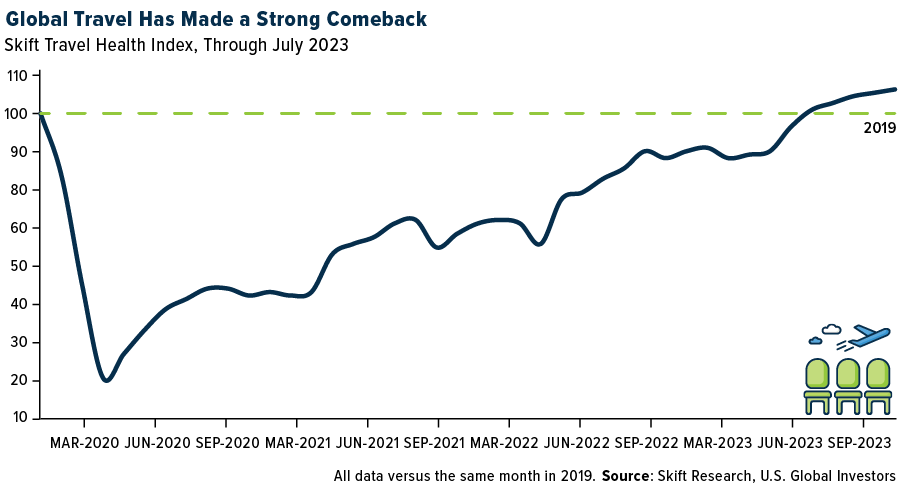

Last month, I shared with you that this summer is expected to mark a new historic high in commercial airline passenger volumes, breaking the previous record set in 2019. One of the unforeseen side effects of the current travel boom has been flight delays, mostly because of staff shortages, and this has raised the issue of pilot retirements.

Not too many people are aware that pilots in the U.S. must retire at age 65, due to federal regulations. That may be set to change, however, if a just-passed bill succeeds in becoming law.

Last Thursday, in a bipartisan vote, the House of Representatives approved the Federal Aviation Administration (FAA) reauthorization bill, which, among other things, authorizes more than $100 billion for airline operations, equipment and airports over five years. It also (controversially) raises the pilot retirement age from 65 to 67.

The new legislation will now need to be negotiated between the House and the Senate to move forward. If it doesn’t pass by the end of the fiscal year on September 30, when the current FAA law expires, crucial aviation programs could be at risk of being shut down.

I’ve written before about the pilot shortage, arguing that a reasonable supply deficit could actually encourage airlines to demonstrate capacity growth discipline and focus on the most profitable routes. I still support this idea, but others see a potential crisis brewing.

A “Tsunami” Of Pilot Retirements?

Testifying before the House Transportation and Infrastructure Committee in April, Regional Airline Association (RAA) President and CEO Faye Malarkey Black warned of a “coming tsunami of pilot retirements.” The shortage has resulted in more than 500 regional aircraft being grounded, Black said, and a 25% reduction in flights at 308 airports, mostly smaller ones.

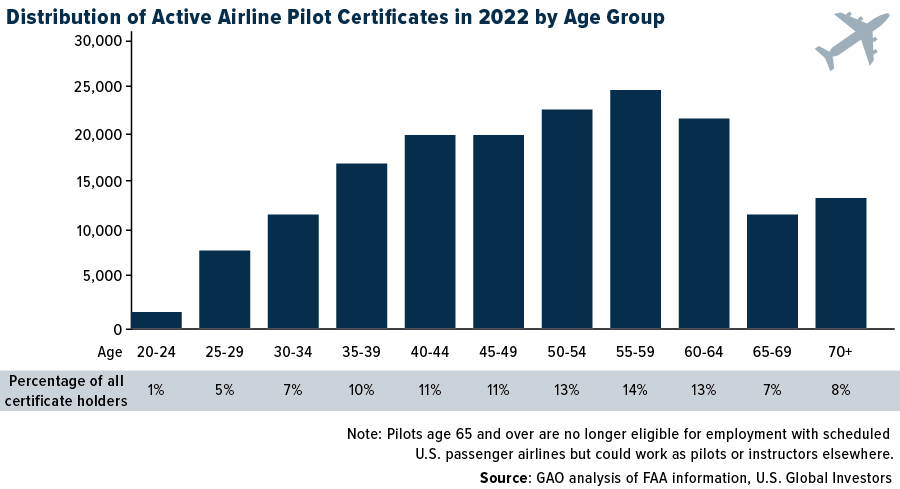

Further, the shortage of pilots, particularly captains, is forecast to be exacerbated as approximately 50% of the workforce will retire in the next 15 years.

These headwinds come despite increased enrollments in pilot training schools and rising numbers of pilots since 2017, according to a May report by the Government Accountability Office (GAO). In the same report, though, the GAO discloses that aviation businesses have reported difficulties in maintaining sufficient numbers of mechanics.

