Editor’s note: Today, Chris Reilly sits down with RiskHedge’s Chief Trader Justin Spittler to discuss the launch of Express Trader, a new letter built around Justin’s PRO Meter.

Justin explains how he uses the PRO Meter to objectively gauge where the market’s headed… and then recommend the three strongest stocks to buy each week.

If this is the first time you’re reading The Jolt, consider joining us today for free investing tips, insider interviews, and expert market commentary.

Chris Reilly: Justin, let’s talk about your brand-new Express Trader letter. We launched it last week to take the complexity out of trading and give busy people your top three trades a week.

But first, congratulations. You’re a new dad! We’ve received a ton of warm messages and words of wisdom from our readers. Edward says, “These are the best years of your life. Enjoy every moment, as it goes by incredibly fast.” Sophie’s advice: “Congratulations—you need to sleep when the baby sleeps!”

How have the first couple weeks been?

Justin Spittler: Thanks, Chris. And I really appreciate the kind words from everyone. It’s exciting. So far my son’s not a big crier; he’s pretty relaxed. But yes, great so far and I’m sure it’ll start getting more challenging soon.

Chris: My first question on Express Trader: Why now?

Justin: Because the election is right around the corner. This is the time when emotions run high, and it’s easy to get sucked into stories or narratives that won’t make you money.

I wanted to give people a consistent North Star every week. No speculating, no politics, no letting anxiety sway your investing decisions. Just: here’s what’s objectively going on in the market this week, and here’s how to profit.

When you’re an Express Trader member, every Monday morning a note from me will arrive in your email. In it, I’ll tell you how markets are set up for the week ahead and recommend three simple trades.

Chris: “Objectively” is the key word here, right? It seems like every day lately, a famous hedge fund manager comes on CNBC and states strong opinions that influence a lot of investors.

Justin: Investors drive themselves crazy trying to interpret news. Just look at the Fed’s rate cut a few weeks ago, the first one since the pandemic.

Half of people say, “Game on, bullish!” Half of people say, “Oh no, this must mean the Fed really thinks we’re heading for a deep recession.”

Earlier in my career, I used to try to prognosticate like this. I’m happy to have found a better way with my PRO Meter.

Chris: Go on…

Justin: Regular readers know I look at hundreds of charts a day, but the PRO Meter (my proprietary one that I’ve been using for years) is by far the most important. I created it to answer this key question: “What kind of market environment are we in?”

In other words, is it time to play offense or defense?

Are we in a strong market where we should aggressively look to PROfit? Or a weak market where we should be more concerned with PROtecting our capital?

If markets look set for a strong week, we’ll get aggressive and press our bets in explosive sectors like tech.

If markets look iffy, we’ll be more conservative, owning stocks that can perform well even if the indexes are treading water.

And if markets look weak, we’ll batten down the hatches and own truly defensive trades like dollars, utility stocks, or certain types of bonds.

This is very important: “Forcing” trades is a recipe for disappointment. You have to let the market come to you.

My PRO Meter boils down the market action into one line. This one chart tells me whether the bulls or bears are in control of prices.

Chris: Who’s in control now?

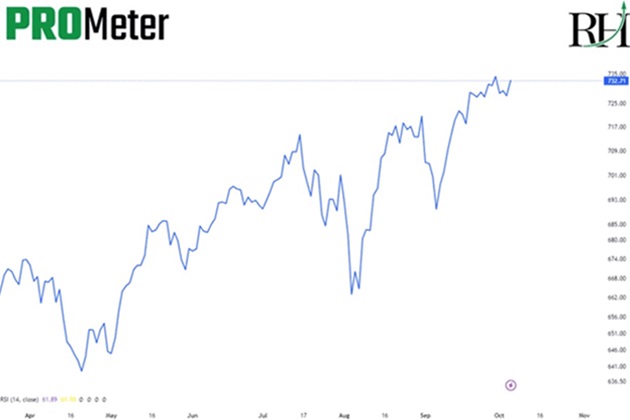

Justin: Bulls. As I told members, it’s time to be “intelligently aggressive.” Here’s the PRO Meter: higher highs, and it’s recorded four up weeks in a row.

Source: TradingView

Chris: How does the PRO Meter work exactly? Could you talk about the calculations that go into it?

Justin: It’s an aggregate ratio. It takes “aggressive” sectors (like tech stocks) and compares them to “defensive” sectors (like utilities). The line only rises when the aggressive sectors are outpacing defensive ones.

This is important because people often assume a rising market is automatically bullish. Not so. If the market is only rising because defensive sectors are dragging it higher, that’s masking underlying weakness. The PRO Meter shows the true strength of the market.

Chris: How is Express Trader different from your RiskHedge Live trading room? One reader noted how you’re recommending different stocks in each...

Justin: In both, my trading philosophy and strategy is the same. In RiskHedge Live, members join me as I trade the markets in real time every day, and we go deep on more sophisticated concepts like position sizing. And we make a lot more trades.

Express Trader is much simpler. I recommend three simple trades to place, once a week. Express Trader is for people who want to make trades without all the unnecessary complexity. And to trade profitably, if I’m doing my job.

Chris: Justin, thanks for sitting down with me today.

Justin: Of course, Chris. Enjoyed it.

Related: Many Investors Overlook Major Breakthroughs in Biotechnology