Markets are taking a breather this morning as Beijing bans certain US semiconductors from use in government computers and servers. Investors are also rethinking the Federal Reserve’s monetary policy path, with Atlanta Fed President Raphael Bostic opining on Friday that only one rate cut is needed this year. Shortly after his comments, however, his Chicago counterpart and self-described “data dog,” Austan Goolsbee, spoke in favor of the Fed’s consensus view that three rate cuts are needed this year, while board member Lisa Cook appeared to support Bostic’s concerns, explaining that the Fed will have to use caution in reducing rates to prevent a resurgence in inflation. Against the backdrop, geopolitical concerns stemming from Russia-Ukraine and Hamas-Israel are pushing up commodity prices, particularly oil. On the economic data front, meanwhile, the pace of new home sales slipped slightly while narrowly missing projections.

New Home Sales Decline

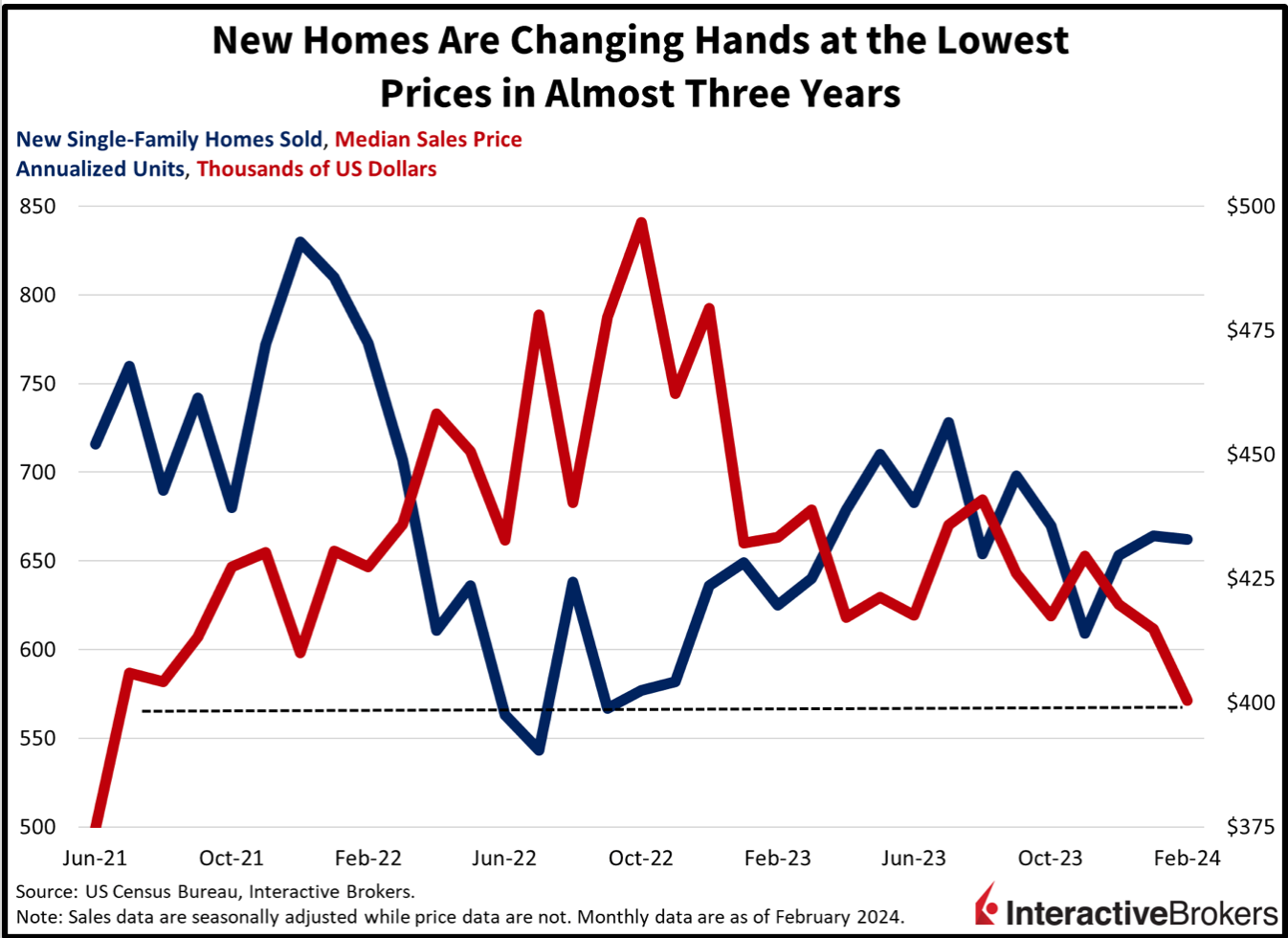

New home sales dropped last month as builder discounts failed to drive purchasing activity higher. The pace of new home sales dropped 0.3% month over month (m/m) to 662,000 seasonally adjusted annualized units (SAAU), missing expectations of 675,000. The Northeast led the weakness, with transactions dropping 31.5% m/m. The Midwest also saw sales falling, with a 2.4% drop during the period. The South and West offset some of the sluggishness, however, with positive rates of 3.7% and 2.3%. Nationally, the median closing price dropped to $400,500 from $414,900 m/m, its lowest level since June 2021. Inventories also increased as a recovery in construction activity has been met with lackluster buying. As of the end of February, the volume of new homes for sale was comparable to 8.4 months of sales based on last month’s transaction tempo.

Energy and Materials Lead on Mounting Geopolitical Concerns

Markets are weaker with stocks down slightly and yields up as investors digest incoming data as well as Fed commentary. Most major US equity indices are lower with the Dow Jones Industrial, Nasdaq Composite and S&P 500 benchmarks down 0.3%, 0.2% and 0.2%. The small-cap Russell 2000 Index is positive, though, gaining 0.7% so far this session. Conditions look much weaker under the surface, with all sectors lower minus