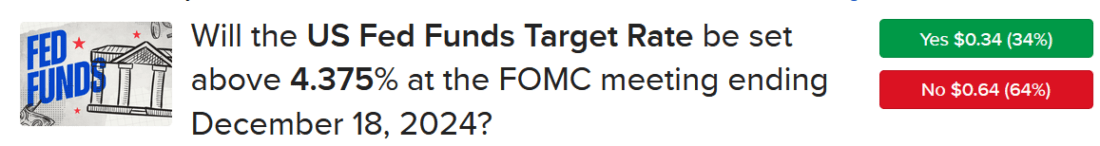

A one-two punch of hawkish trade rhetoric from President-elect Trump and accelerating PCE inflation is bumping up equity market volatility. The Fed’s preferred price pressure gauge is moving away from the central bank’s target just as protectionist proposals threaten to hit consumers with higher costs for goods. The development is especially concerning considering that physical products have been the major driver of disinflation for the last two years. Still, fixed-income players are expecting the central bank to enact another 25-bp trim to its benchmark next month, with IBKR ForecastTraders pricing the odds at 64%. But the outlook for next year’s rate path is increasingly cloudy, especially because this morning’s economic calendar also featured tempered layoffs, robust consumer spending and solid pending home sales. Together, the data offers justification for the Fed to pace itself as it proceeds down the monetary policy stairs.

