Approximately 80% of all S&P 500 companies have reported fourth-quarter earnings as of today, and of those, 75% have reported earnings per share (EPS) above estimates. That’s well above the 10-year average, according to FactSet.

The reason I bring this up is because many investors and pundits appear to believe that the only stocks doing well right now are the so-called Magnificent 7 (Apple, Alphabet, Amazon, Meta Platforms, Microsoft, NVIDIA and Tesla).

No doubt about it, these tech giants are doing an inordinate amount of the market’s heavy lifting. NVIDIA was the best performing S&P 500 stock last year, rising nearly 240% in an artificial intelligence (AI)-fueled rally, and so far in 2024, the chipmaker is up almost 50%.

This one name doesn’t tell the full story, though, and investors who are sitting on the sidelines may be paying a steep opportunity cost.

Or maybe not. This week, we learned that Japan and the U.K. have fallen into recession, with Japan losing its status as the world’s number three economy to Germany. Contagion is a real risk.

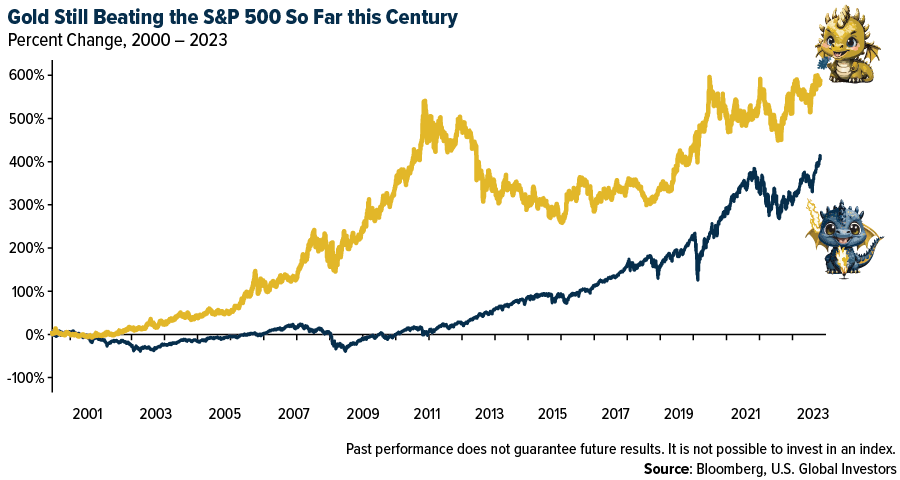

That’s why I always advocate for portfolio diversification; specifically, I recommend a 10% weighting in gold, with 5% in physical bullion (bars, coins and jewelry), the other 5% in high-quality gold mining stocks, mutual funds and ETFs. Rebalance at least once a year.

There’s a chart that I update semi-frequently comparing the performances of gold and the market so far this century. As of the end of last year, gold was still outperforming the S&P 500, with gold delivering a CAGR (compound annual growth rate) of 8.46%, beating the S&P 500’s 7.07%. (The dragons appear on the chart below in observation of China’s Lunar New Year. Happy Year of the Dragon!)

The Economic Ripple Effect Of Shipping Route Changes

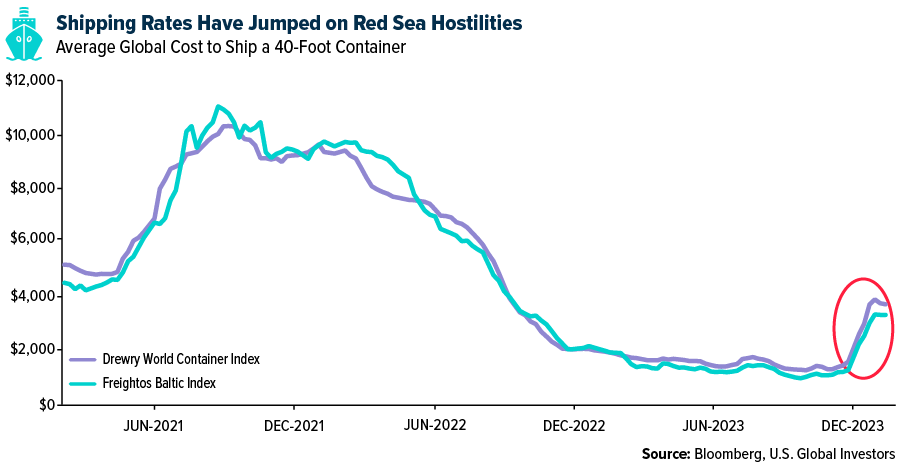

Transportation costs for the shipping industry have surged to a 15-month high as commercial vessels continue to take the lengthier but safer route around the Cape of Good Hope, bypassing the Houthi-controlled waters of the Red Sea.

