Written by: Adam Schrier, CFA and Art Torrey | New York Life Investments

If nothing else, the last two years have shown us the importance of diversification. Expectations of Fed rate policy decisions have been everchanging. The 10 US Treasury yield touched 5% for the first time since 2007. It is important to build a diversified portfolio that can perform well across a range of outcomes, and not rely solely on one particular outcome. Positioning a portfolio for interest rate exposure with a long duration was rewarded in 2020 when rates plummeted but was quite costly in subsequent years when rates rose.

One way of diversifying traditional fixed income exposure is through a strategic allocation to floating rate loans. Floating rate loans are a compelling addition to portfolios because they act as a hedge against fixed coupon bonds, reducing interest rate risk while generating high levels of income. Their coupons have two components - a fixed spread and a floating rate reference rate, which is closely tied to Fed Funds. Because of this, some investors try to time the asset class, entering when rate hikes are set to commence and exiting before the Fed pauses. Of course, timing markets and making bets on macroeconomic trends is very difficult. In our view, this approach has led to the asset class being underutilized over the past 12-18 months, overexposing portfolios to rate risk and underexposing them to credit.

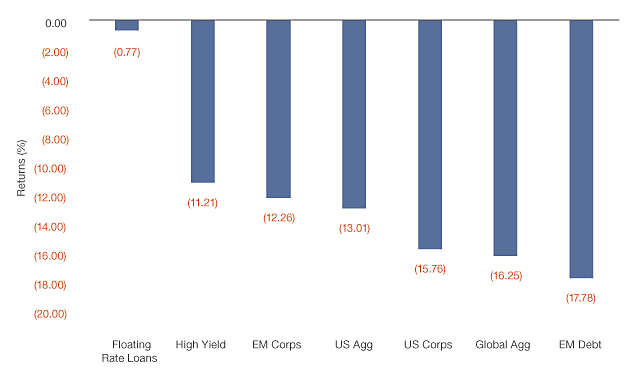

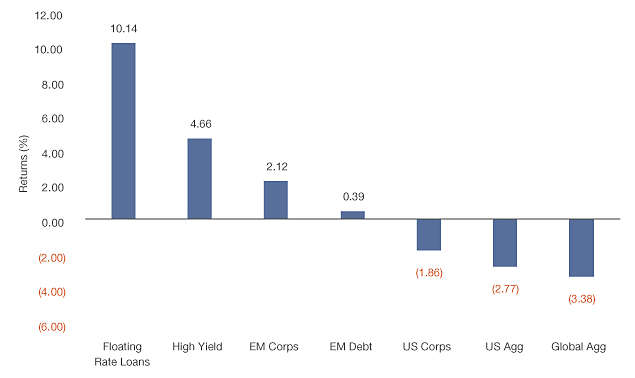

Loan mutual funds saw massive inflows in 2021 as US Treasury yields began to rise with the pandemic recovery, putting price pressure on longer duration bond. The tide turned in 2022 and loan funds began experiencing redemptions as investors anticipated a “Fed pivot” along with economic concerns. Despite waning enthusiasm for loans, the asset class proved to be resilient in 2022, declining just 77 bps compared to high yield, investment grade corporates and the Bloomberg Aggregate Index which were all down double digits. The outperformance continued this year and through 10/31, loans are up 10.14% year to date, drastically outperforming other areas of fixed income.

Floating Rate Loans were relatively resilient in an extremely challenging 2022

Floating Rate Loans are outperforming other areas of fixed income

Source: Morningstar. YTD returns as of 9/30/23. Floating Rate Loans represented by Morningstar LSTA US LL Index TR USD. High Yield represented by ICE BofA US HY Constnd TR USD. EM Corps represented by JPM CEMBI Broad Diversified TR USD. EM Debt represented by JPM EMBI Global Diversified TR USD. US Corps represented by Bloomberg US Corp Bond TR USD. US Agg represented by Bloomberg US Agg Bond TR USD. Global Agg represented by Bloomberg Global Aggregate TR USD. An investment cannot be made directly into an index. Past performance is not a guarantee of future results.

