Written by: Brian Clark | Knowledge Leaders Capital

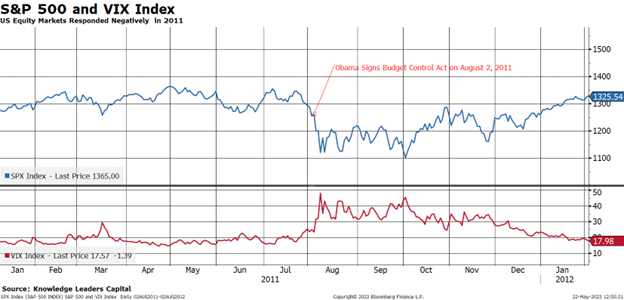

If you are starting to have a case of déjà vu around the current debt ceiling negotiations, you are not alone. In 2011, markets were relatively flat during the year before Congress and the White House (temporarily) buried the hatchet with the passage of the Budget Control Act on August 2, 2011.

As the above chart shows, it was only after agreeing to raise the debt ceiling and cut government spending that stocks took a steep leg downward and the VIX or “fear” index that measures the S&P 500’s implied volatility 30 days forward shot up dramatically.

Hence, it is that distinct feeling that we’ve been here before that has investors mostly concluding that the federal government will agree to raise the debt limit to avoid default on its debt, but that the issues for investors won’t end there. Indeed, House Speaker Kevin McCarthy said this afternoon, “we can get a deal tonight, we can get a deal tomorrow.” While it might take a bit longer, investors may be asking: what comes next?

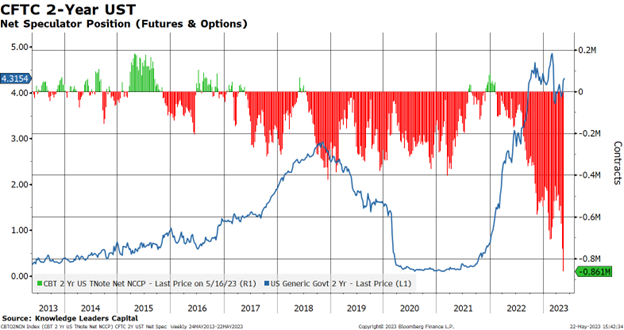

In 2011, the agreed-upon budget cuts led equity investors to question how government spending reductions might affect certain companies, and growth in general. This probably explains the record net speculator short interest in the e-mini S&P 500 and the 2-year, 5-year and 10-year combined option and future contracts. Investors are short both stocks and government bonds to a record extent.

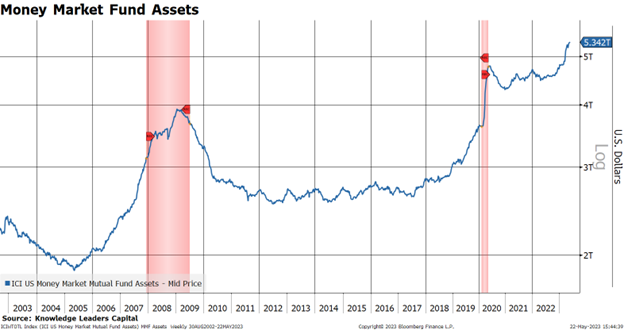

Investors seem to only have eyes for cash.