The detour, though necessary for the time being, has broad implications beyond increased operational costs. Automobile factories have been idled in Western Europe, while shipments of liquified natural gas (LNG) have been delayed or cancelled. Many businesses are reporting inventory builds at the highest level since last June.

The rerouting of shipping lanes, especially along the Asia-Europe routes, underscores the industry’s vulnerability to geopolitical tensions and the necessity for flexibility in operations. Fortunately for investors, this vulnerability may be exploitable.

How Freight Rates Impact Shipping Industry Earnings

If you recall, freight rates similarly exploded to all-time highs in 2022 due to pandemic-related supply chain issues. The added revenue that year helped carriers achieve record annual profits of almost $300 billion in earnings before interest and taxes (EBIT), according to the United Nations Conference on Trade and Development (UNCTAD).

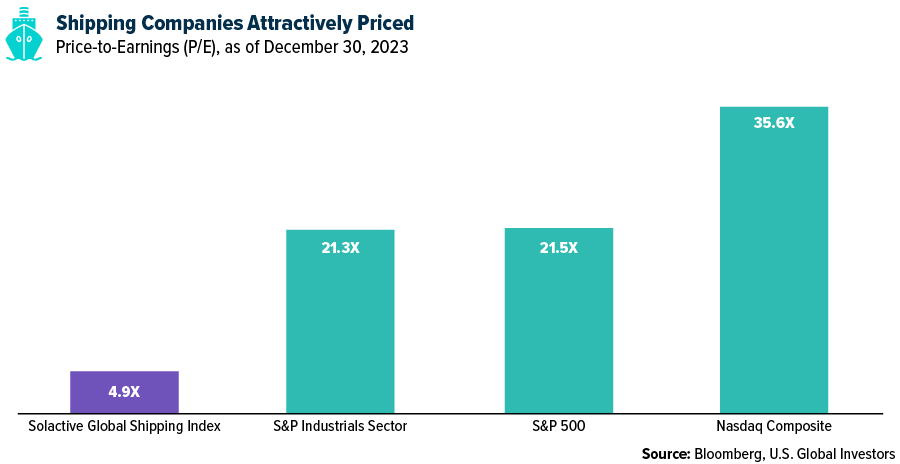

The market appears to favor the chaos. The Solactive Global Shipping Index delivered its third consecutive annual gain last year, rising 25.5%, after advancing a phenomenal 83.2% in 2021, 5.4% in 2022.

With freight rates once again undergoing strong upward pressure, will investors see another bumper year? That’s impossible to say, and besides, shipping stocks have more than performance going for them. The Solactive Global Shipping Index currently trades at a very attractive 4.9 times earnings, which is more than four times more affordable than the S&P 500 and the S&P Industrial Sector, of which shipping is a member; it’s also more than seven times more affordable than the tech-heavy Nasdaq Composite.

Consumer Spending As A Catalyst

As you probably could guess, the shipping industry is closely tied to consumer behavior. When product sales are hot, demand for new orders and transportation services increases.

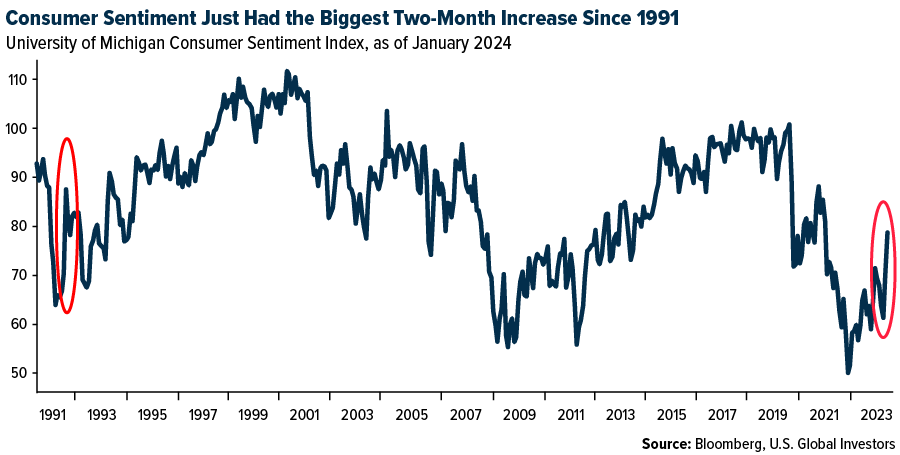

With domestic consumer spending constituting a significant portion of the U.S. economy, the sector’s performance is a bellwether for shipping demand. Encouragingly, consumer confidence indicators, such as those from the Conference Board and the University of Michigan, have shown remarkable resilience in recent months.

This, I believe—coupled with downward-trending inflation and potentially lower interest rates— bodes well for shipping services as consumers continue to exhibit demand for both foreign and local products.

