businesses to growth, which ones to shrink or spin off and how they are run. With Royal Dutch, it is true that canny management can add to oil reserves, by buying them when oil prices are low, but for the most part, much of what happens to it is impervious to who runs the company.

Business Moats

Business moats refer to competitive advantages that companies have over their competitors that allow them to not just grow and be profitable, but to create value by earning well above their cost of capital. That said, moats can range the spectrum, both in terms of sources (cheap raw material, brand names, patents) as well as sustainability (some last for decades and others are transitory). Some moats are inherited by management, and others are earned, and some are high maintenance and others require little care.

In general, there will be less key person value at companies with inherited moats that are sustainable and need little care, and more key person value at companies where moats need to be recreated and maintained. To illustrate, consider two companies at opposite ends of the spectrum. At one end, Aramco, one of the most valuable companies in the world, derives almost all of its value from its control of the Saudi oil sands, allowing it to extract oil at a traction of the cost faced by other oil companies, and it is unlikely that there is any person or group of people in the organizational that could affect its value very much. At the other end, an entertainment software company like Take-Two Interactive is only as good as its latest game or product, and success can be fleeting. It should come as no surprise that there are far more key people, both value-adders and value-destroyers, in these businesses than in most others.

Implications

The notion that a key person or persons can add or detract from the value of an organization is neither surprising nor unexpected, but having a structured framework for examining the value effects can yield interesting implications.

Aging of key person(s)

There are many reasons that key persons leave companies, and while companies can try to stave them off by taking actions to protect key people, there is one reason - aging and death - which are inexorable and inevitable. As key people, especially at the top of an organization age, investors should start factoring in not just their eventual departures, but a decline in effectiveness, as they get older. Speaking of key people in large companies, Berkshire Hathaway has a had a special status, an insurance company with the best portfolio managers in the world in Warren Buffett and Charlie Munger. Well before Munger's passing, Buffett and Munger had bowed to advancing age and had passed the baton on to Ted Weschler and Todd Combs. While Buffett undoubtedly still has a say in investment choices, it is also clear that he has a far lesser role than he used ro, which may explain Berkshire's bet on a company like Snowflake, a company that has a snowball's chance in hell of getting through a Buffett-Munger investment screening.

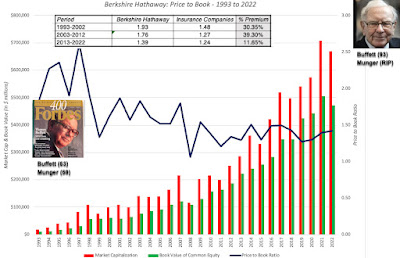

Are markets building in the recognition that Berkshire Hathaway's future will be in the hands of someone other than the two legendary leaders? I think so, and one way to see how markets have adjusted expectations is by comparing the price to book ratio that Berkshire Hathaway trades at relative to a typical insurance company:

In the last decade, as you can see, Berkshire Hathaway's price to book has drifted down, and relative to insurance companies in the aggregate, the Buffett-Munger premium has largely dissipated, suggesting that while Combs and Weschler are well-regarded stock pickers, they cannot replace Buffett and Munger. That may explain why Berkshire's stock price was unaffected by Munger's passing.

Industry Structure

As we shift away from a twentieth century economy, where manufacturing and financial service companies dominated, to one where technology and service companies are atop the largest company list, we are also moving into a period where value will come as much from key people in the organization as it does from physical assets. It follows that companies will invest more in human capital to preserve their value, and here, as in much of the new economy, accounting is missing the boat. While there have been attempts to increase corporate disclosure about human capital, the impetus seems to be coming more from diversity advocates than from value appraisers. If human capital is to be treated as a source of value, what companies spend in recruitment, training and nurturing employee loyalty is more capital expenditure than operating expense, and as with any other investment, these expenses have to be judged by the consequences in terms of employee turnover and key person losses.

Compensation

To the extent that key people deliver more value to companies, it stands to reason that they will try to claim some or all of that added value for themselves. In organizations where they are valuable key people, you should expect to see much greater differences in compensation across employees, with the most valued key people being paid large multiples of what the typical employee earns. In addition, to encourage these key people to make themselves less key, by building teams and grooming successors, you would expect the pay to be more in the form on equity (restricted stock or options) than in cash.While that may strike you as inequitable or unfair, it reflects the economics of businesses, and legislating compensation limits will either cause key people to move on or to find loopholes in the laws.

Lest I be viewed as an apologist for monstrously large top management compensation packages, the key person framework can be a useful in holding to account boards of directors that grant absurdly high compensation packages to top managers in companies, where their presence adds little value. Thus, I don’t see why you would pay tens of millions of dollars to the CEOs of Target (a mature to declining retail company, no matter who runs it), Royal Dutch (an almost pure oil play) or Coca Cola ( where the management is endowed with a brand name that they had little role in creating). This may be a bit unfair, but I would wager that an AI-generated CEO could replace the CEOs of half or more of the S&P 500 companies, and no one would notice the difference.

In conclusion

There are many canards about intrinsic valuation that are in wide circulation, and one is that intrinsic valuations do not reflect the value of people in a company. That is not true, since intrinsic valuations, done right, should incorporate the value of a key person or people in a business, reflecting that value in cash flows, growth or risk inputs. That said, intrinsic value is built, not on nostalgia or emotion, but on the cold realities that key people can sometimes destroy value, that a key person in a company can go from being a value creator to a value destroyer over time and that key people, in particular, and human capital, in general, will matter less in some companies (more mature, manufacturing and with long-standing competitive advantages) than in other companies (younger, service-oriented and with transitory and changing moats.

Related: Tesla in November 2023: Story Twists and Turns, With Value Consequences!