Software stocks dominated the past decade, with names like Adobe (ADBE), Google (GOOG), and Salesforce (CRM) handing out monster gains.

But an important shift is happening—one we predicted in my “10 surprises” issue earlier this year.

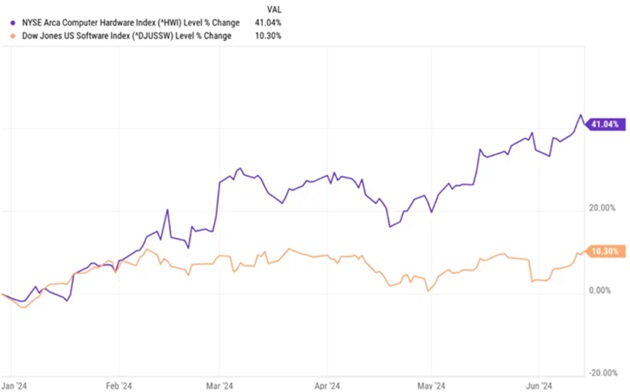

For the first time in a long time, hardware stocks (purple line) are beating software stocks (orange line). And the gap is BIG. Hardware is beating software by 4X this year:

Source: Business Insider

Artificial intelligence (AI) winners like Nvidia (NVDA) are driving this.

We kicked off the year with a special three-part Jolt: WTF happened in 2023? In it, I predicted (and hoped!) that “businesses that make physical stuff will soon dominate.”

Software was the story of the 2010s. We all cut the cord and subscribed to Netflix (NFLX). Uber (UBER) usurped yellow cabs. Kids now bank through Venmo.

But where innovation happens is dramatically shifting from just software (apps) to the combination of software and hardware (tech you can touch).

The most important innovations are no longer happening in “the cloud,” but in the physical world.

Companies are spending hundreds of billions of dollars building AI data centers…

We’re designing cancer-killing jabs…

Bill Gates broke ground on America’s first-ever mini nuclear reactor…

And Elon Musk is helping paralyzed people work again with Neuralink brain chips.

This is great for America and for humanity, and it could spark a decade of unprecedented prosperity. Every investor must pay attention to this important shift in “where innovation happens.”

We’re buying companies leading this shift in Disruption Investor. You can join us here.

1. I can’t believe I’m about to write this.

A year ago, Facebook (META) was a laughingstock in AI.

Now, it has a chatbot that’s bigger and better than the latest ChatGPT. You can play around with it here. (Sorry, Europeans—you’re barred by your nanny government.)

Unlike ChatGPT creator OpenAI, Facebook isn’t trying to make money from chatbot subscriptions. Its AI is 100% free and open source. The code is available for anyone to use and distribute.

This is how Facebook jumped from last place to (arguably) first place in the AI race. Thousands of developers collaborating across the world can innovate faster than any one company.

Selling AI subscriptions? Nah.

Owning the AI “App Store?” That’s more like it.

Facebook made its AI freely available because it wants developers to build their apps using its tech. If Zuckerberg can have the best AI and own the new “App Store,” woah. Success could add a trillion dollars to the company’s valuation.

Facebook is also leading the way in AI devices. Its Ray-Ban sunglasses are like “ChatGPT for your face.”

The glasses can do cool things like translate a foreign menu into English. I bet you’ll soon be able to have a conversation with someone who speaks a different language, with the glasses acting as a real-time translator. Very cool.

I can’t believe I’m about to write this, but… I’ve turned bullish on Facebook for the first time ever.

2. The new fastest-depreciating assets in the world.

It costs billions of dollars to build and train AI models like ChatGPT.

But as one money manager recently put it to me, these models “are the fastest-depreciating assets in the world.”

Startups plough heaps of cash into building the latest and greatest models. Claude creator Anthropic will spend $2.5 billion on compute costs this year alone.

The payoff? It had the best AI model for all of about two weeks.

Facebook and French AI outfit Mistral recently released their latest models. They’re as good or better than Claude on most benchmarks.

And in a few weeks, these models will be dethroned by something else.

Sky-high costs have already sunk a few startups. Stability AI was spending more money per month than it made in an entire year!

And it certainly won’t be the last AI startup that goes belly up. AI is an ultra-marathon. Only companies with very deep pockets will survive.

AI is the single most important stock market trend for the next decade. But there’s a right way and a wrong way to invest.

Remember, we’re in the infrastructure phase of the AI buildout. Big tech companies will spend $170 billion this year building AI data centers.

You want to own the companies drinking from this firehose of money.

Disruption Investor members were early to NVDA, and we’ve made good money. Now, we’re reinvesting those profits into the next batch of AI infrastructure winners.

3. Today’s dose of optimism…

My wife and I used to live in Argentina, and we still have many good friends there.

A century ago, Argentina was one of the richest countries on Earth—as wealthy as America. But thanks to decades of socialist policies, Argentina’s economy is now about as good as war-torn Libya.

Good news: Argentina’s new president, Javier Milei, is implementing some free-market reforms and things are looking up.

Inflation was running at 26% when Milei took over. It’s down to 4% now, the lowest in almost three years.

Freedom is like a magic healing balm for the economy. I’m rooting for Milei.

Related: AI’s $600 Billion Question