Delays, false starts, and setbacks have kept the much-awaited interest rate cutting cycle from coming to fruition until now. All signs point to the September 18th FOMC meeting as the first of many rate cuts to come. In his Jackson Hole speech in August, Powell suggested that “the time has come for policy to adjust,” a clear message that should be enough to rouse investors from their comfortable cash-heavy portfolios, but recent market volatility and inertia itself are delaying major rotations to better yield-producing assets.

Investors are comfortable—too comfortable—with the healthy and risk-free returns they have been earning on cash and cash equivalents since the Fed began hiking rates back in March of 2022. After nearly 15 years of sub-2% rates, investors have gotten hooked on higher rates and need help to let go in favor of assets that can offer better long-term returns.

Today’s cash rates are the new punch bowl, and advisors need to take it away. Although cash and savings rates aren’t going to hit the floor immediately, the best move will be to guide clients out of these short-term assets and into better long-term prospects. Clients who lack a bias toward action may need a push.

It's Not Too Late for Equities

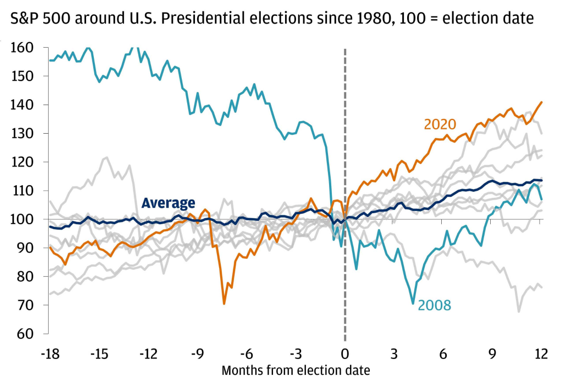

The classic excuse, I’m waiting for a pullback, isn’t relevant, since the S&P 500 had one in August and is having another now. If clients aren’t acting, then they may need clear direction on how to proceed. It is common for markets to not only take a nosedive in September, but also trade down or sideways into the election.

Sources: Bloomberg Finance L.P., J.P. Morgan Wealth Management. Analysis as of November 9, 2023. Elections included are 1980, 1984, 1988, 1992, 1996, 2000, 2004, 2008, 2012, 2016 and 2020.

This historical market behavior is perfect for clients who are overweight in cash or short-term fixed income and need to reposition themselves into higher-growth assets for the rate-cutting cycle. But this also means there is no time to waste. When the Fed begins to ease monetary policy, U.S. large-cap and growth stocks typically benefit, while value and international stocks may suffer.

Frame this asset allocation change within the context of the balance's purpose. Many clients aren’t overweight in cash because they need instant liquidity or total asset preservation on all of it. Instead, it is simply the lowest-risk option to achieve a healthy return lately. Refocus your client on the components and goals of their plan. Anchoring to the mission of their money can help them determine whether that money is truly meant for cash at all.

Relevant Fixed Income Strategies

Rebalancing should be done with the intention of positioning clients not for where the market is today, but where it will be in the future. This means anticipating how rate cuts may impact both equities and fixed income in the medium term. Many long-dated fixed-income products still offer worse yields than their short-dated counterparts, but this won’t last forever, as evidenced by the rapid drop in 2-year yields over the summer.

Building portfolio positions that will benefit from the continued un-inversion of the yield curve will maintain both healthy yields and better total returns beyond the expiration of our current rate environment.

- CD or Fixed Annuity Ladders: For those with short-to-medium timelines for cash needs, or who favor liquidity over absolute yield, building a ladder can be useful to strike a balance. For taxable money, the added tax deferral of a multi-year guaranteed annuity can tip the scales toward those products in the right situation.

- Increase Duration: Stepping a little further out on the yield curve can offer some benefits. As rates fall, there will be pockets of inefficiencies to take advantage of. Finding these choice maturities can be a useful service to clients who are looking for a hand to hold as they step gingerly out of their cash position.

- Own Credit: Credit products are offering compelling yields for those comfortable sifting through the available options. Products like corporate bonds, securitized debt instruments, or the growing private credit market require careful review for the diamonds in the rough. Tread carefully with lower-rated or long-duration debt, which is most vulnerable to wipeout in a downturn and offers diminishing spread premiums.

- Diversify: Mitigate your risk of recession or resurging inflation by building the “Thanksgiving Plate” of portfolios. Take a little from every dish and monitor your positions for opportunities for turnover as dynamics change. There is a place for treasuries, municipal bonds, and CDs alongside securitized debt and high yield.

- Consider Active Strategies: Active management contributes the most when markets are volatile and shifting quickly. Lean on high-quality management teams in an opaque and dynamic fixed-income environment like we have today to take advantage of data, size, and superior liquidity.

Considering the uncertainty of the economy and the upcoming election, it is no surprise that retail and institutional clients alike are seeking comfort. However, doing the right thing isn’t usually the comfortable thing, which is why a nudge or even a push toward better strategies is so important.