Source: ForecastEx

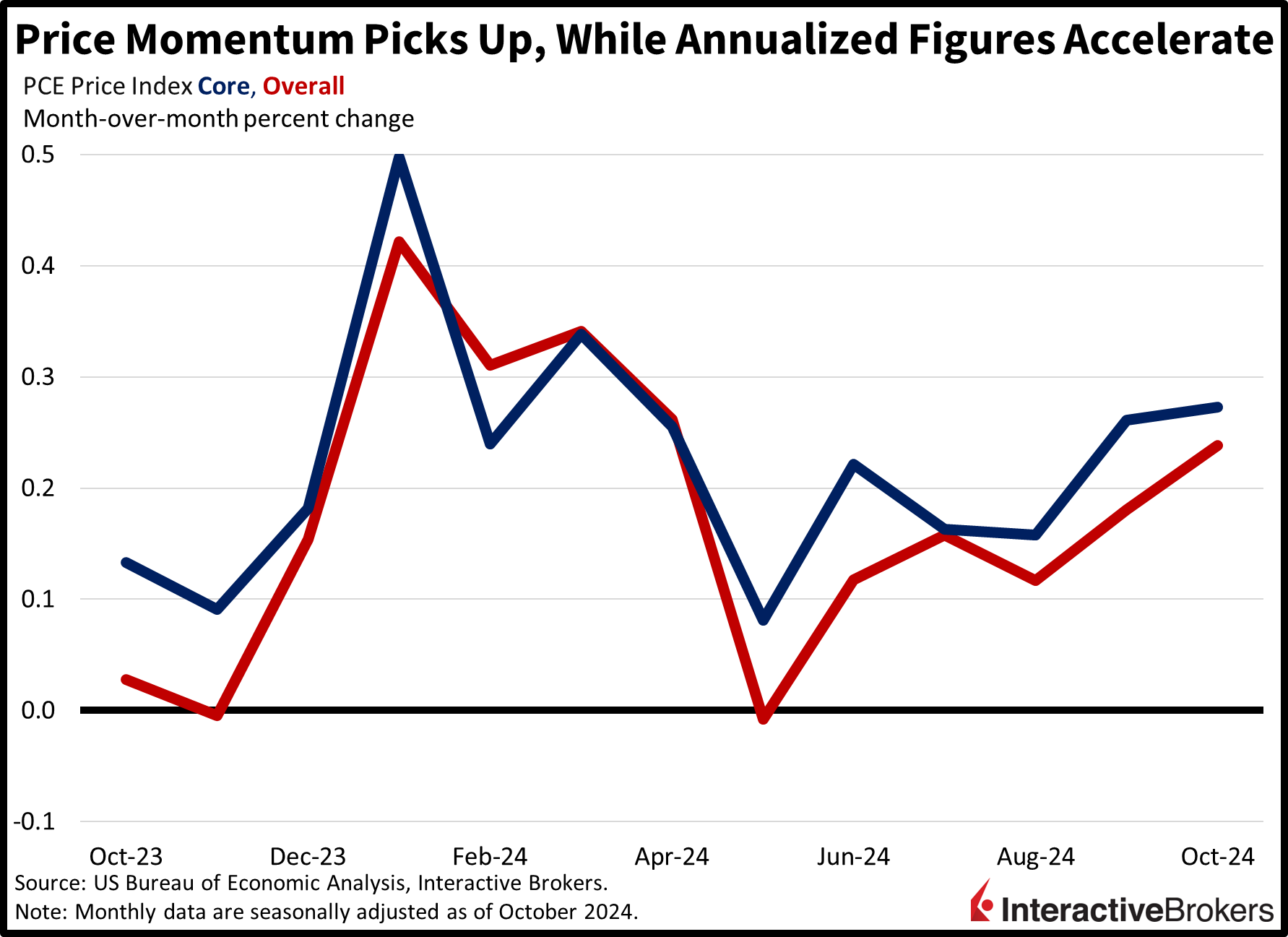

Consumers Shrug Off Inflation

October’s Personal Income & Outlays report reflected buoyant consumer spending amidst continued price pressures. The Personal Consumption Expenditures (PCE) Price Index rose 0.2% month over month (m/m) and 2.3% year over year (y/y), in-line with estimates but accelerating from September’s 2.1%. Similarly, the core figures met expectations, coming in at 0.3% m/m and 2.8% y/y, but picking up from the preceding month’s 2.7%. Cost pressures were led by services and durable goods, which saw m/m advances of 0.4% and 0.1%, while nondurables and energy both declined 0.1%. Food charges were unchanged during the period. Turning to spending, income and savings, the pace of real consumption, which is adjusted for inflation, increased 0.1% m/m. Outlays were supported by durables and services, which climbed 0.3% and 0.2% m/m, but non-durable expenditures retreated 0.1%. Real income, on the other hand, increased 0.3% m/m. The combination of rising incomes and slower outlays drove an increase in the personal savings rate, which now stands at 4.4%, up from 4.1% in September.

