Written by: David Waddell | Waddell and Associates

From ‘Hidin’ Biden’ to ‘Talking Trump’: What It Means for Investors

THE BOTTOM LINE:

Donald Trump’s Presidency feels like a reality show. Cameras catch his every move and microphones record his every thought. Pundits quickly broadcast his pontifications with exaggerated interpretations. This contrasts starkly with the limited access the media received from the Biden administration. Market watchers need to adjust. While Trump may think every thought “out loud”, every thought doesn’t become every policy. As proof, media volatility hasn’t triggered market volatility as interest rates, oil prices and US dollar prices have declined on the year while global stock prices ascend toward all-time highs. The key to navigating Trump 2.0 for investors will be knowing the difference between the reality show… and the reality.

Can you imagine the impact on your family or your business if you thought every thought out loud, just as thought, with emotion and without filters? How cringeworthy!

I wake up every morning and second guess every portfolio decision we have made. As a portfolio manager, I learned long ago that you must “repurchase” your portfolio every day. Over my first two cups of coffee, I actively self-debate the state of the economy, the prospects for corporate earnings, political risks, monetary risks, investor sentiment levels, the merits of our overall portfolio strategy, and the merits of each one of our individual holdings. Some mornings, I leave the exercise convinced. Some mornings I leave the exercise befuddled, requiring more study and more time for assessment.

Given that there are no certainties in forecasting markets, the investment threshold lies with simply believing one thing more than believing the opposite thing. If I held a press conference every morning to share my tossed salad of thoughts, internal debates and opinions, you might find my process erratic. I assure you that it is not. It’s the process every diligent money manager performs. The more heated the internal debates, the more diligent the research, and the better the decision making. The outcomes certainly benefit our clients, but broadcasting each thought along the way certainly would not.

Over the past four years, Joe Biden held 15 solo press conferences. For the Biden administration, silence was golden. For Trump 2.0, the press seems to have a seat with Trump at a partner’s desk in the Oval Office. Should we invade Panama? Should we abolish FEMA, USAID, and the Department of Education? Should we return to the gold standard? Should we buy Greenland? Should we tariff Canadian and Mexican imports by 25%? Maybe not. Trump seemingly never just thinks his thoughts. This, understandably, leaves observers and investors conditioned under “Hidin’ Biden” feeling anxious and disoriented.

In last week’s missive, we worked to redirect focus away from Trump’s thought experiments back towards observable fundamentals. Is the economy growing? Are earnings growing? Are valuations sustainable? The answers are yes, yes and yes. Recognize that Trump’s “out loud” pontifications don’t neatly result in policies. Also remember that we invest in corporations, not governments. When the outlook for corporations diminishes, we will reduce our risk exposures, but not before. Trying to trade a Trump thought tracker is a money loser. On this, there is no debate.

Market Reactions

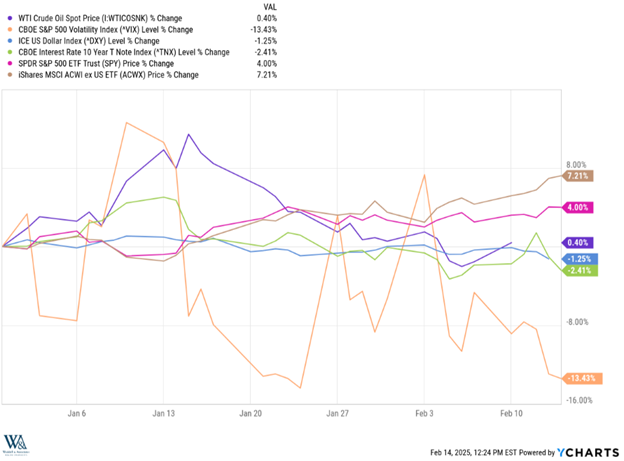

Since the beginning of the year, despite Trump’s vocal volatility, stock market volatility has declined. The VIX volatility index, which measures expectations for market volatility over the next 30 days as calculated by the options market, has fallen 13% year-to-date. Interest rates, as measured by the 10-year Treasury note have fallen 2.6% year-to-date (from 4.57% to 4.45%). Despite all the tough Trump tariff talk, the US dollar has declined 1.25% year-to-date, while oil prices per barrel have flatlined. Concurrently, US equities as measured by the S&P have advanced 4% on the year, while international equities have advanced 7% on the year.

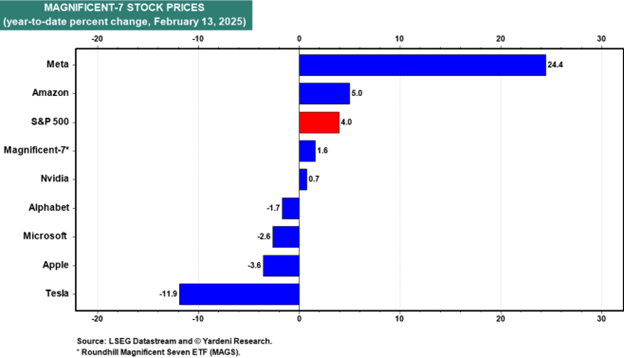

Perhaps the most encouraging reading comes from the highly influential Magnificent 7. Taken together, the market capitalizations of Apple, Amazon, Google, Meta, Microsoft, Nvidia and Tesla account for 30% of the entire S&P 500. For the past two years, the Mag 7 stocks have powered the S&P 500 higher with superlative returns. This year, four of the seven have posted negative returns, turning the Mag 7 into the Lag 7. And yet, the S&P 500 has capably advanced without them:

https://yardeni.com/charts/magnificent-7/

While it’s unlikely that stocks will maintain this pace of gains throughout the year, it’s clear that Trump’s “out loud” volatility hasn’t translated into downside market volatility.

Enjoy the rest of your weekend!

Related: Why High-Yield Credit Still Holds Strong Potential

Sources: LSEG Datastream and Yardeni Research, YCharts