Written by: Colmore

Venture capital (general) vs. private equity funds

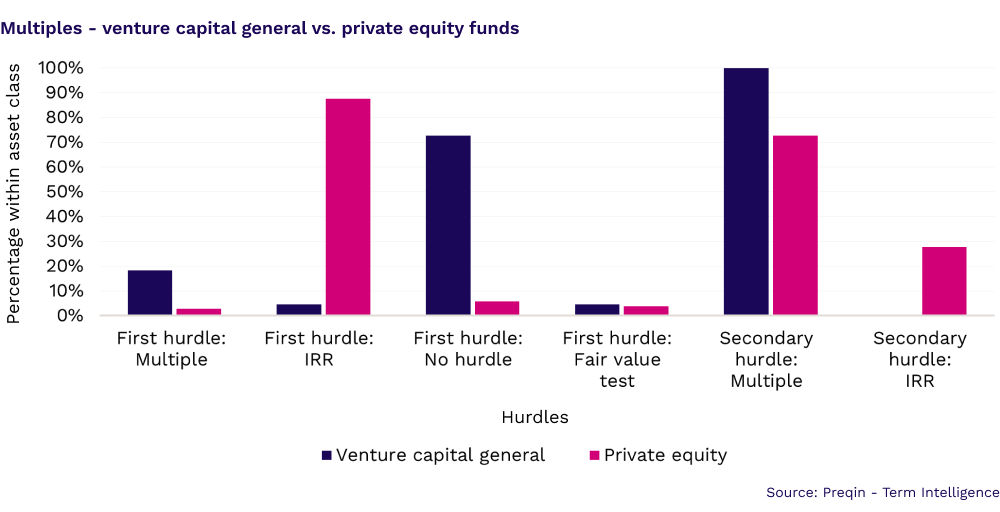

When negotiating terms between LPs and GPs, there are several methods commonly employed to define the basis on which LPs will receive returns generated by an investment. While hurdle rates are generally more prevalent in private equity than venture capital (general) funds, a multiple, if deployed, is a common secondary hurdle for both categories. This allows managers to vary the conditions under which carried interest becomes payable.

Preferred return or hurdle is the rate of return a limited partner (LP) must earn under the limited partnership agreement (LPA) before a general partner (GP) may earn carried interest. Unique to each fund, hurdle rates are usually measured using either compound interest (such as internal rate of return, or IRR), or a multiple. Significant economic consequences for LPs can, however, arise as a result of variations in the drafting of multiples in LPAs. Examples include variations in:

(i) definitions of “contributions” and “distributions” as they relate to the multiples; and

(ii) how contributions and distributions are treated where transactions occur on the same date.

Case study

During a carried interest validation exercise for an LP, Colmore identified a fund whose manager was applying the net cash flow multiple calculation. (1) The result was a higher multiple (TVPI) than they would have achieved under the transactional cash flow method. Under the latter method, contributions were $87mn, distributions $64mn, and a NAV for the investor was $112mn (gross of carry). A 2.5x multiple was required to earn a higher carried interest rate, but the fund had only achieved a multiple of 2.0x under the transactional cash flow method. However, using the net cash flow” method, contributions were now $56mn, distributions $33mn, and NAV remained unchanged at $112mn, resulting in a multiple of 2.59x. This enabled the GP to earn carried interest at a higher rate.

Review of the LPA drafting confirmed that the preferred return was based on a return test, which would be satisfied only once the LP had received aggregate distributions in an amount equal to or greater than 250% of their aggregate contributions to date (the “Return Test”). Neither the LPA definitions of contributions nor return test disclosed that, for the purposes of satisfying the return test, the aggregate contributions would be reduced by, or netted against, the distributions received by the LP.

This case study highlights the importance to LPs of fully understanding how the GP defines, intends to interpret, and ultimately applies a multiple hurdle, as misunderstandings could have significant economic consequences further down the line.

Fig. 1

Through Term Intelligence, venture capital (general) funds were benchmarked to understand market practice for hurdles. We found that:

– 72.7% had no preferred return for the first hurdle, with GPs entitled to carry ranging from 20 to 25%;

– 18.3% of the venture capital (general) had a multiple as the first hurdle basis;

– of the 54.5% of venture capital (general) funds that had secondary hurdles, 100% of these were multiples;

– among the private equity funds reviewed, only 2.9% used a multiple as the first hurdle basis, and

– of the 15% of private equity funds that had secondary hurdles, 72% employed a multiple.

