One thing we’ve developed to help us make good decisions is our MONCON Recession Conditions model. We introduced an overview of the recession forecasting model in a 2018 blog post, so I won’t go over all the details again here.

MONCON is designed to alert us when there is an increase in the probability of a recession within the next 6 months. MONCON 5 signals that there is no recession threat, but the risk of a recession increases as it moves towards MONCON 1.

We have always tried to succeed in not being tricked by human emotions or by the news that a recession was coming unless we saw the data. MONCON just took the recession forecasting data and put it into a score people could understand.

For example, we never fell for the head fakes in January 2016, January 2018, or December 2018.

Remember 2018? The news was basically hammering bearish themes, and the rapid January 2018 sell-off was still fresh. The news was highlighting perceived economic uncertainty over new tariffs, the Fed raising interest rates four times in the calendar year, regulatory concerns related to big tech…which at the time accounted for 11% of the total S&P 500 market cap, concerns over corporate valuations being too high, and the decline in job growth reported in November 2018.

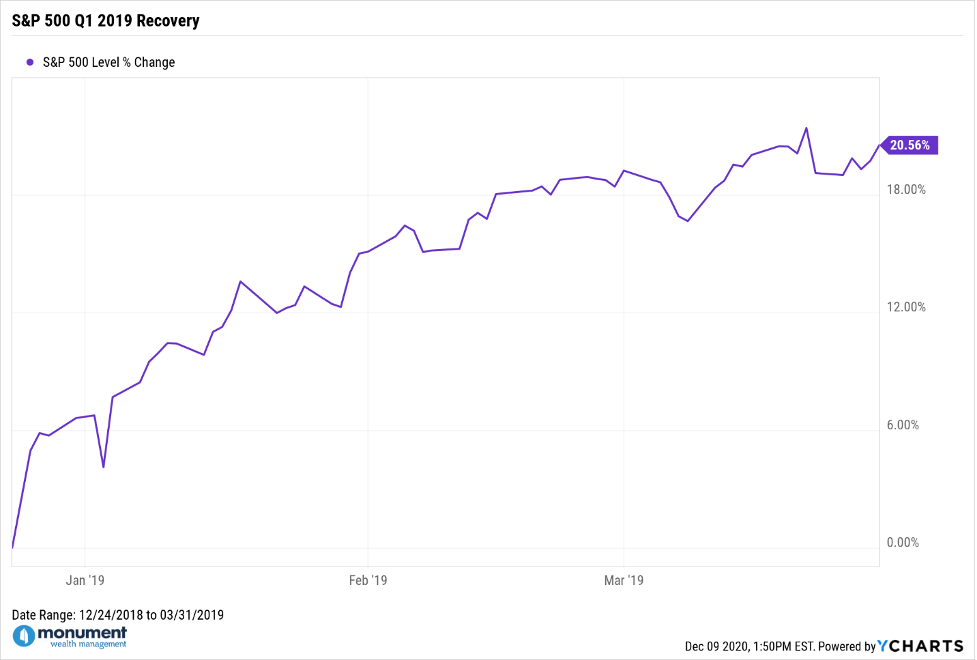

The S&P tumbled 19.63% from October 3rd, 2018, to Christmas Eve.

But MONCON held – it never indicted recession. We did nothing. Here’s what happened…

Down almost 20%, then up 20%. Everyone got a mulligan and a chance to adjust their portfolio if they felt that rollercoaster was too much to stomach.

Where MONCON fell short was in March of 2020. MONCON basically went from 5 to 1 in a day (slight exaggeration, but that’s what it seemed like). You can read about it here, but basically, MONCON was never designed to forecast a pandemic…so it failed.

Even though we raised cash in our clients’ managed portfolios as the rules that govern each strategy created “sell” triggers, there were still losses.

But MONCON didn’t totally fail. MONCON is also designed to tell us when to redeploy cash. So as MONCON hit level 1, we started repurchasing equities into the portfolios at the exact moment most people were scared shitless about further sell-offs – May and June.

It worked, and MONCON started moving from 1 back to 5 before the news ever started to HINT that things were getting better. By September, the inputs that go into MONCON started flipping from recession to expansion, and MONCON moved from 1 to 2. A few weeks later, we saw more inputs flipping, and MONCON kept moving in the right direction.

When the news started forecasting the likelihood of a recession if the election swung to Biden, we saw continued improvements in MONCON inputs, and we ignored the noise.

That worked out well, too, and as of today, MONCON stands at 5 again – “No Recession Threat.”

Models aren’t perfect, and ours are no exception, but they don’t suck either. We think they helped us make good decisions based on facts and data rather than emotion…which is one key to success.

We believe in models, rules, and systems – and for the most part, they have been working well, and we are sticking to them.

It’s one of the things that makes us different – we are not guessing. We look at probabilities and possibilities, coupled with a healthy dose of long-term investing optimism.

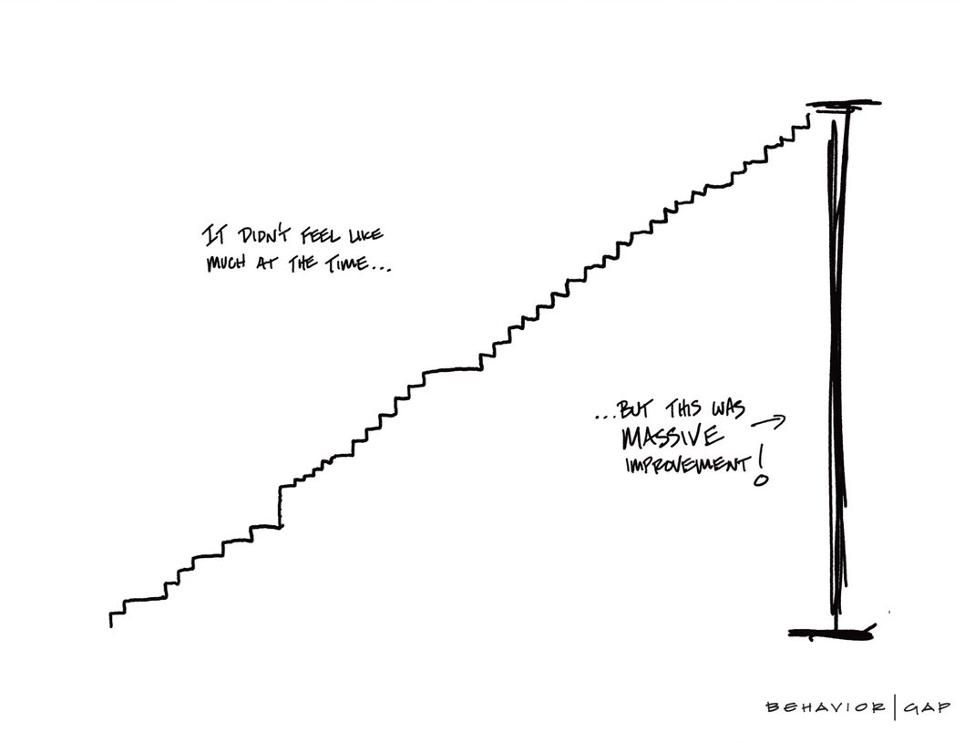

Oh, and don’t forget the power of compounding returns over time. This sketch from Carl Richards is worth a thousand words. It’s what you want your portfolio to look like.

Keep looking forward.

This first appeared on Monument Wealth Mangement.

Related: You Never Know What You Don’t Know About the Market