Who’s the second greatest investor of all time?

Most people have Warren Buffett at #1.

The “Oracle of Omaha” posted compound annual returns of 20% over about 50 years.

Nobody can match that. Buffett’s the king of long-term investing.

But did you know Peter Lynch achieved much higher returns overall?

Lynch ran the famed Magellan Fund from 1977 to 1990. During that stretch, he generated average annual returns of 29.2%. At that rate of a return, $10,000 turns into $279,520 in 13 years.

He’s definitely on the “Mt. Rushmore” of greatest investors.

His book, One Up on Wall Street, is a must-read. That’s me:

In it, he talks about “10-baggers”... stocks that gain 1,000%.

His 10-bagger strategy: find fast-growing companies that can sustain their growth, turn it into profits, and aren’t overvalued.

Lynch retired in 1990. And even back then, without all the new and exciting disruptive opportunities we have today, 10-baggers weren’t all that rare.

In Chapter 6, for example—“Stalking the 10-bagger”—Lynch gave a partial list of the 10-baggers he either didn’t buy or sold too soon during his time at Magellan.

Lynch: “You’ll notice the list only goes up to M, but that’s only because I got tired of writing them down... You can imagine how many opportunities must be out there.”

What about finding 10-baggers today?

Lynch was the inspiration behind our deep research project The Ultimate Guide to Modern 10-Baggers.

Of course, a lot has changed since Lynch retired at 46 with one of the greatest track records in history.

So our team set out to answer: If Lynch were investing professionally today, how would he change his approach to find modern 10-baggers?

With the help of artificial intelligence (AI), we were able to zero in on the Core 4 traits that tend to be shared by true 10-baggers.

But today, I wanted to share an important finding with you.

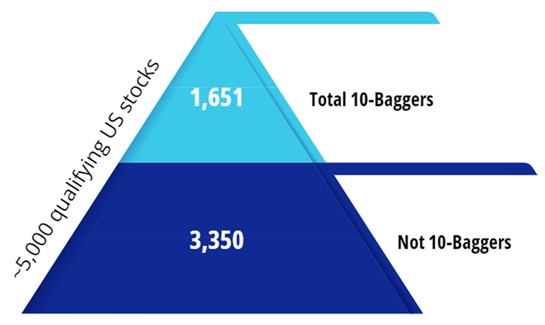

Our team looked at every stock’s monthly closing low and high prices since 2004, and then calculated which ones achieved 10-bagger status at any point.

There were roughly 5,000 publicly traded US stocks in the last 20 years.

Guess how many produced 1,000% returns at any point during that timeframe.

(This surprised me.)

400?

500?

1,000?

No—we found 1,651 stocks that produced 1,000% returns at any point in the last 20 years:

Source: The Ultimate Guide to Modern 10-Baggers

That’s a lot of opportunities to 10X your money.

I’ll admit: This was humbling for me...

I saw one of my stocks 10X back in 2020.

It was my first “10-bagger” (at least on paper). I thought I was something special!

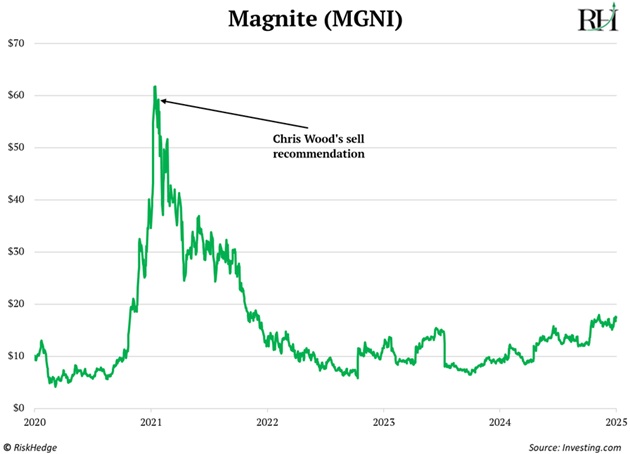

I bought little-known streaming disruptor Magnite (MGNI) a few months after our analyst Chris Wood recommended it. This was shortly after the COVID wipeout.

It shot up fast.

Chris smartly recommended his readers take a “Free Ride” during the rally. Then he recommended selling the remaining position shortly after (it turned out to be almost the exact top):

I held on longer, which was a mistake.

But I bring this up because I’m an editor and writer for RiskHedge, not an investment analyst. But here I was, thinking I had it figured out.

I was fortunate to have Chris Wood as my guide. But the fact is these opportunities are out there for the taking for anyone.

Again, since 2004, there were 1,651 opportunities in which you could have 10X’d your money on a single stock.

And you have one big advantage that Mr. Lynch didn’t...

By the end of his career, Lynch managed billions of dollars. He had to play a different game than us when it came to 10-baggers.

From his book (emphasis added):

In a large portfolio such as mine, I have to hit several [10-baggers] before it makes an appreciable difference. In a small portfolio such as yours, you only have to hit one.

One final thing I should clarify.

In our research report, not all of the 10-baggers we found were created equal...

Many came with a huge asterisk, which we get into.

Out of the 1,651 we discovered, only 347 were what we classified as “true” 10-baggers.

This number excludes all the risky lottery-ticket type stocks like biotechs and gold miners. It excludes all the stocks that only went up 1,000% if you managed to buy them around the depths of 2008/09. And of course, it excluded all memestocks, like GameStop (GME).

With those removed, there were still 17 opportunities a year, on average, to make an investment that will appreciate 1,000% or more.

And Chris and Stephen McBride both believe we’re now in a golden window where 10-baggers are abundant.

Another thing we learned in the 10-bagger project is that they most often come from the tech sector. Specifically, they cluster around new, disruptive technologies and industries. So much disruption is happening these days, it’s hard to keep up.

It’s time to capitalize on the unprecedented growth in technology happening today in AI, nuclear, biotech, solar, drones, robotics, space... and much more.

As Stephen says, “Future’s bright!”

Related:

PS: Stephen’s known as our “disruption” guy at RiskHedge. And he often highlights the disruptive tech trends (and the stocks behind them, some with 10-bagger potential) in his free investing letter, The Jolt. If you’d like to learn more about the disruption happening all around us, sign up here today.