Emerging Economies Steering Global Shipping

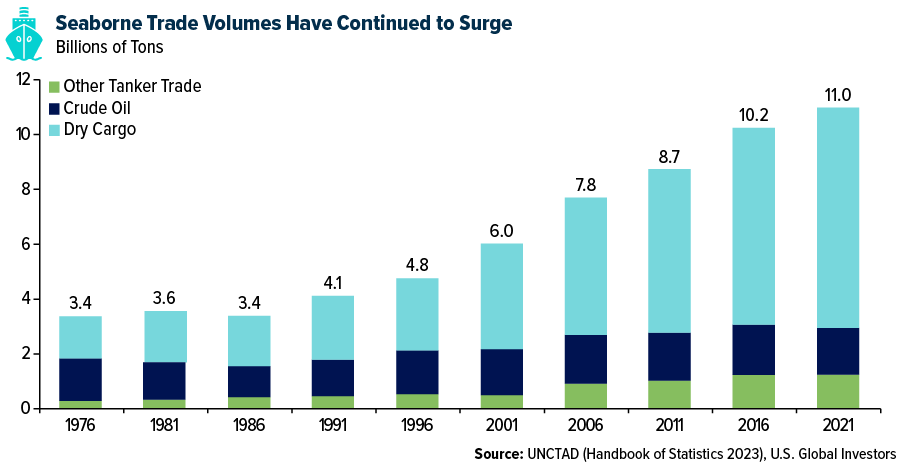

Emerging economies, particularly in Asia, are increasingly becoming the linchpins of maritime trade growth. Since 1990, the volume of goods transported by sea has more than doubled as people in China, India and other rapidly developing countries join the global middle class and seek a more comfortable, “Western” lifestyle filled with modern conveniences.

Asia remains at the forefront of maritime freight, with its ports handling about 42% of the world’s goods, according to the UNCTAD. Due to their central role in globalized manufacturing and containerized trade, developing economies in the Asian continent account for roughly a third of all goods loaded worldwide and half of all goods unloaded.

As the global manufacturing sector shows signs of revival and business confidence surges, the shipping industry stands at a crossroads. The marginal rise in January’s operating conditions for copper and steel users, as indicated by the Purchasing Managers’ Index (PMI), points to a broader economic recovery that could further stimulate maritime trade.

Emerging markets’ contribution to maritime freight will be crucial in charting the industry’s course. With strategic investment and partnerships, the shipping sector can harness these growth drivers to face the challenges ahead, ensuring a resilient and dynamic future for global trade.

Index Summary

- The major market indices finished mixed this week. The Dow Jones Industrial Average lost 0.11%. The S&P 500 Stock Index fell 0.44%, while the Nasdaq Composite fell 1.34%. The Russell 2000 small capitalization index gained 1.34 % this week.

- The Hang Seng Composite gained 3.68% this week; while Taiwan was up 1.16% and the KOSPI rose 1.29%.

- The 10-year Treasury bond yield rose 11 basis points to 4.286%.

Airlines And Shipping

Strengths

- The best performing airline stock for the week was Tripadvisor, up 22.9%. According to Bank of America, third quarter domestic yields held at 5-10% above 2019 levels with ANA and Japan Airlines’ yields boosted by a combination of price hikes and mix shifts. ANA & JAL both appear focused on hiking domestic prices again in the third quarter of fiscal year 2025, given rising costs with less weak seasonal discounting likely in the coming quarters.

- According to Bank of America, Japanese shipping stocks have re-rated to near 1x book as optimism around Red Sea disruptions and upcoming shareholder returns have boosted valuations higher. However, the bank sees current valuations pricing in the Red Sea boost and near-term shareholder return surprise, while ignoring the inevitable normalization of earnings and shareholder returns beyond calendar 2024.

- ADP reported fiscal year 2023 EBITDA of EUR 1956 million (versus company consensus of EUR 1,933 million). The beat of 1.2% versus company consensus was driven by a stronger EBITDA in retail that more than offset a weaker aviation EBITDA.

Weaknesses

- The worst performing airline stock for the week was Turkish Air, down 4.2%. According to Bank of America, system net sales increased 0.3% year-over-year for the week compared to a positive 1.9% last week. On a trailing four-week basis, net sales have increased 2.2% compared to 4.0% in early January and flat in early December. Domestic sales remain stronger than international sales. Domestic sales decelerated to a positive 4.5% from positive 6.4% last week while international decelerated for the third week in a row to -3.1% from -1.8% last week.

- According to Morgan Stanley, emissions from container ships, car carriers and dry bulk ships diverting from the Red Sea are set to increase as much as 70% as vessel operators increase speeds to compensate for the longer route around the Cape of Good Hope. Leading container ship operators including Denmark’s AP Møller-Maersk, and Hapag-Lloyd are among companies which have increased vessel speeds to minimize the extra sailing time for ships that would normally use the Suez Canal.