How are the airlines weathering these crosswinds? In response to workforce supply concerns, airlines are increasing pay for pilots and mechanics. Some regional airlines made significant pay hikes in 2022. Airlines are creating flight schools, and the FAA is supporting industry workforce development initiatives, including grants to attract young people to aviation careers.

To be fair, not everyone agrees that there’s a pilot shortage. The Air Line Pilots Association (ALPA) suggests that the idea of a pilot shortage isn’t factual and is an attempt to detract from airlines’ mismanagement, particularly in the wake of the pandemic.

The spread between views on the pilot shortage could suggest two different investment implications. If the shortage is real and worsening, it could represent a challenge that airlines must address to ensure operational stability. However, if it’s a narrative spun to distract from mismanagement, as the ALPA suggests, it could raise concerns about the governance and risk management of certain airlines, affecting their investment attractiveness.

American And United Airlines Surpass Expectations Amid The Travel Boom

Amid these swirling winds, we’ve seen some major updrafts. Last week, American Airlines increased its earnings forecast for 2023 in response to the travel boom. The Fort Worth-based airline now predicts earnings of $3.00 to $3.75 per share for the year, potentially higher than Wall Street expectations of $3.10.

In the June quarter, American outperformed consensus, reporting adjusted earnings per share of $1.92 and total revenue of $14.06 billion, against the anticipated $1.59 per share and expected $13.74 billion. Furthermore, the airline reported net income of $1.34 billion, up from $476 million in the same period a year earlier.

United Airlines also reported record quarterly earnings, surpassing estimates due to a surge in international travel demand. Despite disruptions, the airline managed a strong financial performance, with shares rising more than 8% last week. In the third quarter, United projects capacity growth of around 16% and an estimated revenue increase of up to 13% compared to the same period in 2022.

Both American Airlines and United Airlines show us that there are opportunities to be had even amid the challenges. They’re also leveraging the ongoing international travel boom, as evidenced by United’s plans to offer direct flights from the U.S. to Manila in the Philippines, starting in October. This expansion into Asia is part of a broader strategy that seeks to leverage the upsurge in international travel bookings after the pandemic slump.

A Clear-Sky Forecast For Airline Investors

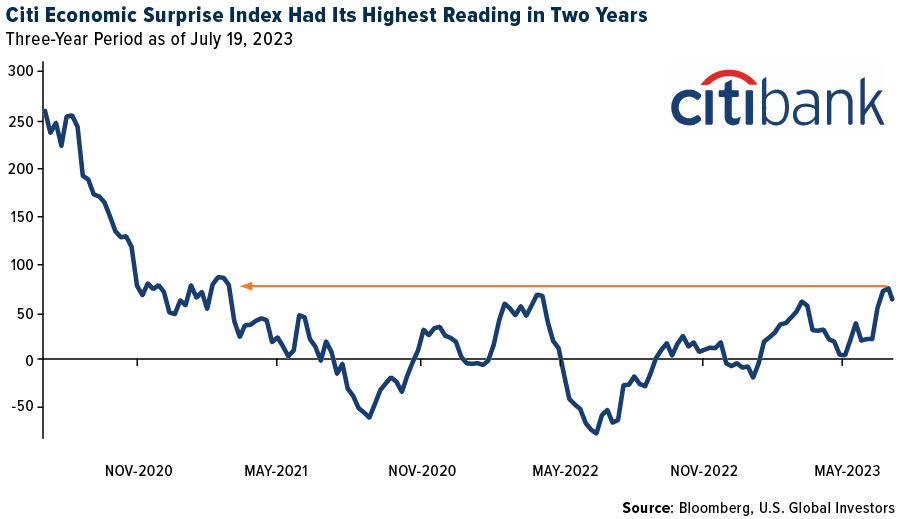

Indeed, recent economic news has been more positive than anticipated, as indicated by the Citi Economic Surprise Index reaching its highest point in the last two years. The index provides a snapshot of how the economy is performing against expectations, with higher numbers signifying better-than-expected results. This uplift has been attributed to favorable recent reports, including decreasing U.S. consumer price inflation, reduced wholesale price increases, lower import prices and fewer-than-expected jobless claims.

A year ago, the same index warned of a potential economic slowdown as the Federal Reserve increased interest rates significantly, while inflation remained persistently high. This led many economists to predict an upcoming recession.

However, many economists are now retracting those predictions as economic data continues to defy expectations.

For airline investors, I believe this is a landscape of opportunity. Amid the turbulence, there are pockets of clear air. There are legislative tailwinds, innovation in training and recruitment, international expansion strategies and an overall robust economy that favors travel. As always, remember to keep your portfolios diversified and your eyes on the long-term horizon.

Related: Top 10 Gold and Precious Metal Mining Stocks Ranked by Free Cash Flow Yield