Written by: David Waddell | Waddell and Associates

The tariff tornado pushed the S&P 500 into correction territory this week, making this the first 10% sell-off since October of 2023. Corrections occur once a year, on average, making this bull overdue. Investors feeling pressure to react should review previous corrections and their highly predictive past of positive resolution. This current correction has not damaged earnings expectations much, making it a valuation correction. While an unpleasant method, we view this as positive. In fact, with valuations on the S&P 500 back below 20x and the 10-year treasury yield down to 4.3%, the market has become undervalued after being overvalued. Don’t expect much progress while Trump pontificates but this market correction has built some support. Continue to view excessive pessimism as your buy signal and remember that absent a recession, the cure for low prices is simply… low prices!

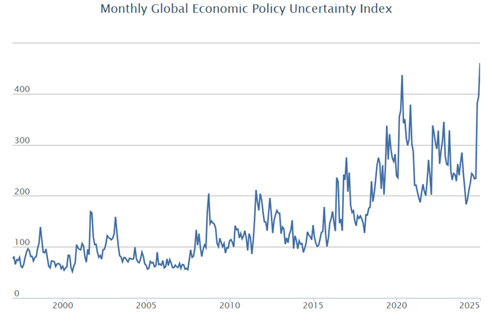

The Trump administration’s “ready, fire, aim” tariff campaign has produced a “ready, fire, aim” selling campaign within the markets. Over the past three weeks, the Mag 7 stocks have declined 16% while the S&P 500 has declined by over 10%. Morning recovery rallies have been interrupted by tariff tantrums, and late day sell-offs have been dispiriting. The Global Policy Uncertainty Index has reached record levels:

Source: https://www.policyuncertainty.com/

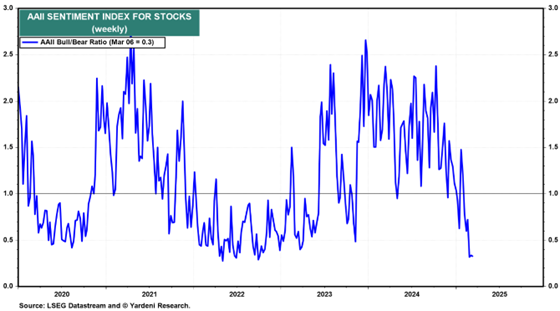

While Investor Sentiment levels have collapsed to near record lows:

Source: https://yardeni.com/charts/bull-bear-ratios/

With so much anxiety and uncertainty afoot, should you sell?

Corrections Reflections

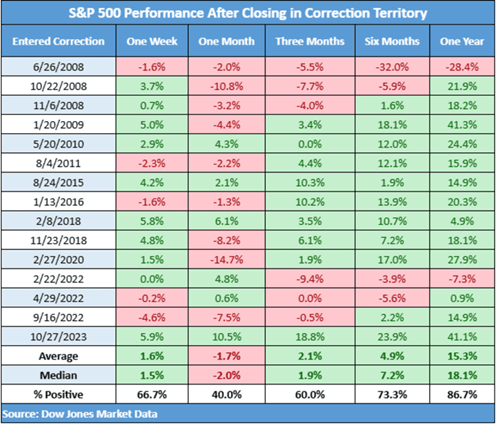

On average, markets decline 3% about seven times per year, 5% about three times per year, and 10% at least once per year. Larger drawdowns become less frequent with 20% declines occurring every four years. Drawdowns of this magnitude typically require recessions. Historically, selling into market corrections has only returned regret for investors. Consider the following chart:

Buying into the last 15 corrections rewarded investors with positive returns 87% of the time over the next year. In two of the occurrences or 13% of the time, selling into the correction proved prescient. While this is compelling, corrections do happen for reasons, and they do require resolution. Note that once markets have reached correction points, the subsequent month and three-month periods offer both losses and minimal returns. Intrepid investors early in corrections risk becoming fatigued as markets equivocate. I suspect this is where we are now.

