Written by: Steven Vannelli | Knowledge Leaders Capital

For all the following charts, we are looking at the sector performance and internals of our group of companies within each sector in North America. We look at the top 85% of market cap, so we consider both large and mid-caps.

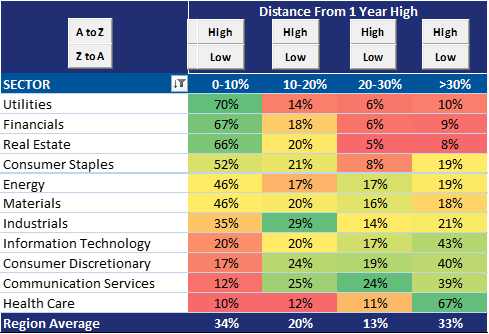

In the table below, we bucket the percent of stocks in each sector that are down certain percentages from 1-year highs. Much attention is paid to the recent weakness in technology, which is warranted, but the sector that has really experienced a stealth bear market is health care. Only 10% of health stocks are down 0-10%, while 78% of health care stocks are down at least 20%, the marker for a bear market.

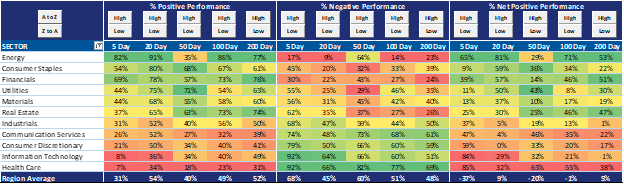

Over the last week in particular the divergence in performance has been pretty striking. Energy stocks—on an equal weighted basis—are up 9.42% in the last week while health care stocks are down 8.1%. Health care is the third best performer over the last four years, trouncing the 6.69% increase in energy stocks.

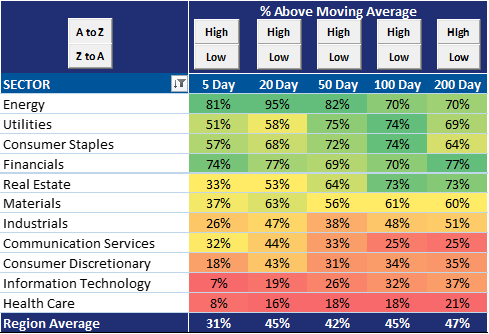

We also measure the percent of stocks above the moving average. Our work suggests that when the percent over a moving average falls below 30%, the sector is oversold. Across all time periods health care is oversold using this metric.

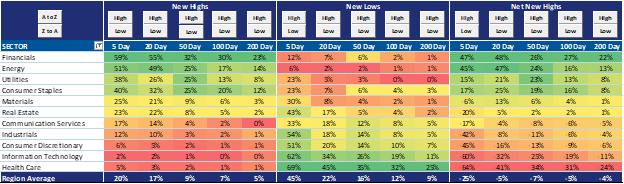

We’ll look at new highs, new lows and net new highs over different time periods. Only 1% of health care stocks are making new 200-day highs while 25% are making new 200-day lows, so the net new highs of health care stocks is -24% over the last 200 days.

Health care also hasn’t done much to protect capital over the last 200 days. Only 31% of health care stocks have generated positive performance over the last 200 days, while 60% are making new 200-day lows. So, net 36% of health care stocks are making new 200 day lows.

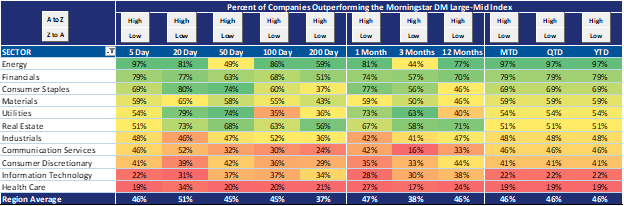

The message from relative performance is the same. Year-to-date only 19% of North American health care stocks have outperformed the Morningstar Developed Markets Large-Mid Cap Index. This in the backdrop where 97% of energy stocks have outperformed YTD.

Much attention has been paid to the weakness in IPOs, SPACs, non-profitable tech companies, etc., but left out the conversation is the stealth bear market in the health care sector.

Perhaps the buy-the-dip mentality starting to strike some should be directed at the health care sector rather than technology.

Related: Instability or Inflation, Which Will the Fed Choose?