Written by: Taylor Furmanski

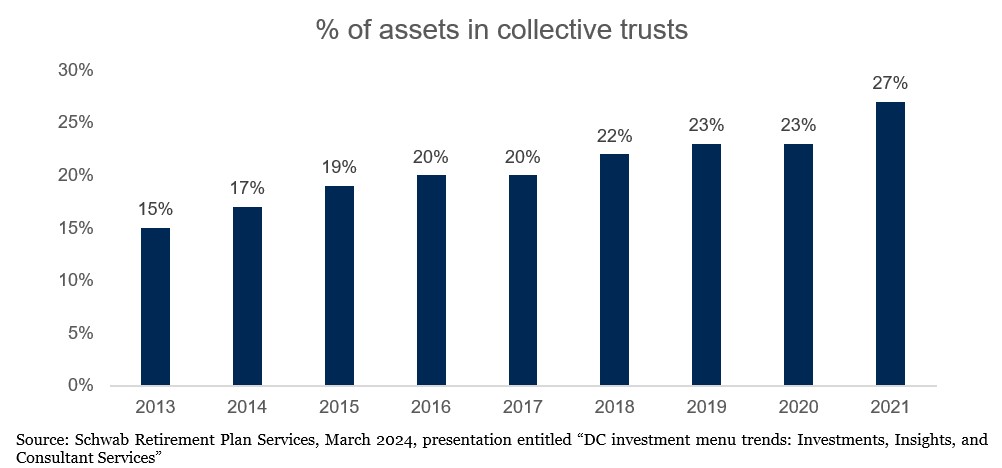

Over the past several years, excessive fees and the failure to consider lower cost share classes for utilized investment strategies has dominated the number of lawsuits against Plan Sponsors. Many Plan Sponsors and retirement plan committee members express surprise when learning that Collective Investment Trusts (CITs) have existed longer than their 40 Act Mutual Fund counterparts. In fact, CITs will celebrate their 100-year birthday in 20271.

For Plan Sponsors of both defined benefit and defined contribution plans, the fund evaluation process begins with thoughtful analysis of qualitative and quantitative factors. Once a committee or 3(38) investment advisor selects an investment strategy suitable for a pension plan portfolio or participant directed investment menu, the next step is to evaluate the investment vehicle (mutual fund, CIT, separately managed account, etc.), best suited to provide access to the strategy.

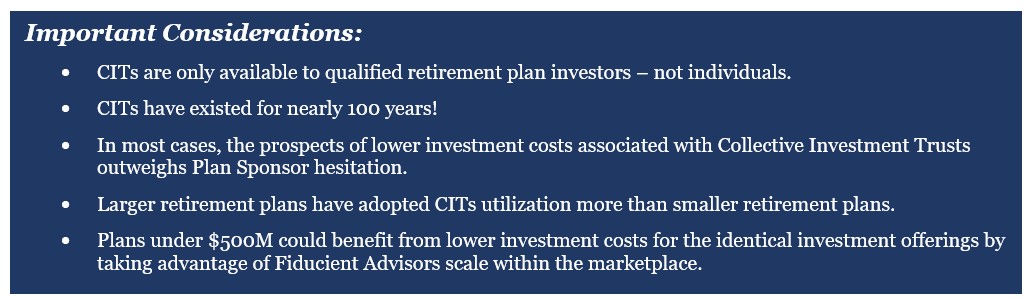

Collective trusts are similar to mutual funds given investors in both pool assets with others and own a portion of the fund. Both vehicles are daily valued and provide investors with a Net Asset Value (NAV). Additionally, both vehicles are professionally managed, audited annually and provide investors with periodically produced ‘fact sheets’. However, there are several key differences between mutual funds and CITs:

