Equity futures point to another decline when the US stock market opens later this morning. Tension in the Middle East escalated further as Israel vowed a “very strong” response to Iran’s recent attack with Iran warning of broader strikes if Israel responds. We are also seeing the shine from China’s recent remarks about further stimulus start to fade as investors get ready for Friday’s September Employment Report.

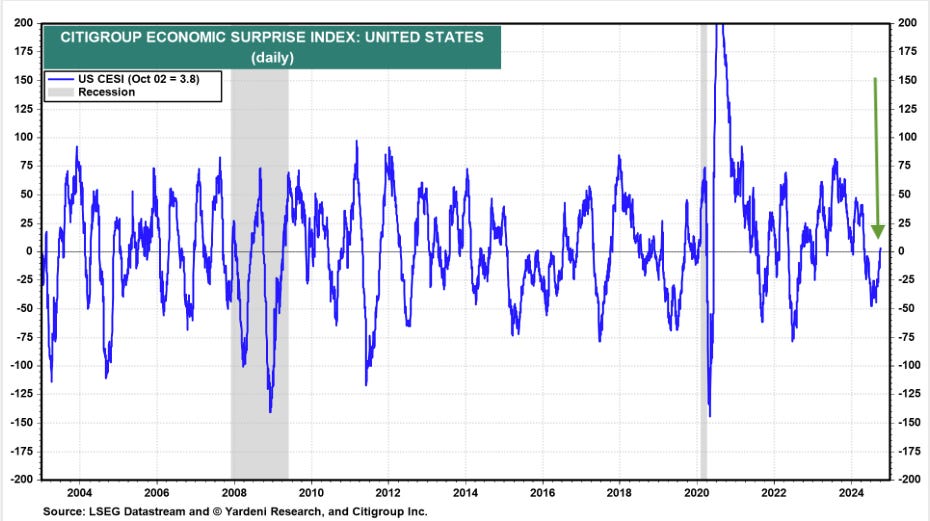

With ADP’s (ADP) September Employment Change Report and the August JOLTs report showing more life in the jobs market than some expected, market expectations for another 50-basis point rate cut in November are fading. Adding to a potential re-think on the pace of upcoming rate cuts, the Citibank Economic Surprise Index (CESI) has turned positive, telling us the recent data has been stronger than expected.

That sets the stage for today’s September Service PMI reports from ISM and S&P Global and what they say about that part of the economy that has been driving the overall US economy. ADP’s September job findings showed the vast majority of job growth during the month was tied to the service sector, suggesting today’s Service PMIs should signal continued growth in that part of the economy.

We will also be focusing on what ISM’s Service PMI data reveals about inflation and job creation ahead of tomorrow’s September Employment Report. Should the findings show continued progress on inflation and a jobs market that is performing better than expected, it would suggest the market may have once again gotten ahead of itself with rate cut expectations.

Should that be the case, it would be another reason for investors to be wary of an overbought, valuation-stretched market with rising geopolitical tensions.

In addition to current geopolitical concerns, while we are only a couple of days into the longshoreman’s strike, earlier comments by the International Longshore and Warehouse Union president Willie Adams are starting to sink in as the union received some support from the White House.

Our view on the port strike continues to be focused on its duration - the longer it goes the greater the risk to the economy, the holiday shopping season, and the undoing of recent inflation progress. Already, long lines of container ships are queued up outside major US ports as the biggest dockworker strike in nearly half a century entered its third day preventing unloading and threatening shortages of everything from bananas to auto parts.

Related: Powell, September PMIs, and Jobs Data: Key Economic Insights