Written by: Cohen & Steers

Real estate has long appealed to investors due to its history of attractive income, total return, diversification benefits and positive sensitivity to inflation. This large investment universe — ranking behind only stocks and bonds in market size — has experienced a significant shift of capital from private investors to the public market in recent decades. As a result, the U.S. equity REIT (real estate investment trust) market has grown from just $9 billion in 1991 to $1.3 trillion today.

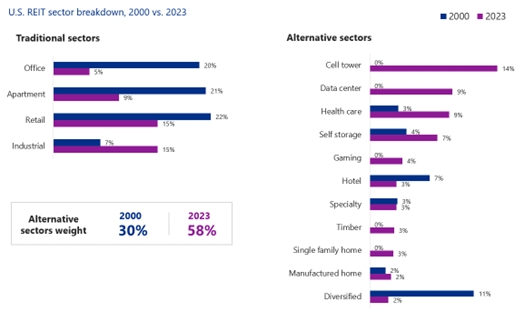

The modern listed REIT market has also expanded into property types beyond the traditional sectors of offices, retail, apartments and industrial, which dominated the market 20 years ago. Today, investors have ready access to an array of alternative sectors, which now make up more than half of the U.S. REIT market. Many of these sectors have grown dramatically on the back of supportive secular drivers.

The most notable change on the real estate landscape has been the growth of technology-focused REITs. Over the past decade, cell tower companies have converted into REITs, creating what is now the largest sector in the U.S. REIT market, with growth fueled by the adoption of 5G, high-definition video streaming and the burgeoning number of connected devices. Data center REITs have grown alongside the demand for cloud computing, streaming content, social media and (increasingly) artificial intelligence. Massive investments will be needed to expand communications infrastructure in the coming years, and we expect towers and data centers will be longer-term beneficiaries of this trend.

Evolving demographics have given rise to different types of residential sectors. Household formation by Millennials and historically low levels of homeownership nationally (pushing more people into the rental market) make a strong investment case for single-family homes for rent, which is seeing high demand from families who either cannot afford to own in fiercely competitive markets, or who prefer the flexibility of renting and wish to live in a suburban neighborhood with a good schools and amenities. Manufactured homes are another option, catering to two types of tenants: retirees in age-restricted communities and lower-income families (in non-age-restricted communities) seeking an affordable alternative to traditional homes and apartments.

Among industrial REITs, the sector has broadened beyond simple warehouses and logistics to include cold storage (think fruits and vegetables and frozen items that wind up in your grocery store). Self storage, meanwhile, serves individuals’ need for space to store their belongings, as well as small businesses for managing inventory. We see population and employment growth fueling long-term demand for the self storage sector.

Health care REITs encompass a variety of asset types, including senior housing, medical office buildings and life science laboratories spurred by the need for health care services. Senior housing, for instance, is seeing rising occupancy, and an aging population of Baby Boomers will likely drive longer-term growth. Enhancements to REIT rules have also created opportunities in health care, with REITs allowed to operate properties with a third party, giving them a stake in the operating business and providing new avenues for growth.

The growth of alternative property types has expanded the opportunity set for REIT investors

At December 31, 2023. Source: FTSE Nareit, Cohen & Steers.

Totals may not sum due to rounding. There is no guarantee that any historical trend illustrated above will be repeated in the future, and there is no way to predict precisely when such a trend will begin. The mention of specific sectors is not a recommendation or solicitation to buy, sell or hold a particular security and should not be relied upon as investment advice.

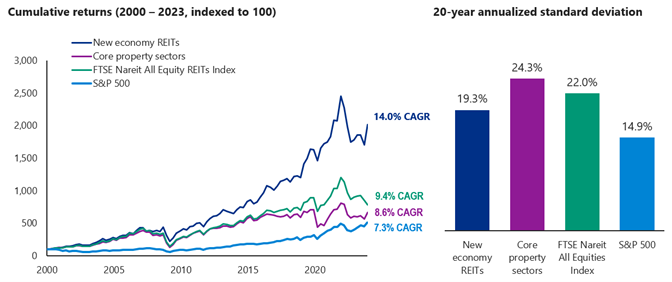

Secular growth provides a potential performance edge

Next-generation real estate sectors, many of which have secular growth drivers, tend to have strong pricing power, resulting in healthy cash flow and dividend growth. Consequently, in aggregate, new economy REITs have historically delivered more attractive returns with lower volatility than traditional core real estate sectors over the long term.

Next-generation sectors have meaningfully outperformed over the long term, with less volatility

At December 31, 2023. Source: Cohen & Steers.

Past performance is no guarantee of future results. The information presented above does not represent the performance of any fund or other account managed or serviced by Cohen & Steers, and there is no guarantee that investors will experience the type of performance listed above. There is no guarantee that any historical trend illustrated above will be repeated in the future, and there is no way to predict precisely when such a trend will begin. Next-generation sectors include health care, data centers, industrial, manufactured homes, self storage, single-family homes, student housing and telecommunication REITs within the FTSE Nareit All Equity REITs Index. Core property sectors include apartments, hotels, offices and retail (combining free standing, regional malls and shopping centers) within the FTSE Nareit All Equity REITs Index. Standard deviation is a statistical measure of volatility.

REITs are well-positioned for the current macroeconomic environment

Historically, REITs have delivered strong absolute total returns following the end of Federal Reserve rate-hiking cycles, often outperforming traditional asset classes. Following a period of underperformance amid an acceleration in interest rates, REIT earnings multiples are attractive. Moreover, REIT fundamentals have remained resilient amid generally low new supply. And while growth is decelerating due to the lagged impact of tighter financial conditions, trends are still above long-term averages.

Longer term, we believe REITs’ strong historical returns and diversified property allocations, including new and emerging sectors, may provide a valuable complement to a stock-and-bond portfolio, potentially improving overall risk-adjusted performance.

Related: Becoming a Sustainable Investor: Understanding the Essence of Climate Adaptation