energy and materials, which are up 1.1% and 0.3%. Energy is leading due to oil prices rising sharply in response to heightening geopolitical tensions between Kyiv and Moscow amidst dwindling hopes for a ceasefire between Tel-Aviv and Gaza. WTI crude is up $1.28, or 1.6% to $82.02 per barrel, as market players dial up their supply concerns. Leading the charge lower among equity sectors are the technology, communication services and industrials segments, with values down 0.6%, 0.5% and 0.4%. Yields are higher, meanwhile, as bond traders raise their inflation expectations while digesting hawkish statements from Bostic and Cook, as a path still exists where the FOMC resists cutting rates on the back of rising commodity prices. The 2- and 10-year Treasury maturities are trading at 4.63% and 4.24%, 4 and 3 basis points (bps) higher on the session. The dollar is paring gains, though, with the greenback’s index down 23 bps to 104.19 as the US currency loses ground versus all of its major developed-market peers, including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars.

Planning for June Cuts?

Investors are hoping to greet summer sunshine with fresh enthusiasm resulting from a potential rate cut in June. Markets are now pricing in a 75% likelihood that the Fed will dish out a June rate cut, but as we approach the June 12 meeting and additional data is released, it’s possible that investors may need to assess more than their plans for summer vacations. Indeed, while Chair Powell last week was overly enthusiastic about cutting rates, a continued rise in commodity prices may prohibit the Fed from enacting accommodative policy. Some committee members may push back against cutting to avoid a resurgence in price pressures that may totally derail the group’s optimistic inflation forecasts. This week’s incoming data on consumer confidence, personal spending, durable goods and unemployment claims are likely to provide more clues on the pace of economic growth, inflationary momentum, business investment and consumer spending. While the most recent Summary of Economic Projections has a median expectation of three rate cuts this year, the likelihood of that happening isn’t a given, with nearly half of the Fed’s 19 officials envisioning only two rate cuts this year and two anticipating none at all.