- According to Bank of America, leisure sales were down 3.4% year-over-year this week, decelerating from -2.2% last week, with each weekly datapoint negative year-to-date. Leisure sales continue to favor domestic at 6.0% this week, with each weekly datapoint positive year-to-date, while international sales were -14.4%, negative each week since late August as demand normalizes from a strong summer travel season in 2023.

Opportunities

- According to ISI, international capacity for U.S. carriers is up 18% year-over-year in the first quarter of 2024. For the second quarter of this year, very preliminary U.S. international capacity is scheduled up 11% year-over-year. Compared to 2019, international capacity for U.S. carriers is up 14% in the first quarter of 2024 and preliminarily up 12% in the second quarter.

- According to UBS, between 2010 and 2023, DSV has increased its Air & Sea EBIT/GP conversion ratio from 32% to 51.5%, mainly to reflect operating leverage as volumes have increased by 426% in Air, and by 256% in Ocean. A potential Schenker tie-up could broadly double the air/sea volumes. UBS believes this would likely further increase the Air & Sea conversion ratio, which could bring an incremental EPS accretion of 6%.

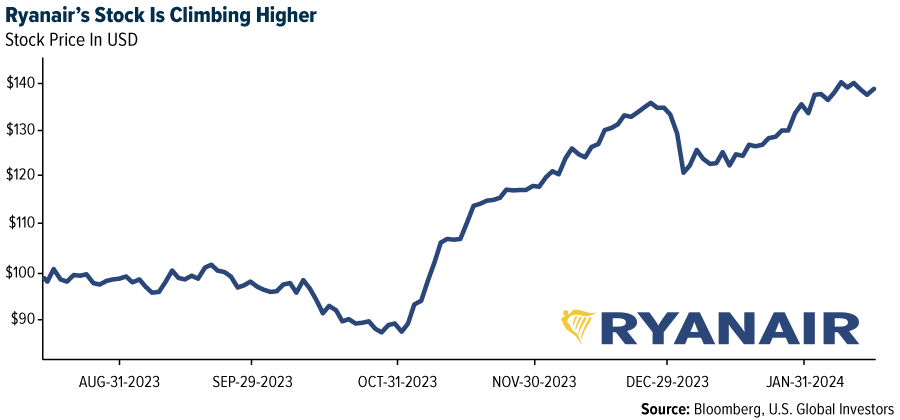

- Ryanair is nearing a deal to provide flights for package holiday giant TUI, according to people familiar with the matter, striking a fresh blow in its battle against online travel agents. A Ryanair partnership with the German travel company could be announced as soon as Thursday, one of the people said, asking not to be named before a deal is final. The talks with TUI follow an agreement Ryanair reached in January with online travel firm Loveholidays, under the condition that no mark-ups were allowed on the Irish discounter’s flights, the person said.

Threats

- For Boeing, UBS says a step-up in union contract wages and non-union annual inflation could be a $0-1.3 billion pre-tax headwind to the $10 billion free cash flow guidance by 2026, depending on Boeing’s underlying assumption for labor. There are offsets; for instance, the backlog has escalators tied to a wage inflation index. UBS thinks it is likely Boeing assumed elevated labor inflation in the $10 billion target, implying an impact well below the high end of that range.

- ISI has seen spot rate changes for VLCCs, Capesizes, LNG carriers, LR2s, and VLGCs over the last 18 months, with three of those five proxy asset classes having rates move by more than 600% during that period, and the other two “topping out” at a mere 200+% trough to peak. ISI notes these extremes are largely related to shifting trade routes and vast disruptions associated with “events,” such as Russia/Ukraine, Panama Canal water levels, and Red Sea disruptions, all of which are well known, but impossible to forecast as it relates to resolutions.

- According to RBC, Boeing reported 27 aircraft deliveries in January, receiving only three orders. The company delivered 25 737 MAX aircraft along with one of each, the 767 and 787, in January. Subsequent events included the FAA adding a cap to Boeing’s production on the 737 to 38/month even though most suppliers appear to be operating at a lower rate. With all the disruptions, Boeing withheld providing guidance for 2024.

Luxury Goods And International Markets

Strengths

- Over the weekend, the Della Valle family, controlling shareholders of Tod’s S.p.A., along with L Catterton, announced a takeover bid offering of €43 per share for 36% of Tod’s shares. The bid is backed by LVMH. The plan is to delist Tod’s from the Milan stock exchange following the bid. Currently, the Della Valle family owns 64.45% of the Company’s shares, while LVMH holds 10%. Shares of Tod’s gained 18% after the deal was announced.

- Preminiary travel data during the Lunar New Year holiday lifted luxury stocks on Friday. Sixty-one million rail trips were made in the first six days of the celebration, the highest in five years and a 61% year-over-year increase. Initial data on roads and air trips also showed year-over-year improvement, as did the hotel room bookings.