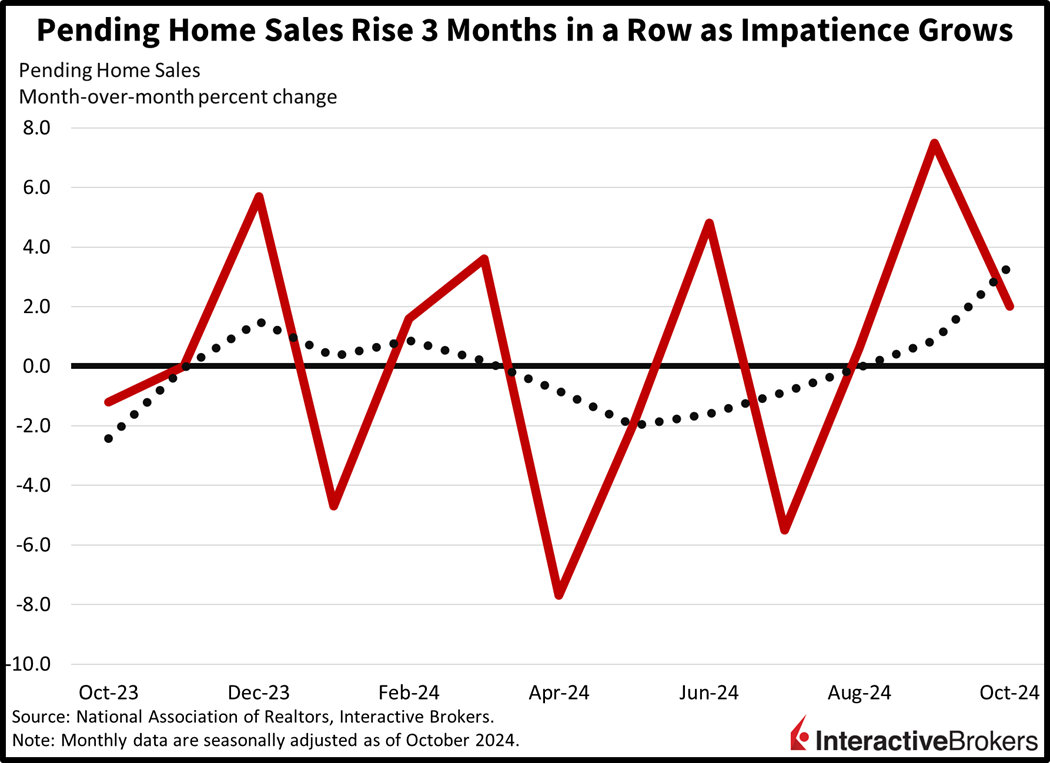

Real Estate Players Grow Impatient

Pending home sales, which are a leading indicator to closings as agreements are signed about 30 days prior, improved for the third consecutive month in October. Contract signings rose 2% m/m in October, beating expectations calling for a -2% figure but slowing from September’s 7.5% growth clip. The progress was diverse across regions, with the Northeast, Midwest, South and West sporting gains of 4.7%, 4%, 0.9% and 0.2%. Anecdotal evidence suggests that buyers and sellers have given up on waiting for lower mortgage rates, while rising job gains, a buoyant stock market and improving inventories are luring prospects to the negotiating table.