Multiple-based preferred return

A multiple-based preferred return is recorded as a multiple of an investor’s contributions and can be expressed as 1.25X or 1.5X invested capital. The preferred return multiple most commonly used is the total value paid-in (TVPI) multiple, which is derived from the following formula:

(a) Multiples: definitions of “contributions” and “distributions” in the LPA

The definitions of ‘contributions’ and ‘distributions’ in an LPA as it relates to the multiple can have a real impact on how a multiple is calculated – and therefore, significant economic consequences for LPs. Traditionally, all cash contributions made by an LP irrespective of how those contributions are utilized are considered contributions in association with the above metric. However, an alternative methodology for the multiple can arise if the definition of contributions specifies that only a certain subset of cash contributions (i.e., contributions for portfolio investments) may be considered to calculate the return metric. The exact definition of contributions under the LPA will therefore determine the distribution threshold the fund must exceed before carry is earned or allocated at a higher rate.

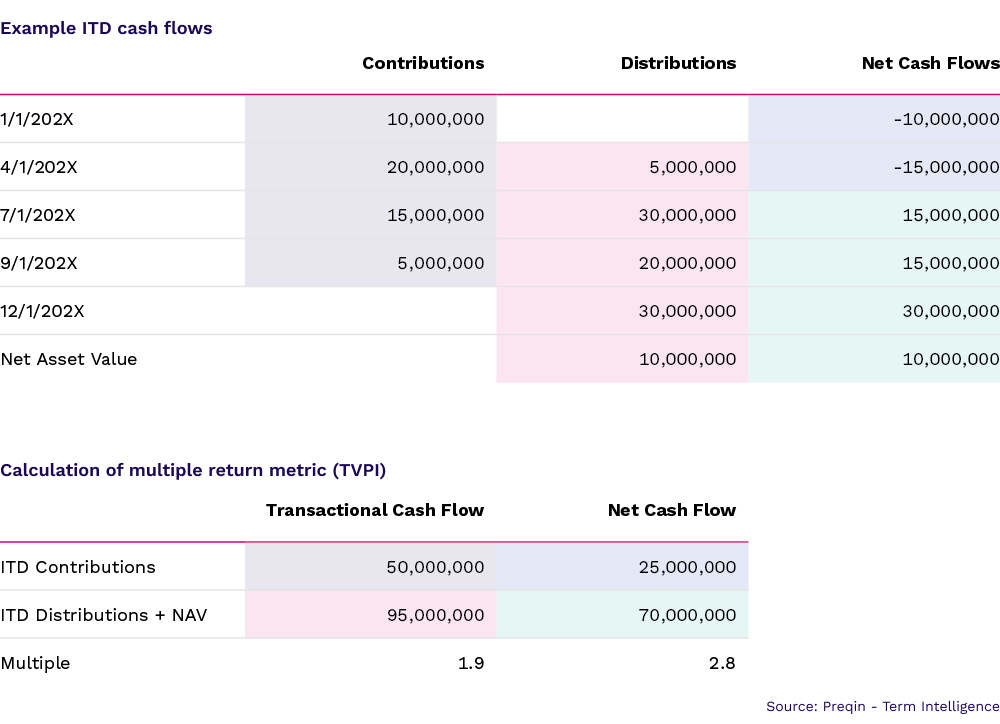

(b) Multiples: inception-to-date contributions

A separate issue arises around how contributions and distributions are treated when transactions occur on the same date. In the example in Fig. 2, the LP has inception-to-date (ITD) contributions and distributions for Fund A that we use to calculate the multiple return metric. We employ the transactional cash flow method where each transaction is considered independent of the other. The net cash flows will be used to calculate the multiple under the net cash flow method. In this example, the net cash flow method derives a much higher multiple of 2.8x compared with the 1.9x multiple generated by the transactional cash flow method. If the fund had a preferred return multiple of 2.0x, it would not have reached its hurdle using the transactional method but would have far exceeded it by applying the net cash flow method.

Fig. 2

(1) Conducted as part of FAIR, Colmore’s fee validation service

Related: Manufacturing Recovery Met With Fiery Price Pressures