- Tod’s was the best performing S&P Global Luxury stock, gaining 18.17% in the past five days. Shares gained more than 18% on Monday after the merger, mentioned above, was proposed.

Weaknesses

- Inflation in the United States continues to decline, but this week the Consumer Price Index (CPI) was reported above the estimates of Bloomberg economists. The month-over-month CPI was expected at 20 basis points but was reported at 30 basis points. Similarly, the year-over-year CPI was anticipated to be 2.9% but was reported at 3.1%.

- This week witnessed a decline in foreign global currencies alongside a strengthening of the dollar. The dollar’s resilience was supported by CPI figures in the United States, which surpassed expectations. This, coupled with strong PPI data released on Friday, bolstered the dollar’s performance, and led to a weakness in foreign exchange markets.

- Lululemon Athletica Inc. was the worst performing S&P Global Luxury stock, losing 4.47% in the past five days. Despite the absence of significant news regarding the company this week, there was observed profit-taking behavior, likely in response to a 60% surge in the company’s shares over the past year.

Opportunities

- Goldman Sachs raised its 2024 outlook on European equities. The broker downgraded the energy sector to neutral from overweight due to falling energy prices and lowered utilities to underweight from neutral. However, the bank upgraded industrial goods and services, and construction & building materials based on improving demand and lower energy costs. Additionally, the travel and leisure sector was raised to overweight from neutral, while the consumer product sector was boosted to overweight.

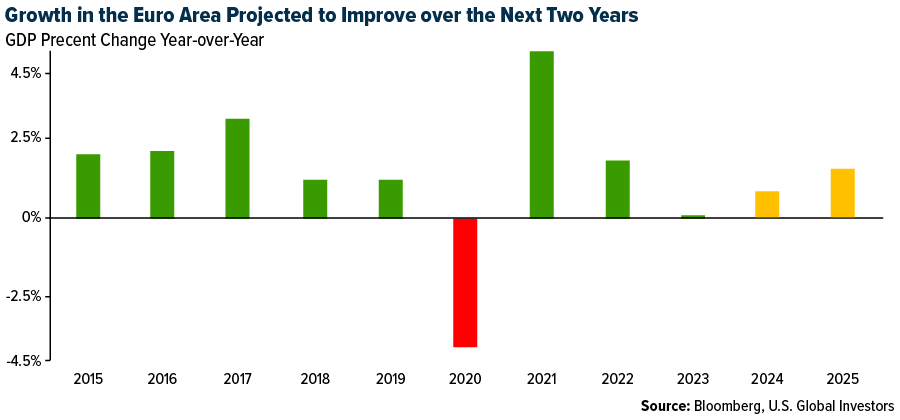

- This week, the European Central Bank revised down the Euro-area growth outlook for 2024, expecting the member countries of the Euro currency to expand by 80 basis points, compared to the previously estimated growth of 1.2%. Nevertheless, the Euro-area is expected to gradually recover from the mere 10 basis points recorded last year.

- LVMH will serve as one of the primary sponsors for the upcoming Summer Olympics. Given Paris’ reputation for luxury and extravagance, this luxury giant will gain market recognition through its sponsorship of the Olympic events. Additionally, Chaumet, a luxury jeweler under the LVMH umbrella, will have the honor of designing the medals. Furthermore, the esteemed leather goods brand Berluti will outfit the French athletes for the opening ceremony, which will take place on the River Seine on July 26.

Threats

- With inflation in the United States being stubborn, and not declining as fast as expected, the Federal Reserve may decide not to cut the rate any time soon. Following the release of the CPI data this week, yields rose while equities declined.

- Bloomberg reported global fund managers are avoiding Chinese investments by choosing other emerging markets investments that specifically avoid China. Further, there was the comment that shorting the China market was still the second most crowded trade in February, after long the magnificent seven.

- European Central Bank’s Chief Lagarde warned against quick interest rate cuts and that rising wages could fuel inflation. She emphasized that Europe needs to see a sustainable 2% inflation target before rushing into an easing policy. Officials are debating the first rate cuts happening between April and June, depending on wage and profit data.

