Not all risks are created equal; looking at merger arbitrage through a managed risk lens

That risk and reward are related is a key tenet of Modern Portfolio Theory (MPT) and portfolio construction. To achieve a return above the risk-free rate, usually figured as the yield on a 3-month U.S. Treasury bill, you have to assume some level of risk, but it’s important for investors to minimize exposure to those risks not associated with the expectation of positive returns and to manage the remaining risks to better the chances of seeing some of the “rewards” from the risk/reward relationship.

Looking at merger-arbitrage strategies like that employed by our fund, the IQ Merger Arbitrage ETF (MNA), we can break those risks into two categories:

- Deal-specific risk, and

- Stock price risk of the acquirer from deals being financed by stock (i.e. the acquirer’s stock price declines, negatively impacting the value of the transaction).

Deal-specific risk

Merger-arbitrage funds like MNA seek to take advantage of the positive difference in the announced price of a transaction and the current price. A recent example of this as it applies to MNA is the Meet Group (MEET), which received an all-cash offer of $6.30 per share on March 5th. As deal completion risk rose during the early stages of the Covid 19 shutdown, the deal premium widened and the price of MEET fell. MNA added MEET during the April rebalance at $5.92. The deal subsequently closed on Sept 8th at the original offer price of $6.30 and the fund made over 6% on the transaction.

But not every deal works out, creating vulnerability. The risk: when a transaction falls apart, the stock price of the target usually declines.

This can be mitigated by portfolio diversification. The recent announcement by LVMH that it would not be completing the acquisition of Tiffany (TIF) is a case in point. TIF, a luxury consumer goods company, fell nearly 10% on the news and, with a weight of over 5% in MNA, knocked 50 basis points from performance. However, MNA (MNA-NAV) was up .14% for the day, with meaningfully positive contributions from other holdings such like Vivint, E-Trade and Noble Energy. The embodiment of this deal-specific risk, yes, but partially mitigated through diversification.

Acquiring stock price risk

Acquiring companies often announce that they will use their own stock to pay for the deal. This introduces two more risks. One is systematic risk or the risk that the broad market – or a sector – will fall prior to the completion of the deal. We were reminded of this in Q1 when the coronavirus began to spread and stocks plunged around the world, and again more recently with the early September declines of -6.7% and -10.3% in the S&P 500 and Nasdaq, respectively.

One way to mitigate the negative risk from broad market or sector sell-offs is by hedging. Merger arb strategies can apply a hedge, or a short, on the acquiring company or the overall sector. MNA, for example, may be long the target company in a proposed merger or acquisition and short the sector. This provides some risk mitigation from broad market or sector specific declines.

The remaining risk is the company specific risk of the acquirer. This is the risk that the acquirer will underperform the market or its sector. Having an implied long exposure to the acquiring company allowed the fund to retain the positive expected results from both the anticipated deal closing and the potential for the acquirer’s stock outperforming its sector over the time horizon we held the deal.

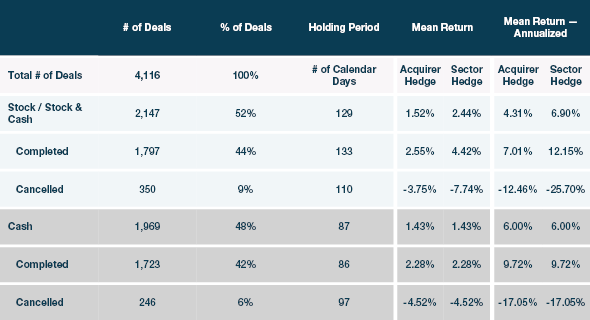

Our research has shown that historically, about 84% of merger deals have completed successfully and 52% of all merger deals are comprised of stock or a combination of stock and cash. As shown in the table below, of the stock-based deals that completed, those with a hedge on the sector tended to outperform those with a hedge applied on the acquirer.

Returns on Merger Arbitrage Transactions Net of Hedge and Transaction Type

FactSet: Analysis period from January 1, 1998 – December 31, 2018. Past performance is no guarantee of future results. One cannot invest directly in an index. Sector hedge performance is represented by the S&P 500 sector and regional index returns.

A recent example of this is Vivint Solar (VSLR) which is being acquired by SunRun (RUN) in an all-stock deal. VSLR was added to the index in the August rebalance and has subsequently gone up 20%, largely reflecting a 21% gain in SUN. At the same time, the sector has declined -1%.

Because all-stock deals are currently prevalent, short positions, or hedge ratio, in the MNA index was over 50% as of 8/31/20, well above average, providing a hedge against the systemic risk described above.

By definition, any investment that offers a return in excess of the risk-free level involves some risk. But not all risks are the same. Some offer no expected upside and should be avoided, while others offer the potential to generate positive returns, but should be managed in a prudent fashion. Investors should understand where and how their risks are being assumed, and structure their portfolios accordingly.

Related: Are Mergers & Acquisitions Back?