Written by: David Waddell | Waddell and Associates

THE BOTTOM LINE:

Investors won after Tuesday’s election! All major averages hit new highs and logged their largest post-election gains ever. Adding to the optimism, Chairman Powell cut the Federal Funds rate another .25% with the futures markets placing a 70% chance that he will cut another .25% on December 18th. Economic data arriving in the background reinforced the “soft landing” scenario and 76% of S&P 500 companies reported higher earnings than expected with overall earnings doubling growth expectations for the quarter. For those dismayed by the political outcomes, perhaps the financial outcomes offer some consolation. But if not, take solace. America’s democracy remains intact, and the mid-term elections will occur on November 3rd, 2026, providing the country yet another opportunity to change its mind.

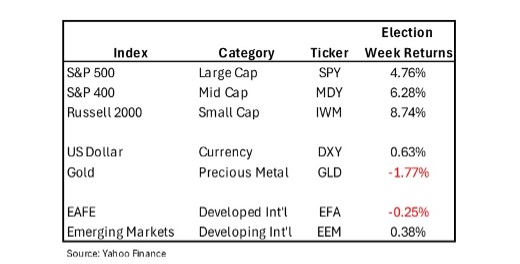

Investors won after Tuesday’s election as Wednesday produced the highest post-election day returns in history! The S&P 500 large cap index surged 2.5% compared with its average post-election day return of -.4%. The Russell 2000 small cap index surged even more, rising 5.8%. All major market indices hit all-time highs (including Bitcoin), with the gains continuing through week’s end. Here are how the major market indices closed out the week:

The Stealth Tax

This puts the Trump economic agenda on display. With a clear mandate, Trump will have no difficulty extending the 2017 tax cuts. Furthermore, he may lower the corporate tax rate even more from 21% to 15%. Additionally, deregulation reduces a stealth tax that we can argue has an even greater impact on corporate profits.

According to the Government’s own OMB (Office of Management and Budget), compliance with federal regulations costs companies around $300 billion annually, roughly in line with what firms spend on corporate taxes. Furthermore, 40% of the S&P 500 is currently under investigation by the justice department. Anti-trust has also been busy as of late, most notably with its effort to dismantle Google.

The Scales Balance

Trump’s pledge to slash the regulatory burden will free up capital and embolden innovation, especially across smaller companies with less discretionary capital to expend on compliance. For those fearful that Trump’s tough tariff talk will cause inflation, note that tax cuts, regulation cuts, technological advances, and heightened energy production all provide disinflationary offsets.

We have also witnessed this bluster before, yet inflation averaged 1.9% over Trump’s first term, squarely below the Fed’s 2% target. Also, inflation expectation indices finished the week essentially unchanged and Gold, seen as a hedge against inflation and chaos, declined 2%.

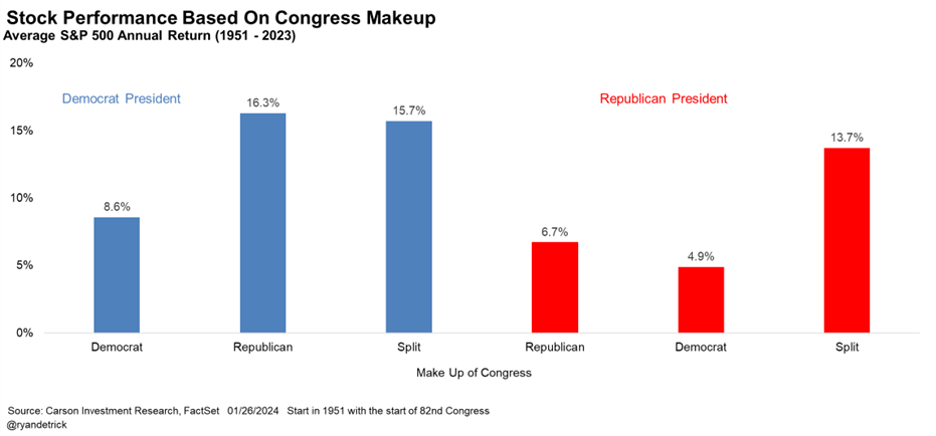

Lastly, note that Trump’s America First message led to a sizable differential between onshore and offshore returns as capital quickly immigrated and repatriated into the US. Overall, it was a robust market rally to begin Trump 2.0, but history proffers caution when one party rules them all:

What Unified Control Means

Between 1951 and 2023, Republicans held unified control for a total of 10 years with S&P 500 returns averaging 6.7%, annualized. For comparison, when the Democrats held unified control for a total of 20 years, the S&P 500 returned 8.6%, annualized. This compares with average annual returns of 14.5% when Congress is split, and 9.9% for the 43 years surveyed as a whole. The lesson? Too much of a good thing for party loyalists has historically meant less of a good thing for investors.