Energy And Natural Resources

Strengths

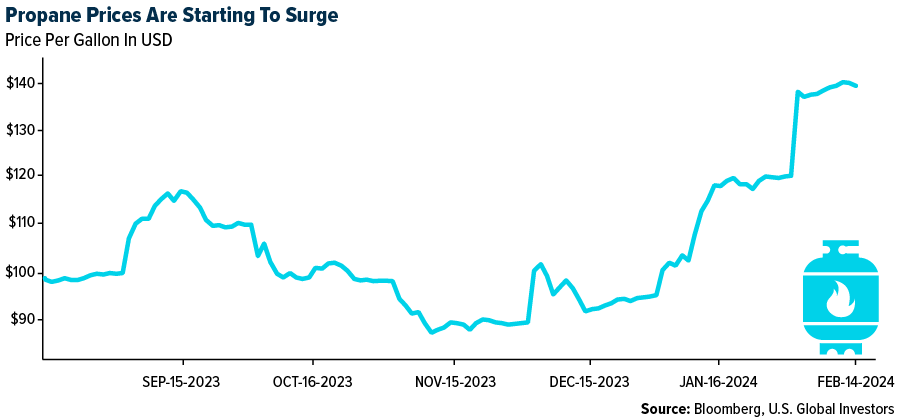

- The best performing commodity for the week was copper, climbing 3.93%, on rising optimism surrounding a rebound in Chinese demand and perhaps an unwinding of short positions taken against the red metal. According to UBS, propane prices have rallied 21.7% to $0.82/gallon from the fourth quarter driven by mid-January cold weather (impacting demand, refinery supply, and production and strong U.S. LPG exports).

- Aluminum prices have found support around $2,200/ton, notwithstanding persistent macro headwinds. That support has been driven by a confluence of factors. Most importantly, perhaps, global aluminum supply is expanding by an average of only 2.4% out to 2025, compared to 4.7% between 2011 and 2017.

- According to Goldman, the fall in OECD total oil landed commercial stocks to 43mb lower than their average end of January/February balance forecast of 2,780mb and the 54mb rise in oil on water stocks since the start of Red Sea disruptions, driven almost entirely by emerging market (EM) stocks. Because OECD total oil commercial stocks account for about half of landed global oil stocks, Red Sea disruptions explain about half of the bullish 43mb downside surprise in OECD commercial stocks, which is worth $3-4/barrel to their Brent forecast in their pricing framework.

Weaknesses

- The worst performing commodity for the week was natural gas, dropping 12.78%, and marking the sixth weekly consecutive loss. Warmer weather is curtailing demand. With inventories of natural gas in storage 14% higher than the five-year average storage level, it paints an oversupplied commodity picture. Glencore Plc plans to sell its stake in a nickel mine and a processing plant on the islands of New Caledonia following a dramatic slump in prices. The world’s top commodity trader will seek to sell its 49% stake in Koniambo Nickel SAS, according to a statement from KNS. The company would begin “without delay” to suspend operations at its ferronickel plant while a new investor is found.

- Oil has traded within a band of about $10 this year as risks from the conflict in the Middle East have been partially offset by ample global supplies and a shaky demand outlook — especially in China, the second-biggest consumer. Demand forecasts for China have additional downside risks, Goldman Sachs Group Inc. analysts said in a note, citing a surge in electric-vehicle sales and conversations with local consumers.

- According to RBC, uranium spot prices ended a volatile week lower, with Cameco’s announcement for 2Mlbs market purchases and a return to nameplate production taking the market by surprise and pulling prices down.

Opportunities

- Global oil demand is set for another year of “robust” growth, according to the chief of Saudi Arabia’s state-run oil company. “We see 104 million barrels of demand for this year, so a growth of about 1.5 million barrels,” Saudi Aramco Chief Executive Officer Amin Nasser said at a conference in Dhahran on Monday. “So, it is robust.”

- Diamondback Energy Inc. agreed to buy fellow Texas oil-and-gas producer Endeavor Energy Resources LP in a $26 billion cash-and-stock deal to create the largest operator focused on the prolific Permian Basin. Diamondback will fund the deal with 117.3 million shares and $8 billion in cash, the two Midland, Texas-based companies said in a statement Monday. Diamondback shareholders will own 60.5% of the company after the deal closes. Shareholders of Endeavor, which is not publicly traded, will own the rest.

- Canada’s energy minister Jonathan Wilkinson said that the country is “looking at how to optimize the regulatory and permanent processes so you can take what is a 12 to 15-year (permitting) process and bring it down to maybe five,” adding that “there are ways you can just do things smarter. There’s no reason that you can’t do permitting of different things between federal and provincial governments at the same time, instead of doing them sequentially.” Speaking toward ESG, the official added that, “I think the environmental community also recognizes that there is no energy transition without significantly enhanced volumes of critical minerals.”

Threats

- Train drivers at BHP Group Ltd.’s Pilbara iron ore operations in Western Australia have voted to strike on Friday morning for 24 hours, potentially cutting supply to the producer’s Australian export hubs. However, by Thursday morning, the industrial action was called off after reaching an in-principle agreement which the union characterized as an “industry leading” agreement which addressed their key concerns. You can’t easily replace skilled labor; perhaps margins will be squeezed for BHP or customers will see higher prices.

- Oil production from the U.S. shale patch is expected to grow at a slower pace next month after a speed bump late last year knocked output off its record level. Combined crude production from the seven U.S. shale basins is forecast to rise to 9.72 million barrels a day next month, up 0.2% from February, the U.S. Energy Information Administration said in a report Monday. That is a deceleration from last year’s average month-over-month growth of about 0.9%.