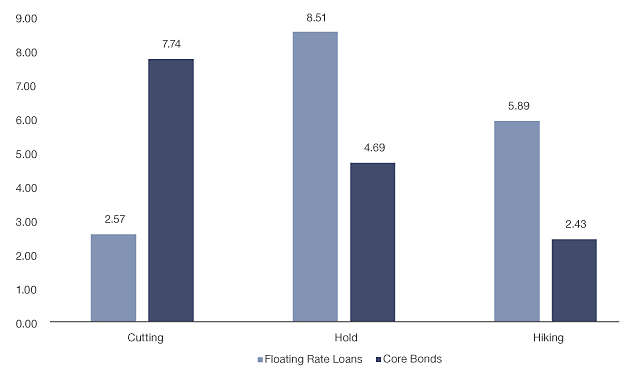

Historically, when the Fed is hiking rates, floating rate loan coupons increase and at the same time, longer duration bonds can struggle if Treasury yields are also increasing. On the other hand, when the Fed has cut rates, longer duration bonds have outperformed floating rate loans. Less obvious is that over the last 30 years, floating rate loans have outperformed core bonds while the Fed has been on hold. The below chart shows rolling 1-year periods based upon Fed policy since 1992, and we found that on average, loans outperformed core bonds both when the Fed has been on hold and when they were hiking rates. With expectations of “higher for longer”, there is a case to be made for investing in floating rate loans.

Loans outperformed core bonds during Fed pauses

Source: FactSet, Morningstar. Average 1 year rolling returns 1/31/1992 - 9/30/2023. Floating Rate Loans represented by the Credit Suisse Leveraged Loan Index. Core bonds represented by the Bloomberg Barclays US Aggregate Bond Index. Loosening represents 1-year periods in which the Fed Funds Target Rate was lowered. Tightening represents periods in which the Fed Funds Target Rate increased. An investment cannot be made directly into an index. Past performance is not a guarantee of future results.

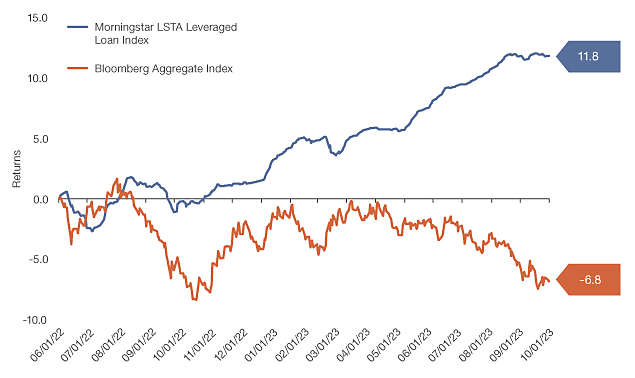

Since the summer of 2022, the loan market has outperformed core bonds by almost 1800 bps. This is noteworthy because that is when floating rate loan outflows were accelerating as strategists were starting to recommend adding duration. This is a case in point demonstrating how hard it can be to time rates and the penalty for being incorrect. Having an allocation to both strategies would put performance in between and alleviate the need to make the correct bet.

Source: FactSet 6/1/22 - 9/14/23. An investment cannot be made directly into an index. Past performance is not a guarantee of future results.

