From timely to timeless, the 3 most important points we can make about stocks, bonds, ETFs, markets and investing...updated weekly

ROAR Score weekly update

-

Our "Reward Opportunity and Risk" (ROAR) score remains at 10 for the 2nd week.

-

This means a 2-ETF portfolio that can only be allocated to SPY and BIL would be 10% SPY and 90% BIL.

-

There's one more lower rung on the ROAR ladder. That's 0% SPY. I'm not there yet, but barring a near-term bottom that last more than 2 hours, as was the case with Tuesday's facade and fade, that could happen soon.

3 Quick Thoughts on markets

-

The stock market has changed. The reasons (to me) don't matter. Risk was high and that means stocks were vulnerable. It is playing out on our screens every day.

-

This is phase 1. If there is a phase 2, it will likely take the form of selling pressure that has nothing to do with how many Fed rate cuts we'll have this year, or how long the tariffs will remain in place at their new levels. Think Baby Boomers reducing their currently extreme stock portfolio weightings to avoid un-retiring.

-

They, and others who have had a nice long ride can potentially create a selling wave that reverses the buying wave, driven by automated investing in 401ks, etc. Let's see if phase 2 gets underway. If so, learning how to exploit that for profit will be a priority for many investors. That's a big part of what Sungarden is about.

3 ETF (or index) charts I’m watching

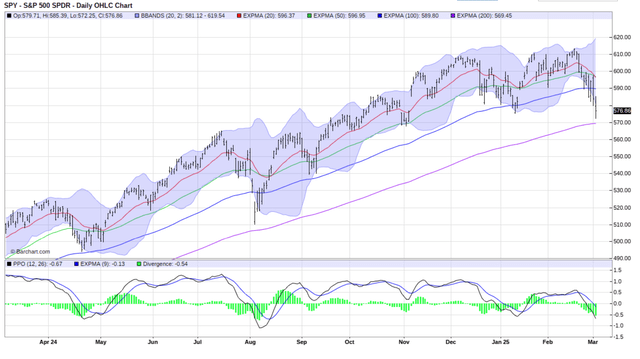

This is what I mean when I say "anything can go up at any time, for any reason." But that doesn't mean there isn't risk attached. The risk I see here for SPY is massive. And while I'd "expect" to see this much lower as spring continues, I remain steadfast in my believe that "playing offense and defense at the same time" is the best way to navigate this quirky, algorithm and index fund-infused stock market.

Barchart

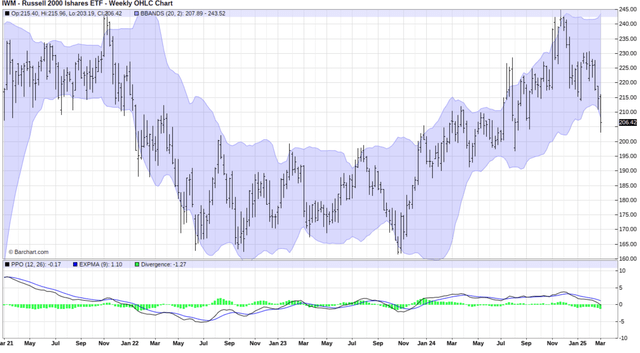

How weak and risky are small cap U.S. stocks right now? As my subscribers to the Sungarden YARP Portfolio investing group at Seeking Alpha know, I recently bought puts on IWM, and they paid off (a double) in about 1 week. That's a fast-moving decline. This chart signals to me that it had better start recovering soon, or another 20% dive is on the table. Never a guarantee, just bigtime risk.

Barchart

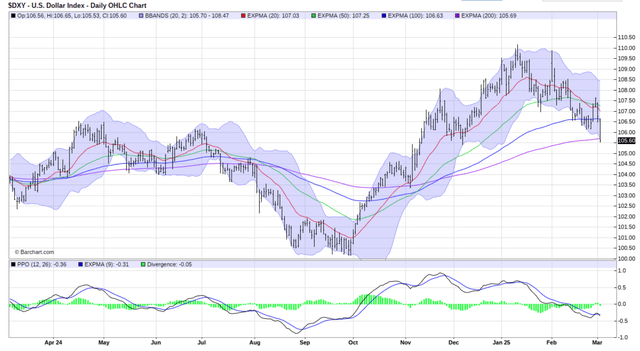

This is a developing story, and won't likely make the headlines as quickly as tech stock volatility or Bitcoin. But the US Dollar was off nearly 1% today. That doesn't happen often. This is the type of quiet, orderly slide that can suddenly steal headlines. I took my first step toward trying to exploit a potential dollar crash by initiating a small position today in an ETF that owns one of many non-USD currencies. Currency investing has not been a "thing" for a while, but as they say, everything old becomes new again.

