Overall, Mag 7 and technology were investors’ friends yesterday as the Nasdaq Composite rose 1.22%. Despite an S&P 500 index advance/decline line that still ran in favor of “Declines” (181/322), yesterday saw that index post modest gains of 0.49%. Aside from Apple (AAPL), Mag 7 names figured prominently in the top 10 contributors to return for the index, with Nvidia (NVDA) alone accounting for just under 70% of the day's results. The Dow had another down day, shedding 0.20%, and small caps, while not explicitly tied to Mag 7 & technology did advance 0.14%. It’s not lost on us that markets have been dropping in 2-4% intervals and clawing back 1-2% at a time but until the macro environment starts to stabilize, and recession/stagflation fears start to settle down, this seems to be the current status quo.

Sectors also saw a similar advance/decline profile as our last update with the exception being that it was 75% of index weight posting gains this time led by Mag 7 laden Technology, Consumer Discretionary, and Consumer Services groups.

Despite dropping 10% yesterday, volatility remains high as the Cboe Market Volatility Index (VIX) closed at 24.23. Despite equity volatility moderating modestly, gold remains elevated at $2,933.80/oz and the 10-year treasury saw its yield tick higher to 4.31%.

The Tematica Select Model Suite shared in yesterday’s rally, led by Digital Infrastructure, Artificial Intelligence, and despite a recent push by the White House to reverse congressional approval, CHIPs Act. A 14.51% rebound in Intuitive Machines (LUNR) helped not only that name but Space Economy as well.

Stocks May Have Rebounded But Headwinds Remain Ahead

While indicating a mixed stock market open later this morning, equity futures are well off their early morning lows. We’ll want to see how those futures react to this morning’s February Producer Price Index (PPI) report, which is expected to follow the February Consumer Price Index (CPI) report and show a downtick in inflation pressures. What stood out to us in yesterday’s CPI report was the drop in airline ticket prices as that followed Delta Air Lines (DAL), American Airlines (AAL), and Southwest Airlines (LUV) recent sales and profit forecast cuts for the current quarter. In a filing with the SEC, American shared that part of its revised outlook reflects “softness in the domestic leisure market, primarily in March…”

Note the timing, that’s after the February drop in airline ticket prices found in the latest CPI report. That builds on the expanding list of retailers that have cited weaker consumer spending prospects as they issued weaker guidance that fell short of Wall Street expectations. Hammering that home, yesterday Colgate Palmolive (CL) shared it is seeing some hesitancy in the consumer and some destocking across various channels.

Shortly thereafter, American Eagle (AEO) issued downside guidance for the current quarter, with comp sales expected to fall mid-single digits, calling out the quarter is off to a slower start than expected. Moreover “ongoing consumer uncertainty and changes in the operating landscape, including tariffs and strength in U.S. dollar, are also creating factors for us to navigate.” That led American Eagle to guide fiscal year revenue and profits down on a year-over-year basis.

It indeed takes more than one company to make a trend, but when we string together comments and disappointing outlooks from Colgate Palmolive, American Eagle, Macy’s (M), Kohl’s (KSS), Abercrombie & Fitch (ANF), Target(TGT), and Walmart (WMT), it’s time to question the outlook for a key part of the US economy - consumer spending. Recent data has shown rising inflation expectations among consumers, which raises renewed questions about spending power. Pairing that with record consumer debt levels, the explosion in February layoffs captured in the latest data in the Challenger Job Cuts report, and overall uncertainty emanating from Washington, makes for a strong tailwind for the Cash-Strapped Consumer.

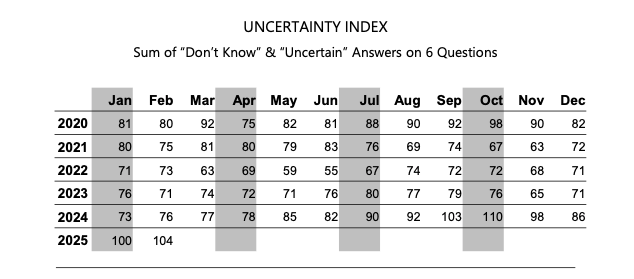

There are also reasons to question near-term business investment prospects. Tariff uncertainty for one, and the Atlanta Fed’s GDPNow model for the current quarter slipping into negative territory for another. Those help explain why the the Uncertainty Index found in the NFIB’s latest Small Business Optimism Index rose to its second-highest recorded level. As we’ve seen before, during periods of high uncertainty businesses, generally speaking, tend to pull back on hiring, spending, and investments. That’s another likely near-term headwind for the economy.