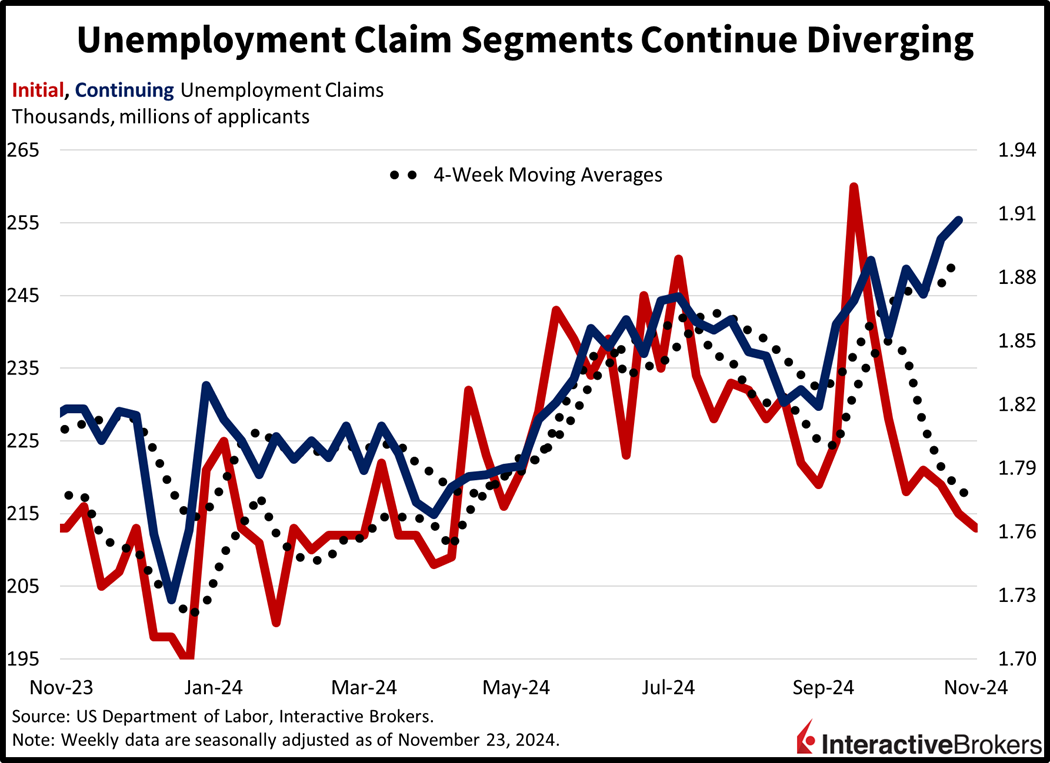

Job Search Challenges Persist

Unemployment claims continue to point to a deceleration in the solid labor market, with modest layoffs being met with extended waits for job seekers. Indeed, initial unemployment claims came in at 213,000 for the week ended Nov. 23, near the previous period but arriving slightly less than the projected 216,000. Continuing claims, however, remained near their recent highs, arriving at 1.907 million for the week ended Nov. 16, near the anticipated 1.910 million and the prior interval’s 1.898 million. Four-week moving average trends were bifurcated again, as folks looking for new jobs are having to fill out more applications and dress up for more interviews on a relative basis. The averages for both components changed from 218,250 and 1.877 million to 217,000 and 1.890 million.

