Written by: Tim Pierotti

Hedge Funds are more net-short of equities than at any time in the last ten years. Unfortunately, that tells you absolutely nothing about the near-term direction of stocks. On average, hedge funds have been fighting the tape and underperforming all year. Sure, these portfolio managers are certainly smart and well trained, but they don’t always get it right and when they are all clustered with a singular view, often the smart bet is to go the other way. I happen to agree with the negative bets, but being part of a deeply consensus bearish trade that isn’t working is a deeply uncomfortable feeling.

The reason so many of the hedge funds are playing for a bearish move is because the credit data has rapidly become consistently foreboding. Credit is contracting at a historic pace. Fewer loans and loans resetting at much higher rates beget the credit cycle and, in-turn, the recession. Substack and FinTwit are abuzz with “FUD”, Fear. Uncertainty. and Doubt.

On Monday, Apollo’s Chief Economist Torsten Slok wrote this cryptic comment regarding the Fed’s most recent H.8 data (a weekly bank survey conducted post Silicon Valley and Signature’s collapse) which was released over the weekend, “The largest 2-week cutback in bank lending in US history - The largest 2-week cutback in bank lending to corporates in US history - Largest decline in lending to real estate on record - Largest decline in lending to multifamily construction on record.”

Credit was already tightening ahead of the regional bank crisis, but it has accelerated sharply since then. We won’t see another Senior Loan Officer Survey until May 8th, but we have seen other data that confirms the sharp tightening that showed up in the H.8 survey. The National Federation of Independent Businesses just reported that companies are having a harder time accessing credit and experiencing some “sticker shock” at available rates. The Dallas Fed surveyed businesses in that region who reported a sharp contraction in credit availability from both Commercial Real Estate as well as for Commercial & Industrial.

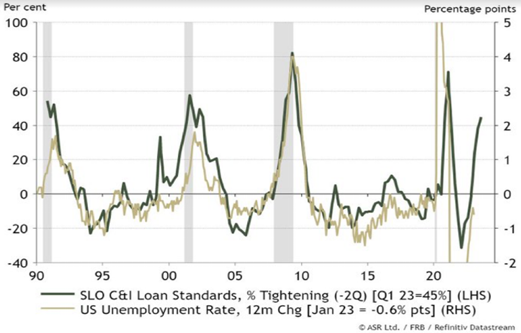

In case you are wondering if the economy can fight through a credit crunch, I would point you to the chart below from Ian Harnett from Absolute Strategy Research:

The chart clearly shows the very high correlation to tightening credit conditions and employment. As the cost of capital rises and its attainability dwindles, companies struggle to grow and margins come under pressure. As night follows day, tougher credit conditions mean fewer jobs.

As the chart below from the NY Fed illustrates, the lending standards issue is not contained to businesses but also to the consumer.

As of this writing, Fed Funds futures are pricing in one more hike to come in May followed by a series of cuts in the second half of the year. The Fed will see quite a bit of data between now and May 3rd when the next FOMC is scheduled that might just change their mind.

The question then becomes: Is bad economic data good for the stock market because it means the Fed is finally closer to the long awaited pivot? I don’t know the answer of course, but I doubt it. We have a credit cycle to go through and I would be shocked if equity market bottom was put in well before the credit cycle begins. The Fed is loathe to cut too early especially as wage growth is still running north of 6%. If we see the Fed cutting rates in 2023, it will only be because the economy is contracting rapidly.

Related: Rethinking 60/40: How Multi-Year Guaranteed Annuities Can Help