Stephen’s note: Today, I’m bringing in RiskHedge’s Chief Trader Justin Spittler to share how he’s approaching the upcoming election and potentially volatile markets.

Stephen McBride: Justin, we’re less than a month and a half from one of the most hyped US presidential elections in history. And because this is such a close race, there’s even more uncertainty than usual.

Reuters says: “US election is just one risk among many for nervous stock market”...

How do you see the market being impacted by the election as we get closer?

Justin Spittler: So, if you watch cable news (I don’t), it may feel like the fate of everything hangs in the balance. But the election has almost zero impact on my stock-picking process.

If you’re like most people, you have a political bias… a candidate you want to be president.

And when you have a “horse in the race,” you’re more emotionally invested in the outcome.

When emotions seep into your decision-making process, you’ve got a problem. Emotions blur the line between what you want to happen vs. what’s most likely to happen... which can cost you money.

Even if you can rein in your emotions, politics can still end up costing you thousands of dollars. This is because, while many political stories “feel” important, they’re usually just “noise” that’s all but impossible to profitably act upon.

So, when making investing decisions, I suggest you tune out politics entirely.

Stephen: Couldn’t agree more. Warren Buffett, the greatest investor of all time, said: “If you mix politics and investing, you’re making a big mistake.”

Stocks typically trend higher regardless of who controls the White House. That’s not because markets “only go up.” It’s because American businesses are moneymaking machines, which drives stock prices higher.

But investing for the long haul is different than what you do. As a trader, you’re nimbler and happy with booking quick gains and moving on to the next great opportunity.

You can still afford to ignore the election in the short term?

Justin: All I need to do is look at price action and I can ignore all the election noise.

I take my cues from the market, simple as that. I analyze hundreds of charts every day. I examine the price action of stocks, bonds, commodities, interest rates, and the VIX, aka the “fear index.”

I do this because price is objective. It doesn’t care who I think the next president of the United States will be. Instead, it tells me what millions of market participants are doing with their own money.

This is FAR more important than what I or anyone else thinks will happen.

Stephen: And what are prices telling you right now?

Justin: That there’s money to be made if you want it...

Yesterday, the S&P 500 hit another all-time high.

What’s more, after months of defensive names leading the market, we’re now starting to see a healthy rotation into the more “risk-on” sectors.

This includes the Communication Services Select Sector SPDR Fund (XLC), First Trust Nasdaq Cybersecurity ETF (CIBR), and iShares Expanded Tech-Software Sector ETF (IGV), all coming off their highest weekly closes ever.

This is bullish.

Stephen: So it’s safe to assume none of your recent trades or recommendations are “election specific”...

Justin: I’ve been doing what I’ve done all year. Focusing on leaders.

Many traders try to “bottom fish” and buy when the market is still falling. This exposes them to quick losses that make it hard to stay in a trade. Always remember: Cheap stocks are often cheap for a reason. There’s no reason why a stock down 20% can’t fall another 20% or more.

When you buy a stock in an uptrend, momentum has your back.

Most stocks are like rafts floating down a strong river. The current will sweep the raft in the direction the river is going. Those who paddle against the current will only exhaust and frustrate themselves.

You can make great money by simply investing in stocks in the strongest groups.

Stephen: I know this simple strategy led you to write about IPOs in 2019, “stay at home” trades in 2020/2021, even energy stocks in 2022, which was basically the only thing that worked that year.

And it helped you achieve an 89% total return during last year’s beta test for your paid trading room, which is having another solid year in 2024.

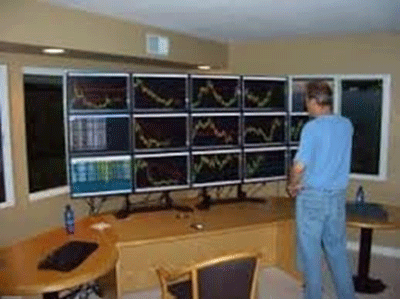

Justin: Traders tend to complicate things. It’s human nature. They think they need 12 monitors and to watch all these different patterns at once, like the poor dude below (ha):

Source: TradingSim

It doesn’t have to be that (and shouldn’t).

Focus on price action, buy leaders, and don’t get caught up in any noise or distractions.

Of course, there’s a bit more to it than that, but you get the idea. Even billionaire Stanley Druckenmiller—who strung together 30 straight profitable years from 1980 to 2010—said, “People always forget that 50% of a stock’s move is the overall market, 30% is the industry, and maybe 20% from stock picking.”

Stephen: Thanks, Justin.

And reader, if you’d like to hear more on how to handle the potentially volatile market leading up to November’s election, consider signing up for The Jolt today.

Related: The News Fuels Our Fear More Than Ever: Data Reveals Why