What We Are Doing About It

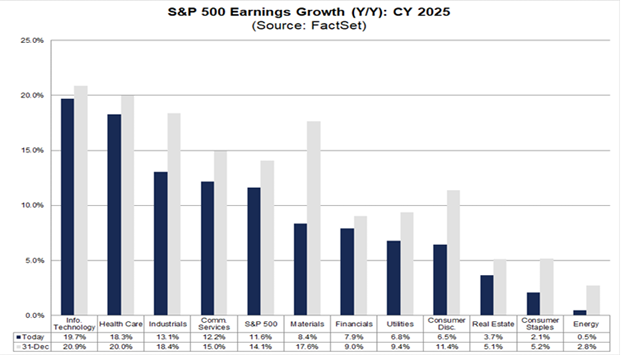

The time to plan for a firefight is not while you are in it, but before it begins. Earlier this year, we rotated two core positions within the equity model portfolio to achieve two key objectives (for compliance reasons, we cannot discuss trade specifics here, call us for details). First, we de-risked a position within the portfolio to lock in previous Magnificent 7 gains. Second, we aligned a position within the portfolio with Trump’s re-industrialization agenda.The first strategy provided immediate benefits as the Mag 7 became the Lag 7 over the past month. The second strategy should benefit from tariff impositions once longer-term industrial investment projects are initiated. These will not begin in earnest until Trump’s tariff commitments harden. For now, the tariffs appear non-committal making investment projects non-committal. Hence the “growth scare” that plagues equities. Business commitments will remain on pause until the economic uncertainty index profiled above the mean reverts. Businesses have an uncanny ability to adapt and generate profits once they know the rules. The “uncertainty pause” has not led analysts to throw in the towel on 2025 earnings:

While the S&P 500 has corrected 10%, full-year 2025 earnings estimates have only declined from 14.1% to 11.6%, still well above long-term averages. Additionally, analysts still expect earnings growth across every sector. While earnings have remained supportive for this bull, valuations have not. Recall our concern over stock market multiples entering the year. At 22 times earnings, the valuation for the S&P 500 appeared problematic, requiring resolution. Either earnings would have to grow faster than returns to reduce the valuation multiple (our base case) or the market would correct, forcing faster multiple compression.

Source: https://yardeni.com/charts/stock-market-p-e-ratios/

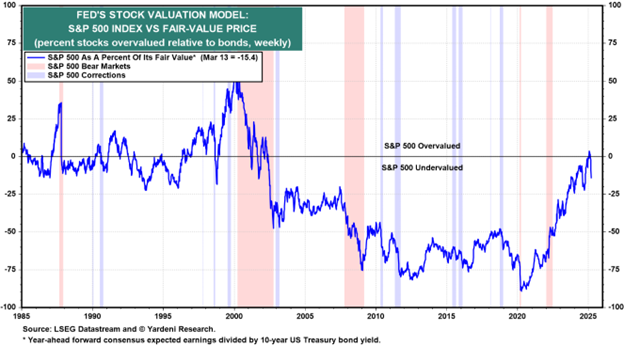

Given the relatively steady earnings outlook, this correction has triggered meaningful multiple compression. The 22x P/E at the end of 2024 has become 19.9x by March 13th. Paired with a 10-year Treasury yield of 4.3%, this market has flipped from being slightly over-valued to being undervalued:

Source: https://yardeni.com/charts/feds-stock-valuation-model/

This does not ensure that the rally resumes but it does provide insurance against anything far nastier than a garden variety correction. Therefore, we remain committed to our allocations and to our strategy of adding to positions during negative sentiment extremes in anticipation of a brighter 2026. 2025’s “growth scares,” “uncertainty pauses,” and “policy panics” will require investor patience and vigilance. We have both. So let us worry for you… and you can enjoy your weekend!!

Related: Global Market Transformers: Where International Equities Are Headed

Sources: PolicyUncertainty.com, FactSet, Yardeni Research, Market Watch