Written by: Vivek Bommi and Steve Hussey

Banks’ stock and bond prices were battered by the crisis that overtook US regional banks Silicon Valley Bank (SVB) and Signature Bank (SB) and Swiss banking giant Credit Suisse (CS). We believe that the underlying causes of these failures were idiosyncratic rather than systemic. US and European central banks appear to agree, as they have demonstrated their confidence in the banking system by continuing to hike rates. We also think a renewed focus on rigorous liquidity management by central banks and regulators will ultimately be a positive for the sector and its bondholders.

For now, bank bondholder sentiment remains very negative—particularly for investors in “Additional Tier 1” bonds (AT1s). But once bond markets grow more confident that the crisis is past, relatively strong fundamentals and attractive valuations can create an improved backdrop for selective financial credit investors later in 2023. We think investors should focus on issues from the larger and stronger banks and should still consider opportunities for finding relative value in AT1s.

US Regionals Contrast with Larger National Champion Banks

SVB, based in Santa Clara, California, fatally mismanaged its interest-rate exposure and liquidity levels and was shut down by regulators on Friday, March 10, triggering a global sell-off across bank stocks and bonds. Digital banking and social media accelerated the failure. Despite this dramatic turn of events, SVB’s predicament is, in our analysis, a fairly contained situation with limited risk of contagion, especially after the backstop provided by US authorities to protect all SVB depositors, including those with balances exceeding the usual limit of US$250,000. Smaller US regional bank SB also faced company-specific difficulties related to crypto markets.

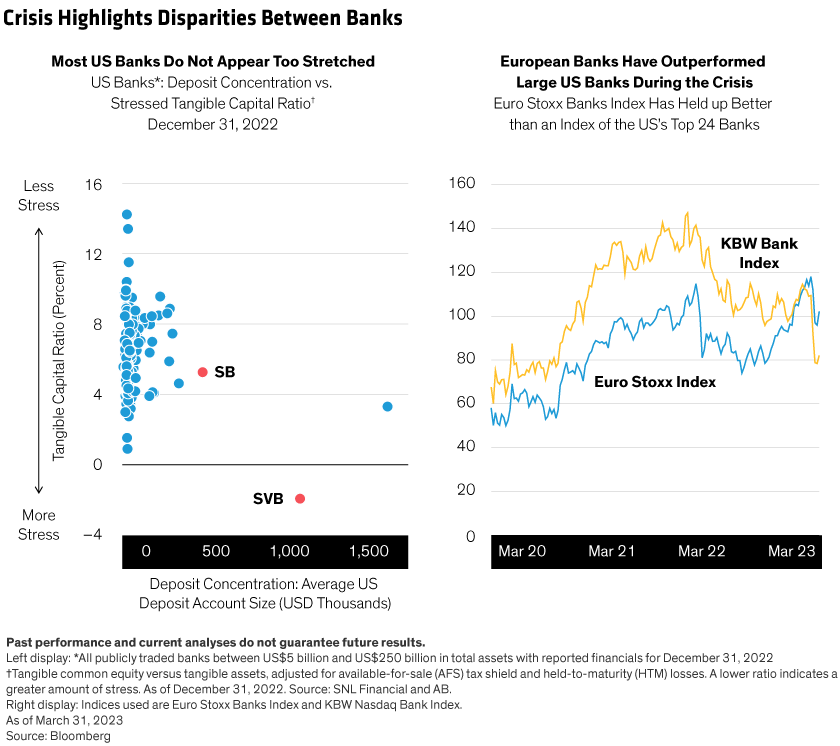

Subsequently, regional banks across the US have suffered deposit flight and others may face difficulties in the months ahead. Even so, it’s clear that SVB and SB were far more exposed to large depositors than their peers are (Display).

We think that the larger US and European national banks in general should be viewed in a different light. These banks are typically bigger and better diversified, with more stable sources of funding and more disciplined risk management—including oversight and hedging of interest-rate risks. They also tend to benefit from a “flight to quality” in times of stress. European banks are subject to more rigorous regulation than those US banks that have less than US$250 billion in assets, and can depend on more stable funding, with less competition for deposits from money-market funds and much less interest-rate exposure in their domestic fixed-income markets than in the US. As a group, European banks have outperformed large US peers during the crisis period.

