How to tame your inner FOMO

Stocks and ETFs have ticker symbols. These are typically 3 or 4 letters, and that system has been used to identify and trade since the days of ticker tape.

One ticker that is not currently used is this one: FOMO. It has become a popular investor expression lately, even if it is not the ticker symbol for a company’s stock, or for an ETF.

FOMO is Fear Of Missing Out…on the gigantic gains that “everyone” seems to be making in the stock market. Rest assured, FOMO is real. However, a lot of FOMO-inducing assumptions are more illusion than reality.

If you are a conservative-minded investor, perhaps in retirement or approaching it, you need to find a balance. That balance is between staying anchored to your preservation-first investing mantra, and feeling like you are getting your “fair share” of the market’s appreciation. How do you do that?

First, a reality check

Much of the stock market has not been a bonanza this year. I have written about this from many angles over the past few years, so feel free to look back and reference those articles.

What I will add to it simply is this: with 6 weeks left in the year, more than half the stocks in the Dow Jones Industrial Average (16 out of 30) are DOWN for 2020. Small caps, value and non-U.S. stocks are only recently getting some air under them. It’s been a very narrow market.

However, that is masked in the “headline” stock indexes, like the S&P 500. This has been the case for the better part of the past 3 years. Historically, that is when stock investors are most vulnerable. It follows that this is when FOMO is at its highest. That’s where we seem to be right now.

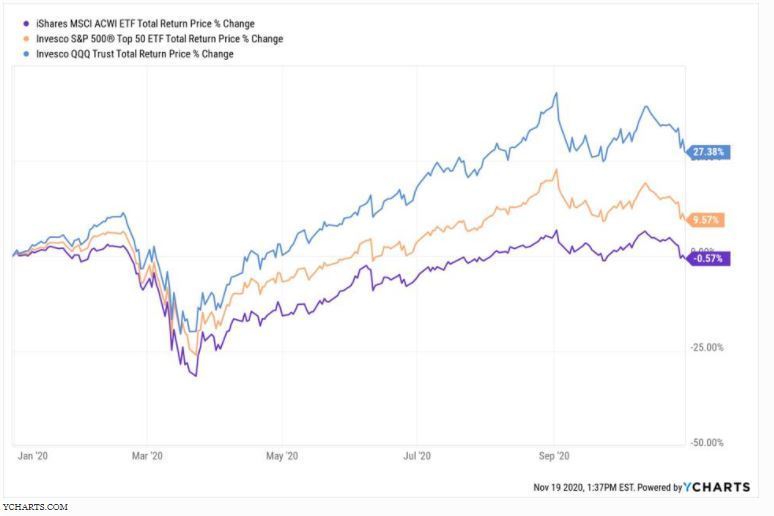

I wasn’t going to include a chart in this article, like I usually do. Then, I thought of this, and realized it summarizes this point about 2020 very simply, and clearly.

Above, you see 3 ETFs charted for 2020, through October 31. The blue line is the Nasdaq NDAQ -0.2%, which is dominated by a half-dozen Mega-Cap stocks, most of which don’t pay dividends. Great companies, but absurdly priced at this point, as I see it. Chase away, but know what you are buying, in terms of valuation.

The orange line is the 50 largest companies in the S&P 500. That group earned nearly 10% in the first 10 months of the year. It’s essentially those big Nasdaq names, and a relatively small group of others.

The World according to me

I say that because of the purple line, dragging up the rear on the chart. That’s the MSCI World Index, which is over 2,000 companies. It’s flat for the year, even though it includes the stocks in the first two groups above it on the chart.

Summary: most of the stock market around the globe has been flat or down this year. What worked in the recent past (2018-2019) worked again this year, albeit with a huge pandemic plunge along the way. That’s the past.

The future could very well be about the rest of the world evening the score a bit. But even if that didn’t occur any time soon, you need to prevent your FOMO from ruling your investment emotions. After all, this is not a game, it’s a process. And buying what went up, because it went up, is a risky strategy. It works for traders, but not usually for investors.

What are you investing for? Are you sure?

This is when it helps to remember what you are investing for. It’s not a race, it’s a lifestyle financial support system. And, if you are already using your portfolio for that purpose, or getting closer to the time when you will, you have to separate two things. Specifically, what you need from your portfolio now, and what you need later.

I keep an internal scoring system for the ETFs and stocks I follow (it won’t be internal for much longer, but that’s another story for another day). That scoring system starts with a very simple assumption: any investment can rise in price at any time. What separates investments, and different market conditions, is the amount of risk if major loss is attached to that appreciation potential.

Fighting FOMO

That’s where the FOMO comes in. I am not a professional psychologist, but after 30-plus years of doing this, I am at least an investor psychologist, of sorts. And this is when people tend to want to own what they wish they had owned in the recent past. Better to take account of the current environment, without obsessing about backward-looking analysis of what just worked. In short, don’t chase, invest.

2020: the longshot year

Here’s another way to think of it. Any year in the stock market can go several different ways. But of course, we don’t know which way it will go in advance. The way things turned out in 2020, with the broad stock market up, given all that has happened, was one of those possibilities.

But was it the “obvious” one? I doubt it. 2020 has been an investment year that is better characterized by what some aggressive investors “got away with” as opposed to what we’d expect to happen if, by some horrible twist of fate, we had 10 years like this one.

So, 2020 was probably a low-likelihood outcome. In the same way that a horse wins a race at 20-1 odds, and you say to yourself, “I should have bet on that horse,” so, too, do we need to keep our perspective when years like this occur.

The investment outlook

When we do that, we see a group of pros and cons that add up to, as always, return potential. However, I think that return potential has a lot of risk of major loss attached to it. Does that mean you hide in cash? Not really. But it does mean you consider how much traditional equity market risk you take on.

That’s why I favor a 3-piece approach to portfolio construction. A core equity portfolio, for long-term growth potential and to keep the FOMO at bay. That, joined with a hedge piece, guards against major downside risk. And, a tactical piece, which addresses the back-and-forth nature of modern investment markets.

In other words, if you agree with me that buy-and-hold investing is a losing proposition for the next decade, it helps to have a dedicated portion of your portfolio that can capture shorter-term profit potential, wherever it may appear.

Conservative investors

Remember, I am speaking to the “Conservative” investor here. If you are an investment speculator, or someone that feels no need to be educated about a defense-first investment mindset, none of what you just read is as relevant to you. But thanks for reading, anyway!