Written by: David Waddell | Waddell and Associates

THE BOTTOM LINE:

The USA will have a new president-elect, likely by this time next week. While this has driven high anxiety across television displays, the internet, and dinner tables, the markets have remained remarkably calm, exiting October essentially where it began. Surprise! For investors, this should act as a true reveal. Private sector activity matters more than presidential activity. US GDP grew 2.7% last quarter. S&P 500 earnings grew 5%+. Neither show signs of slowing. Regardless of who wins The White House, those invested in US companies will continue winning as long as Americans remain dynamic, industrious, and innovative. That’s a bet worth making, and is historically rewarded—no matter who occupies 1600 Pennsylvania Ave.

While attention fixates on the difference-maker in a hotly contested election, investors shouldn’t overlook the true October surprise this year. For the month of October, the S&P 500 traded within a 2.5% range and ended the month down less than 1%.

A Spooky History

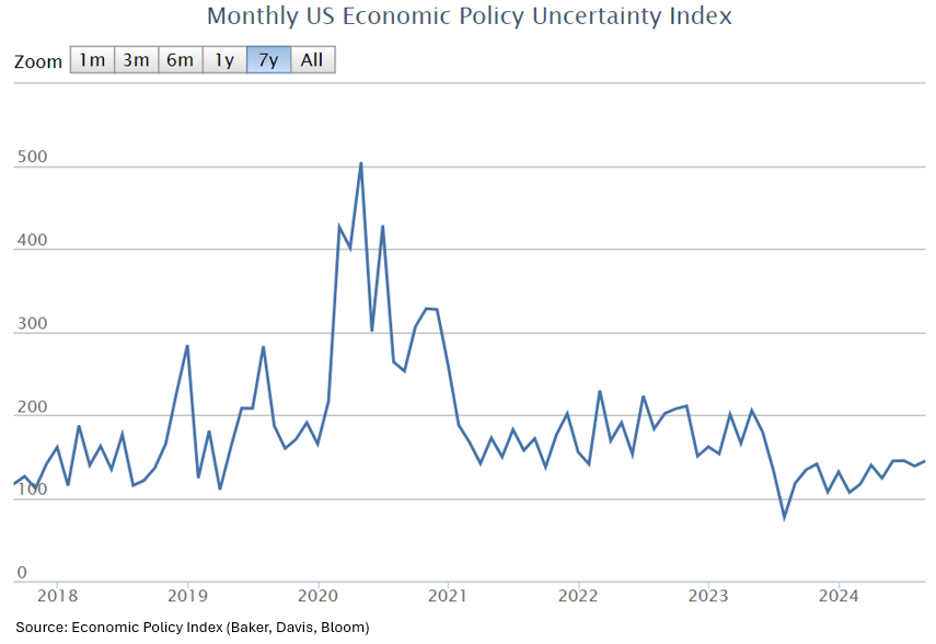

October has a history of spooky market behavior. General volatility levels rank 34% higher in October compared to the other months and three of the last four trading days with losses of more than 10% occurred in the month of October. With Trump vs. Harris worldviews overheating social media feeds, conflicts raging worldwide, and a mixed bag of economic data, conditions were set for a potentially red October. So why the lullaby? First, while Trump and Harris seem far apart, neither of their economic policies seem to be causing much concern:

