Written by: David Waddell | Waddell and Associates

Markets leapt to new record highs this week as Chairman Powell and the FOMC left rates unchanged, maintained their outlook for three cuts in 2024, and released a very buoyant Summary of Economic Projections (SEP) survey. The decision not to cut rates wasn’t a market mover. The continued three rate cut forecast, rather than two, definitely contributed, but the big lift came from the dramatic increase in the Fed’s overall economic assessment, as shared below:

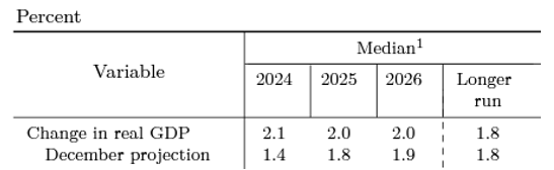

LET’S START FIRST WITH THE FED’S GDP OUTLOOK:

Note the column on the far-right that projects long-run GDP growth for the U.S. economy at 1.8%. That’s the number the Fed considers our domestic economic growth “potential.” Now note that the Fed believes the U.S. economy will grow “above potential” over 2024, 2025, and 2026 at 2.1%, 2.0% and 2.0%, respectively. That’s good news!

The Fed also upgraded its growth projections from December’s SEP release by .7% in 2024 (2.1%-1.4%), .2% in 2025 (2.0%-1.8%), and .1% in 2026 (2.0%-1.9%). That’s a 20% increase in growth expectations over the full three-year period, and a 50% increase in growth expectations over the coming year. That’s really good news!

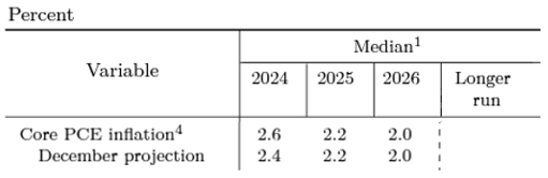

NOW LET’S EXAMINE THE FED’S INFLATION OUTLOOK:

This is the Fed’s preferred inflation measure that they use to set policy. While they didn’t pencil in a longer-run inflation estimate, the Fed targets 2%. Therefore, the Fed estimates that inflation will run above target for 2024 and 2025 at 2.6% and 2.2%, respectively, before returning to their 2% target in 2026. That’s bad news. The Fed also increased its inflation expectations by .2% for the three-year period—also bad news.

However, in percentage terms, the additional .2% inflation expected only amounts to a 3% increase over the three-year period and an 8% increase over the coming year. On its own, maybe that’s bad news, but when you consider GDP upgrades of 50% for this year and 20% over the next three years versus an inflation upgrade of 8% for this year and 3% over the next three years… that’s great news!!!

Per the data, the Fed believes the U.S. economy has entered an upgrade cycle where it can produce more economic growth per unit of inflation. This may be an early acknowledgment of the AI technology cycle just entered, or at least the anticipated benefits.

On Friday, I had lunch with an entrepreneurial friend and client. He works for a company that reads through large corporate databases to find useful litigation information. He explained to me that by using AI to scan millions of documents for an upcoming project, they were able to lower their proposal price by 66%. That’s an astounding reduction. Imagine the disinflationary power of applying generative AI economy-wide. This alone could explain the Fed’s newfound optimism.

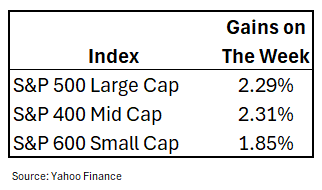

Consider this, if the Federal Reserve believes that upcoming productivity gains will produce higher growth with lower inflation, then investors should believe in profitability gains that will produce higher returns. As per the following gains on the week, apparently… they do:

Enjoy the week!

Sources: U.S. Federal Reserve, Yahoo Finance

Related: Don’t Overlook an Important Piece of RIA M&A: Telling Your Story