This week we witnessed a truly consequential global event. But not for equity investors.

The world needs to pay attention to anything that ratchets up tensions in the Middle East, and the spectacle of Iranian missiles being thankfully intercepted over Tel Aviv was gripping and momentous. Thankfully, we have not yet seen the conflict escalate, and even though the possibility for a resumption of hostilities is ever-present, we don’t see that concern reflected in key asset prices.

Yesterday morning, hours before Iran launched its offensive, we offered the following quick take about the situation, featuring my persistent reminder about the difficulty that equity markets face when trying to price global events:

Middle East tensions: They’re certainly not good for markets by any means, but it’s important to keep in mind that equity markets are not particularly good at discerning the impact of geopolitical events on stock prices. Remember, investors are very good at figuring out how news events might affect revenues, earnings, cash flows, etc., but that’s very tough to do for the vast majority of stocks when it’s events halfway around the world. Instead, I look to bonds, where there is indeed a flight to safety bid, and oil, which is up modestly, but by no means panicky.

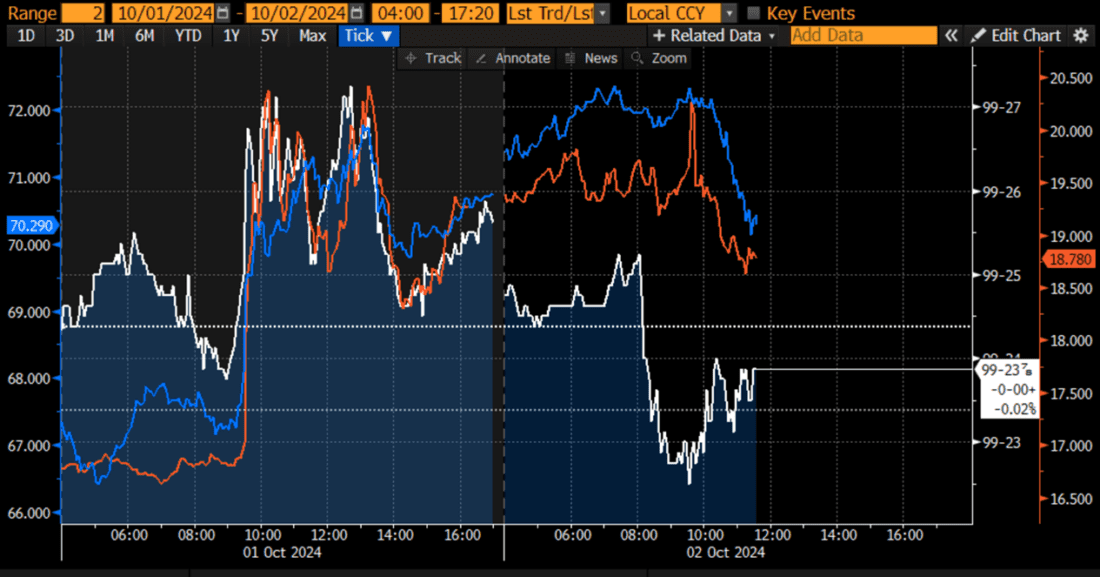

Indeed, after the news broke about US intelligence warning of a potential Iranian attack on Israel, the risk-off trade intensified. That was understandable, of course. The chart below shows three of the key indicators that I tend to watch for signs of market concern, 2-year Treasuries, crude oil, and VIX. The news-related pop is obvious:

2-Day Chart, 2-Year Treasuries (white, near right scale), November NYMEX WTI Futures (blue, left scale), VIX (red, far right)

Source: Bloomberg

Note that the flight to safety trade ebbed somewhat during the hours that elapsed between the intelligence warning and the time when the rockets started flying. On a personal note, I happened to be in a major newsroom when the barrage started. There was a real buzz as reporters and producers scrambled, and my planned segment took on a much different tone than anticipated. Quite frankly, it was exciting to offer real-time market commentary while uncertainty was at a peak. (Here’s the link)

Once it became evident that the worst was over and Israeli authorities gave a tentative “all clear”, we saw those key measures reverse somewhat. This morning, we see all of them dipping somewhat after an overnight lift, with T-notes leading the decline after a stronger than expected ADP National Employment result.