|

Source: NFIB

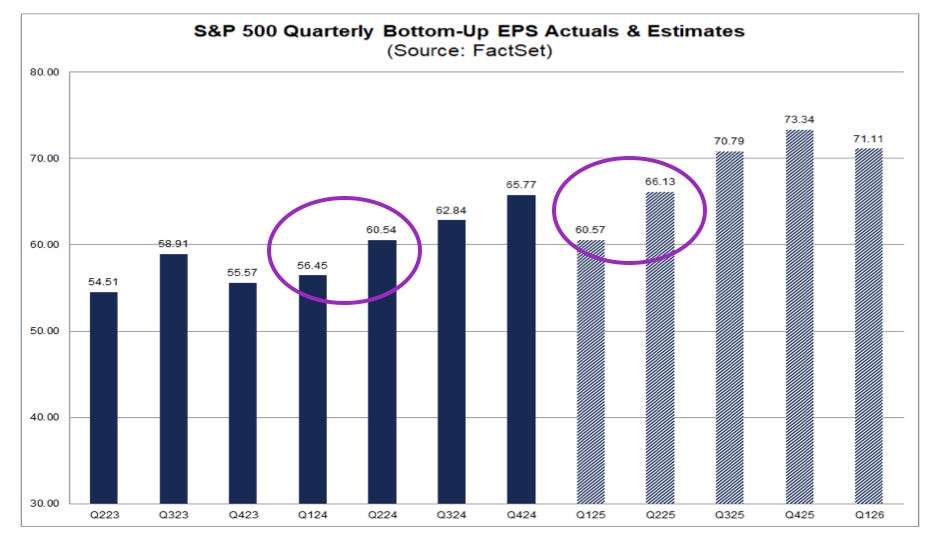

As we look ahead, expected Trump reciprocal tariffs targeted for April 2 as well as tariff countermeasures from China, Canada and now the European Union in addition to those items laid out above, are leading us to question S&P 500 consensus EPS growth expectations for Q2 2025. The current consensus tallied by FactSet calls for those earnings to grow 9.2% compared to those for the Q1 2025 quarter. That’s a quicker pace than the 7.2% gain posted in the Q2 2024 quarter compared to Q1 2024 when the economy faced far fewer headwinds and uncertainties.

The likely scenario as it stands today is companies will issue more conservative guidance for Q2 2025 than the market expects. Should that play out, it would likely raise questions for the arguably even more aggressive ramp in EPS growth projected for 2H 2025 (+13.8% compared to 1H 2025 vs. the 9.9% achieved in 2H 2024 compared to 1H 2024. Granted some of that forecasted 2H 2025 EPS acceleration may be tied to Trump tax cut hopium, but reality is pointing to progress on that front being a late Q2 2025 event. Given the timing, it doesn’t seem like many companies will be able to bake that expectation into their June quarter guidance.

Putting it all together, while the stock market rallied off from oversold levels yesterday, there are still multiple headwinds that could restrain its performance in the coming weeks and months. More chop that sustained upward movement could be what we see as the market contends with technical resistance ahead. For the S&P 500 that clocks in first at 5,737.35(the 200-day moving average) with much heftier resistance, as we can see in the above chart above, near 5,947-5,957.

The smart play would be to follow where spending, be it enterprise, consumer, or other, is still happening if not ramping. To us that keeps us bullish on our Artificial Intelligence, Cash-Strapped Consumer, Cybersecurity, Digital Infrastructure, Nuclear Energy & Uranium, and Safety & Security targeted exposure models and strategies. And yes, given our comments above and what is likely ahead, it stands to reason some exposure to our Market Hedge model is warranted.

We’d also suggest you read this weekend’s Thematic Signals, where we will share multiple ripped-from-the-headlines confirmation points for those strategies and others.

Related: What’s Driving Markets This Week: Powell’s Testimony, CPI & Trump’s Tariffs