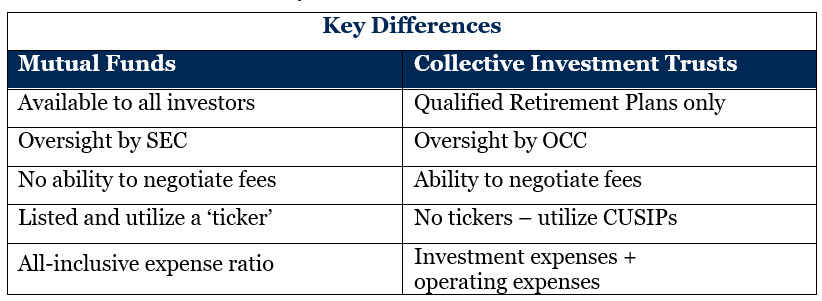

Over the past several years, the utilization of CITs has become more common. According to data from Schwab Retirement Plan Services, in 2019, Collective Investment Trusts garnered 26% of all plan assets amongst larger plans (more than $500 million of plan assets)2. Comparatively, Collective Investment Trusts garnered only 18% of all plan assets amongst smaller plans (less than $500 million of plan assets)2. Collective Investment Trust asset growth has expanded meaningfully over the past several years and now accounts for 41% of all plan assets amongst larger plans (~58% growth over four years!)2. However, Collective Investment Trust asset growth amongst smaller plans has not mirrored larger plans.

Plans Above $500M have larger utilization of collective trusts

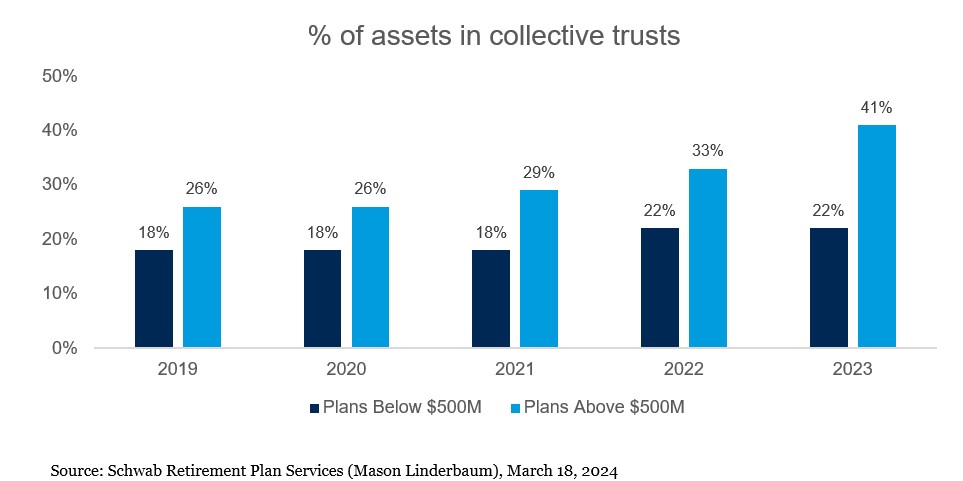

Since 2013, amongst all plan sizes recordkept with Schwab Retirement Plan Services, retirement plan assets concentrated in Collective Investment Trusts have climbed from 15% to more than 25% of all assets (*excluding Stable Value Funds)3.

Common CIT concerns shared by Plan Sponsors include:

- CITs Do Not Have Tickers – Rather than a ticker, a CIT has a CUSIP which identifies the strategy. The disadvantage of a CUSIP is that most participants are familiar with tickers and can more readily find information on publicly available sources (Morningstar, Google Finance, etc.). CUSIPs by contrast cannot be entered in publicly available sources to obtain fund information. Rather, participants would obtain fund information (such as daily price movements or performance) via the recordkeeper’s participant portal. While initially this annoyance may seem material, our experience has taught us that participants and Plan Sponsors have been able to quickly move past this hurdle with education and communications.

- Different Regulator – Familiarity with the SEC has built a level of comfort with the regulatory body. When Plan Sponsors consider the utilization of CITs, the second most common concern and hesitation for adoption is focused on regulation. The Office of the Comptroller of the Currency (OCC) regulates CITs, and while different offices there are many similarities. The OCC requires trusts to produce annual audited financial statements, both clear on the National Securities Clearing Corporation (NSCC) and have daily valuations similar to SEC registered mutual funds. However, one feature some Plan Sponsors find attractive is CITs are governed by the declaration of trust. In short, CITs are held to a Fiduciary standard, the same standard as Plan Sponsors, unlike mutual funds which are held to a lower prudence standard.

While concerns are often understandable, we often encourage the Plan Sponsor to consider the potential benefits:

Negotiable Fees – A trust offers an opportunity for a variable fee structure, which may afford the opportunity for lower investment costs. With CITs in some cases, Fiducient Advisors has been able to aggregate client investible assets as a way to obtain access to lower cost share classes containing higher investment minimums. Additionally, in some cases, Fiducient Advisors has been able to negotiate preferred pricing through the creation of a standalone Fiducient Advisors share class.