CS was an exceptional case. After suffering years of losses in its investment banking arm and significant deposit outflows in late 2022, the CS management team implemented a significant restructuring plan with a notable lack of urgency. This left the bank vulnerable to a loss of clients’ and investors’ confidence during the panic triggered by the US regionals. Its rescue merger with UBS was negotiated with the Swiss authorities over the weekend of March 18/19, leaving CS shareholders with a fraction of their previous stock value and CS AT1 bondholders with nothing. This highly controversial resolution will likely lead to litigation and has prompted greater bondholder wariness of AT1s, especially in Switzerland.

Central banks across the UK, the EU and Asia have distanced themselves from the Swiss approach. They have reaffirmed AT1s’ priority over equity in the capital structure and reasserted that stockholders must be the first to take capital losses when a bank’s viability is at stake. Given time, these assurances should be supportive of a market that can offer attractive value.

Prospective Changes Mean Greater Protection for Bondholders

While changes to regulation will take time to enact, the crisis has forced authorities to focus on liquidity management, as shortage of cash was central in the recent panic.

Just as, following the 2008 global financial crisis (GFC), regulators forced banks to significantly strengthen their capital buffers, so after the 2023 bank failures we expect a regulatory review leading to tighter minimum liquidity standards, especially for smaller US banks. We also anticipate an ongoing debate about the potential moral hazard of extending deposit insurance coverage and the need for better and more timely bank reporting.

More stringent bank regulation may help reduce loan growth, hitting profitability. Although this would hurt stockholders, we expect it would create greater security and increased confidence for bondholders.

In the shorter term, the Fed, Bank of England and European Central Bank have all continued to raise rates, demonstrating their confidence in the banking system and their expectation that the crisis will result in tighter financial conditions that will help slow the economy. If commercial banks adopt more conservative lending policies, that would slow credit growth and improve security for bondholders.

Larger Banks’ Fundamentals Are Strong

The crisis has also highlighted some US regional banks’ relatively high exposure to riskier commercial real estate and leveraged private investments loans, which may threaten their capital positions.

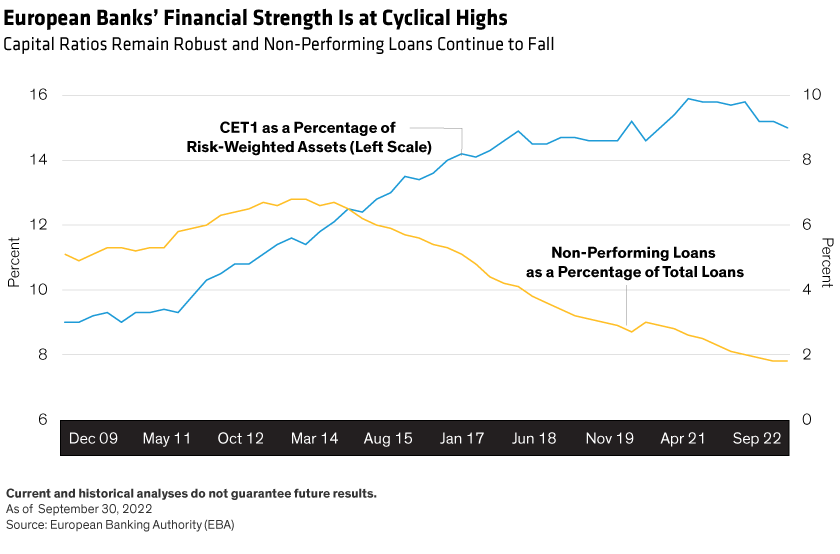

But larger US and European banks continue to maintain very strong capital reserves in response to more stringent regulation. Common Equity Tier 1 (CET1) ratios remain high, notably in Europe (Display), providing a buffer for their AT1 bondholders.

These banks have been able to keep CET1 ratios at high levels even as they’ve returned significant “excess” capital to shareholders in the form of share buybacks and dividends, because internal capital generation through rising profitability has been improving. So far, the banks have delayed passing the benefit of rising interest rates on to savers—a longstanding practice that marks out the current period as a high point for profitability.

We expect reported CET1 ratios will gradually decline toward the banks’ medium-term targets, but banks should retain material buffers over and above minimum requirements, giving AT1 investors significant protection against potential losses. Meanwhile, credit ratings across the banks have remained very stable.

A continued reduction in nonperforming loans (NPLs) also provides strong support for bondholders. We expect NPLs will rise in the medium to long term as economies slow down, but the banks’ guidance is that expected loss rates will likely revert only to pre-COVID levels.

So, from a credit perspective, banks are in the best shape they have ever been, and we maintain a constructive view on the health of the financial sector despite short-term volatility.