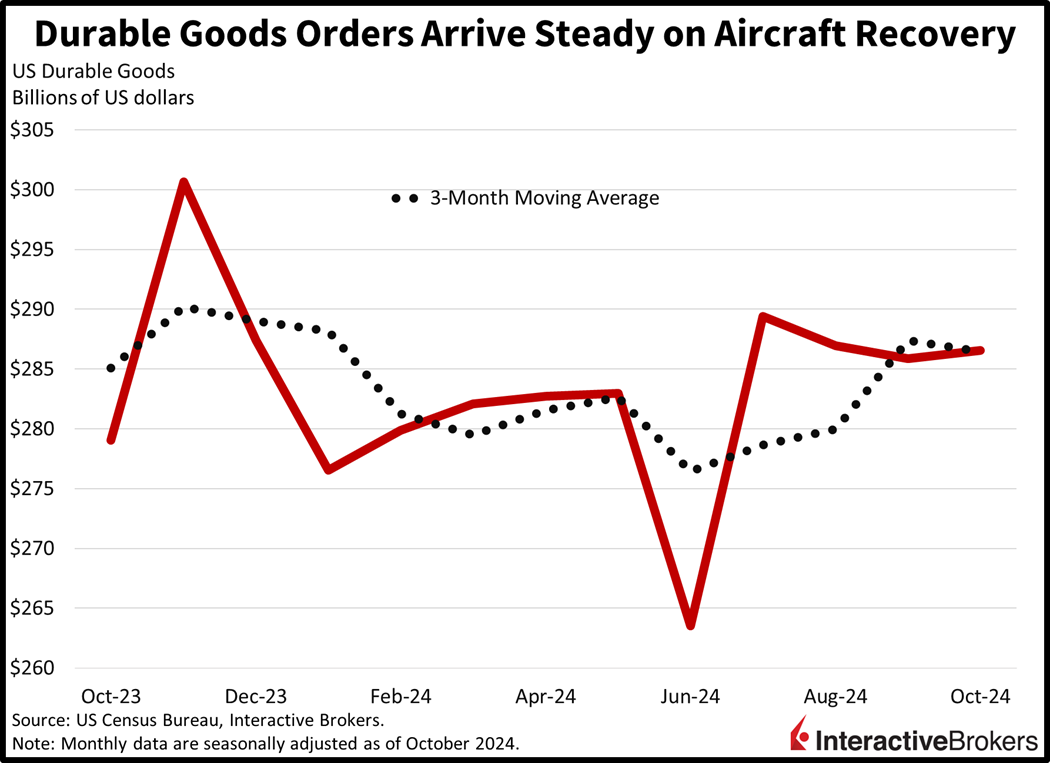

Durable Goods Record Lackluster Results

Durable goods orders were little changed last month as a recovery in aircraft purchasing drove a modest increase. Transactions rose 0.2% m/m, missing the median estimate of 0.5% but recovering from the previous month’s 0.5% subtraction. Manufacturing books were led by the defense aircraft and passenger airplane categories experiencing upticks of 16.6% and 8.3% m/m. The electrical, communications, other, machinery and fabricated metal products also supported results albeit marginally, growing 1.3%, 1.3%, 0.3%, 0.3% and 0.1%. Computers, primary metals and automobiles and parts, however, weighed upon results with receipts dropping 2.5%, 0.7% and 0.4% m/m. Finally, the non-defense, capital goods excluding aircraft segment, a proxy for business investment, declined 0.2% m/m, offsetting much of the progress from September’s 0.3% growth rate.

Corporate Profits Flat

This morning’s updated GDP forecast for the third quarter was unrevised from the preceding 2.8% growth rate estimate. Corporate profits, released in the same report, sported a 0% quarter-over-quarter annualized growth rate. The profitability data include privately held companies and small businesses that aren’t listed on public stock exchanges.

Tech Leaders Express Optimism for AI

Dell Technologies (DELL) posted earnings that surpassed the median analyst expectation, but its revenue fell short of forecasts. The company’s guidance for as much as $25 billion in current-quarter revenue, furthermore, missed expectations for $25.57 billion and $2.65, respectively. On a positive note, Chief Operating Officer Jeff Clark opined that companies are only in the early stages of building infrastructure for AI. HPs (HPQ), meanwhile, said its addition of AI in its personal computers helped support sales, but its earnings guidance for the current quarter missed estimates, causing its share price to fall approximately 8%. AI is also being embraced by digital security firm CrowdStrike (CRWD). The company posted quarterly revenue and adjusted earnings that exceeded expectations, with its topline increasing of 29% y/y. CrowdStrike said clients are embracing its Falcon Flex subscription model and its use of AI in its security platform. In another tech earnings report, Workday (WDAY), a provider of human resources and finance software, reported a 16% y/y increase in revenue and top-and bottom-line results that exceeded expectations, but its current quarter guidance was weaker than estimates. Workday’s head of finance, Zane Rowe, says the US government’s upcoming efforts to improve efficiency could create a large opportunity for the company.

Trump Rally Reverses

Stocks are facing selling pressures with all major benchmarks in the red despite solid sectoral performance. Bonds are getting bought, however, as the dollar takes a dive following a ferocious run. For equities, the Nasdaq 100, S&P 500, Dow Jones Industrial and Russell 2000 indices are down 1.2%, 0.4%, 0.2% and 0.1%. The turbulence is being led by technology, consumer discretionary and industrials, which are the only segments lower; they’re trimming 1.8%, 0.4% and 0.1%. Upside leadership is comprised of healthcare, real estate and consumer staples, meanwhile, which are higher by 1%, 0.9% and 0.6%. Treasurys are catching bids, with the 2- and 10-year maturities changing hands at 4.22% and 4.25%, 4 and 6 basis points (bps) lighter on the session. The Dollar Index is getting clobbered with a decline of 83 bps as the greenback suffers versus most of its major counterparts, including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian tenders. Commodities are mixed with copper, cold and crude oil up 0.4%, 0.4% and 0.1%, while silver and lumber are lower by 0.9% and 0.6%. WTI is trading at $69.05 per barrel as traders analyze Middle East ceasefire developments, mixed stateside inventory conditions and rumors of OPEC+ delaying production increases.

Gratitude, Not Agita

Pre-thanksgiving volatility could create conditions for agita at the Thanksgiving dinner table tomorrow, but gratitude for the rallies of the last two years is warranted. Folks, back-to-back years of S&P 500 returns in excess of 20% are rare, having last occurred in the late 1990s. I wish you all a Happy Thanksgiving while offering a reminder that the US stock market will close this Friday at 1:00 PM ET. Finally, the end of the week’s economic calendar will be quiet, but I will be covering Japan and EU inflation prints to finish off the month. Thank you all!

To learn more about ForecastEx, view our Traders’ Academy video here