- Guinea, a West African nation, and among the world’s biggest bauxite producers (which is the raw ore for extracting aluminum from), is planning on introducing a carbon tax on mining companies. According to Bloomberg, Guinea also has the world’s largest undeveloped iron ore deposit. Guinea stated it is targeting to raise $4.3 billion from the tax to fund development projects. This could mean higher aluminum costs in the future.

Bitcoin And Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was VeChain, rising 61%.

- Bitcoin hovered around $50,000 this week after scaling the closely watched level for the first time in over two years, a remarkable comeback from the crypto scandals and wipeouts that had cast doubt on the industry’s viability, writes Bloomberg.

- Citigroup has carried out simulations which show how a private equity fund can be tokenized on a blockchain network, potentially paving the way for greater adoption of distributed ledger technology on Wall Street. The bank worked with Wellington Management and WisdomTree to carry out its ‘proof of concept,’ writes Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Celestia, down 7%.

- Genesis Global has settled a lawsuit brought by New York’s top law enforcement official alleging the bankrupt crypto lender defrauded customers of its now-terminated Gemini Earn program, which was run jointly with Gemini Trust Co. The settlement is structured so that assets that could have otherwise gone to state authorities will instead be returned to former Earn customers and other Genesis creditors, writes Bloomberg.

- New Zealand central bank governor Adrian Orr has issued a warning about cryptocurrencies such as stablecoins, saying they are no substitute for fiat money. Stablecoins are “the biggest misnomers” and “oxymorons,” Orr told a parliamentary committee Monday in Wellington, writes Bloomberg.

Opportunities

- Crypto traders are snapping cheap, out-of-the-money (OTM) bitcoin calls at levels around the cryptocurrency’s lifetime high of $69,000. Over the weekend many call options at strikes $65,000, $70,000, and $75,000 changed hands on Deribit, the world’s leading crypto options exchange by volumes and open interest, according to Kelly Greer in an interview with CoinDesk.

- Bitcoin climbed past $52,000 this week in a broad cryptocurrency rally that saw Ether, the second-biggest token, advance back to where it was before the TerraUSD stablecoin collapsed almost two years ago. Bitcoin’s 22% year-to-date gain pushed its market cap above $1 trillion for the first time since December 2021, according to an article published by Bloomberg.

- Chris Rayner-Cook, formally head of global trading and financing at the U.S. crypto exchange Coinbase Global, has joined Brevan Howard Digital, according to a person familiar with the situation. The one-time portfolio manager at hedge funds including Millennium and Citadel was with Coinbase for about three years, writes Bloomberg.

Threats

- A Kansas bank that failed last July after its CEO allegedly siphoned off funds to buy cryptocurrency drew $21 million from the Federal Home Loan Bank System shortly before collapsing, writes Bloomberg.

- Binance Holdings founder CZ’s sentencing for failing to implement anti-money laundering policies was delayed to April from February 2023. U.S. District judge Richard Jones in Seattle on Monday rescheduled Zhao’s sentencing without providing a reason, writes Bloomberg.

- A new crop of legal challenges awaits issuers of spot Bitcoin ETFs now available to broad swaths of investors, lawyers say. The investment vehicle’s broad appeal means that issuers need to go above and beyond standard compliance with disclosure requirements, focusing on investor education to acquaint those less familiar with volatile digital assets, writes Bloomberg.

Gold Market

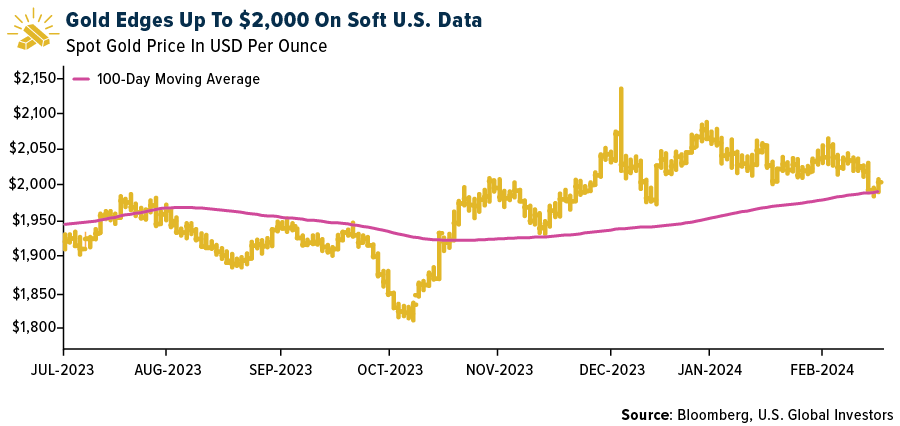

This week gold futures closed at $2,025.20, down $13.50 per ounce, or 0.66%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 0.46%. The S&P/TSX Venture Index came in up 1.86%. The U.S. Trade-Weighted Dollar rose 0.16%.