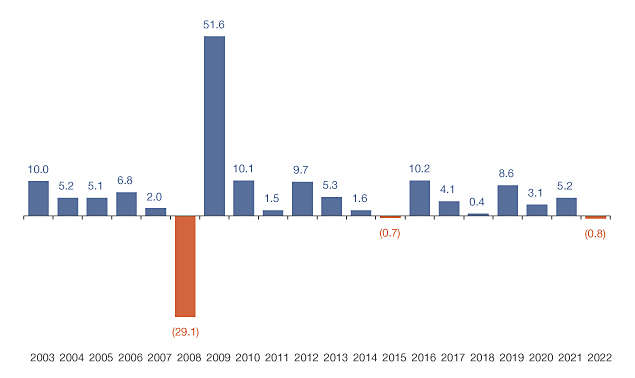

Another reason to make loans a strategic position is a portfolio is that historically the asset class has generated fairly consistent returns. There is a misconception by some that they have been “burned” by floating -rate loans in the past, but. besides the financial crisis, there were two down years, both less than 1%. Conversely, there have been four years with returns greater than 10%.

Source: FactSet, 2003-2022. Loans represented by the Morningstar LSTA Leveraged Loan Index. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.

Pairing floating -rate Loans and Bonds

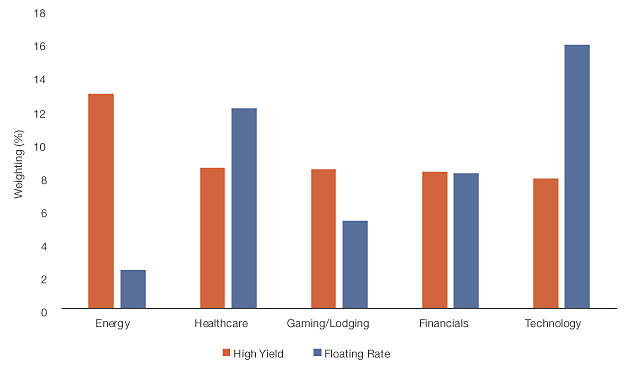

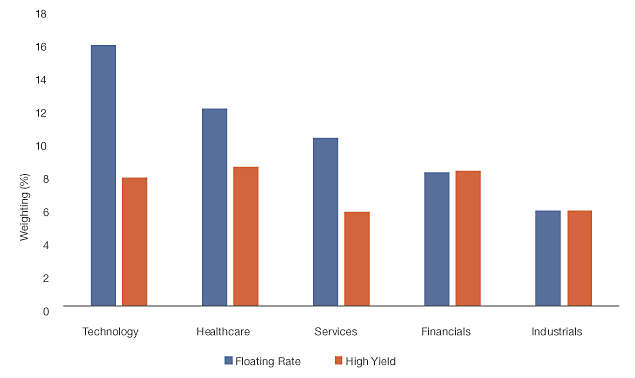

When it comes to high yield bonds and floating rate loans, it doesn’t have to be an “either or” decision. The markets have become increasingly distinct over time. As the loan market has grown to be approximately the same size as the high yield market, there is less overlap between issuers. High yield issuers tend to be larger companies with a higher percentage of publicly traded companies whereas the loan market tends to have a greater proportion of private companies. Looking below at sector weightings, high yield has significantly higher weights to energy and gaming/lodging. On the other hand, the loan market has greater exposure to technology, healthcare, and services, the top three sectors in the market .

Top 5 HY Sectors by Weighs

Top 5 Loan Sectors by Weight

Source: J.P. Morgan 8/31/23. High Yield is represented by ICE BofA U.S. High Yield Constrained Index and Floating Rate is represented by Morningstar LSTA U.S. Leveraged Loan Index. An investment cannot be made directly into an index. Past performance is not a guarantee of future results.

When making the case for floating-rate loans, it is more of a question of “why always” rather than “why now.” Timing entry and exit points in investing has proven to be extraordinarily difficult, especially being able to do so on a consistent basis. A key tenet of investing has always been diversification, and this has never been more important than in the recent past when there have been so many potential outcomes, given broad uncertainty — monetary policy, fiscal policy, inflation, geopolitical events, etc. These past 12-18 months have shown that treating the asset class as a tactical trade can have an high opportunity cost. It’s time to think of floating-rate loans as a strategic allocation.