It is. Crazy, like a fox. Here are the top three reasons to invest beyond the Mag 7:

1. Diversification and Mitigating Concentration Risk.

Many financial products are the Mag 7 in a different wrapper. A fund might have a thematic name and then, when reviewed with a quick glance at the top 10 holdings, one realizes that it is really a screen boiling down to the same 7-10 companies. This can lead to a lack of diversification, otherwise known as Concentration Risk. Lack of diversification is not only risky, as a large sway in the market can move an entire portfolio, but diversification is also a fiduciary duty.

The EATV ETF is diversified across the global food and material supply chains, providing diversification and exposure to a growing sector with a $14-$19 trillion total food systems addressable market.

The EATV top 10 holdings as of January 1st, 2025 are Ingredion, On Holdings, Vitasoy, Sensient Technologies, Vita Coco, McCormick & Co, Fresh Del Monte, Mission Produce, SunOpta, and Seneca Foods. For the full list of companies in EATV, click here.

2. Impact.

While returns are (almost) everything, bringing down the carbon footprint of client and individual portfolios is good for business. It can keep clients happy, provide client and firm alpha, and maintain high standards of stewardship in business. With increasing relevance, firms, like banks, will also have to account for their carbon footprint.

The EATV ETF is the only ETF certified as carbon neutral without buying offsets according to ACA Global's Ethos ESG. EATV maintains a 1.18C global temperature warming potential, well under The Paris Accords' suggested 1.5C. For a benchmark reference, the S&P 500 Index is 2.86C.

3. Early Bird (Smartly) Gets the Worm.

Do you wish you bought Nvidia before the split at $70 rather than $700? Getting in on a secular trend early has the potential for the most growth capture and alpha.

The EATV ETF, by investing in the innovative companies creating compatible and diversified proteins and syn-bio technologies, seeks to capture the $14-$19 trillion food systems transformation. This shift has indications of large-scale mass adoption as natural resources dwindle, population increases, and climate pressures loom. In short, the window to do nothing is closing and we will be forced to begin creating efficient and less damaging protein.

Food, second only to fossil fuels and larger than transportation in terms of emissions impact, is responsible for 30% of the world's greenhouse gas emissions. It is also the primary driver of biodiversity loss and deforestation according to the United Nations Environment Programme. These pressures, expenses, and a mounting pandemic risk are driving an inevitable shift in how we create our food.

Get in early on the innovations that are driving a novel and healthy food system shift and, like the early bird, stay well fed.

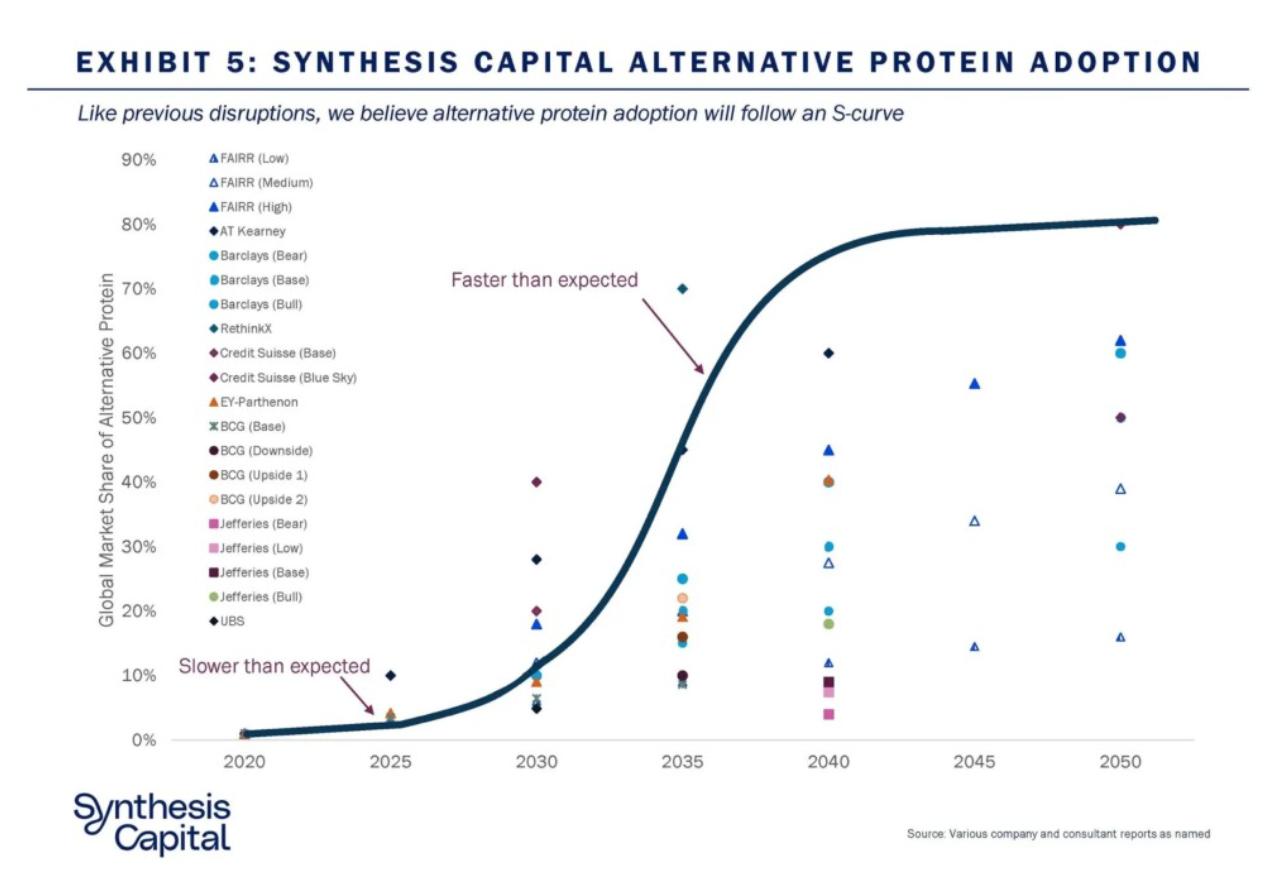

Below is a chart by Synthesis Capital of an average of the estimations of food systems transformation growth by investment firms UBS, Credit Suisse, Jeffries, and others.

Related: The Growth and Impact Potential of Investing in Food System Transformation