Strengths

- The best performing precious metal for the week was palladium, up 9.51%. All the precious metals rose this week, except for gold. Palladium rose 4.17% and silver gained 3.90%. Barrick Gold over the weekend said that the Nevada Gold Mines is “strongly positioned for growth.” The company said the Nevada Gold Mines have “come a long way” since 2019 when Barrick and Newmont pooled their assets in the state. The Nevada Gold Mines are “now making a strong start to the new year on the back of performance improvements and new growth prospects.”

- Zimbabwe’s central bank accumulated 793 kilograms (25,000 ounces) of gold reserves since introducing a law that compels mining companies to pay part of their royalties using the metal. The reserves were collected after mines in the southern African nation produced 30.1 tons of gold last year, compared with a record 35.3 tons a year earlier, Reserve Bank of Zimbabwe Governor John Mangudya said by phone from the capital, Harare, on Tuesday.

- Royal Gold reported fourth quarter earnings of $0.95 per share, ahead of consensus of $0.76 per share, with fourth quarter gold-equivalent ounces (GEOs) of 77,100 ahead of consensus of 73,900, with key positive variances at Penasquito and Xavantina, as well as from taxes.

Weaknesses

- The worst performing precious metal for the week was gold, down 0.66%. Bloomberg reported U.S. January retail sales and weekly jobs claims came in softer-than-expected and gold got a nice lift at the end of the week, but not enough to flip in a positive rise in price like the other precious metals. According to Morgan Stanley, the volume of India’s rough diamond imports in January increased by 63% year-over-year (YoY) and remained flat month-over-month (MoM); their value increased by 43% YoY (-11% MoM). The data came in above the five-year average for the first time since August. Rough prices during the period declined by 13% YoY and 11% MoM.

- Shares of precious metals producer SSR Mining Inc. plunged as much as 59% Tuesday after the U.S. company halted operations at its flagship Turkish gold mine following a landslide — its second incident at the site within two years. SSR said it suspended operations at Çöpler Mine in eastern Turkey after a “large slip” on the mine’s heap leach pad — a pond where metals are extracted from ore — Tuesday morning.

- South Africa’s gold production fell 3.4% YoY in December versus revised -2.9% in November, according to Statistics South Africa. Mining production rose 0.6% YoY versus revised up 6.9% in November.

Opportunities

- Barrick Gold Corporation announced that it plans to undertake a new share repurchase program for the buyback of its common shares. Barrick’s Board of Directors has authorized a new program for the repurchase of up to $1.0 billion of the Company’s outstanding common shares over the next 12 months. Barrick Gold Corp. will consider buying back debt on an opportunistic basis, said the top executive of the world’s No. 2 gold producer. Barrick would consider debt tenders if market conditions became attractive, Chief Executive Officer Mark Bristow said Wednesday in an interview.

- Share and debt buybacks are rare in the mining industry as mining is a capital-intensive industry and assets and equipment must be acquired or purchased. Interesting to note that Barrick’s gold production has sunk to its lowest level in 23 years, as highlighted on Bloomberg this week. Mine closures, expansion work and maintenance have taken their toll on annual output and Barrick is addressing this in part by addressing corporate structure, and perhaps waiting for higher prices to reinvest.

- According to RBC, for the GDXJ, they highlight the potential addition of Emerald Resources following inclusion in the GDX in the second quarter of 2023. They also see as a potential re-addition AngloGold Ashanti, which has fallen within the junior universe threshold, and would be consistent with prior re-additions back into the junior ETF including Fresnillo (Q3/23) and Kinross (Q2/22).

Threats

- One month after their historic launch, ETF insiders and crypto proponents alike say Bitcoin spot funds are proving an unequivocal success on key trading measures. Some 21 trading days in, the funds have raked in about $2.8 billion in total net inflows, data compiled by Bloomberg Intelligence show. That considers the $6.4 billion investors yanked from the Grayscale Bitcoin Trust after it was converted from a trust into an exchange-traded fund.

- According to Morgan Stanley, the value of rough lab-grown diamond imports increased by 5% YoY and 2% MoM, coming in above their four-year average and showing similar restocking trends as the rough stone market. Similarly, polished lab-grown exports increased by 10% YoY and 36% MoM, coming in above their four-year average, pointing to a better dynamic versus polished stone.

- According to Bank of America, for 2024, SSR Mining is guiding to gold equivalent ounce (GEO) production of 540-600k at all-in sustaining costs (AISC) of $1,575-$1,625 per ounce (/oz). This compares unfavorably to Bloomberg consensus at around 592k GEO and $1,577/oz, and Visible Alpha (VA) consensus at around 601k GEO and $1,582/oz.