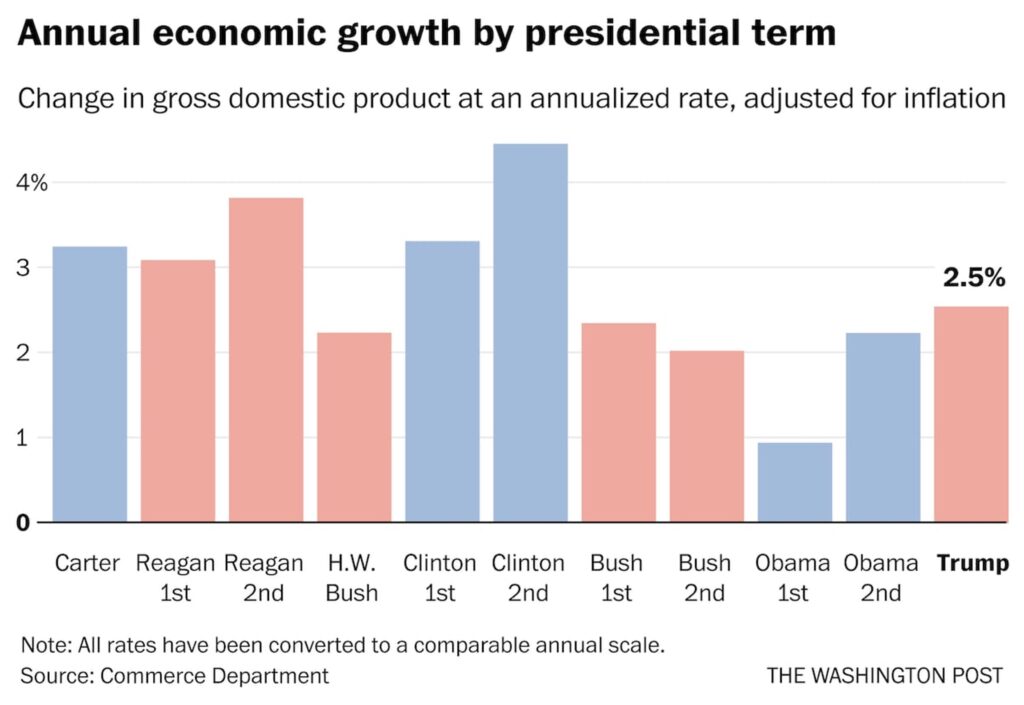

Perhaps that’s due to expectations of a divided congress, or recognition that Presidents themselves have much less influence over economic growth than widely assumed. Consider the GDP growth rates listed below (Trump rates are pre-COVID):

The Truth About the Market and Elections

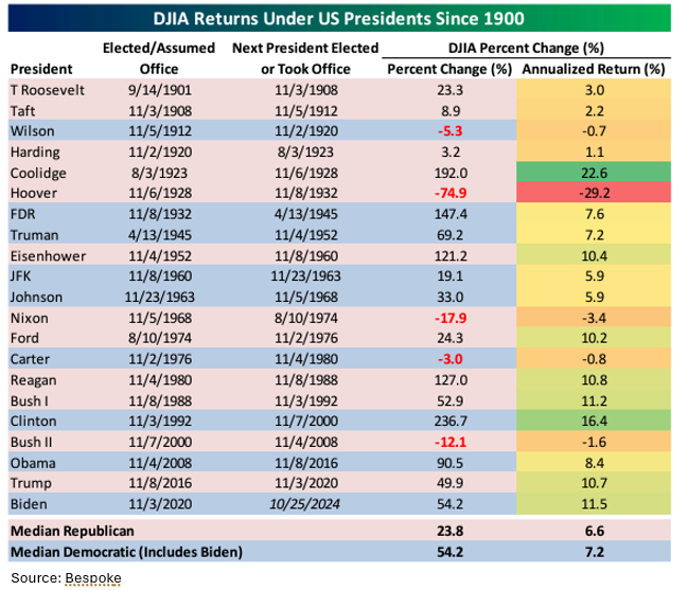

Outside of Obama’s first-term clunker, the US economy has grown 2%+ under every president dating back to Herbert Hoover. Turning to the stock market, the performance differentials between presidential administrations are just as inconclusive:

Looking at the price returns for the Dow Jones Industrial Average going back to 1900, Republican Presidents have rewarded investors with 6.6% annualized gains while Democrat Presidents have rewarded investors with 7.2% annualized gains. I haven’t done the statistical work, but I suspect that the -30% return under Hoover accounts for the differential. How did the Dow perform under President Trump? It rose 50%. How did the Dow perform under President Biden? It rose 50%.

We Invest in Companies, not Governments

I do not know who will win the Oval Office on Tuesday. I do know that I have received a flood of queries surrounding the implications for investors. Based upon the history presented above, the implications are immaterial. What powers the US economy and investor returns is not presidential policies, but trillions of micro decisions made by an industrious, ingenious, and innovative population. Our hard-coded system of laws, property rights, and protections provide 338 million Americans with the incentives to pursue prosperity and retain the rewards. So, stress less about Tuesday. We invest our client assets in companies, not governments, and with our dynamic, ever-growing economy, earnings continually rising, and AI contributions just beginning, the future is bright no matter who takes Tuesday.

Sources: Economic Policy Index, Department of Commerce, Bespoke

Related: How To Choose the Right Firm To Build a Successful Advisor Career