Rate Cuts = Higher Rates

The Fed cut rates again this week, trimming .25% off the overnight rate. For those of you who own money market funds, your yields just dropped. For those of you who hold mortgages, your yields did not. Remember, while the Fed calibrates its rate decisions to achieve 2% inflation and full employment across the economy, the longer end of the yield curve calibrates its rate decisions to nominal GDP growth expectations.

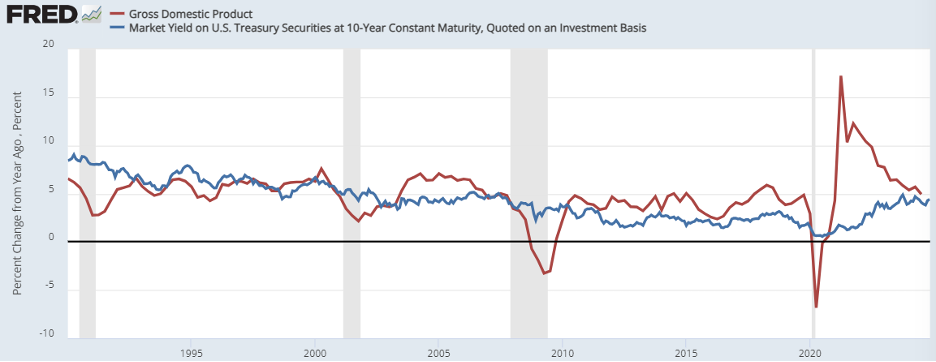

Intuitively, lower short-term interest rates improve longer-term economic growth potential. Additionally, a more growth-centric policy array also improves longer-term economic growth potential. Both apply upward pressure on longer-term yields for the right reasons. Consider the relationship between nominal GDP growth (inflation inclusive) and the 10-year Treasury yield:

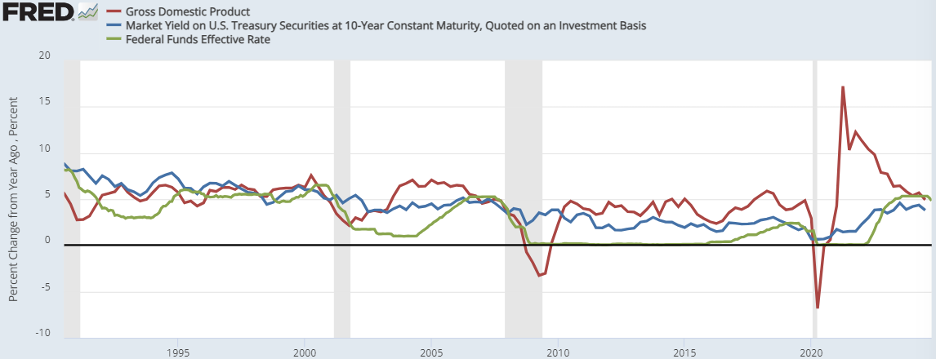

Over the time-period for the dataset above beginning in 1990, nominal GDP (red) averaged 4.8% on a quarterly basis, while the 10 Year Treasury yield averaged 4.2% (blue). Prior to the GFC in 2008 the spread between the 10 Year and nominal GDP averaged .3%. Post GFC, the Fed distorted the interest rate curve with its zero-interest-rate policy, widening that gap, as seen when adding in the Federal Funds rate (green):

In the mid-1990’s, the Fed cut rates after raising them aggressively to reduce recession risks and ensure a “soft landing”, making that period the best analog for where we are today. It worked. Nominal GDP rose from 4.6% when they began cutting rates in early 1995 to 6.3% before they started raising them again in 1997. Over that two-year period, the yield on the 10-year Treasury rose from 6% to 7% in sympathy with the higher growth rates, despite Fed rate cuts. Most importantly, household net worth advanced 20%.

Here is my point: Over the past week, I have heard a lot about how the new administration’s policies will lead to higher inflation, Treasury bond auction failures and punitively higher longer-term interest rate levels for mortgage borrowers, leading to another housing crisis and economic collapse. While all of that is possible, we do not see that as probable.

More likely, the uptick in rates seen recently doesn’t reflect US credit quality concerns, but is an acknowledgement that near-term recession risks have fallen, and that long-term nominal GDP growth potential has risen. While you may pay more than you like for a mortgage under this scenario, you will have higher income and a larger net worth to subsidize it—and when a recession does inevitably arise, you can always refinance.

Sources: Yahoo Finance, Carson Investment Research, FactSet, FRED