Bank Debt Valuations Are Looking Cheap

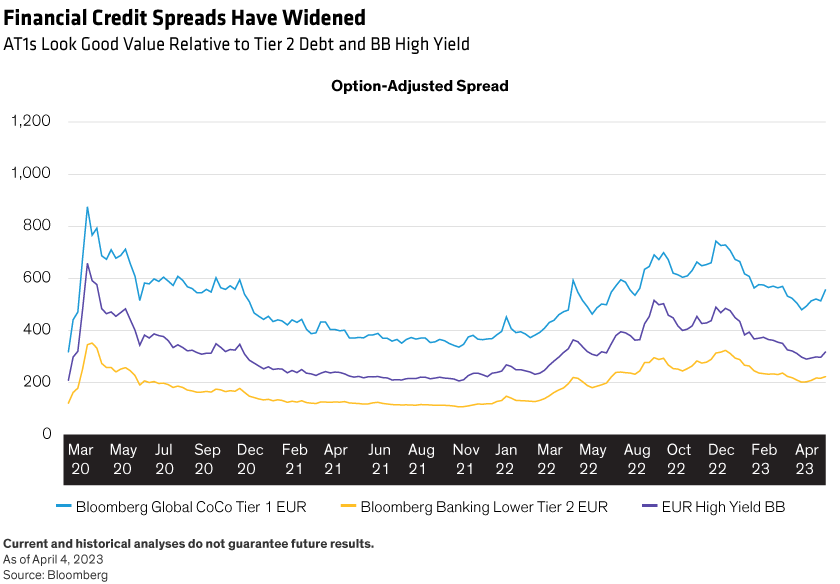

Considering the strong financial picture for the larger banks, we believe that their subordinated debt looks relatively cheap. (Display).

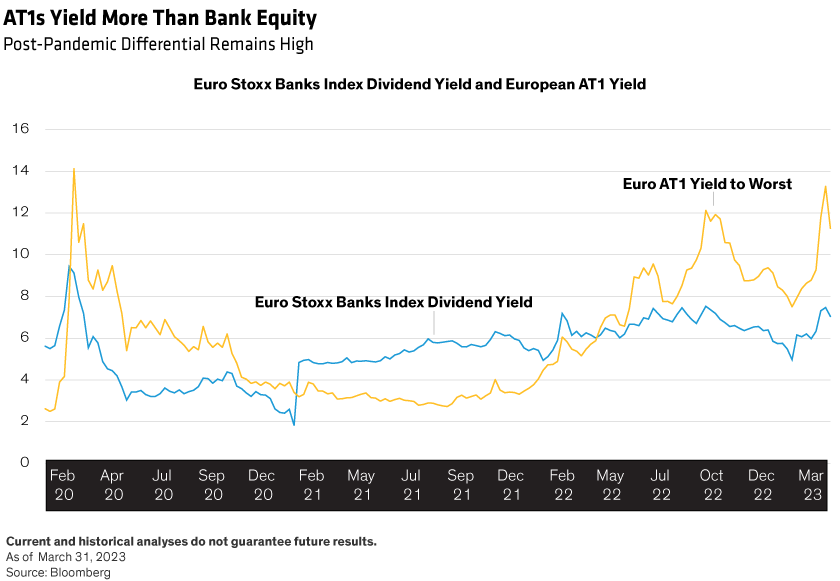

The relationship between AT1 yields and banks’ equity dividends has varied over time, reflecting in part the different outlooks of fixed-income and equity investors. Since mid-2022, AT1s have also been unusually cheap relative to bank equity, considering the balance of risks in jurisdictions that uphold the traditional creditor hierarchy (Display).

How Should Investors Respond to the Crisis?

The crisis has demonstrated how much faster liquidity problems can translate into panic and depositor flight in the era of online banking and viral social media. We believe this creates a permanently higher level of risk and will require increased vigilance. Investors in AT1s will need to apply extra scrutiny to bond documentation and be ready to sell much faster if banks hit trouble. Regulators and governments have, however, learned to respond more promptly and with better coordination than in previous crises.

For now, continued caution is warranted in the AT1 market. A significant volume of AT1 bonds is due to be called this year and in 2024. If banks decide to extend their maturities, yields could rise and prices fall further. Against this background, we see better near-term prospects in senior financial bonds in the larger well-capitalized banks, given their fundamental resilience during the crisis.

But we think it won’t be long before the AT1s of stronger banks in supportive jurisdictions return to favor. When all’s said and done, the combined attractions of very high yields and high quality issuing banks will prove hard to match in credit markets.