I attended and spoke at the European Blockchain Convention this week in Barcelona, where the energy around digital assets, Bitcoin and Web3 was palpable. Among the 6,000 attendees, there was a sense that we’re on the brink of a new era in finance and digital infrastructure

One conversation that particularly struck me came from an unexpected source—my taxi driver, who hailed from East Africa. He was talking about M-PESA, a mobile payment system that’s revolutionized financial services across his home region. While Venmo and Zelle are household names here in the U.S., M-PESA has been quietly leading a financial revolution across Africa for over a decade.

M-PESA, which stands for “mobile money” in Swahili, launched in Kenya in 2007 by the mobile network operator Safaricom, targeting the unbanked. A survey just a year earlier found that under 20% of Kenyan adults had a bank account, whereas over half either owned or had access to a cellphone.

Today, M-PESA boasts more than 66 million users, including my taxi driver, and processes 33 billion transactions annually. And its success is no longer confined to Kenya. It’s expanded to countries such as the Democratic Republic of Congo, Egypt, Ghana and, most recently, Ethiopia, a country often referred to as the “last frontier” for digital banking.

Bitcoin Complements M-PESA

To me, what’s remarkable is how M-PESA was born out of necessity. In the early 2000s, people in sub-Saharan Africa would send cellphone airtime minutes as a form of currency. This simple, innovative idea evolved into a formal mobile payment system, operated by Safaricom in partnership with Vodafone, and became a model for not just payment apps that came after it but also financial inclusion.

Similarly, Bitcoin was born out of necessity in the wake of the 2008 financial crisis, offering a decentralized alternative to the traditional financial system. Both systems were created to address the gaps left by centralized institutions, but they operate in fundamentally different ways.

M-PESA operates within the framework of a centralized mobile network provider, making it subject to regulatory oversight. It also relies on traditional financial infrastructure.

Bitcoin, on the other hand, is decentralized by design, allowing peer-to-peer transactions without intermediaries. It provides a global, borderless payment network that complements services like M-PESA by offering greater financial autonomy, particularly in cross-border transactions.

Together, M-PESA and Bitcoin represent two sides of the same coin—innovative solutions born out of crises, each pushing the boundaries of what’s possible in financial inclusion and access.

The Growing Strain of Immigration

One year ago, I shared with you my thoughts on the immigration crisis, both here in the U.S. and Europe. At the time, there was speculation that international bad actors may be at least partially to blame for the record numbers of immigrants pouring across the Southern Border. You can read the article here. Below is an update to the story.

Immigration is once again making headlines (has it ever stopped?), and it’s not just the sheer numbers that have people talking. Concerns about mass migration—both legal and illegal—have dominated political and economic conversations in the U.S. and Europe.

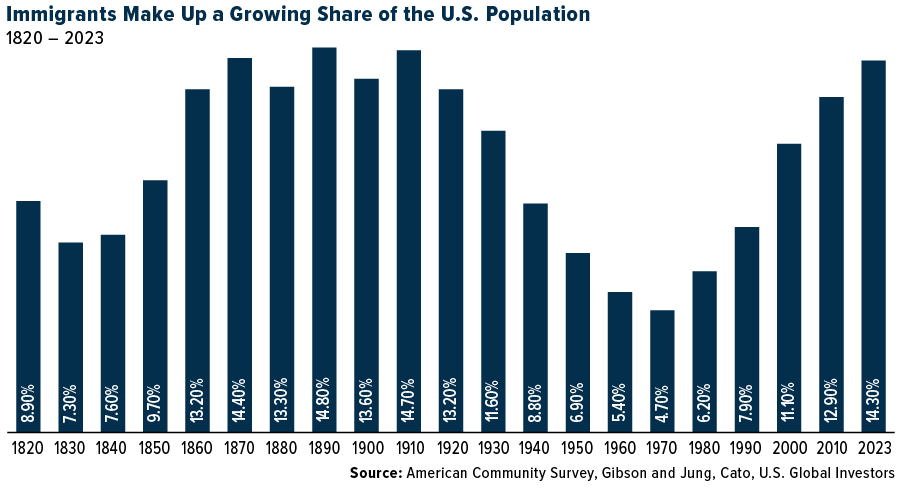

Although the number of migrants crossing into the U.S. has eased in the past 12 months, the underlying challenges remain. The Center for Immigration Studies estimates that the illegal immigrant population in the U.S. stands at 14 million strong, a significant increase from just a few years ago. And at 14.3% of the total population, the share of foreign-born residents is at its highest level since the early 1900s, when waves of immigrants came from Italy, Poland and elsewhere.