Regarding ADP: the increase of 143,000 jobs beat the 125k consensus, while last month’s 99k was revised to 103k. Although ADP is a highly imperfect predictor of the ensuing Nonfarm Payrolls report, bond traders hoping for rate cuts are sensitive to perceptions that solid employment results might impede the Fed’s willingness to oblige them.

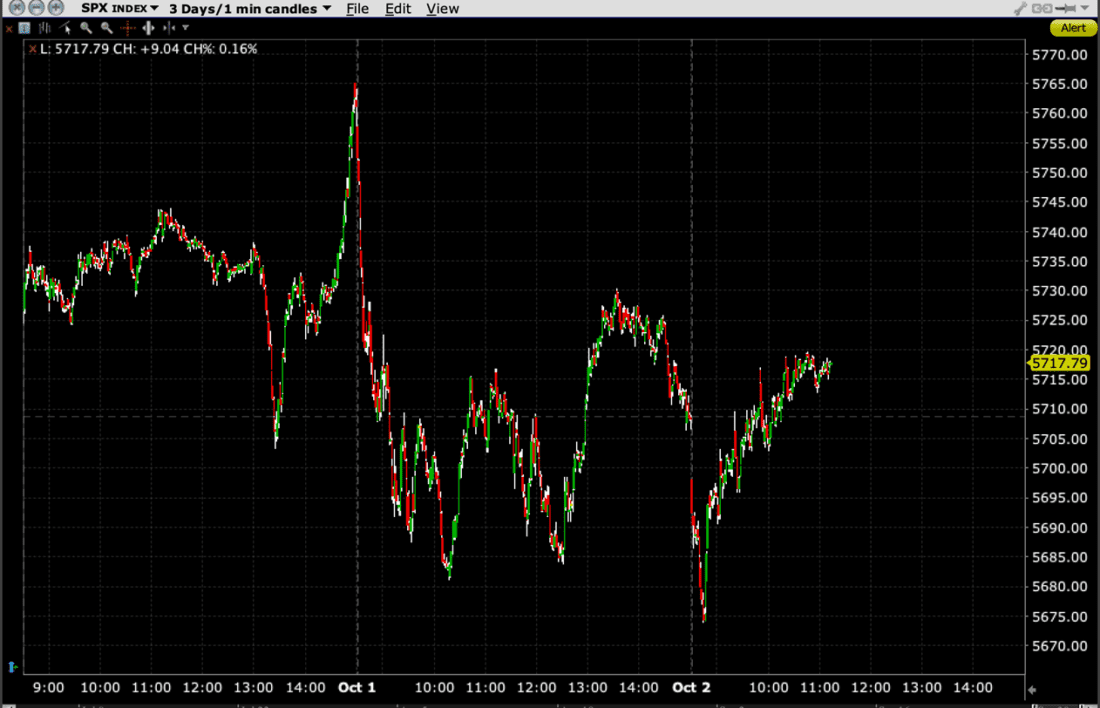

As for stocks, after a brief attempted selloff after this morning’s open, traders bought the initial dip, and stocks are generally consolidating around yesterday’s closing level. Bear in mind that yesterday’s lower close for SPX essentially recouped the rally that occurred during the last 20 minutes of Friday’s trading, which was seemingly a “mark the close” rally as the third quarter came to an end:

Source: Interactive Brokers

If global events are causing investors to reassess their risk exposure after a truly stellar quarter, there is nothing wrong with that. Investors should always be reassessing their risks, especially after a period of solid performance. But overreacting to global events that have ill-defined consequences for the inputs that truly influence stock prices — revenues, earnings, cash flows, etc. – can cause investors to lose focus. If global events do affect those inputs, such as oil prices boosting domestic energy stocks, then by all means pay close attention. If not, be wary, but don’t freak out.

Related: Big Fireworks From China