Barchart

3 stock charts I’m watching

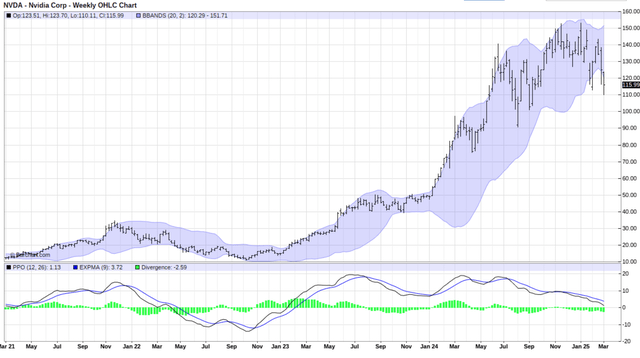

The Magnificent 7 drive QQQ, and QQQ drives SPY. That, in turn, drives investor attitudes toward the "stock market." And based on some of the trading activity I've studied recently, it could finally be starting to drive some folks away. Lower lows on THE glamour stock of our time (NVDA) is not a good look.

Barchart

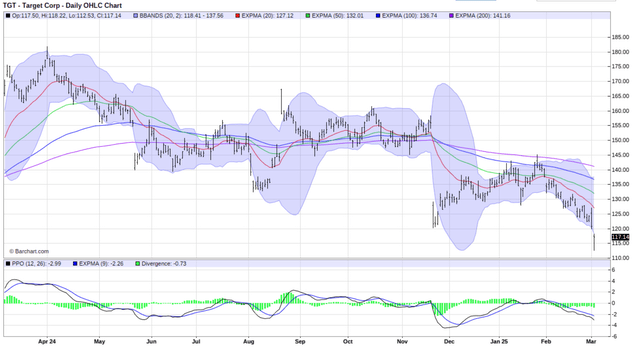

When will the bull market end? When the dip-buyers give up. It is not happening with the highest-profile stocks, but it is happening underneath. TGT is a good example: Crashed on earnings late last year, rallied 20% to suck people back in, and sets a new low today. Be careful with that BTFD stuff.

Barchart

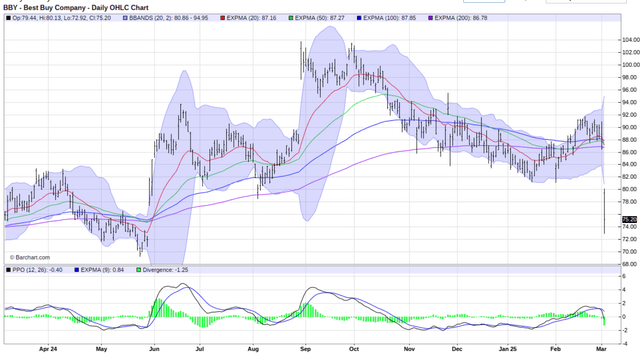

Why are all of my stock holdings paired with options in some form? To try to take the risk out of taking a risk. The "dog collar" approach I've been writing about frequently in Seeking Alpha and teaching to the investing group I lead is drawing a lot of interest. I think that's because when stocks fall off the table, the fact that I've defined my worst-case scenario up front instead of letting the market have it way with my money is appealing. Here's one (BBY) I was looking at buying, but passed on.

Barchart

Final thoughts for now

This is not a trustworthy stock market, period. That just means the way I try to make money and not lose big has to adjust. Frankly, the type of market gyrations we have seen recently are historically where I've most distinguished myself as an investor.

Related: Timely vs. Timeless: 3 Must-Know Investing Insights