Today, the new arrivals are straining resources in ways that directly impact the American taxpayer and investor alike.

Springfield’s Skyrocketing Rents

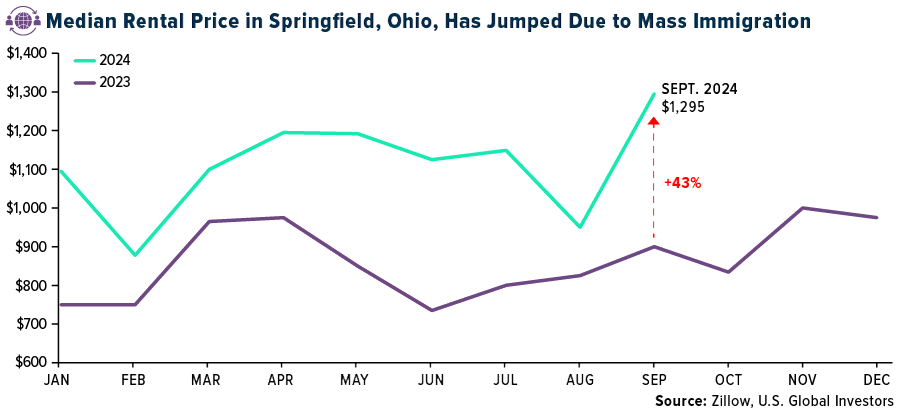

Let’s take Springfield, Ohio, as a microcosm of what’s happening across the country. You’ve probably heard that this town of 58,000 has seen a significant influx of Haitian asylum seekers, leading to skyrocketing housing costs and a sharp rise in the cost of living. The median rental price in Springfield jumped 43% in just one year, according to Zillow. Locals are feeling the pinch at the pump and the grocery store as inflation ripples through their economy.

It’s not just prices that are going up. Health care providers are stretched thin, as more translation services and additional staff are needed to accommodate the growing population. Earlier this month, Ohio Governor Mike DeWine announced $2.5 million in state support for Springfield, but the burden on local taxpayers is undeniable.

We’re seeing similar stories play out across the U.S. as towns and cities grapple with the surge of new arrivals. In New York City, Mayor Eric Adams, recently indicted on federal corruption charges, reported last summer that the city expected to spend $12 billion over the next three years on housing, food and health care for recently arrived immigrants. To cover these costs, the city plans to cut services across the board—sanitation, public education, even the police force. The fiscal strain is real, and it’s hitting Americans where it hurts most.

Immigration Is Testing Europe’s Social Welfare Spending

What’s happening in the U.S. is mirrored on a much larger scale across Europe. Over the past decade, 29 million immigrants—both legal and illegal—have poured into the region, overwhelming an already dysfunctional immigration system. Concerns about public safety and inadequate integration policies have led to widespread public unrest. Just look at the riots in the U.K., where immigration has emerged as a defining issue.

Investors should be paying close attention. Western Europe, traditionally known for its social safety nets and generous welfare systems, is struggling to accommodate this massive population influx. Europe’s current situation is a reminder that unchecked migration, without the proper systems in place, can lead to long-term fiscal challenges.

Legal Immigration as a Solution to Shrinking Fertility Rates

Having said all that, it’s important to recognize the value of legal immigration. With fertility rates having fallen well below the replacement level—or 2.1 children per woman—the U.S. and Europe face the prospect of near-zero population growth. Legal immigrants, then, play an essential role in maintaining productivity and supporting programs like Social Security.

The hard truth is that the U.S. and Europe face declining populations and a shrinking tax base. I believe the solution lies in smart, sustainable immigration policies—ones that emphasize legal pathways and prioritize integration.

Related: European Stocks Soar Amid Surge in Defense Funding: Investment Opportunities in Focus