Editor’s note: Today, Stephen sits down with RiskHedge Executive Editor Chris Reilly to share his crypto market script for the coming months, and why you should consider the “barbell strategy”...

Chris Reilly: Stephen, after storming out of the gate this year, bitcoin’s (BTC) stalled out. It hit an all-time high of nearly $74,000 in March but hasn’t been able to get back to that level since (currently at around $66,000).

Some readers have asked if this crypto cycle is over.

I want to get your thoughts on that in a second, including your forecast for the rest of the year and your recommended investing approach... but first, what’s been holding the bitcoin price back these last few months?

Stephen McBride: I believe two main factors are driving crypto prices.

#1: AI is stealing crypto’s thunder.

Artificial intelligence (AI) has been the dominant investing theme for the past 18 months. AI chip king Nvidia (NVDA) briefly became the world’s most valuable company last month.

This shifted attention (and dollars) away from blockchain. Investors who would’ve previously allocated money to crypto instead chose to pile into AI winners like Nvidia.

#2: Mt. Gox and Germany.

Mt. Gox used to be the world’s largest crypto exchange. In 2014, it became the scene of the worst disaster in crypto history. Mt. Gox revealed hackers stole 850,000 bitcoins from its exchange. Roughly $8 billion worth of the stolen BTC was recovered.

A decade later, some investors who had their bitcoins stolen are getting them back. In fact, distributions are already underway. Traders dumped BTC ahead of these distributions, “frontrunning” potential selling. But a recent Glassnode report shows investors are instead holding onto their recovered bitcoin.

Finally, the German Federal Criminal Police Office dumped billions of dollars’ worth of BTC over the past month. Germany’s “FBI” seized over $3 billion worth of bitcoin from criminals. It’s already sold the entire stash.

Now, here’s the important takeaway for investors:

Despite this tidal wave of selling... BTC is only 12% from all-time highs.

Chris: It sounds like maybe the worst is behind us? And the crypto cycle has legs?

Stephen: Yes. We’re still in a bull market.

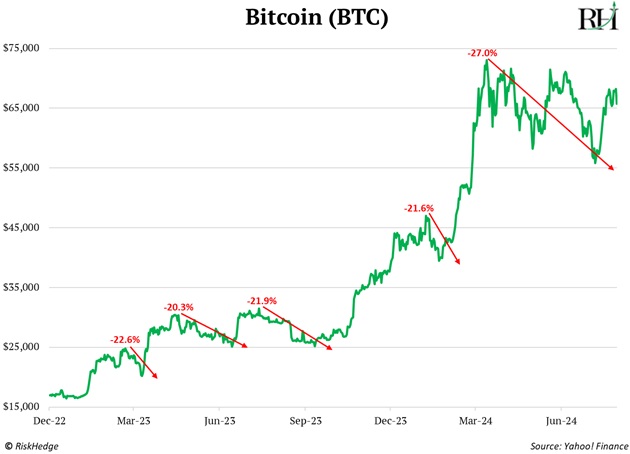

This is BTC’s fifth 20%+ selloff since bottoming in late 2022. This pullback is perfectly normal. Volatility is par for the course when it comes to investing in crypto:

I expect prices will likely chop around these levels for the next month or two before we hit fresh highs later in the year.

My one word of guidance for the next few months is patience. The hardest part of investing isn’t the buying or the selling. It’s the waiting.

We’re in typically what’s been the best time to own crypto, as I explain here.

And thanks to the bitcoin and brand-new Ethereum (ETH) ETFs, we’re now seeing the “infinite bid” come to crypto...

Chris: What do you mean by “infinite bid?”

Stephen: In short: Restless ETF flows will drive crypto markets higher over the coming months and years.

Wall Street has steadily bought bitcoin ETFs since they launched in January. Over $1 billion poured into these funds last week alone. The same will happen with Ethereum ETFs, which just launched last Tuesday.

Think about it like this... When tens of millions of Americans get paid every other week, they buy stocks on autopilot through their retirement accounts.

This creates continuous demand for stocks, which puts a floor under prices.

Thanks to the ETFs, crypto now has an “infinite bid” as well. The world’s largest asset managers—including BlackRock, Fidelity, VanEck, and others—are telling their clients to buy and hold BTC in their 401(k)s.

The floodgates have opened. Billions of dollars of Wall Street’s money are pouring into crypto for the first time ever.

Chris: Do you recommend buying bitcoin?

Stephen: No, and I still think it will hit $150,000 this cycle (about 125% higher from here). But simply put, there are much better opportunities in crypto, including Ethereum (one of my largest positions).

Ethereum is only about one-third the size of bitcoin. That means it takes less money to move its price.

I think Ethereum could attract around 20% of the inflows bitcoin got. What will happen when billions of new dollars flow into Ethereum? Much higher prices, I expect.

And in my RiskHedge Venture crypto advisory, I focus on a specific group of smaller coins—real crypto businesses making real money—that have historically outperformed bitcoin during big upcycles like we’re in today.

Chris: I know you recommend an effective allocation strategy in Venture. Can you quickly summarize?

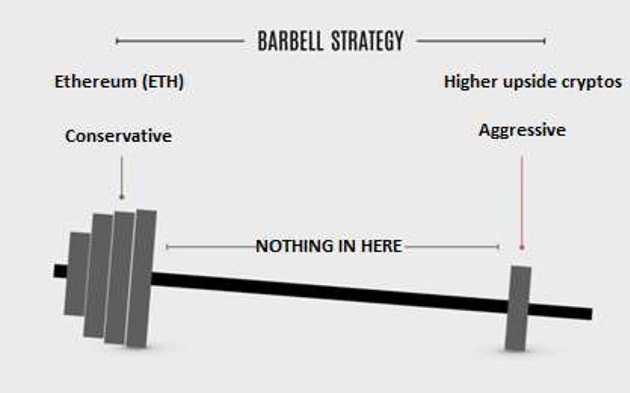

Stephen: Our barbell strategy is a portfolio construction tool that strikes the right balance between risk and reward. It does so by investing in two distinct types of assets, on both extremes.

On one end, you have “safer” assets. On the other, you have “higher-upside” assets. Just like a barbell, you load it on either end, with nothing in the middle.

This allows you to potentially earn higher returns… while the “safer” portion should cushion any losses.

You’ll invest the majority (75% to 90%) of your money in the safer portion. And you’ll put the other 10% to 25% into higher-upside assets.

In Venture, our crypto portfolio resembles a lopsided barbell:

We invest 75% of our crypto allocation into larger, “safer” cryptos like Ethereum. (I put “safer” in quotes because crypto is an early stage technology, and no crypto has a comparable level of safety to financial assets like government bonds, cash, and certain groups of stocks.)

And we put the remaining 25% into tinier, higher-upside tokens.

But crypto is just one asset in an overall portfolio. You should only put a small percent, say 1% to 2%, of your investable assets into crypto.

Chris: Great stuff, Stephen—thanks. And reader, if you’re interested in learning more about the smaller cryptos Stephen recommends in Venture—and gaining access to his full portfolio—membership is now open again. Details here.

Related: Buy Some and Get on With Your Life